段永平卖拼多多put要接盘了,我不想接盘怎么办?

感觉假期休完人麻了,市场灵敏度磨损了,忽视了两大重要事件:

- 美国10年期国债收益率升至6周高点,报1.644%

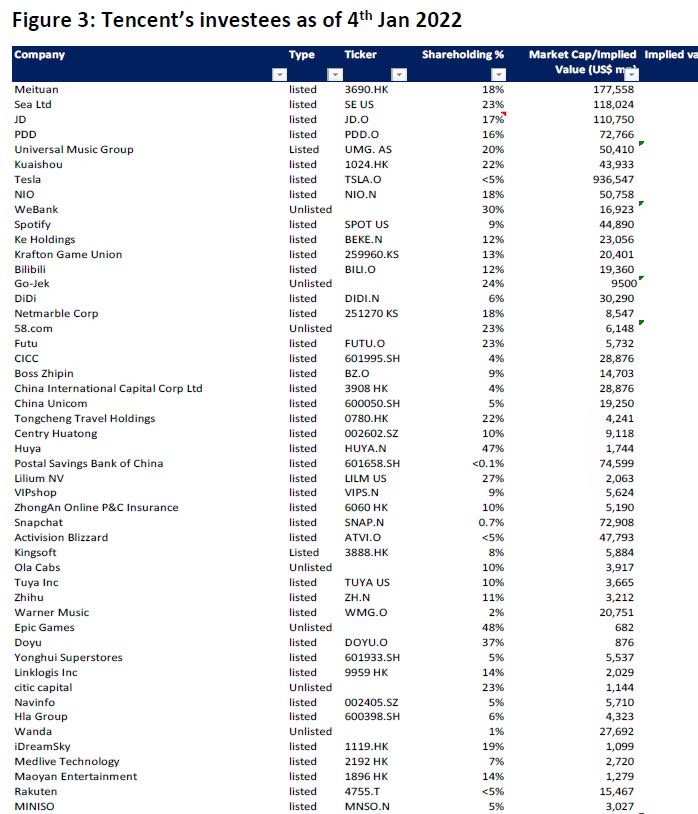

- 腾讯减持京东后又继续减持2.6%se

分别影响了昨天的成长股和中概股,从而带跌纳斯达克。今天盘前临时亡羊补牢赶一篇,谈谈中概股sell put如何止损。

首先谈谈策略的逻辑:

之前在:41%的概率,本周标普再创新高!这篇文章里提过@多算胜 推荐的止损方法:

注意,当股价反弹转涨,需要在正股做空价位平仓正股。也就是将备兑put再次转换为sell put。

判断股价趋势是这个策略的要点,这是一个多空思路转换的过程。因为sell put是以接盘为兜底的看多策略,不管put卖的有多低,只要趋势转向突破行权价方向下跌,那么sell put就很难获利。而备兑put是看跌策略,由卖空正股和卖put组成,跟备兑call正好相反,是空头使用的逢低平仓做空策略。

也就是说当你准备卖出100股正股变为看空策略,你要确定股价趋势变了。

具体到拼多多

那么中概股,准确来说是拼多多$拼多多(PDD)$的趋势变了吗?

变了。

腾讯陆续减持成了悬在中概头顶的大杀器,简直就是2022年的Bill Hwang。虽然有减持预案,不能随意胡来砸盘,但抛售预期会始终盘旋在二级市场的上空。

具体到操作

如果你卖出的是$PDD 20220121 50.0 PUT$,那么现在就卖出100股,如果做空成本价4820,那按照12月7日最低价格1.8来计算就是不赚不亏。如果你的权利金卖出价格低于1.8会产生亏损,你需要计算一下价差,看看是不是直接平仓put亏损更低。

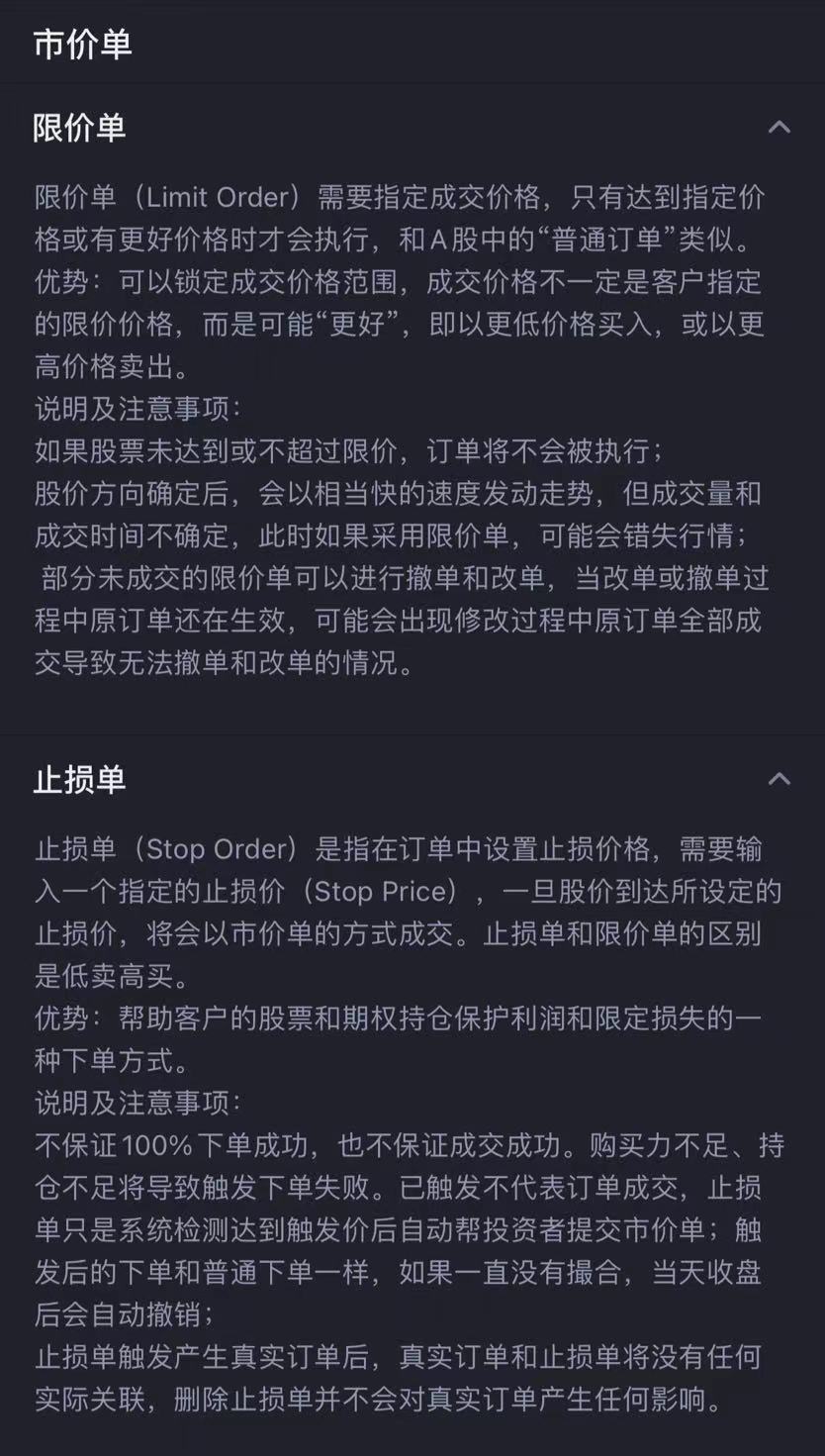

如果你卖出的是$PDD 20220121 47.0 PUT$,那么挂一个47的止损卖出单,不用盯盘,股价跌到47会自动卖出。

段永平会接盘吗?

从段永平公开的四次操作来看,目前只有拼多多这次翻车概率比较大,算了一下,需要接盘的股票有70万股。

可能会有人寄希望于段老板能大力出奇迹,把股价在1月21日之前维持在50元以上,但我觉得略有难度,相当于和整个市场预期对抗,还是不要有这种侥幸心理,做好止损策略。

策略可行性

说来也巧,昨天我刚刚实践完这个sell put转备兑策略。

1月3日周一我看股市大涨,手握特斯拉备兑以及英伟达sell put,想再做点什么,于是交易了一张amd 146的sell put。转天周二大跌,于是卖出100股AMD正股组成了备兑put组合,后来就安心睡觉了,预计周五收盘正股和put一起行权,同时收获权利金。

如果amd走势翻转,那么我会挂一张146的止损买单,原价买入正股平仓。

关于更多策略转换目前就分享到这里,有问题大家来评论区哈。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

这个好,可以琢磨一下

其实最好的卖空点是在股价大跌时(越高于行权价越好),这样就不怕股价在卖空价上下频繁震荡(少交手续费)少盯盘(盘前盘后不能成交止损单)。

这篇文章不错,转发给大家看看