阿里未老先衰,互联网巨头集体卖惨,传统电商见顶了?

$京东(JD)$ $阿里巴巴-SW(09988)$ $腾讯控股(00700)$

嗨,大家好,我是晓艺~

最近又到了财报季,中概股陆续披露财报,在这其中我比较关注的呢就是阿里巴巴和京东了。

不知道大家是什么感觉,就我个人而言,最近几年我用的比较多的就是京东和拼多多,淘宝给我的感觉就是高不成低不就。尤其是到货速度,京东的体验感要远远好过阿里,上午买下午到,这购物体验京东真的是完爆淘宝。而在价格上呢,淘宝也不具有什么优势,很多小东西上拼多多买是真香啊,其实说白了还是穷...

所以说,京东也是走出了一条有独特护城河的路,并且越走越宽。而阿里巴巴,在核心电商这业务上,被拼多多、抖音和快手直播带货蚕食了不少。这些也都体现在他们的财报上,今天呢,我们就来聊聊阿里、京东这些互联网巨头吧。

一、阿里巴巴

11月18日,阿里巴巴集团发布了2022财年第二季度财报。

可能有人看到这就疑惑了,为什么是2022财年第二季度呢?

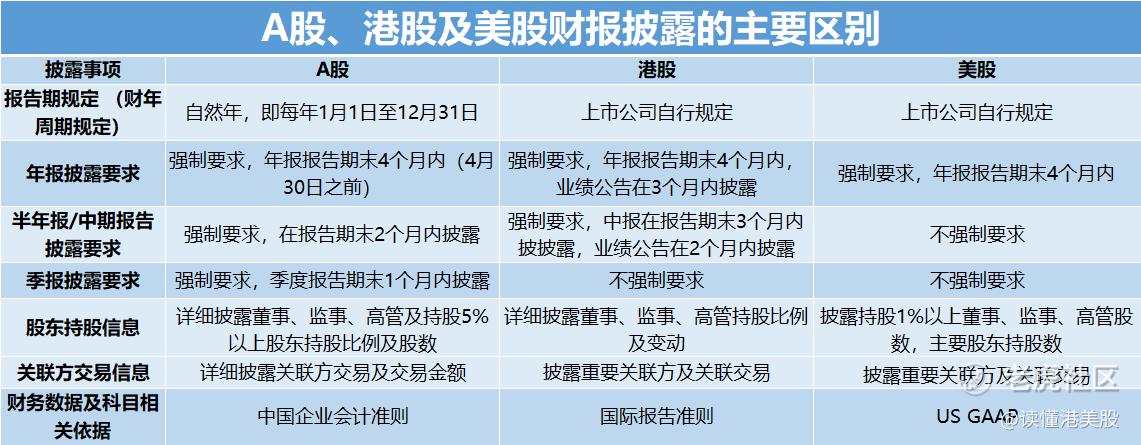

我们来讲一下,阿里巴巴是在港股和美股上市的。与A股不同,港美股市场对于上市公司的财报要求不是按照自然年(1月-12月),而是按照财务年计算,企业可以根据自身行业的特点与经营状况自由选择会计年度起始时间,但原则上时间跨度为1年。

我给大家整理了一下港美股和A股之间财报披露时间的差异,大家可以好好看一下:

考虑到电商行业的季节性因素影响,阿里巴巴采取了不同于其他公司的财年计算方式,阿里巴巴的财年是从当年4月1日-次年3月31日,所以说2022财年Q2也就是指今年的Q3啦。

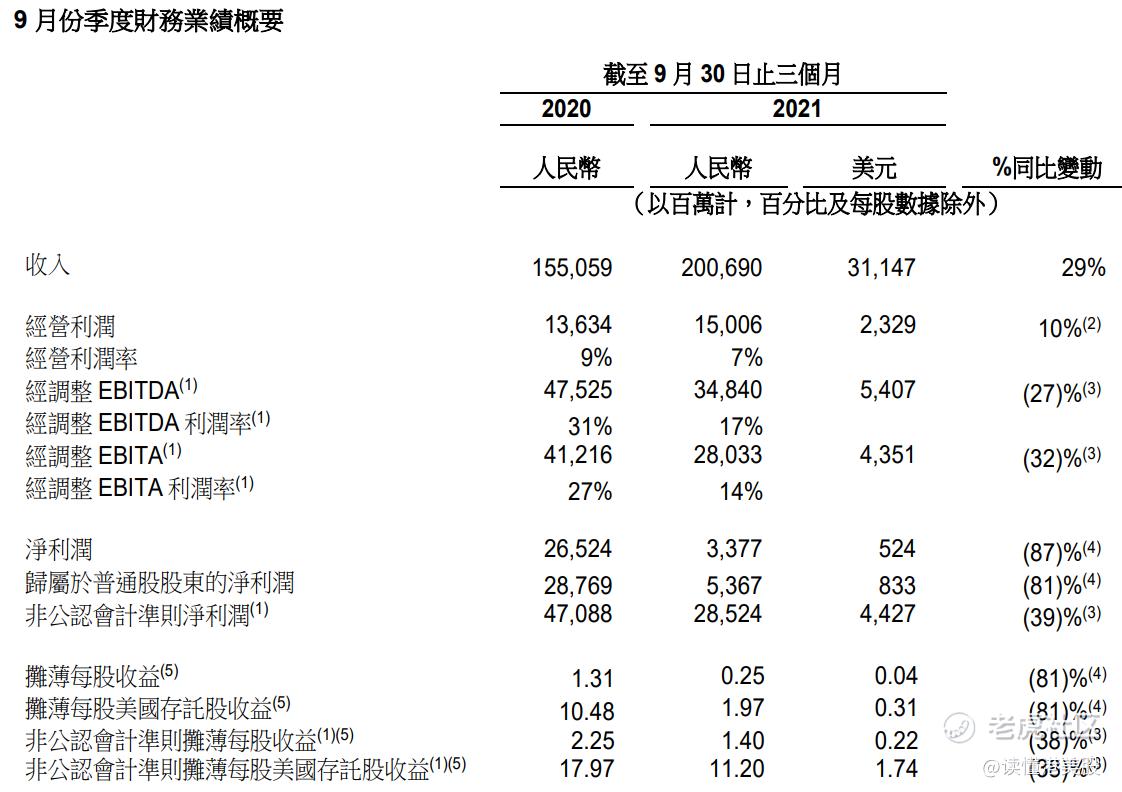

第三季度,阿里巴巴的总营收是2006.9亿元,同比增长29%,低于市场预估的2061.7亿元;若不考虑合并高鑫零售的影响,其总营收为1804.38亿元,同比仅增16%。

阿里财报刚出的时候,网上就有不少吃瓜群众在讨论,阿里这个利润下滑得太大了。我也是去仔细看了一下,乍一看啊确实是不太乐观,非公认会计准则下的净利润下降了接近4成。

但是呢,大家要清楚人家阿里早就说过了,“计划将2022财年所有增量利润及额外资本用于支持平台商家,以及投资于新业务和关键战略领域。”

并且阿里要投资ESG,创造更多社会价值,现在降的这点业绩对于阿里来说都不算事。毕竟真正的重点,还是得去看未来的发展。

我们还是来具体看看阿里的各个业务情况吧。

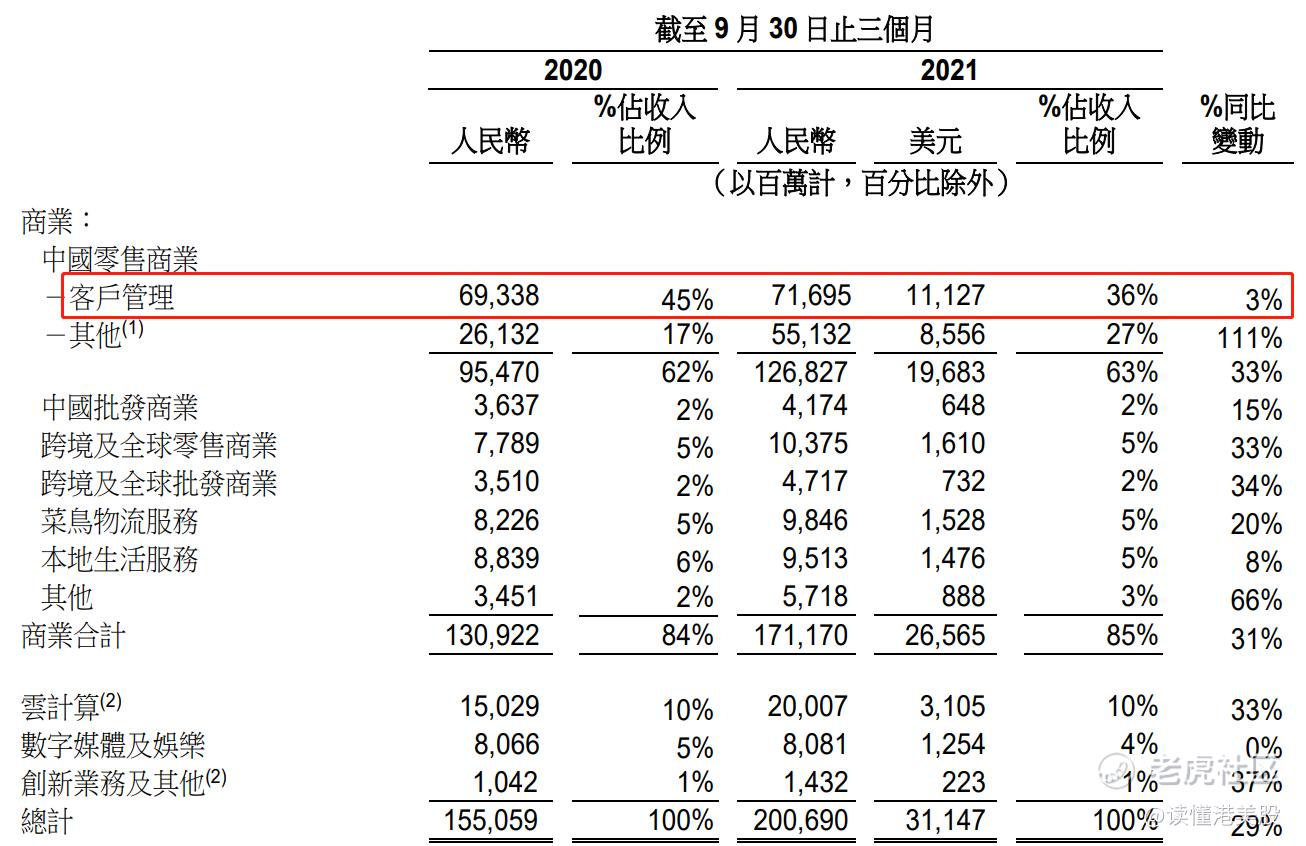

在第三季度中呢,增长倒数第一的是阿里大文娱,收入同比几乎没有增长。倒数第二名是“中国零售商业”板块下的“客户管理”收入,同比仅增3%,这一部分的收入主要是来自淘宝天猫的广告费和佣金。虽然近几个季度这项收入占总营收的比例有所下降,但这一部分业务仍然是阿里最重要的收入来源。

根据近几年的财报,我们可以发现阿里的自营业务越做越重,越来越像京东了。阿里“中国零售商业”板块下的“其他”业务(主要包括高鑫零售、天猫超市、盒马等直营业务)在三季度贡献营收551.32亿元,同比大增111%,占总营收的比例达27%。

除此之外呢,财报还显示,阿里巴巴的中国零售市场GMV同比仅录得“单位数”增长,而阿里传统优势的服装和配饰类目GMV增长放缓。

二、京东

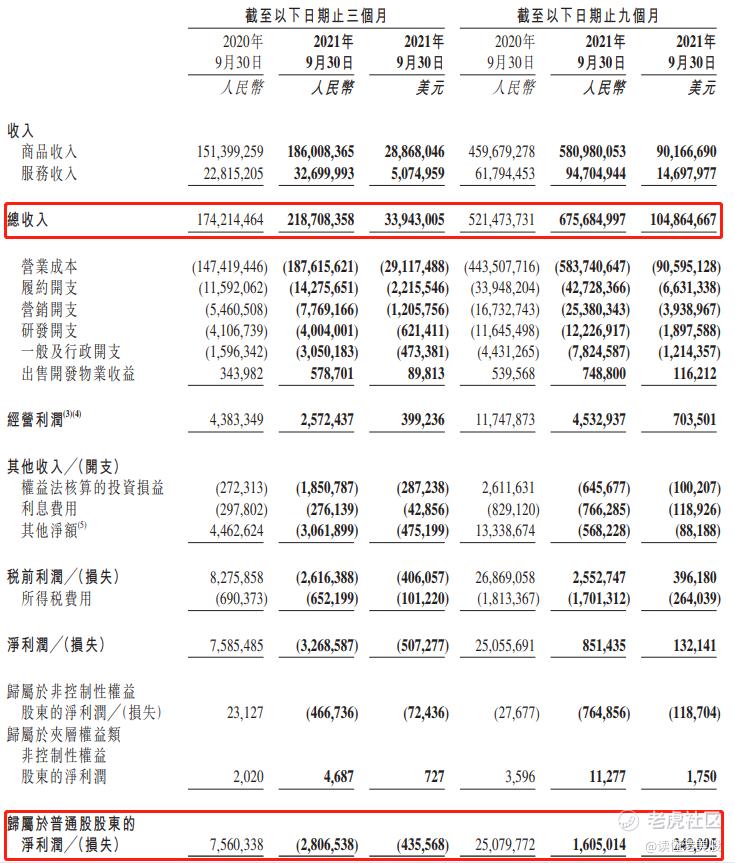

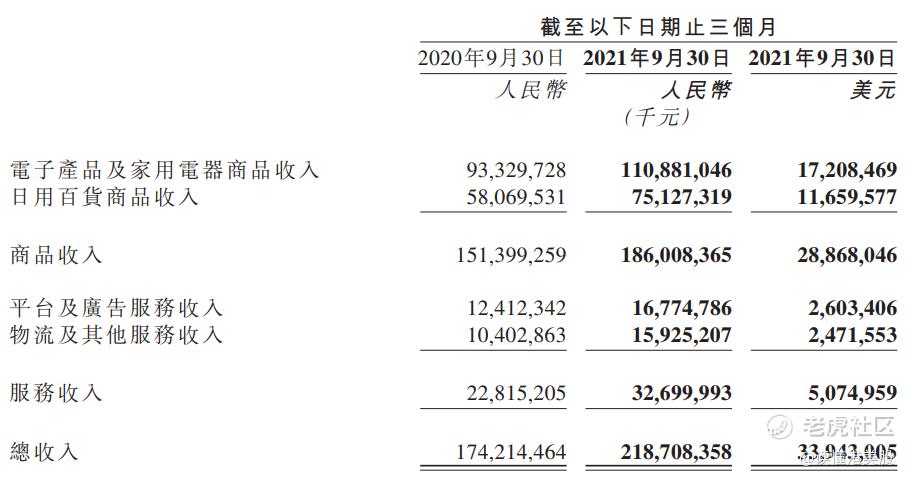

11月18日,京东发布2021年第三季度财报。第三季度,京东的营收为2187亿元,同比增长25.5%;归母净亏损为28亿元,而在去年同期为盈利76亿元;非GAAP净利润为50亿元,去年同期56亿元。

京东的收入中,主要分为商品销售收入和服务收入,前者就是京东自营,后者则是由“平台服务收入”、“物流及其他服务收入”构成。

根据财报,“平台及服务收入”(主要来自3P业务的广告和佣金收入)这部分业务达168亿元,同比增长35%,高于京东总营收的增长,也显著高于阿里巴巴“客户管理”收入3%的增长;京东三季度的“物流及其他服务收入”(主要来自物流外单)达159亿元,同比增长53%。

总体来看,京东这份财报是比较稳健的,特别是营收同比大增(核心电商业务)。

我们一对比京东和阿里的财报,他们之间的区别就出来了。同作为核心电商业务,京东的护城河还是比较深厚的,但阿里则很容易被拼多多、抖音、快手冲击,电商的业务影响很大。

三、唯品会

最近呢,曾经的第三大电商平台——唯品会发布了第三季度的财报。当然啦,现在的唯品会市值不到70亿美元,和阿里、京东早就不在同一个量级上了,慢慢地被大家淡忘了。不过呢,唯品会是目前最传统电商模式的坚持者,也能说明一些行业现象。

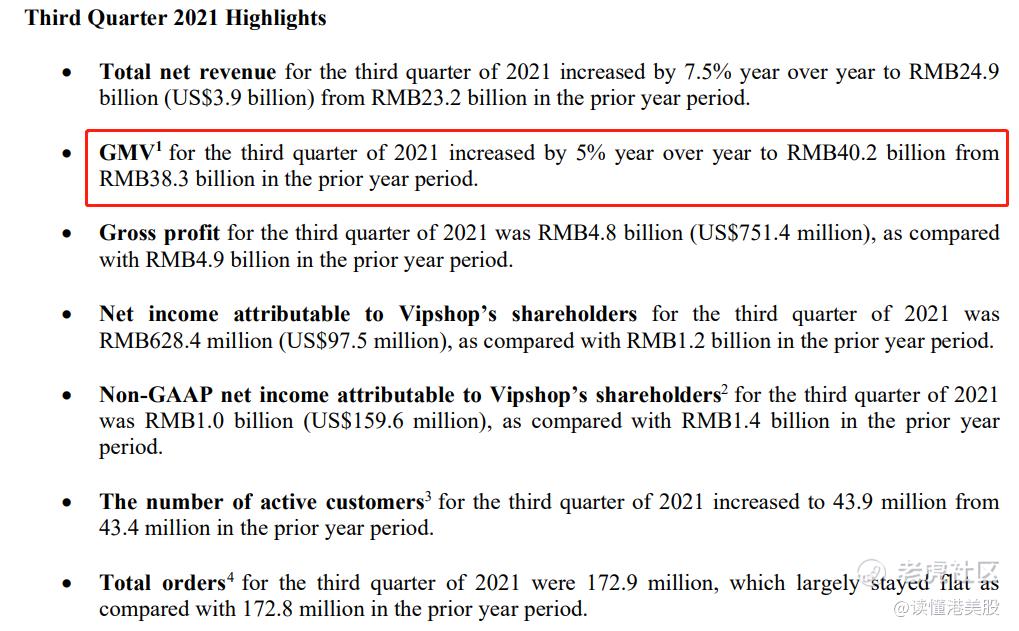

根据财报,在第三季度,唯品会净营收达249亿元人民币,同比增长7.5%;按非通用会计准则,归属股东净利润为10亿元;不按非通用会计准则,净利润下滑49.5%至6.28亿元。作为连续36个季度盈利的唯品会,现在的盈利能力也是大幅度下降。

对了,在唯品会的财报里还有一点,需要我们着重关注一下,就是唯品会三季度的GMV为402亿,同比增长5%!对比阿里电商GMV增长也在个位数,所以,整个传统电商的大盘,可能真的快到顶了。

四、总结

目前,在国家对互联网的强力监管以及倡导共同富裕的大背景下,互联网巨头们都在尽量低调,求生欲满满,不断强调自己并不赚钱,这样的表现也算是合情合理。

但是说真的,对于电商的盈利能力,总感觉不至于像现在这么惨,净利润下降的也太快了点。在今年上半年还表现的不错,到了这一季度互联网巨头咋集体卖惨,也是很有意思,是不是用力太猛了点啊。

从阿里、京东、唯品会的最新财报或许已经告诉我们,在未来很长一段时间内,电商行业将告别高利润、高增长的时代了。

投资港美股,就看读懂港美股!

声明:以上投资分析不构成具体买卖建议,股市有风险,入市需谨慎。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 灯塔国02·2021-11-29马云马老板如果现在不学习京东,估计以后的路就更难走了。1举报

- 低买高卖谁不会·2021-11-29唯品会还活着吗?太没有存在感了,还以为早就不在了。1举报

- 弹力绳22·2021-11-29拼多多现在不是在转型吗?你看好不看好这个转型?1举报

- 梅川洼子·2021-11-29电商行业已经告别高利润、高增长的时代了,不过内卷这条路可能不适合阿里。1举报

- 迪士尼迪斯尼·2021-11-29原本我还想这几天抄底阿里的,你这文章来的有点及时。1举报

- 哎呀呀小伙子·2021-11-29你说的几家财报中,你觉得京东的增速也不能入你眼?1举报

- 玉米地里吃亏·2021-11-29抖音可能是未来的拼多多,现在正在高速增长,这个可不能忽略。1举报

- 丹尼尔加·2021-11-29非公认会计准则下的净利润下降了接近4成,怪不得最近的阿里跌跌不休。1举报

- 瑞草含芳·2021-12-07啥时候才能变好1举报

- 不怕你飞就怕你不跌·2021-12-05还有一点阿里是给美团买菜1举报

- 权力的游戏厅·2021-11-29接下来看好抖音和快手的发展,京东也还行,阿里和多多估计就要被淘汰。1举报

- 刀哥拉丝·2021-11-29电商这一块,护城河最深的也就是京东了。1举报

- protac·2021-12-08做时间的朋友点赞举报

- 魔鬼鱼MOGUIYU·2021-12-07这篇文章不错,转发给大家看点赞举报

- blhy900·2021-12-02long run baba hUat1举报

- 愚心·2022-05-23开点赞举报

- 燕麦玖·2021-12-08阅1举报

- 二狗砸·2021-12-08见顶了点赞举报

- In_s·2021-12-08见顶了点赞举报

- 适时做T·2021-12-08…点赞举报