拼多多为何痴迷农业? 站在农业升级角度去思考

在对农产品上行的持续观察和研究过程中,我们的观念也经历了几次比较大的调整。如早期认为只要将资金或相关生产要素投入农村市场,便可结出令人欣喜的果实,其后我们加入了人才这一生产要素,以为“新农人”回巢将对该领域起到决定性作用等等,但如今反思大都有以偏概全的问题。

当我们夸大一个要素,而忽视相关配套设施和生态时,就会对现状产生过分乐观或悲观的结论,事实上,一个产业能否稳步前行一方面固然是靠生产要素的投入和改变,而更重要的动态看相关生产要素是否持续在改善区间。

本文将通过详实的数据分析,解答以下问题:

1.如今农产品上行究竟处于怎样的阶段;

2.相关要素的持续成长性又如何?

3.拼多多在新一季财报中继续要扩展农产品电商业务,这又是为何?

在过去几年时间里,我国政府一直在积极推动提高农民的收入问题,在政策方面最为明显的乃是“土地流转”,打破原有制度制约,以此提高大面积耕种比例,提高耕种效率,为农民增收。

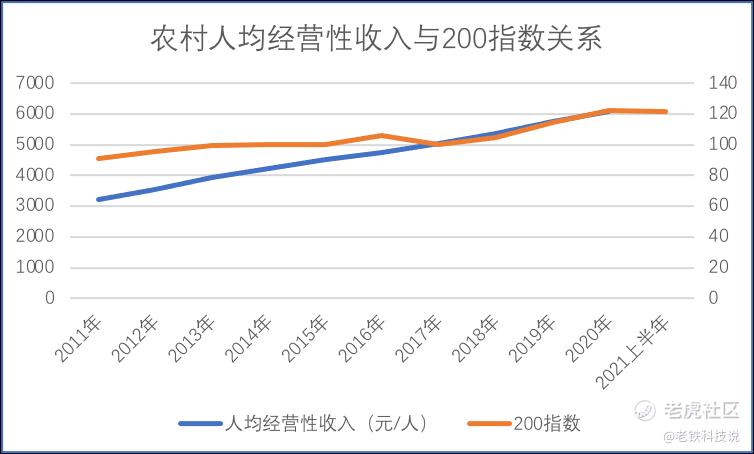

以2017年为分界线,在此之前农产品200指数与人均经营性收入之间有明显的“剪刀差”,从逻辑推论,该剪刀差主要为农产品由田间地头到城市市场中的差价,也就是说,农产品在城市菜场销售所产生的收益并未等比例传导至农民的经营性收入中,农民收入被抑制。

其道理也比较容易理解,小农耕种且层层流通周转都要留足毛利率,利润被渠道吃掉,农民在产业链中溢价能力极弱,获利也就较低。

与此同时我们亦发现,2017年之后两条线开始弥合,而彼时恰是土地流转被快速推进的时期,产生了相当积极的一面。

就此角度去看,农产品上行在政策的鼓励之下,已经打开了上行的天花板。

那么这又处在一个什么样的阶段呢?

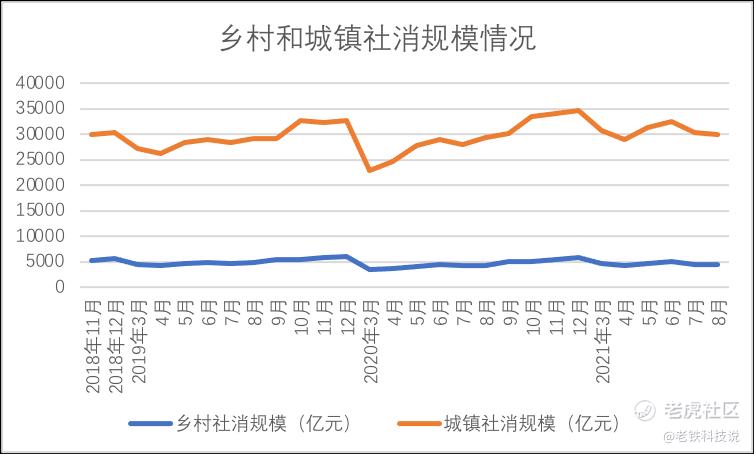

若农民对增收充满信心,大概率会将此信心反馈在消费端,于是我们用社消情况来看农民对增收的信心情况,见下图

上图中可以明显看到,对比城镇消费乡村社消更为平淡,而城镇社消规模起伏则相当之大。引用统计学的标准差这一概念之后,我们测算上图周期内,城镇社消的标准差乃是乡村的4倍之多。

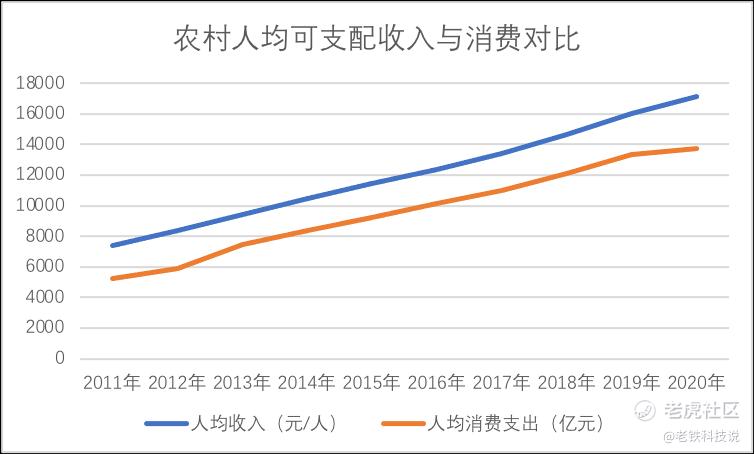

考虑到消费习惯,其主要原因为农村消费更为偏向耐用品,对改善型消费仍然相当保守。从消费反推收入,不难发现,尽管土地流转之后农民收入有了明显增长,但并未充分改变农民的消费信心,也就是说,农产品上行对农民收入的增加并未形成持久的预期,此阶段也就是树立信心的关键时期。

上图亦再一次验证了上述结论,在2020年后,人均收入仍在增长而消费出现明显下滑,信心受到不同程度的冲击。

如此就可简单概括当下我国农产品上行的现状:1.政策红利正被打开,长期释放红利;2.农村居民对未来尚未有确切乐观的信号,需要持久推动,说农产品上行是一场持久战是毫不为过的。

那么对于以拼多多为代表的企业进入农产品领域,这又是一个怎么样的时机呢?

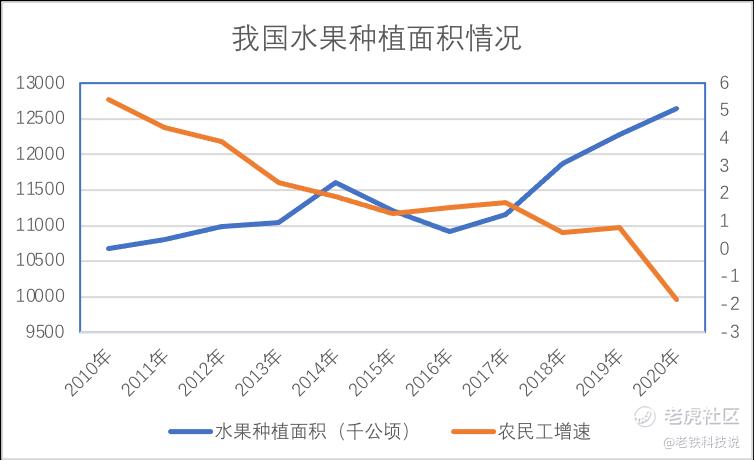

在我们对数据的观察中,有一个结论是相当清晰的:受政策红利等因素影响,农村居民对“经济作物”的偏好陡然上升,再看下图

我们以水果作为经济作物代表,在过去几年时间里,该部分种植面积整体上呈现了迂回上涨的局面,尤其值得注意的是,同样是2017年该部分水果种植面积曲线斜率陡增。

在前文分析中,我们已经明确2017年是农业的转折年,在上图中又得到了一次交叉验证,可见结论之精准。另一方面,我们又对比了农民工的增长情况。

很显然,一方面乡村经济作物收益预期在增加,而另一方面受人口红利等因素影响,农民工外出务工的规模也在缩减,也就是说,由于受未来预期乐观的影响,外出务工人员选择返乡从事经济作物种植,“新农人”成为新的社会现象。

也正因为“新农人”的出现,从根本上提高了农业从业者的素质,并带来的城市的先进经验,可以说农产品上行已经具备了爆发的潜质。

这也就引出了行业新的话题,经济作物种植规模上升,市场如果的运行机制如果依然以上一个周期进行(以批发模式为主,农民在产业链中分配利润极低),这就又会挫伤农民的积极性,产生丰年伤农的问题。

因此,我们既要看行业改进的希望,亦要明确市场机制提高之迫切,如此才能从根本上提高农民收益。

我们再看以拼多多为样本,线上企业对农产品上行的侧重点和希望,展开分析之前有必要认真梳理下拼多多的模式和变化。

拼多多本质上是一家平台电商,为商家提供交易渠道和流量支持为主,收入主要有广告收入和交易收入(主要为移动支付手续费为0.6%)。

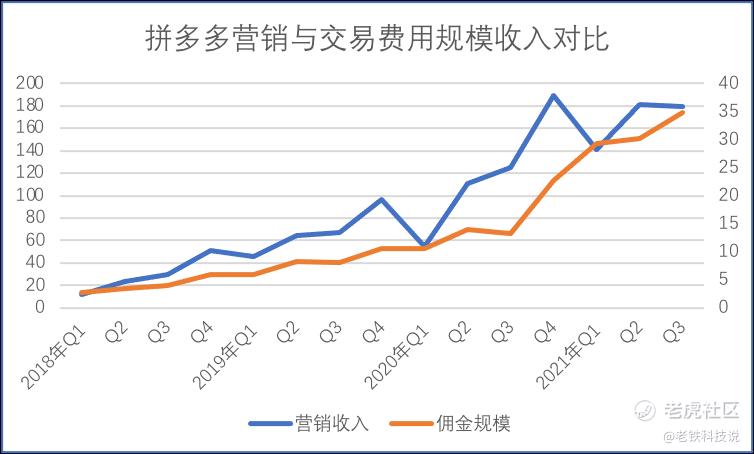

于是我们整理了拼多多广告收入的增长情况,见下图

在过去接近5年时间里,受用户规模和其带来的流量增长,拼多多营销类收入总体处在快速的增长势头中,成为市场对其持以乐观态度的支撑点,但与此同时我们也注意到进入2021年之后,该数字增长明显变缓,此部分被悲观者认为是增长乏力。

作为一家电商平台,理论上用户规模增长必然带来流量的膨胀,而后者又是广告收入成长的基础,但为何拼多多在用户仍然增长之时,广告收入出现了停滞呢?

我们想到交易性收入这一指标,相较于营销收入,交易收入更加确切,毕竟这是代表商家实际成交量的,用两组数据做对比更为直观,见下图。

除2020年Q1以外,两条线大多数时期保持了同等的节奏(2020年Q1主要为疫情下对商家进行主动减负),但进入2021年之后,我们发现两条折线日益分化,Q3交易收入仍然在大幅增长之时,市场费用竟然停滞了。

在此之前,两条折线分化我们是有预期的的,毕竟社区团购作为新业务对营销类收入贡献不大,但却贡献交易收入,但真相真是如此浅显吗?那么我们就有必要对上图中的两条折线进行长周期内的相关性测试。

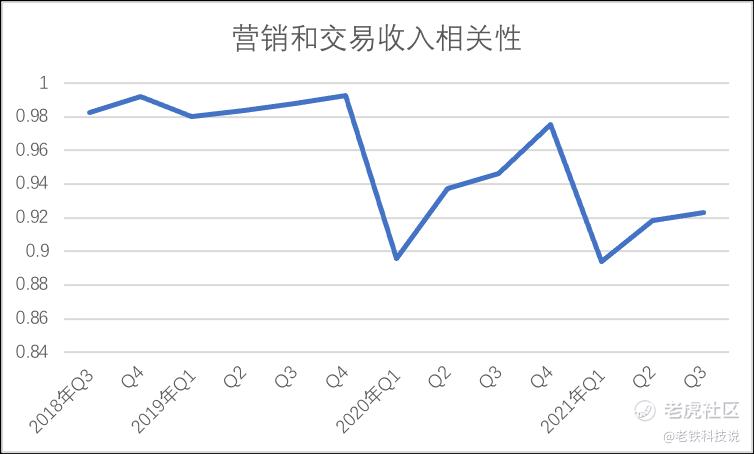

我们用excel测算了自2018年以来两条线的相关性情况,见下图

可以极为清楚看到,在过去三年多时间里,营销和交易收入两条折线的相关性是不断下降的,即便剔除2020年Q1这一突发事件因素亦是如此,也就是说,或许社区团购业务的成长降低了营销收入的比重,但放在长周期的视野里,我们不难发现此趋势乃是持续相当长时间的。

这也为解释拼多多在2021年Q3的收入“异常”提供了新的解释:平台以牺牲营收成长性为代价对商家进行了让利,也就是故意抑制了平台的商业化能力。

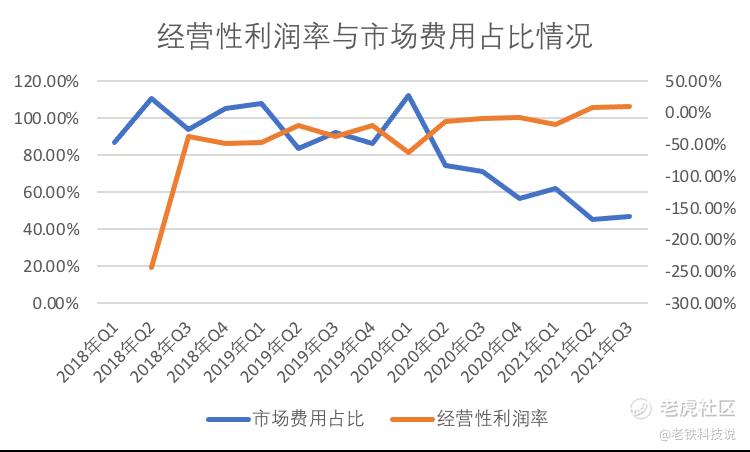

这也悄然改变了拼多多的商业模型,在过去很长一段时间企业都采取了强市场费用吸引用户,做大市场再进行市场投入这一循环中,成长迅速但也存在不少争议,如质疑此模式是否可以持续。

在上图中可以清楚看到,进入2020下半年之后,拼多多就开始削减市场费用占比情况,且经营性利润率又在持续改善通道中,企业在进行积极的利润化转型,从估值模型看,企业似乎正在从市销率引导市场进入市盈率。

脱离此背景单考虑成长性我们认为是不太全面的。

对拼多多进行梳理之后,我们再来看农产品上行的预期问题。

如开篇所言,农产品上行的关键并不仅仅是资本和生产要素的投入,而是商业模型的重塑,尤其在政策红利被打开后,原有商业模式下的利益分配机制很难激励农民的积极性。

也就是说,农产品上行要由要素驱动升级为模式驱动。当我们以拼多多为样本进行运营层面分析之后,就不难发现其中的契合点:

1.相比于其他电商平台,农产品在拼多多平台上是高频SKU,结合降低商家市场费用这一背景,农产品商家在拼多多中一直零佣金,是“减负”的最大受益者,或会提高平台在商家中的凝聚力,并反哺用户端认可,实现正向循环,这是模式再造的起点;

2.当我们无论是用CPI还是用菜篮子指数,抑或是细分领域的期货指数(如云南咖啡豆价格指数)去验证时,农民收入与该指数关系并不特别密切,提高市场分配机制在农产品销售中,意味着降低中间商权重,拼多多的社交电商价值亦在此;

3.进入2021年之后,拼多多研发费用占比陡增,这也意味着企业开始逐渐由商业模式驱动向研发驱动转型,可能会给农业带来持久的改变。

作为农民的孩子,我最后仍然要强调:农产品上行是一个苦差事,需要持久性,希望大家能携手长伴,共创未来。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 兰博基尼比基尼·2021-11-2951%的营收增速,并没有让市场满意。在财报披露前,市场预期拼多多第三季度的营收为41.6亿美元,预期的营收增速为88.6%,如此看来,拼多多的这份成绩单,是不及预期的。受此影响,美股开盘后,拼多多股票遭到市场抛弃,股价闪崩、暴跌,盘中最大跌幅一度接近20%,截止收盘,全天跌幅高达15.86%,再度刷新2021年以来的最低点,单日市值蒸发超161.6亿美元(约合人民币1034亿元)。点赞举报

- 尾灯支架·2021-11-2911月26日美股盘前,拼多多发布2021年第三季度财报,报告期内,拼多多营收215.06亿元,同比增长51%,增幅较一季度的239%和二季度的89%大幅放缓。 拼多多继续保持盈利趋势,第三季度归属普通股股东净利润为16.4亿元,去年同期为亏损7.85亿元。数据非常强劲,如果未来监管有所缓解或许现在入场是不错的机会1举报

- 小虎不下山·2021-11-29本季度,虽然拼多多继续实现盈利,但营收不及预期,互联网用户触及天花板,互联网电商下半场,拼多多模式彻底显性,市场用脚投票,表现出对拼多多的耐心有限。奇偶派曾在拼多多三季报前报道《商家逃离拼多多》,对构成拼多多生态极为重要的中小商户的困境处境进行了详细描述和分析,这也是拼多多后院失火的典型状况。点赞举报

- 托马斯火车头·2021-11-29利润扭亏,营收同比增长,但是投资者看到的是,拼多多三季度营收环比下降7%。投资者对环比增长比较敏感,意味着公司单季度增长遇到瓶颈,占营收半壁江山的在线营销服务这个季度只有124亿元,上个季度为180亿元。此外,活跃买家数达8.673亿,单季增长只有1740万,市场预期2000万,同比增长19%,增速进一步放缓。点赞举报

- 清茶一杯_0228·2021-12-03这充分说明拼多多更具有社会责任感。资本市场需要的是快餐文化,割韭菜。大家都知道做农业是件苦差事,连大佬农民的儿子都不想干事,拼多多干起来了,这是一件多么值得尊敬的、爱护的。但就是有那么一些人自己不干好事,居心叵测的围攻拼多多。拼多多加油💪💪💪支持你点赞举报

- 量化交易追随者·2021-11-29拼多多的股价从2月份最高点的212.59美元,跌至当前的68.46美元,累计跌幅达68%,从高点跌下来已没了近万亿市值。大家觉的现在可以进场吗1举报

- 控盘坐庄最在行·2021-11-29本季度拼多多营收同比增长51%,相比二季度的同比增速89%,出现了肉眼可见的下滑。不过,对比来看,阿里巴巴第三季度的营收增速为29%,京东的这一数字为25.5%。可以预见的是,未来,拼多多营收放缓将是新的常态。点赞举报

- 想飞的鱼026·2021-11-29市场从拼多多的财报中嗅到的危险信号是,拼多多正在变慢。营收增长放缓,活跃用户数增长也在放缓。而拼多多拿出亚当和夏娃时期的“遮羞布”是,16.4亿元的净利润,主要来自对营业成本、费用的控制。点赞举报

- 雷斯司机·2021-11-29在具体的业务方面,网络营销服务及其他收入为179.47亿元,同比增长44%。交易服务收入为34.77亿元,同比增长161%。商品销售收入为8210万元,同比下降79%。点赞举报

- 权力的游戏厅·2021-11-29毛主席说过了,农村是一片广阔的新天地,多多干的不错。1举报

- 蓝侧切0·2021-11-29个人觉得拼多多年度活跃买家数量达到了8.6亿人,已经触及互联网用户增长的天花板,下沉市场增长空间有限,会影响营收增长。点赞举报

- 哎呀呀小伙子·2021-11-29三农一直是国家重点监控的行业,多多搞这个赚钱可能会有,但是想要保证利润可能不好有。点赞举报

- 岿然不动的稳·2021-11-29一夜暴跌1000亿,拼多多突然闪崩,一则财报“吓懵”市场?这到底是肿么啦点赞举报

- 梅川洼子·2021-11-29拼多多昨天的股价大跌是因为财报还是因为农产品?点赞举报

- 刀哥拉丝·2021-11-29黄峥刚走,这信任的掌门人就给拼多多跳转了航向,这个似乎有点不妥了。点赞举报

- 玉米地里吃亏·2021-11-29作为农民的孩子,有情怀是可以的,但是要把这个当成生意,可能就比较难了。点赞举报