当年末时点遇上变异病毒,金融市场都不太好看涨了

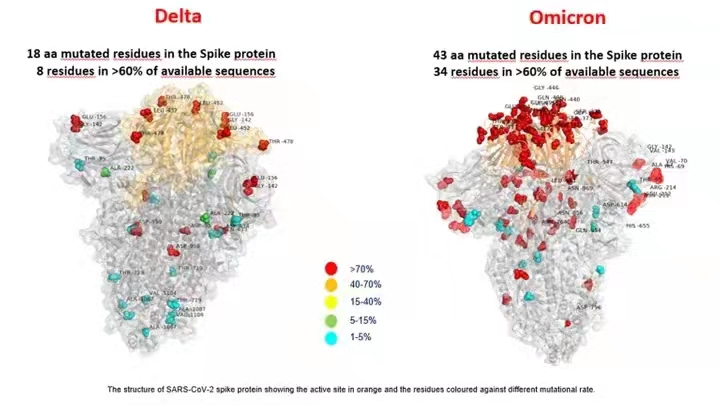

没想到此前想出的种种可能的利空消息,还真没猜到变异病毒的消息能对金融市场带来如此大的波动。究竟是调整一步到位,还是中期趋势反转?分品种评估一下。

外盘年末通常是大型机构调仓结算的时刻,所以如果前段时间获利较大,那么临近年底,有点风吹草动都会带来市场获利了结的动作,所以年末行情一般都不能省心。变异病毒由于传播迅猛,足够引起人们对经济复苏的恐慌,最坏的情况是现有疫苗和药物效用下降,导致世界大部分国家又重新封锁,再一次导致经济停顿,因此只要有利润,市场获利了结的心态会很坚决,单日波动也会加大。

具体关于原油市场的解读,大家可以看我上星期刚刚做的老虎直播课:

这种消息出来后,除非短时间内有特效药或疫苗阻止传播,不然市场恐慌情绪会有一段发酵的时间,加上冬天本来就是此类病毒的传播高峰,恐怕冬天期间,金融市场都不太好看涨了。但过了冬天,市场调整比较充分后,或许就是个可以交易的重要黄金坑。

那这消息,对当下主要的商品影响如何呢?

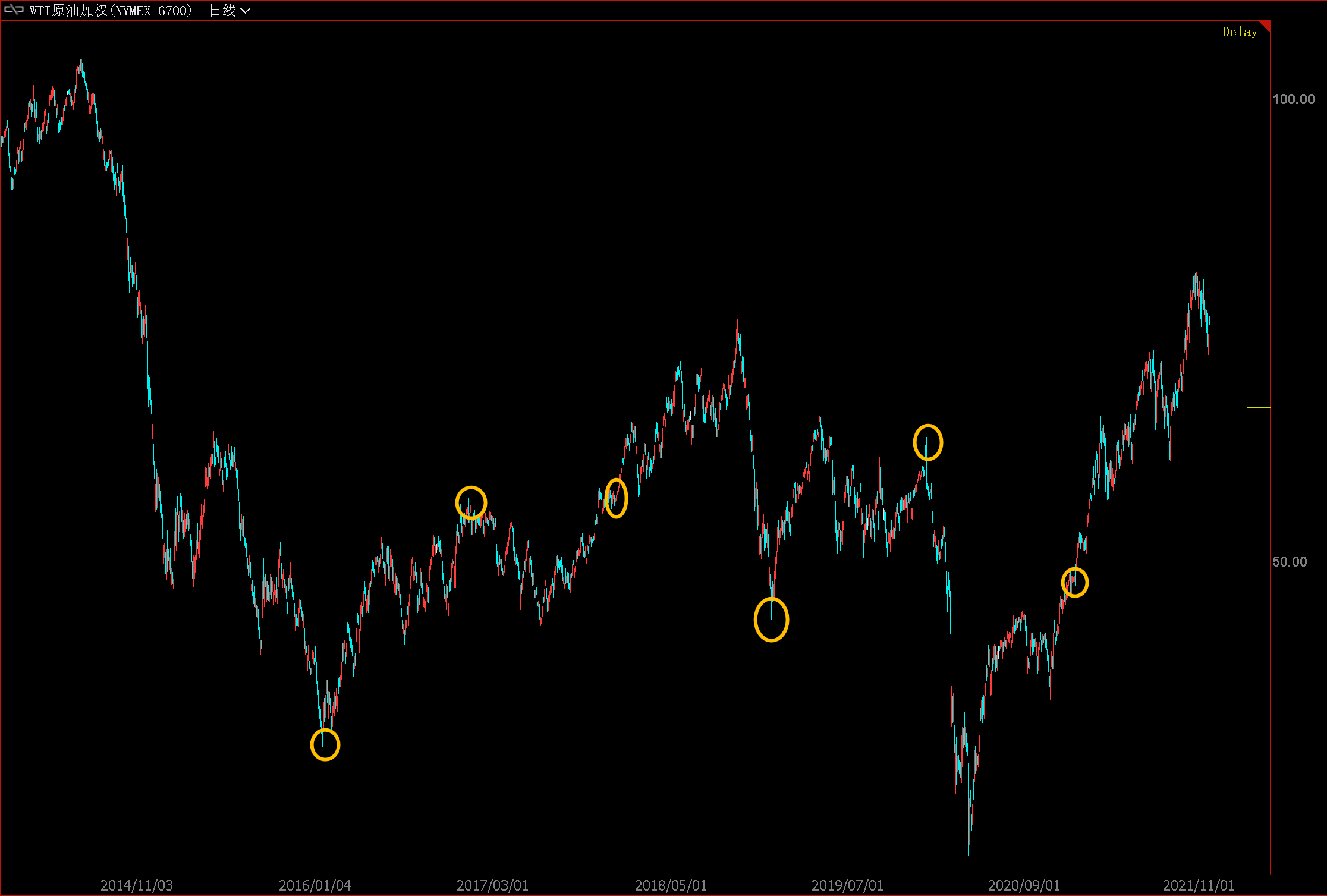

一、原油

12月30日时,原油价格理应低于75美元,是此前帖子一直强调的观点,变异病毒消息此料未及,没想到会一天跌那么多,少赚钱了(哭)。而后续原油的行情会动荡,中期趋势仍看空至年底,但幅度已被压缩,下周如果再大幅杀跌,不妨小量抄底,由于12月2日OPEC+会开会讨论增产细节,按油价这种跌幅,OPEC+有理由不再扩产,所以小赌多头即可。

另外,还是建议大家关注多汽油04空燃料油04的对冲组合,在最近的行情中仍能稳定获利,多关注。

(原油1月份见阶段顶或底的概率都很高)

二、美股

病毒又起,再一次利好纳指利空道指。但想像去年3月份那样的暴跌不太现实,毕竟有疫苗和药物,各国也不会像去年那样全面封国。因此对来说美股来所也就是阶段性利空。目前走势其实是9月份高点调整后的延申(美股调整一般2-3个月),因此12月过后,看看春天是否有黄金坑出现。

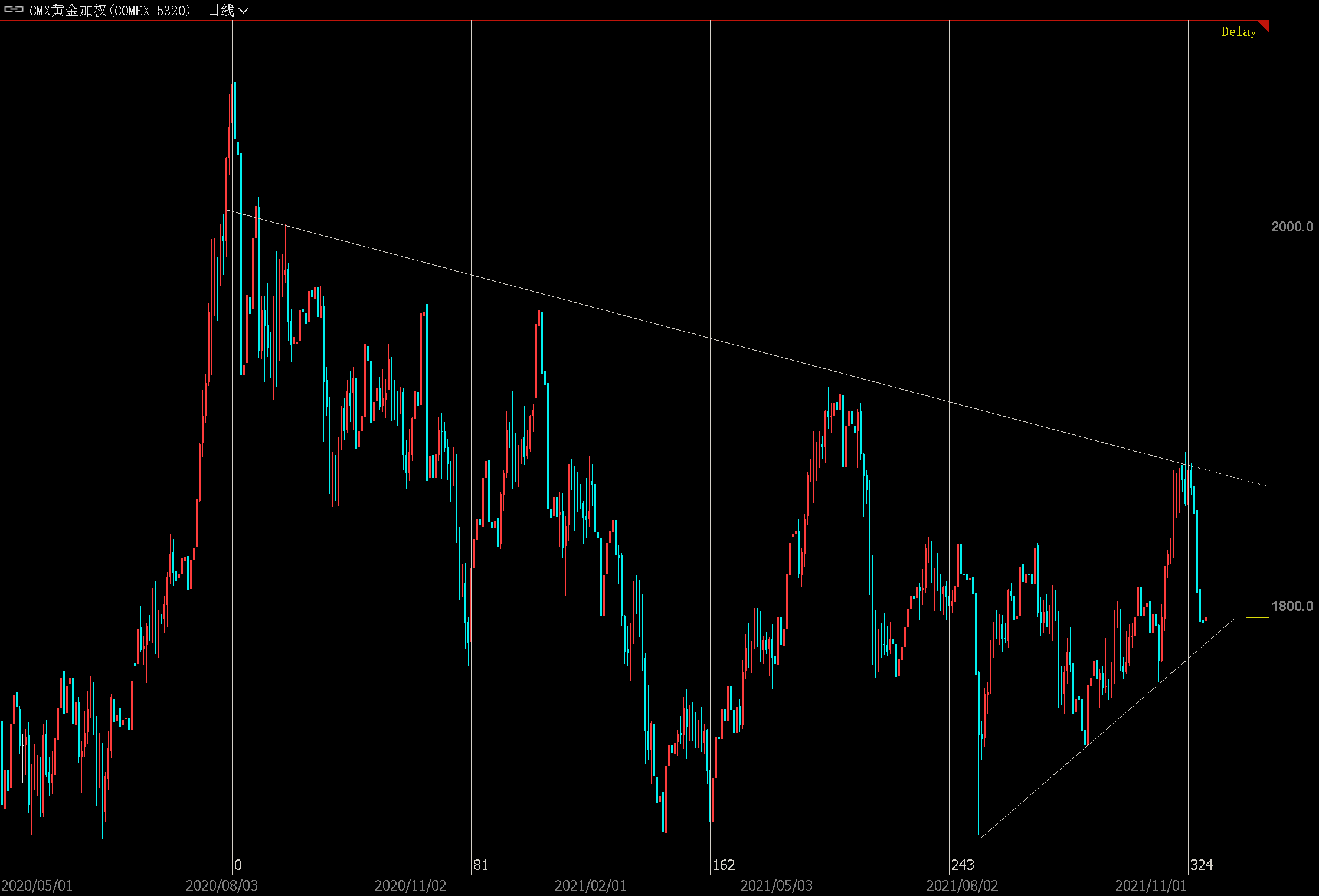

三黄金

黄金自11月16日的时间周期高点1880点开始算,理论上跌幅应大于100+美金,而当前刚好有100美金,是否调整完毕,就得看下周的表现了。但月线图表比较弱势,所以建议大家还是空头看待比较好。

四农产品

暂时还未知变异病毒对农产品这类刚需品种的影响有多大,拉尼娜天气炒作仍在,其实最好的状态就是,农产品价格因变异病毒砸下来到安全位置再重新做多。当美小麦涨到900附近时,很容易会引发大调整,而当前价格虽未触及900但也接近,消息配合的话调整也很快速,大家注意获利了结等待。

$WTI原油主连 2201(CLmain)$ $黄金主连 2112(GCmain)$ $小麦主连 2203(ZWmain)$ $NQ100指数主连 2112(NQmain)$ $A50指数主连 2112(CNmain)$

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

哈哈