你别过来啊再过来我要通胀了

一顿操作猛如虎,涨跌全看美联储。

有一个问题一直萦绕心间。达某与木头姐、甚至美联储(大多数官员)一样,都主观认为美国通胀是短期的,是稍纵即逝的;既然如此,继续持有成长股就不必过于慌张,理由之前说过,这里不再长篇累牍。但百密怕疏,有一个关键的问题还要考虑。这个问题是:

WHAT IF 这帮人 ARE DEAD WRONG?

也就是说万一(也不是万一,真是万一就不用考虑了),通胀一直持续,那我们美股的组合要怎么办?

以史为据,温和通胀通常利好“权益资产”(“权益资产”是“股票”的逼格叫法,如同称猪肉为乌金),因为温和通胀往往是经济增长的表征,公司利润水涨船高,股价自然也翩翩起飞。但是如果温和通胀恶化为硬核通胀,则经济过热、通胀飙升之下,股票市场可能不说是腥风血雨也是风雨飘摇。

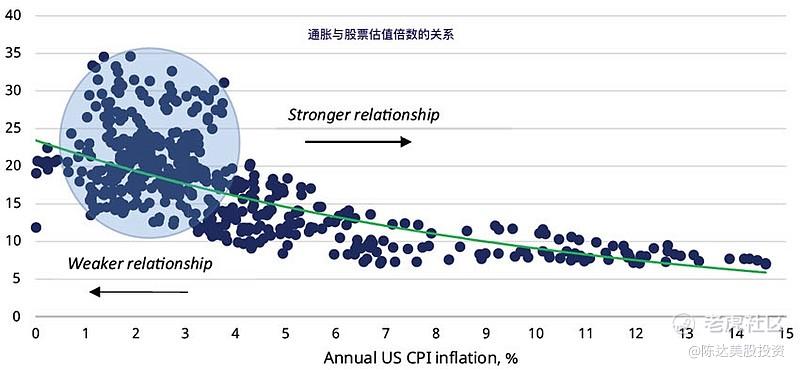

从美股某一段(1973-2000)的历史数据来看,只要通胀在3%以下增长(我们将这个数字定义为“温和通胀”),个么在90%的情况权益资产是可以跑赢通胀的;但是如果超过了3%并且持续增长,股票投资的收益就开始有像掷骰子开大小了。所以不考虑通缩的情况(通缩是最坑爹的),3%以上的通胀并持续上涨对股市不算友好。

(数据取于1973年至2000年,美国CPI数据以及MSCI USA Index(美国大中型公司指数),研究来源于SCHRODERS INVESTMENT)

从上图也可以看到,当通胀在3%-4%以下,通胀与股票整体估值倍数的关系,所谓的散点图(scatter plot)就跟散弹枪开的一样,完全没啥规律可言;但是如果超过了4%,到一个比较高的水平,虽不能说完全呈线性关系,但基本上可以看出高通胀会带来低估值。

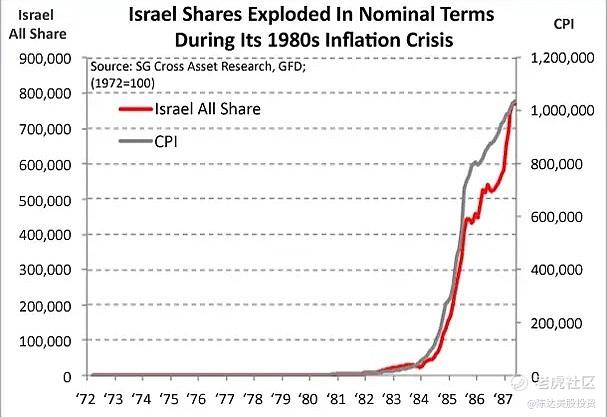

然而再极端一点的,如果超级通胀来了呢(hyperinflation,定义为三年内累积通胀超过100%),这时候你持股也不必太慌了,慌的是持币的人。历史上最有名的超胀就是魏玛共和国,当时股市基本跟通胀肩并肩;以色列在八十年代时也有过超胀,一但超级通胀,股市就跟香奶奶的包一样,必须暴涨,因为本质上是本币在暴跌。

(以色列股市股价(红线)与以色列通货膨胀(灰线)在80年代超级通胀时的表现,来源:SG Cross Asset Research)

当然自诩为神的美联储应该不至于让超胀发生;而面对通胀甚至是超胀,结论还是要持股而不是持有美金,但问题是持什么股。

逻辑而言,抗击通胀,本质上是对抗一种货币现象,那你就选择在成本增长的情况下能提价的公司,也就是所谓有定价权的公司,定价权本身就意味着你有能力提高收入,能追得上甚至跑得赢通胀。比如在消费端所谓的 big brand name 大品牌,大自然啊你尽管通胀好了,我反正一路拉产品(服务)的售价。所以大家可以去关注下,过去一年时间里大家看到苹果啊、微软啊、LV啊啥的,都涨得贼好。(因为市场预期高通胀将持续)。

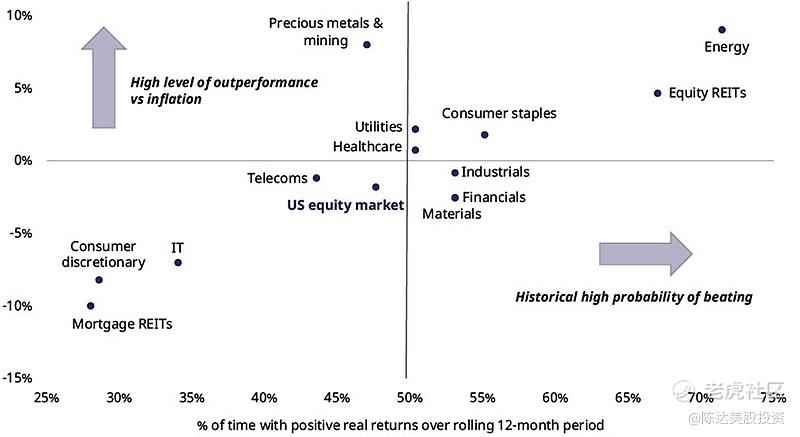

不过定价权这个思路,你就必须要有选股的能力,也就是你要有在一堆臭皮匠里选中猪哥亮的眼光。同样是big brand name,如果你一不小心踩到诺基亚牌名牌地雷,买了这种股票,就需要用一生来治愈。其实作为consumer discretionary (可选消费)这个板块而言,根据历史数据,在通胀的环境下表现乏善可陈;根据历史数据,在通胀的情况下表现的好的板块,还得是能源股、REITs(房地产信托基金)、必需消费股,这桃园三结义可是抗通胀神器。

(来源同上,各行业的股价表现,横轴是历史上能跑赢通胀的几率,纵轴是回报表现)

所以注意从历史上看,IT股和可选消费,在持续通胀面前都一筹莫展。原理也很简单,高通胀会带来高的折现率,会让画大饼的未来现金流(promised future cash flows),看起来没那么香。这也是为什么木头姐无比青睐的那些正现金流要么在未来里要么在想象的超级创新科技股,在近期的表现会卑微到了泥土里。

打个比方,崔如琢是全中国最贵最会炫富的画家,而十年后崔大师画的价格,很大程度上受到这十年他又能画多少画的影响。成长股的估值逻辑类似。

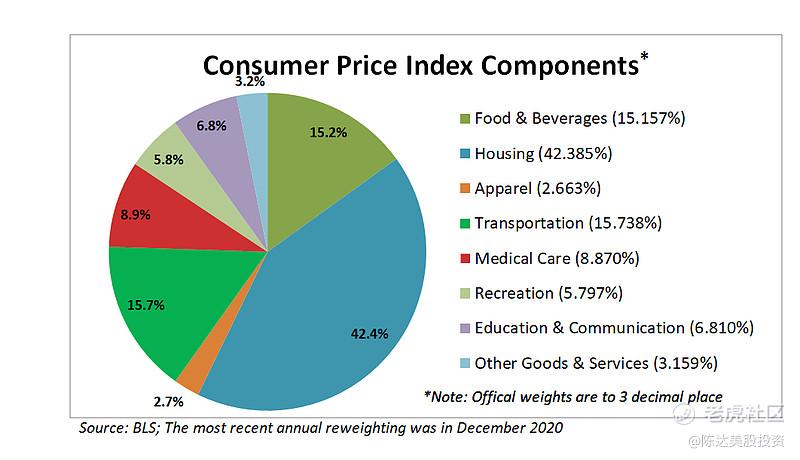

还是回到上一张图,能源(energy)、REITs、必需消费(consumer staples)为什么在通胀环境里表现那么强,其实逻辑也直男到可怕,在美国CPI指数的设定里,40%是住房成本,15%是交通能源,15%是食品,你CPI暴涨的原因就是这些生活成本涨,当然直接就是利好这三个板块。你其实都搞不清谁是因谁是果,是因为能源公司疯狂提你的油价而导致了高CPI,还是高CPI预期促使能源公司去疯狂提价。

(美国CPI指数的组成,2020年。数据来源:劳工统计局BLS)

银行股,在图里看起来不算是太CPI受害股,不过通胀对于银行、金融股而言肯定不是好事,原因也很简单,银行的商业模式是利差,往往是最大的债主,而债主都怕高通胀。老赖最喜欢高通胀,恨不得今天找你借的100万明天就变成了一堆擦屁股纸。所以债台高筑的人,本质上都是货币的大空头。

公共事业股,水电气煤,往往表现也一般,因为他们很像债券;当通胀上去了,债券的利率会上升,而他们的吸引力相对自然也就下降了。但一般还是会很稳,穿越牛熊。

所以基本结论是通胀如果控制在相对低的水平,那么不会太影响股市的估值;但如果超过一定的水平——比如3%或4%,进一步的上涨将总体上伤害股票市场。当然我认为这也有边际递减的效应,也就是说伤害到一定程度,就麻了。真的摆烂到超胀的状态,那股价就会跟着超胀随波逐流。而上升的通胀对于不同板块的影响也不一样,历史上大概率跑赢通胀的是能源、房地产信托基金、必需消费,当然还有你吃得准不会挂掉的大牌子;所以你可以根据你对通胀的预判,来调整自己的组合。

但事实上最难的还是预判市场的预判,也就是去猜,这种持续通胀有多少已经price in了,未来会不会有转机。因为如果现在才切换到能源或者REITs,或者所谓有定价权的大品牌股,是不是已经晚了,是不是会两头挨打。这要三思。

------------------------------------

本文不构成投资建议;

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

通胀与股市的关系