【月入一万美元的期权实战策略】最强的下跌保护PP(12月篇)

新股神Tom Lee在12月27日接受CNBC采访的时候表示看好2022年美股会有双位数的增长,但同时他也强调2022上半年极有可能发生一次10%以上的回调。他的看法至少说明一点:在3次加息的预期下,2022年的美股之路将是崎岖不平的。面对这样动荡的市场,我们期权玩家有什么应付的招数呢?

在之前文章《做买家还是卖家? 》里我曾经打了一个比喻说做期权的卖方就像是卖保险的:如果那个雷不劈下来,那个保险费我们就笑纳了;如果那个雷劈下来了,那么卖家就向买家支付损失。你也可以把期权看作是卖家向买家提供了一种保险的服务,那个权利金就是买家所支付的服务费。不知道大家有没有反过来想想,我们自己是不是也有买保险的需要呢?

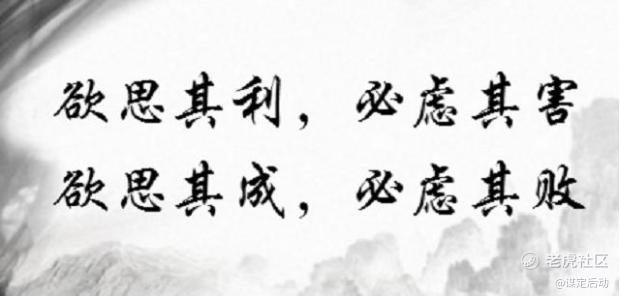

诸葛亮曰:欲思其利,必虑其害;欲思其成,必虑其败。意思是想从某件事情中谋取利益,首先想想会不会带来坏处;想要谋划某个事情使其成功,必须考虑会不会失败,失败了会怎么样。这是诸葛孔明的治国领军之道,却也是投资之道。新韭菜散户在入场前一般都是只想着赚到钱如何如何,不大考虑亏了钱怎么办,或者也懒得去想。

其实少亏钱也是赚钱的另一种方式,非常重要的是,少亏钱能让我们更长久地留在牌桌上,投资是长期的,你赚了多少是看你真正离开牌桌的时候所能带走的筹码。因此决定投资是否成功不仅仅看你在牛市里赚了多少,也要看你能否在熊市里保住本金。“留得青山在,不怕没柴烧”,只要我们保住本金,才能保住翻盘的机会和希望。

以往的期权策略我们说的都是怎么赚钱,而这一期我们说一个怎么让我们少亏的期权策略:Protective Put(保护性看跌)。

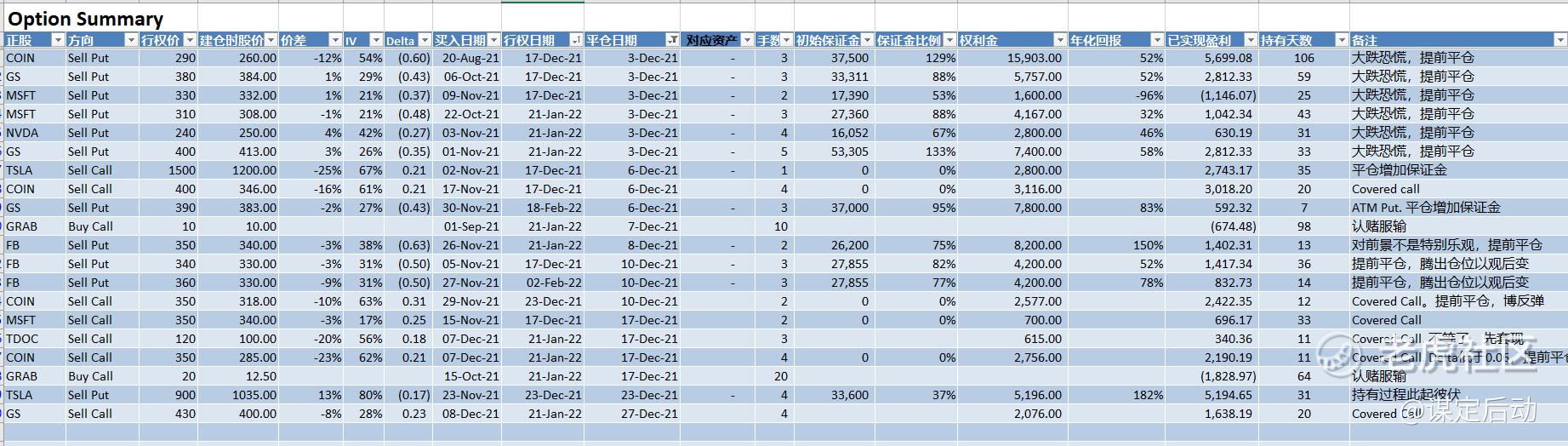

按照国际惯例,先看看我期权策略这个月的收益情况:

十二月份盈利3万1千刀

2021年全年平均每月落袋盈利2万8千刀,夏普比率1.61,杠杆率1.82。

这是跌宕起伏的一个月,月初的时候大跌,我提前平仓了很多SP以降低风险度,盈利减少了,但是平稳地度过了危险期。到新年行情开启的时候,我手头上的SP持仓已经是一个算是健康的盈利状态。

12月份完成的期权交易一共20笔,记录如下

截至12月30日我的$特斯拉(TSLA)$ 持仓

截至12月30日我的$Coinbase Global, Inc.(COIN)$ 持仓

截至12月30日我的$Meta Platforms(FB)$ 持仓

PP的优点:最强的下跌保护

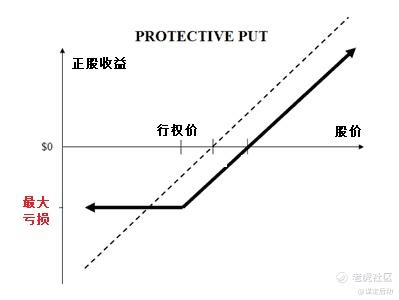

保护性看跌期权 (Protective Put,简称为PP), 是指在持有100股正股的同时买入一个行权价低于当前股价的看跌期权。

当股价跌超过行权价的时候,Put的买方可以以行权价卖出100股的正股,从而减少了损失。比如,特斯拉现在的股价是1100,我有100股正股,我觉得两个月后的股价会下跌,于是买入一张行权价为1000的Put,两个月后,特斯拉受负面消息和加息政策的双重打击,股价暴跌至850。这时候我可以以950的价格卖出100股正股。本来我的损失是(1100-850) x 100 = 25,000,因为有Put的保护,我的损失就减少到(1100-1000) x 100 = 10,000了,等于赚了15,000。

持有股票就是看涨,股票涨多少你就赚多少,同样的,股票跌多少你就亏多少。而买Put就是看跌股票,当股票下跌时你就能通过这张Put赚钱。而这两者结合,就是一种下跌保护的期权策略:当股价下跌的时候,你的损失会减少,当股价跌下Put的行权价的时候,损失就不会再增加了。

从上面的这个盈亏曲线图看,PP的单纯持有正股相比,在保留了正股上方盈利的空间之外,完全封住了下方亏损的范围,也就是完全封住了股价跌破行权价以下的风险。这就是PP的威力,这是保护性力度最强的期权策略。

PP的缺点:高成本

当然,期权的世界总是有得有失的,想要鱼与熊掌兼得,那是想得太美了。PP能提供最强保护的代价是它高昂的成本。下面以纳指ETF(QQQ)为例:当前ETF股价是401,一个月后到期的ATM Put价格是8.15,就是说买了这个ATM Put以后不管跌多少就都不怕了。

我们来算一下,如果这个Put买一年的话需要多少成本?成本应该是8.15 x 12 = 97.8,占比是97.8(权利金) / 401 (正股价值)= 24.3%!要知道2021一整年里,QQQ的增长才23%,24.3%的保护成本把这一年的盈利都吃掉了。

由此我们也可以得出一个结论:PP是不能经常做的,这个策略只能在特殊的市场环境下偶尔使用。

多大的保护取决于你愿意花费多少成本

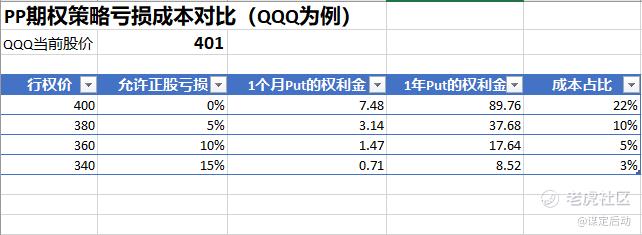

成本太高,那么我们买个OTM Put又如何呢?还是上面的例子,如果把行权价降低一些,买个行权价380,360的,或者340的又如何?我们来看看下面的表格。

对于PP策略,最重要的一环就是选择行权价。那么我们怎么选择行权价呢?选择行权价就是选择你愿意承受的最大亏损以及你愿意付出的代价。如上图,如果你不愿意承受任何回撤,你需要支付的代价是22%的年化回报,如果你愿意承受5%的回撤,你的代价将是10%的年化回报;如果你愿意承受10%的回撤,那么代价就是5%的年化回报。如此类推。

行权价的选择没有对错之分,这只和各人的判断和风险承受能力有关,只是这个选择在开仓前就应该计算清楚。

PP和CC的差别

期权这个金融衍生品被发明出来的初衷其实是用来对冲风险的。Protective Put(PP)和Covered Call(CC)都是保护性的期权策略,让我们在股价下行的时候能保护住利润。PP和CC最本质的区别是表达投资者对后市大方向的不同看法:如果认为后市下跌可能性大且幅度会比较深的话,可以采用PP来保护头寸不受下跌影响;如果认为后市横盘或者微跌,而不会暴涨,那可以采用CC的策略来赚取额外收入。

降低PP成本最优解 - 未雨绸缪

降低PP成本最好的办法就是当股价处于高位的时候开仓PP。这个时候IV(隐含波动率)不会太高,成本也就降下来了。这就是所谓的”别人恐惧时贪婪,别人贪婪时恐惧“。

但是猜顶是一件几乎不可能的任务。”别人恐惧时贪婪,别人贪婪时恐惧“,这话听着容易,但是对于经历过牛熊的老韭菜们知道,能做到的这点的都是股神。正常人都是别人恐惧时也跟着恐惧,这可是人类演化的结果:几十万年前,当一只剑齿虎追过来的时候,大家都会非常的恐惧,并且把这种恐惧的情绪传达到还没有看到狮子的同伴,于是一群人都四散奔逃了,那些不会被恐惧情绪感染的家伙就被剑齿虎叼走了,于是留下来的基因都是会被恐惧情绪感染的,作为后代的我们血液里流动的就是这样的基因。

当市场大跌的时候,IV会变得很高,这时候人人都抢着买Put保护,不可避免地Put的价格会变得很高,想要保护就要付出更大的代价。

但是Timing the Market(市场择时)是一件很难或者是近乎不可能的任务,那么我们还有什么其他的办法来降低PP的成本吗?

买Put后再卖出 一个更低行权价的Put

还是以上面QQQ为例说明,PP的保护力度是从行权价到零的范围的,但事实上,QQQ的股价不可能跌到零的,从下图看2021年的最低点是352,那么我们可以认为需要保护的这段时间里QQQ不会跌超过360,

于是我们可以卖出一个行权价为360的Put,得到的权利金为1.47,那么我们这个对冲保护期权组合的成本就从7.48减少到7.48 - 1.47 = 6.01,成本减少了近20%。

当然,万一如果股价跌破360,这个策略就对正股完全没有保护了。期权策略都是取舍,有得必有失,这是我们操作期权是要有的基本概念。

买Put后再卖出 一个Covered Call

上面的做法是牺牲更低股价保护的代价来降低成本,好处是保住了万一股价上升的盈利空间,循着这样的思路,如果你对股价的上行不抱希望了,那么你可以以牺牲股价上升的盈利空间而卖出一个Covered Call(CC),从而同样实现降低PP成本的目的。

你看,期权的组合就是这样取舍关系,有得必有失。

了解对手的想法

期权是一个零和的游戏,你卖出去的期权一定被一个买家买走的,你赚到的就是TA亏掉的,反之亦然。也就是说,每次期权交易你都有一个对手的。对于那些期权卖家来说,PP策略或许不是你盘子里的菜,又或许你也没有多少机会能用到,但是了解这个策略的内涵却是对你操作Sell Put的策略非常有帮助的,因为这正是你的对手的思考模式。

所谓知己知彼,方能百战不殆。

之前的系列文章(400万+ 阅读量)

【月入一万美元的期权实战策略】论期权卖家的修养(11月篇)

期权进阶篇:【月入一万美元的期权实战策略】给Sell Put加条腿(10月篇)

期权进阶篇:【月入一万美元的期权实战策略】稳赚不赔的期权策略了解一下?(9月篇)

期权入门篇:【期权系列特别篇】苹果新品发布在即,期权咋整?

期权入门篇:【月入一万美元的期权实战策略】期权是一个什么梗?(7月篇)

期权策略图解:【月入一万美元的期权实战策略】图解信仰派打法(6月篇)

危机应对:【暴跌启示录】裸卖看跌期权策略的危机应对特别篇

勿忘初心

我们投资的目的是让我们的生活变得更好,有更多的时间陪伴家人或者做自己喜欢的事情,而不是相反。

本人爱好航拍,下面分享一个我的航拍视频。新加坡中央集水区,摄于2020年。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

这篇文章不错,转发给大家看看

这篇文章不错,转发给大家看看

这篇文章不错,转发给大家看看