【故事会】“滴血验癌”神话破灭,“女版乔布斯”面临20 年牢狱之灾!

栏目说明:小话不定期给大家分享有趣的故事,内容来源于网络,希望给您带来更好的阅读体验!

- 转自公众号:三联生活周刊

- 作者:刘周岩

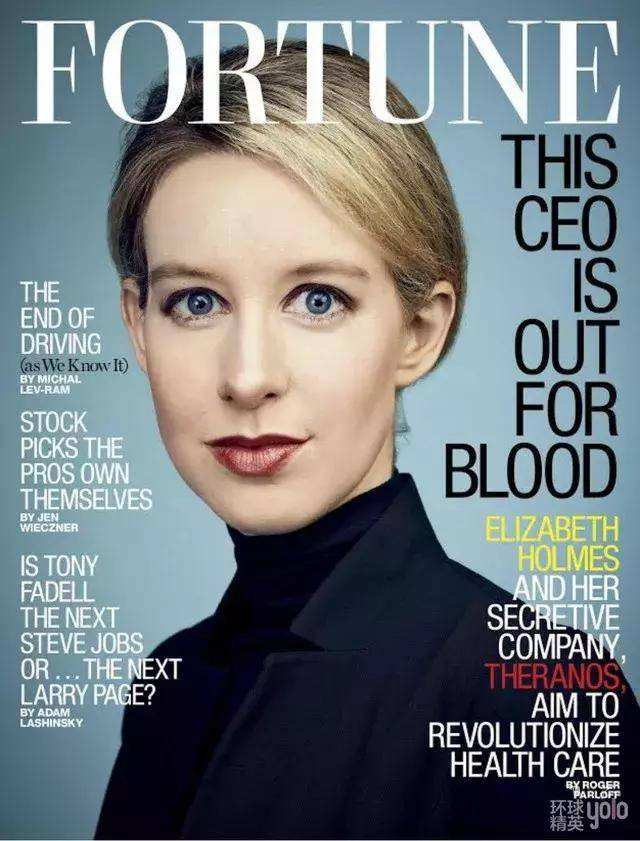

1月3日,血液检测公司Theranos创始人 伊丽莎白·霍尔姆斯 被判四项欺诈罪名成立。据报道,她将面临最高 20 年的监禁、25万美元的罚款以及对每项罪名的赔偿。这位曾因“滴血验癌”而名噪一时的“硅谷宠儿”黄粱梦碎。

不是所有斯坦福辍学生都能创业成功,穿黑色套头衫的也不都是乔布斯。

01 “女乔布斯”的诞生

2015年5月,亨利·基辛格(Henry Kissinger)博士遇到了一点麻烦。

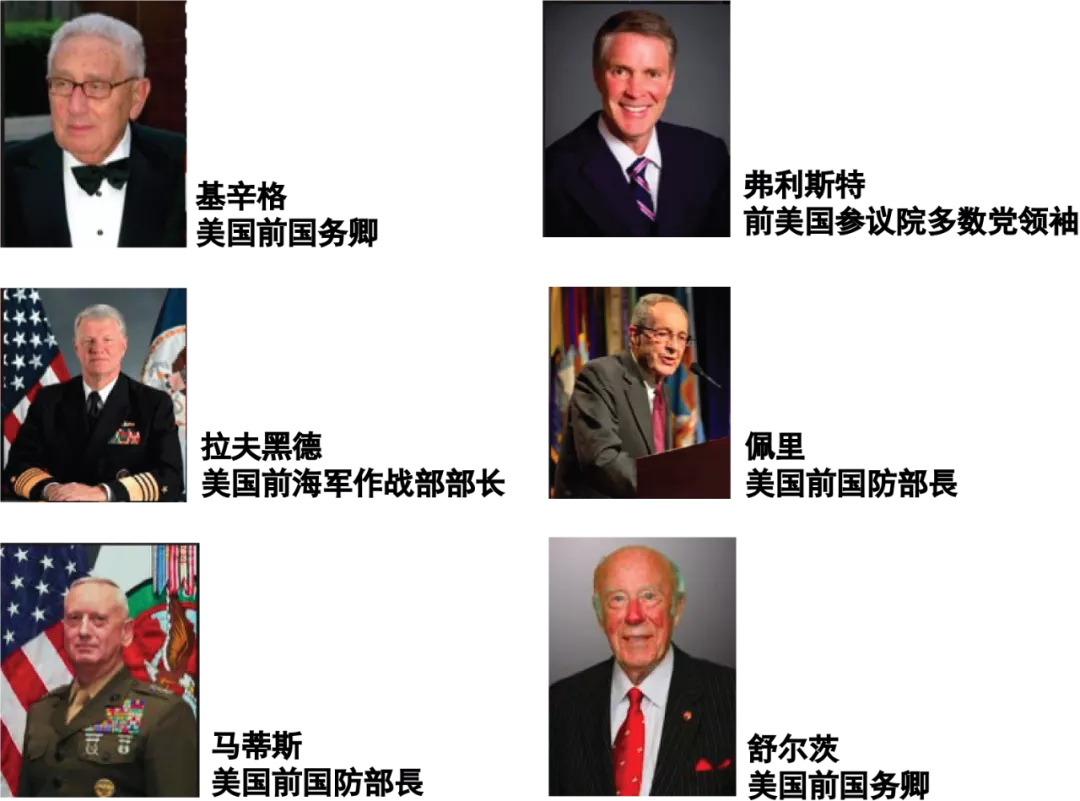

几个月前,他还亲自出席了自己颇为欣赏的年轻人 伊丽莎白 的生日聚会,加入了她创办的公司的董事会,甚至和夫人一起张罗着为她介绍男朋友。2014年的这场盛大的生日聚会是在他的老朋友、同样为前美国国务卿的舒尔茨(Georg Schultz)家里举办的,当时舒尔茨94岁,基辛格92岁,而伊丽莎白只有30岁。

但到了2015年,大家开始发现,伊丽莎白向这些重量级支持者们隐瞒了太多东西。她不仅隐瞒了已经有男友的感情状况,估值近90亿美元的创业公司也是一场骗局:

她宣称研发出了一种设备,将革命性地改变疾病诊断与预防的流程,这种神奇设备最终被证明并不存在,一切不过是她吹出的一个泡沫。

伊丽莎白,1984年出生在美国一个富裕家庭,父亲曾出任安然公司副总裁,后在美国政府任职,母亲在美国国会工作。

伊丽莎白从小就对成功有着超出常人的渴求,9岁的一次家庭聚会上,姑姑问她以后的理想,她回答:

“成为亿万富翁。”

日后的公开采访里,她也多次说:

“在我很小的时候,我就相信私人企业是产生影响力最好的方式,它是改变世界的工具。”

对于一个有着这样理想的年轻人,入学斯坦福大学是无需犹豫的选择。

相比于其他学校,斯坦福尤其强调商业与科技的结合,地处硅谷心脏地带,孕育出了无数改变世界的企业:$Altaba(AABA)$ 、$谷歌(GOOG)$ 、$LinkedIn 领英(LNKD)$ ……

2002年,伊丽莎白高中毕业,进入斯坦福大学学习化学工程,她相信生物科技领域适合自己,因为这既可以促进社会公益,又有广阔的商业前景。

入学仅一年,伊丽莎白就决定辍学开始创业,看似疯狂的举动却获得了老师和家人的鼎力相助——大家都希望且相信她能成功。

斯坦福工程学院的明星教授钱宁(Channing Robertson)成为她的公司的第一位顾问,钱宁的博士生成为第一位雇员,父母的朋友、同学的父母等人成为第一批投资人:

伊丽莎白在只有一份26页的商业计划书的情况下,就融资了600万美元。

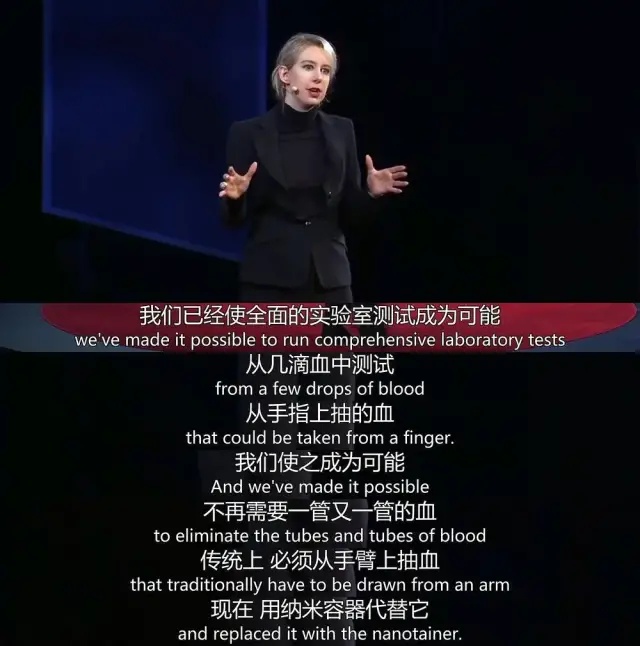

伊丽莎白的创业口号是“一滴血改变一切”:

她宣称要研发出一种便携设备,只需戳一下指尖抽取一两滴血,便可进行全方位生化信息提取,这种设备小到可以放在便利店甚至每个人家中。数据将无线传输给医生,迅速反馈身体状况和诊疗方案, 可以实现癌症筛查在内的数百项项目。关键检测价格也不会太贵,很多人都负担得起。她将公司命名为Theranos,正是Therapy(治疗)和Diagnosis(诊断)两个词的组合。

如果成功,这将大大提高疾病预防的效率,甚至从根本上改变包括医院、药企在内的医疗体系运行模式。

在日后的无数演讲中,她会动情地谈起自己的舅舅如果能早点筛查出皮肤癌就不会那么早离开人世,世界上每天都有太多人因无力负担程序繁琐、费用高昂的血液检测而错失治疗良机。

她所许诺的未来是“一个和所爱之人不必早早挥手告别的世界”。

讲到动情处,她总会流下泪水,许多听众都被她身上“那股震慑人心的力量”打动了。

一滴血里确实包含了足够多的生化信息,理论上伊丽莎白的想法存在可能性。但降低取血量、缩短数据分析流程、将设备小型化等,会面临一系列不易解决的技术难题而难以实现。

但是,研发困难并不意味着融资困难。

硅谷盛行着一句话:

“投资在很大程度上投的是人,而不是项目。”

伊丽莎白,是各方面看起来都无比合适的人。“斯坦福辍学创业”的标签、一个好的故事、优秀的家庭背景,在设备研发进展缓慢的情况下,就开始让资源之间互相叠加、彼此背书。

在她的公司估值约1600万美元时,她宣称接下来的一年内会有5家公司采购Theranos的产品,带来1亿到3亿美元的营收。这一信息是她虚构出来的,但成功骗取了一笔投资,她随即利用刚到手的投资,游说来了数家公司的采购订单,假变成了“真”。

在创业投资领域,有一种心态被称为FoMO(Fear of Missing Out),即“害怕错过”:

越是大企业,机会成本越高,一旦错过一个新兴科技,差距将和对手越拉越大。

2010年,在尚未见到核心技术的确凿展示之前,沃尔格林签下了5000万美元的订单,并贷款2500万美元,计划在全国药店网店铺开Theranos的小型检测中心。

2010年前后,硅谷的投资行情也处在高位。金融危机之后,大量资本从楼市、股市等撤出,寻找着新的去处。这也正是$Meta Platforms(FB)$ 创造奇迹的一年,年中时估值230亿美元,到年底就翻了一番变为500亿美元,许多资本都希望能够复制投资下一个Facebook的传奇。

而伊丽莎白有意塑造着自己将成就一番大事业的气氛。

她开始频繁登上《福布斯》《财富》等杂志封面,入选各类“改变世界的年度十大企业家”等名单,还被时任总统奥巴马任命为美国全球创业大使。对她疼爱有加的舒尔茨更是介绍了一众老友加入她的董事会为其背书,除基辛格外,还包括前海军陆战队将军、后成为特朗普政府国防部长的马蒂斯(James Mattis)、前参议院多数党领袖弗里斯特(Bill Frist)等。

02 覆灭

2015年10月15日成为Theranos公司命运转折的一天。

当天的《华尔街日报》刊登了第一篇揭露Theranos内幕的报道:

《一家高估值创业公司的挣扎》,副标题“硅谷实验室Theranos估值90亿美元,但并未在全部测试中使用其自主科技”。

戳穿Theranos泡沫的《华尔街日报》记者约翰·卡瑞尤称:

伊丽莎白,最显眼的一点是她19岁辍学创业。人们自然会想到在类似年龄辍学创业的比尔·盖茨和扎克伯格,但他们从事的行业不同。 计算机是一个可以出现少年天才的领域,可生物医药不是。我的直觉告诉我不对。

《滴血成金》作者约翰·卡瑞尤,他发表在《华尔街日报》上的系列调查报道揭开了伊丽莎白的创业骗局内幕:

卡瑞尤在对Theranos进行调查之后发现,不仅Theranos的研发不顺利,而且他们使用一系列造假手段欺骗投资人和公众,甚至直接购入$西门子公司(0P6M.UK)$ 的大型分析仪,将输出结果伪装为自家小型设备的数据。从2015年末开始,卡瑞尤连续在《华尔街日报》推出数十篇揭露Theranos的报道,并于2018年将其补充形成了《滴血成金》一书。正是这本书的热销,使伊丽莎白的惊人骗局在2018年引发了美国公众的关注。

随着其他媒体的跟进和官方调查机构的进驻,一系列发生在Theranos的荒诞情景被披露:

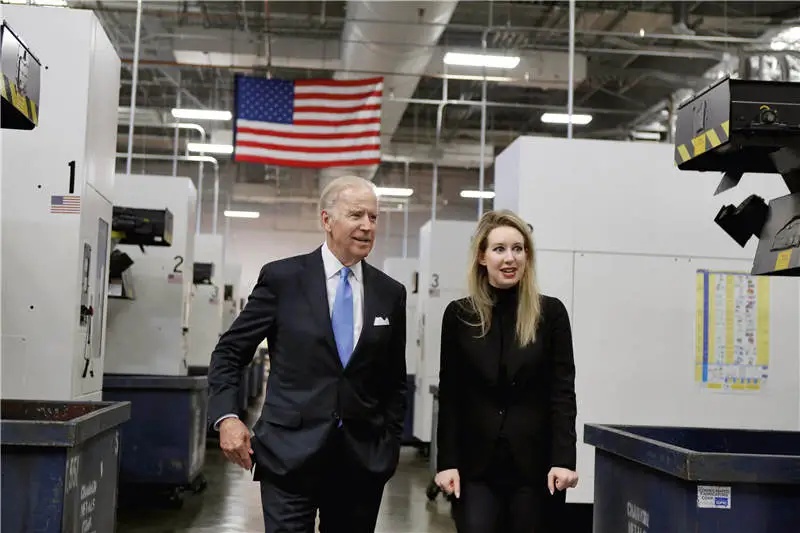

2015年7月,时任美国副总统拜登(Joe Biden)应邀前往Theranos的实验室参观。为了给拜登塑造一个最前沿的公司研发形象,伊丽莎白竟指挥手下伪造了一个假实验室,使其看起来是全自动化的。为避免暴露的风险,她甚至要求非亲信工作人员不要来上班。匆匆带拜登看过那些视觉效果上非常高端的仪器后,她组织了一个圆桌讨论,阐述其健康和医疗理念,这是她最擅长的部分。拜登在参观之后感慨: “这是代表未来的实验室。”

伊丽莎白当时和团队去瑞士演示,设备在瑞士临时出了故障,技术团队的同事都十分低落,但伊丽莎白却说演示大获成功,原来她用假数据糊弄了过去。当莫斯利 向伊丽莎白挑明了此事并且劝她不要再这样做时,他被当场开除了。

如此规模的造假行为,是怎么在公司内部被压制下来的?

原来从入职起,Theranos的员工便被层层法律条款所套牢,被迫接受严格的保密协议,于是只有两种出路:

与公司管理层同流合污,一同造假;或者离开公司,但不得向外界透露任何相关信息,否则会被 Theranos的 律师告到破产。

伊丽莎白同样迷倒了传媒大亨默多克,获得了高达1.25亿美元的投资,这既是Theranos收到的最大个人投资。2015年9月,卡瑞尤的第一篇报道即将见报,而默多克正是《华尔街日报》母公司的所有者。伊丽莎白多次找到默多克,要求压下这篇“错误”的报道。

默多克给出的答复是:

不会干涉编辑部的独立判断。

后来,伊丽莎白在法庭上为自己辩护:

这不过是又一个创业失败的故事。硅谷90%的创业公司都失败了,虽然各路人马投进来的数十亿美元已经打水漂,但我没有上市套现,谈不上任何欺诈。

卡瑞尤,认为这是彻头彻尾的狡辩,因为Theranos的不成熟检测技术和欺诈行为,已经导致有的病人一度延误病情。

卡瑞尤还说:

我很肯定的是,她15年前从斯坦福辍学时是真的想改变世界,不是从最开始就蓄意诈骗。只不过当进展不顺利时,她对成功的渴望蒙蔽了自己,让她走上了不归路。这其中更有许多人在利用她,将她一步步推向深渊。

- END -

.. ...

免责声明:本文来自网络自媒体,本人不发表任何观点和立场。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

這篇文章不錯,轉發給大家看看