加息与缩表会是决定价值股跑赢科技成长股的信号枪吗?

导读:

近期,美股成长股在taper、加息与缩表等一轮的货币正常化操作预期急剧升温之下迎来了暴跌,以纳斯达克为代表的科技股表现尤为惨烈,甚至创下了2000年科网泡沫破灭以来的最差表现,可谓是步步惊心,在市场暴跌之际,美股投资者的信心也在剧烈动摇,加息与缩表会戳破美股的牛市泡沫,从而将美股带向牛市谢幕演出,那么关键点就来了:

1. 美股当下的泡沫真的很大吗?估值分位数如何?盈利预期如何?

2. 这一次缩表的规模会有多大?上一次缩表的规模有多大?

3. 加息与缩表真的是美股牛市的天敌吗?美股就必然会跌入熊市吗?

接下来,我们将具体分析。

美联储的上一轮货币正常化路径及重要时间节点及美股表现回顾:

①2013-05-22,联储主席伯南克表示会削减QE3,正式开始货币正常化的进程;

②2013年10月,缩减购债Taper预期升温,并从2013年12月18日开始Taper

③2014年10月29日,宣布QE3结束,从实施taper到QE3结束,实际上花了10个月的时间;

④在taper结束以后,美联储开始酝酿加息,并在2015年12月15日进行了美联储的首次加息,将联邦基金利率从0.15%上调整至0.37%。在首次加息之前,纳斯达克表现一直相对强势,反而是在12月首次加息之后,美股才开始一轮调整,从2015-12-15到2016年2月9日,纳斯达克调整幅度接近14%,二月份企稳以后开始新一轮上行。

⑤加息之后的缩表:在加息一年多以后,2017年4月5日美联储开始释放出缩表的信号,此时距离第一次加息(2015-12-15),时间过去了16个月,联邦基金日利率从0.15%调升至0.91%,2017年5月24日,联储提出要进行定量式缩表并在6月14日披露具体的缩表方案,2017年9月20日,美联储表示将从2017年10月正式缩表,正式缩表时,联邦基金日利率是1.16%。从美股的走势来看,在缩表落地之前,从美股纳斯达克指数走势来看,却是出人意料的单边上涨行情。

⑥正式缩表的阶段:2017年10月到2019年10月,整个缩表历时2年,在整个缩表的过程中加息也还在继续,到2019年4月份,联邦基金利率上行至2.4%左右以后,美联储的加息结束。而在加息的尾声阶段(2018年底),税改对于美股盈利的刺激接近尾声,而中美贸易战的爆发加剧全球经济的不确定性导致2018年底美股整体盈利见顶,因此市场迎来一波加息尾声阶段的暴跌,2018年10月-12月跌幅接近25%。

因此,通过梳理回顾上一轮货币正常化阶段纳斯达克的表现有助于我们正确认识各个阶段,美联储的表态以及加息、缩表对于股市走势的影响,上一次货币正常化期间,美股的表现依然很稳健只是在加息与缩表的末期出现了一轮大跌。

那为什么这一次,还没有开始加息,美联储就要开始缩表了,市场的表现也大不一样?

当然,全部参照历史无异于刻舟求剑,今时今日的宏观环境与当时有天壤之别,12月以来美股的波动明显较大,成长股更是迎来了近十年的最差表现又与2015-2019年货币正常化阶段的表现完全不同。

【更高的估值水平+大幅度提前的缩表表态+更大规模的缩表可能规模】这三者的组合是导致近期成长股大跌的核心原因所在,也是与上一轮货币正常化阶段市场走势不一样的原因所在,接下来具体分析:

①市场整体的估值水平相较于2016年大幅度提升,导致估值对于加息预期的敏感性更高,加息预期升温阶段的市场波动会更加剧烈,成长股的跌幅也会更大。

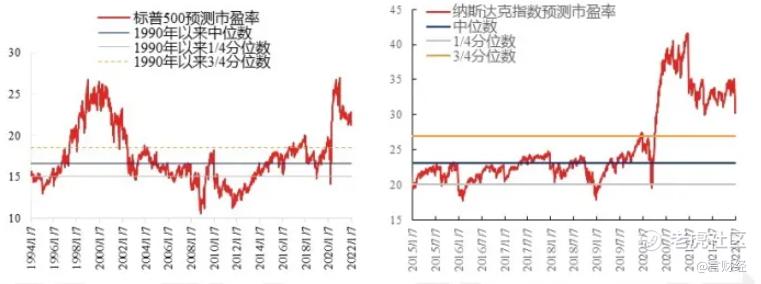

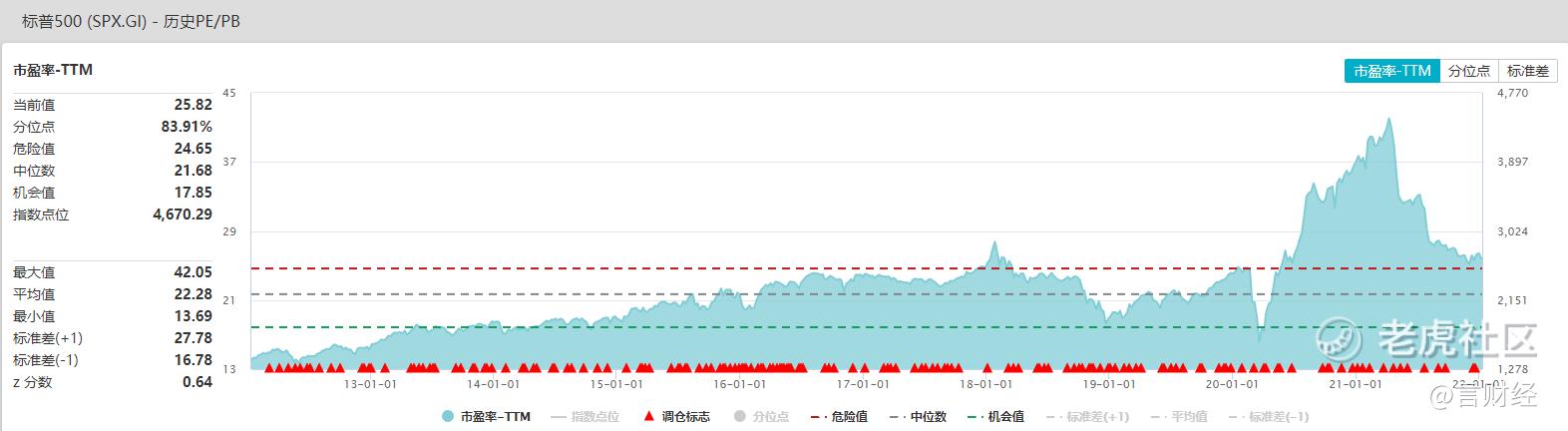

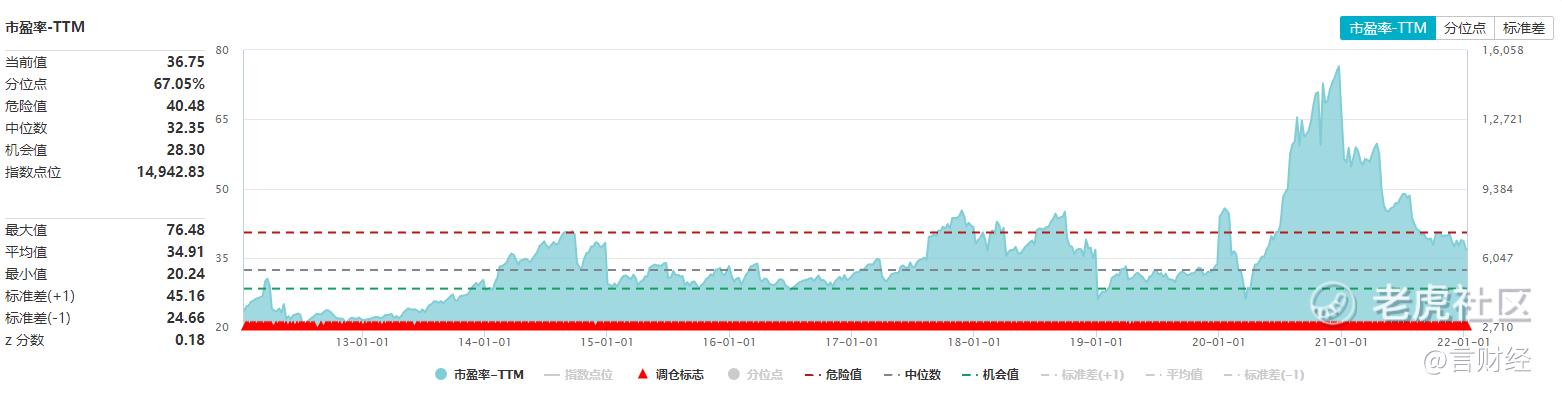

截止到2022年1月7日,标普500指数的预测市盈率为21.3倍,高于1990年以来的3/4分位数,也超过1990年以来均值向上一倍标准差,普标500的整体估值处在近30年的相对高位,而纳斯达克的预测市盈率为30.3倍,高于2002年以来的3/4分位数,也超过2002年以来均值向上一倍标准差,当下纳斯达克普标与纳斯达克的估值都处在历史上的相对高位,因此在加息预期升温阶段的波动也会更大。

②2022年以来成长股的加速暴跌主要是源于缩表的表态大幅度提前,导致市场缺乏准备,预期快速提前带来成长股更大的抛压。

2022年元旦以来的加速暴跌,主要是因为美联储突然表态要加快缩表,根据前文的回顾,上一次货币正常化严格遵循了【Taper-加息-缩表】这一进程,首次缩表发生在加息已经近两年之后(2015年12月首次加息,2017年10月首次缩表),而本次美联储表态缩表是在加息都还没有开始的大背景下发生的,所以当12月份FOMC会议纪要一发出来,直接加速了市场的恐慌,成长股被疯狂卖出,以ARKK为代表的成长股大受冲击,ARKK从11月至今已经回调超过30%,1月3日至今,短短六个交易日下跌又超过10%,可谓是将成长股的风声鹤唳发挥到了极致。

但投资者不仅要问,为什么就是成长股跌了,标普500却没怎么跌呢?

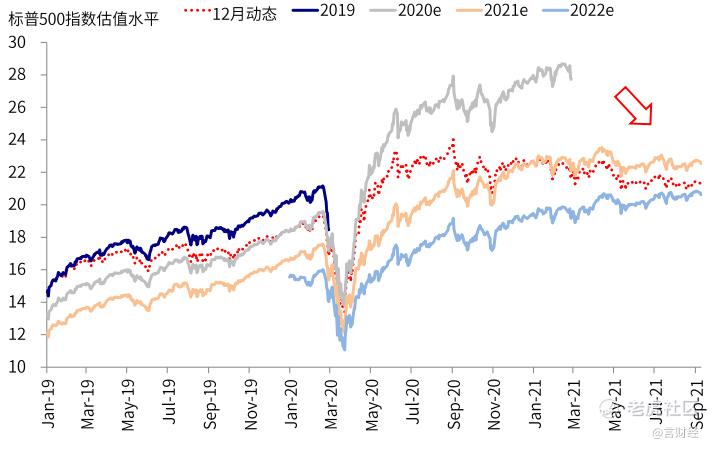

我们认为,本轮调整市场杀跌的主要对象是现金流较差或者迟迟还没有盈利的科技成长股,估值快速回落,而标普500更均衡的行业以及工业企业扎实的现金流使得标普整体的调整幅度不大,并且从估值切换的角度,如果切换到2022年估值,标普500的估值水平回到了2019年。

③缩表的规模差异决定了市场的承受能力不一样,本次缩表的规模会远超上一次是导致近期成长股大跌的另一个核心推手。

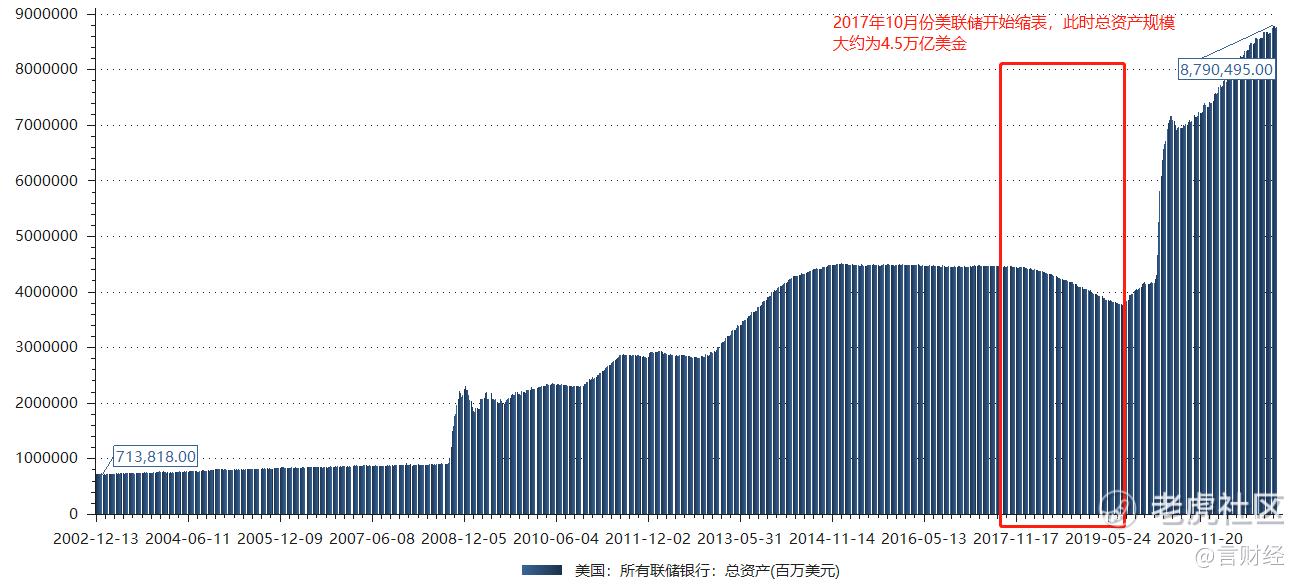

前一次缩表阶段从2017年10月份开始到2019年9月份结束,美联储的资产规模从4.45万亿美元缩减至3.76万亿美金,缩表规模为0.69万亿美金,缩减幅度为15.5%,2019年9月以后由于经济下行压力加大,美联储开始新一轮的扩表。

而本次缩表之前,美联储的资产规模8.79万亿美元,相比疫情前的4.18万亿,大幅度增长1.1倍,资产规模与2017年相比更大,即使按照上一次的减量幅度15.5%,缩表的规模将达到1.36万亿美金,是疫情前美联储资产规模的32.6%,如果减量的幅度更大,导致流动性被回收的压力会更大,对市场的冲击也更大,短期我们无法判断本次缩减的规模会有多大,只能持续深入跟踪。

实际上加息对于股票走势的影响并不是关键因素,加息与缩表更多影响的是股票的估值水平,在预期升温阶段会对股市整体的估值水平形成较强的扰动,尤其是成长股,但是等到加息或者缩表正式启动以后,决定股价走势的就变成了公司自身的成长性与盈利的持续性。

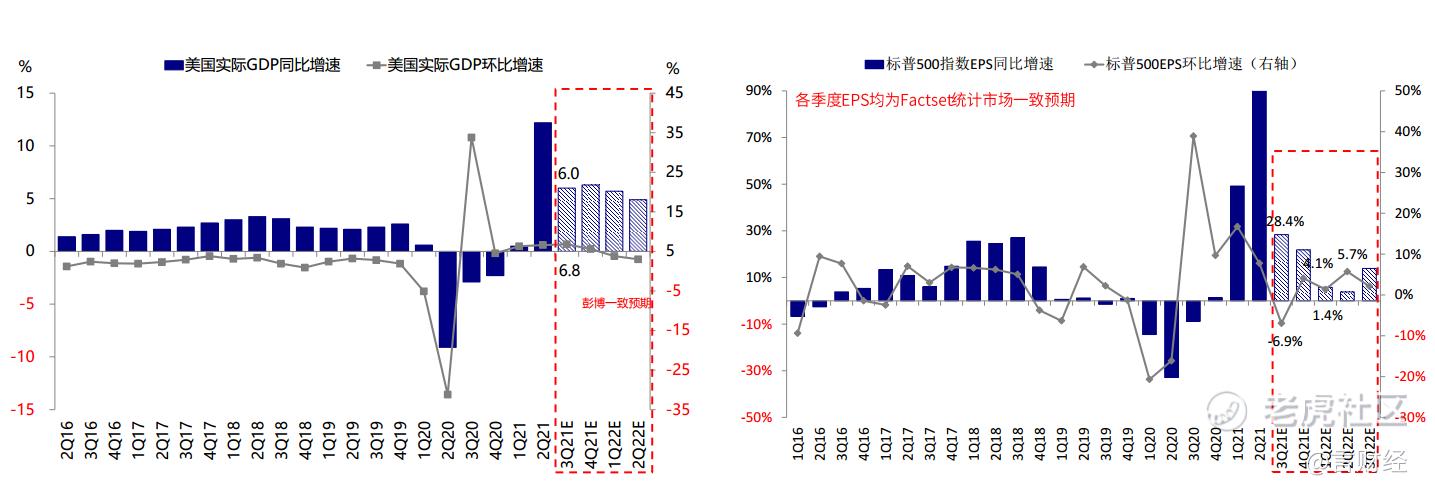

我们可以看到在上一轮货币正常化的关键3年(2016-2017-2018年),美国股市的波动都不大,核心点就在于从2016年开始,在税改以及中国重启房地产周期的拉动下,美国的GDP增速逐季度改善,从而带动美股盈利水平从2016年Q1开始逐季度改善,一直到2018年Q3美国GDP增速见顶回落,标普500指数的EPS增速也触顶回落,在盈利触顶以后,股市才真正意义上迎来了一**跌。

因此,我们可以看到,加息或者缩表影响的是估值水平,但是决定股市涨跌的核心变量还是在于盈利水平,因此,我们不能简单认为要加息了要缩表了美股就要暴跌了,核心点在于加息的状况下,标普或者纳斯达克公司盈利的持续性如何,如果盈利继续上行,股市中长期就不会出现大问题。

当下三大指数的估值水平如何?成长股后市机会远不如价值股吗?

标准普尔500,当下PE TTM为25.82倍,位于历史的分位点为83.91%,高于危险值,如果切换到2022年底的估值,有望回到中位数以下,估值的安全性较高。

纳斯达克的估值水平,当下PE TTM为36.75倍,位于历史的分位点为67.05%,高于中位数估值,如果切换到2022年底的估值,则纳斯达克的估值有望回到机会值的水平。

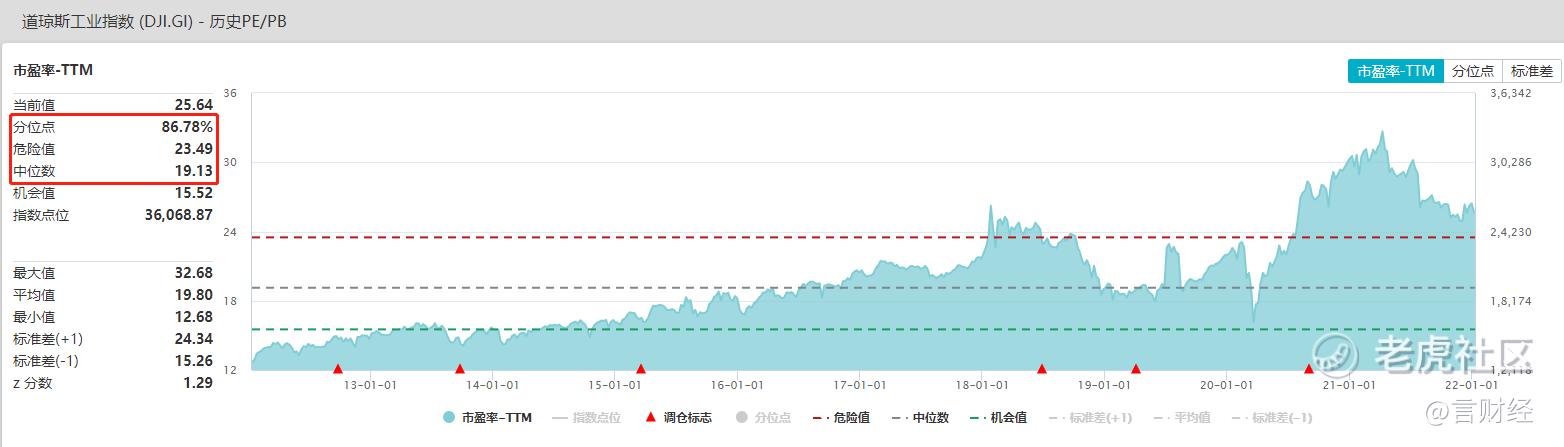

而道琼斯的估值水平,当下PE TTM为25.64倍,位于历史的分位点为86.78%,高于危险值,估值在三大指数里面最高。

从估值的角度,道琼斯指数的估值相较于历史上反倒是最高的,而我们认为其盈利持续性被市场高估,反而决定了道琼斯指数为代表的价值股后期未必能跑赢成长股,而反观成长股,近期因为各种预期的升温导致估值快速回落,事实上很多成长股2021年一整年都没有涨甚至在跌,已经消化了一年的估值,近期的暴跌更是导致估值再度回落,目前很多成长股的估值水平相对于其盈利增速已经不算贵,本**跌以后,反倒是提供了比较好的介入时点。

因此,我们后期仍然相对看好估值回落到合理位置的科技成长股,包括大型科技股:苹果以及微软、数据中心芯片三巨头英伟达、AMD、迈威尔科技,以及上游的EDA寡头CDNS/SNPS,近期持续调整的光刻机寡头阿斯麦、晶圆代工巨头台积电、以及增长稳健的云计算巨头包括$Salesforce(CRM)$ 、$Adobe(ADBE)$ 、INTU、埃森哲以及云计算细分行业的龙头包括Shopify、$ServiceNow(NOW)$ NOW、Zscaler、MongoDB、Team等。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

内地货币政策方面适度放松汇率巩固分子端,适度放松中长端利率;财政方面基建兜底;产业政策方面,边际改善分子端...今年不会大起大落