美国通胀“爆表”,分析师给出最佳投资标的!

12月CPI环比上涨0.5%,同比上涨7%,40年来的最高水平。

根据$瑞银(UBS)$ 的研究显示:

12月CPI中,机动车、租户租金价格上涨强劲;进口商品、机票和医疗服务价格稳步上涨。食品和能源方面,价格涨幅放缓,但预计未来仍会继续快速上涨。

面对持续攀升的高通胀,美国著名股票研究机构【The MotleyFool】的分析师,一直认为资源类股票是对抗通胀的利器,并推荐了三只股票:

这是一家以黄金为主的矿业公司,但他们从来不运营任何矿山,他们有点像矿业里面的VC。意思是说,他们找到一些还未勘探的矿山,低价买入,然后交给别的公司勘探,自己只收取1%~3%的矿山收益。

因为矿业投资里最大的风险就是“勘探过程”,FNV这商业模式,使得他们得以很好的规避风险。

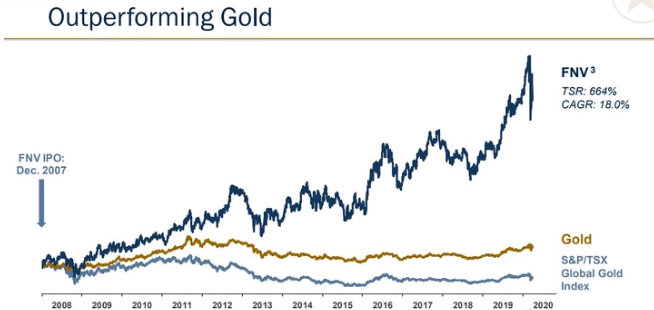

因此,他们的股价可以常年跑赢金属价格或矿业公司指数:

电动汽车对铜的需求是燃油车的四倍。此外,铜还用于可再生能源,及许多与电气化趋势相关的行业。随着新能源时代的到来,铜的需求将会激增。

CVX 是最好的能源企业之一,即使在油价和天然气价格较低的情况下也能产生回报,况且现在能源价格都处在高位。另外,CVX 的股息率高达5.6%,本身就足以抵消目前美国6.2%的通胀率。

……

最后,大家聊一聊:

- 在高通胀背景下,你是否看好资源类股票2022年的表现?

精彩留言用户可获得888社区积分噢!

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

37

举报

登录后可参与评论

虽然这个1.5%可变的,可以是1%,可以是0.5%,也可能高达2.5%,看谈判如何。

这个生意很不错啊,相当于拿很小的钱,去赌一个长期的利益。

$Franco Nevada Corp(FNV)$我得去观察一下这个公司了,真聪明的策略