如何用期权玩转财报季(5):跨式期权还可以这么做?

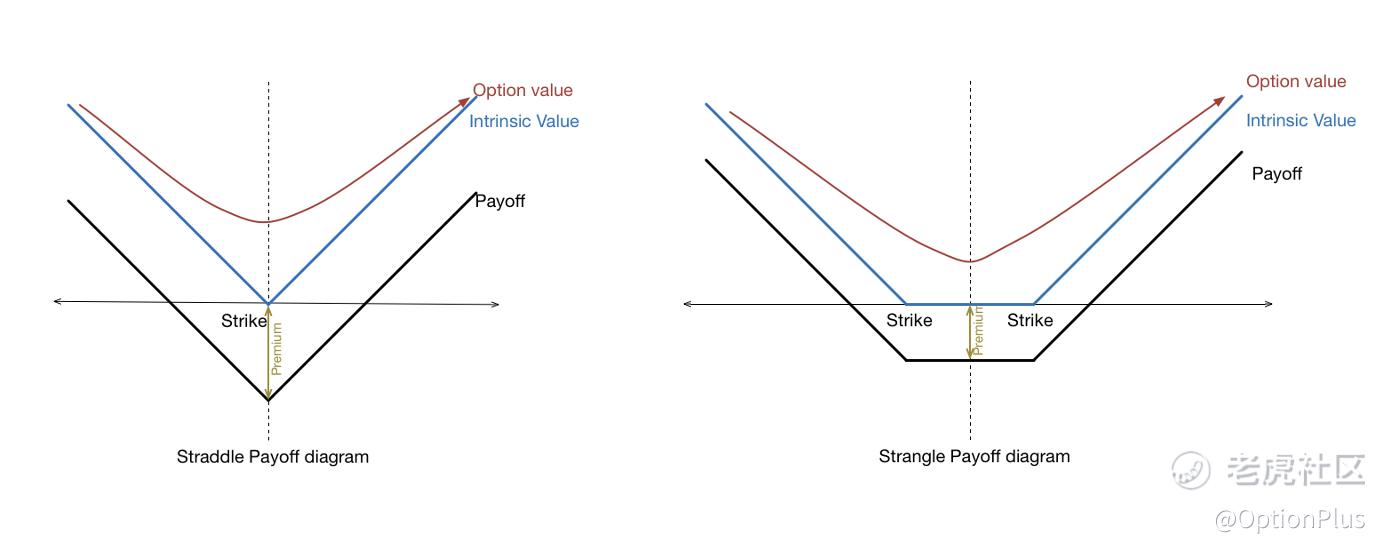

又一个财报季开始了,期权最常见的用于赌财报。最先接触的期权大概就是单边买call或者买put,发现单边赌财报的赢率不大了之后,有些初学者就会开始做跨式期权,跨式有两种Straddle 和Strangle。

为了区分不同点,Straddle通常被称为马鞍式,指的是买行权价和到期日都相同的call 和 put的组合,行权价通常临近现价(ATM)。这种策略最大优势是不判断方向只赌波动大,也就是需要正股波动足够大使得一边的收益大于两边的成本,风险是正股价格波动不大,无法抵消购买两份期权的成本。

Strangle是异价跨式期权,跟Straddle的区别是,它是买行使价不同,但到期日一样的的call和put的组合,行权价通常是价外(OTM)。在价格突破(不管涨破还是跌破)某一区间时可以获利,也是赌波动率,适用于正股价格波动非常大的股票,典型的是成长股、科技股。

简单画个可视化图

跨式非常普遍被运用于赌财报,因为这是一个无方向性策略,通过股价的波动来取得好的回报,大波动最常见的场景就是财报,比如我看本周财报的$(NFLX)$和$台积电(TSM)$ 有大量的跨式大单成交:

但我想给大家另一个思路,同样可以取得很好的回报。

就是在财报前一周左右买入跨式,然后在财报前1-2天就卖出。这个方法跟常见的拿到财报出来后再卖不同在于,在财报落地之前就要卖出。

主要是赚取财报发布前几天波动率急剧上升带来的期权收益。通常财报发布前3-7天隐含波动率(IV)会骤升,在这个IV上升之前进入,然后在IV涨到高位值时候就获利走人。比如一家公司的IV中位值是在60%-70%,那么这个时候就买入call 和 put,等IV在财报前大概率85%-90%时候就止盈,有的期权我在财报前IV超过100%。

为什么我这么做?

我经常说期权卖方,但跨式是买方策略,call和put都是买入,买入期权时间是最大的敌人,期权买方有时间价值的耗损,两边都是买入耗损是很大的。通常,做跨式是希望通过股价的波动来弥补时间价值的损耗。期权的希腊字母指标Theta,就是时间价值损耗数量化值。还有一个希腊字母是Vega,就是用来衡量期权价格和预期波动率之间的关系。如果要学时间耗损和预期波动,可以用Vega和Theta来算算。但是我觉得去计算这个必要性不大。

简单说,IV越高,期权价格也越高。虽然时间损耗量很大,但是推高的IV可以有效抵消时间价值损耗,有时候IV带来的价格上升幅度大大超过时间价值的损耗,这经常发生在$特斯拉(TSLA)$ 的期权上。

为什么不拿到财报后?

如果财报落地整体并没有特别大的波动,那么IV会骤降,尤其到期日临近的期权IV会降至接近0,叠加时间价值的耗损,这个赌财报的损失会更大。但是如果财报前IV没有太大的跳高,股价也没什么波动,那么损失也更有限。

还需要特别强调一点,如果财报前一周,股价已经开始跳高,IV已经启动,那进去做的意义可能不大了。交易是概率游戏,具体哪天IV会飙升,到什么程度,不同标的不同trigger,都要具体情况具体判断,每个股票的每次财报发布都不是一样的。这里只是说一个方法。

感兴趣的朋友可以用模拟盘试试,我看老虎在推广模拟盘。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

胸腺五肽

学习

对冲期权,技术式投资。