紧扣数字化加速红利,台积电将率先撞线万亿美金市值?

导读:

全球晶圆代工之王, $台积电(TSM)$ 公布了2021年四季度的季报,再一次超市场预期,凭借稳扎稳打的业绩,台积电市值再度逼近7000亿美金的整数关口,与英伟达的市值差距再度拉进,谁先撞线万亿美金市值,成为第一家市值突破万亿美金的半导体公司,让人期待。

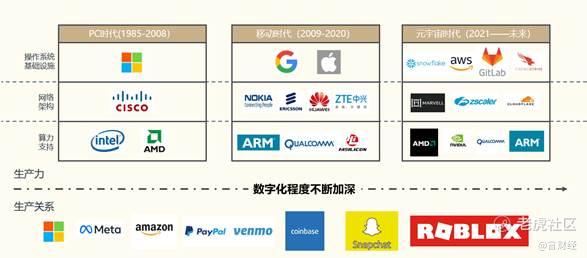

从2008年底至今,台积电上涨了接近23倍,这23倍涨幅的后面,是全球半导体产业深刻变局的十年,专业化分工进一步深化,晶圆代工成为IDM模式以外最大的受益者。伴随人类社会的数字化进程不断深化,从PC到智能手机再到自动驾驶跟万物互联,芯片作为数字化基底迎来爆发式增长,而且在可以想见的未来,在元宇宙时代,算力的不断提升会带来更大的芯片需求,这之中,作为全球晶圆代工的执牛耳者,台积电无疑是那个最受益的卖水者。

2022年1月13日,台积电公布了最新一季度的业绩,新季度的业绩如何?未来的展望囊如何,我们一起来分析一下:

新季度业绩分析

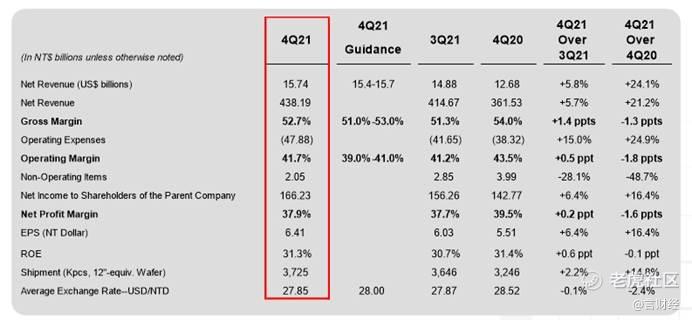

2022年1月13日,台积电(纽交所代码:$台积电(TSM)$ )公布截至2021年12月31日的第四季度的财报,第四季度台积电实现合并营收为新台币4381亿元,净利润为新台币1662.3亿元,每股摊薄EPS为新台币6.41元。与去年同期相比,第四季度收入增长了21.2%,而净利润和摊薄后每股收益均增长了16.4%。

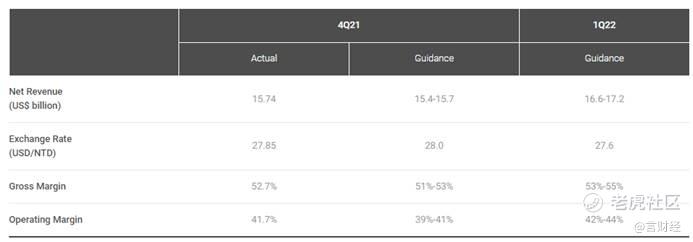

以美元计算,第四季度收入为157.4亿美元,同比增长24.1%,较上一季度增长5.8%。本季度毛利率为52.7%(贴近指引上限(51-53%)),营业利润率为41.7%,净利润率为37.9%。2021年全年营收568.2亿美金,yoy+24.9%,全年毛利率51.6%,受汇率不利影响约2%。

从过往十年各个季度的表现来看,21Q4台积电收入与净利润均创下历史新高,单季度收入创下近五个季度新高,下季度收入同比仍将提速,非常超预期。

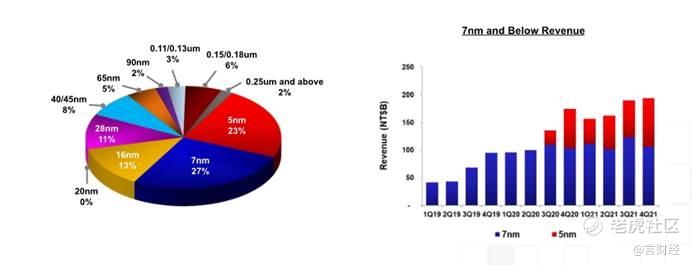

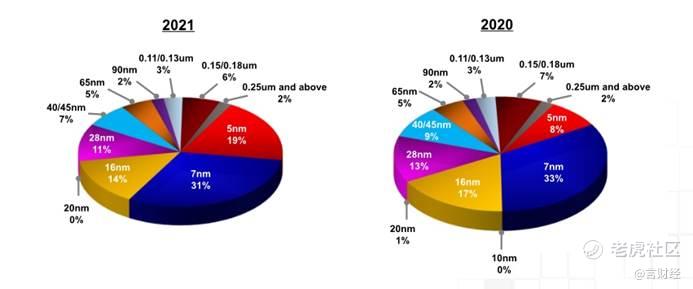

·按照制程分类:5nm贡献23%营收,7nm贡献27%营收,16nm贡献13%营收,28nm贡献11%营收。7nm及以下(7,5nm)合计贡献50%营收。

2021年全年与2020年相比:5nm占比迅速提升,从8%快速提升至19%,7nm占比则小幅度下行,占比从33%下降至31%,5+7nm占比50%超过去年同期的41%,高端制程占比过半。

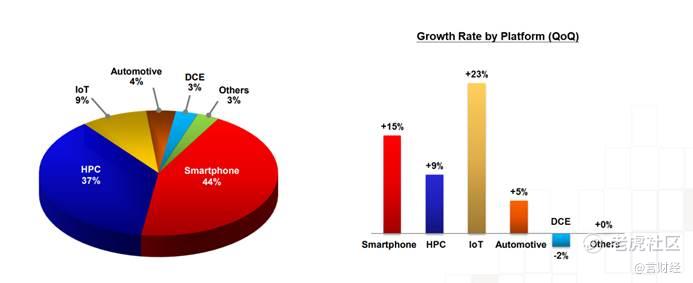

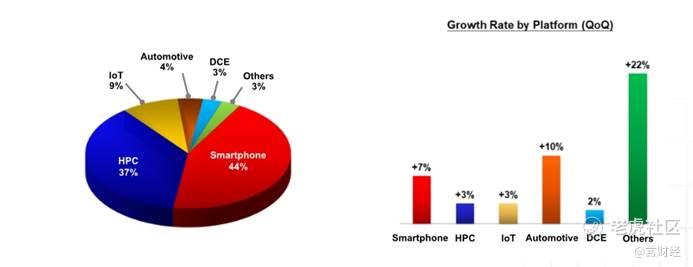

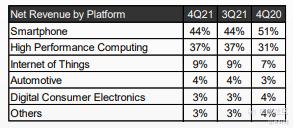

·按平台分类:智能手机占比44%,环比三季度增长7%,HPC占比37%,环比三季度增长3%,IoT占比9%,环比三季度增长3%,汽车芯片业务占比4%,环比三季度增长10%,数字消费电子(DCE)占比3%,其他3%。从环比增速来看,四季度智能手机与汽车芯片环比增速提升。

·资本开支Capex规划:

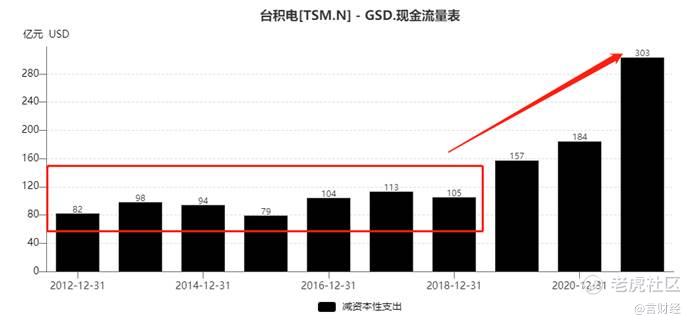

从过往十年的资本开支来看,2012-2018年,台积电的资本开支基本上维持平稳,每年的capex在100亿美元左右,而近三年从上图可以明显看到台积电的资本开支在大幅度扩张,这背后反映的是台积电为了先进制程所做的大规模扩产,也反映了数字化加速之下,芯片的需求爆发式增长。

2021年台积电的资本开支为303亿美金,而展望2022年,公司维持全年capex指引为400-440亿美金,相较于去年提升100-140亿美金,YOY增长33.3%-46.6%,资本开支的70-80%用于将继续用于先进制程(包括2/3/5/7nm)、10-20%用于特殊工艺(主要是成熟制程,公司重点扩产28nm,需求来源于多摄驱动的CIS以及非易失性存储器(NVM)等各领域需求,以及很多终端硅含量的提升)、10%用于先进封装。可以看到台积电还将继续维持较高的资本开支增长,公司表示,扩产主要是因为5g及HPC应用带来多年结构性高增长趋势还会延续。

N5进入爬产第三年,行业竞争力强劲,预计2022年营收占比进一步提升;N4P 2022H2有产品计划Tapeout,N4X更适用HPC领域,2023H1风险试产。N3研发on track,2022H2开始生产,客户参与度比N5高,N3E规模量产会在N3一年之后。

·下季度营收展望:营收罕见环比增长,一季度业绩展望大超预期

根据公司目前的业务前景,管理层预计2022年第一季度的整体业绩如下:

2022Q1:公司收入预计在166亿-172亿美元之间;毛利率预计在53%至55%之间;营业利润率预计在42%至44%之间。

我们取中值,同比21Q1的126.79亿美元大幅度增长33.29%,则环比增长7.4%。通常来说,一季度是整个电子行业的淡季,但台积电一季度的营收罕见环比21Q4增长,这一点非常超预期,这背后反映出芯片的需求仍然强劲。

关于台积电未来展望:稳扎稳打向万亿美金迈进

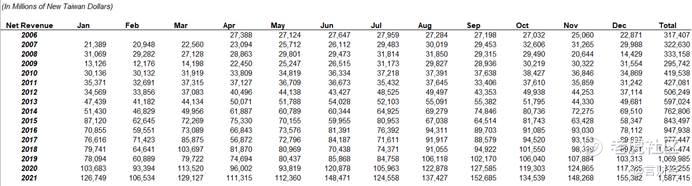

台积电前阵子公布2021年12月净收入:合并后,2021年12月的收入约为新台币1553.8亿元,较2021年11月增长4.8%,较2020年12月增长32.4%。2021年1月至12月的收入为新台币15874.2亿元,较2020年同期增长18.5%,再超预期。

2021年四季度,台积电的收入占比最大的智能手机从51%下行到44%,而HPC则大幅度提升,未来的几个季度大概与HPC会超越智能手机成为台积电最大的收入来源。

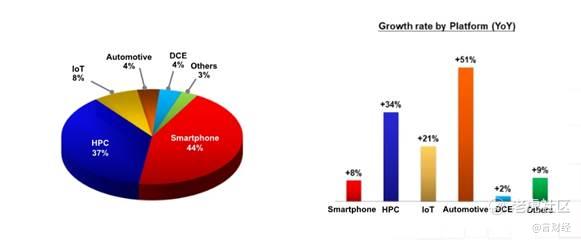

从2021年全年,台积电的终端应用来看,智能手机占比44%,YOY+8%;HPC占比37%,YOY+34%;IOT占比8%,YOY+21%;汽车芯片占比4%,YOY+51%;DCE占比4%,YOY+2%,其他占比3%,YOY+9%。从全年的终端来看,智能手机仍是第一大占比,但是增速已经远不如HPC,IOT与车载在快速成长,HPC与IOT、车载是台积电下一个十年新的增长点,尤其是HPC,CPU、GPU和AIC加速器是公司预成型HPC的主要领域。

对于2022全年,台积电预计整个半导体市场将增长约9%,代工行业的增长预计将接近20%。公司的业务将受到下游行业领先特别是智能手机、HPC、物联网,汽车这4个平台的强劲需求的推动。为了确保供应链的安全,公司预计库存水平将高于历史。虽然短期的失衡可能会或可能不会持续,但长期半导体需求的结构增加,这背后是由5G和HPC相关应用的行业趋势所支撑的。公司还观察到许多终端设备中的硅含量增加,包括汽车、个人电脑、服务器、物联网和智能手机。因此,公司预计产能将在整个2022年继续保持紧张状态。

展望2022年,我们判断四季度及一季度业绩展望超预期主要是苹果iPhone13系列的持续大卖,以及HPC业务的回暖,四季度北美云厂商开支回暖带动服务器需求持续高增,英伟达与AMD 、迈威尔科技$迈威尔科技(MRVL)$ 等公司的收入增长说明数据中心的芯片需求仍然足够强劲,而IOT也有望延续高增长,伴随供应链的逐步缓解及需求的持续恢复,我们对台积电22年的表现也持乐观态度。

关于台积电的长期增长前景和盈利能力,随着技术变得更加普及,台积电正在进入一个更高的结构性增长时期,全球将踏上5G时代和一个更加互联的世界,这推动了对计算能力的巨大需求。为了使计算更高效,需要使用更多的先进技术节点。多年来,5G和HPC相关应用的趋势是尝试多站点联合体量增长,通过选择长期结构性增长,大量半导体包含在HPC、智能手机、汽车和物联网应用中。公司正与客户密切合作,利用我们的Capex扩产和投资于领先技术来支持需求。

按美国计,公司的收入从2019年的346亿美元增加到2021年的568亿美元,成长约1.6倍,EPS为1.7倍。公司预计未来几年的长期收入复合年增长率CAGR将在15%-20%之间。

而从更长周期的角度来看,在IOT万物互联与更远期的元宇宙时代,芯片的需求还会迎来长周期的上行。

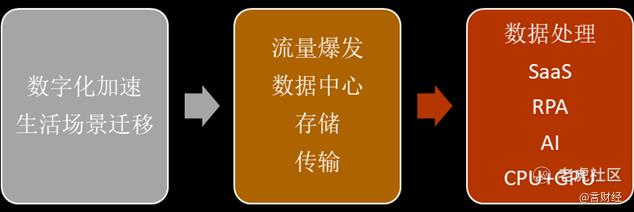

以2020年疫情爆发以来的趋势来看,疫情爆发导致物理隔离,企业停工、学校停课,办公与教学的需求被迫转移到线上,直接导致企业的线上化迁移,这个过程中,企业上云的趋势在短期内不断强化,上云必然导致底层架构的扩容,推动芯片需求快速增长,芯片需求增长以后,晶圆厂开始快速扩产,推动半导体设备出货大增,而汽车智能化加速导致汽车芯片、AI芯片等需求持续增长又更加推动了半导体行业的景气度提升,这就是过去两年费城半导体指数持续走牛的根源所在,这背后就是万物数字化在加速。

从各个IC设计厂商的收入增速来看,我们截取2021年第二季的收入增速来看,包括高通 、英伟达 、联发科、AMD 、联咏科技、迈威尔科技 在内的科技巨头收入增速都非常高,这一切的背后都是需求的快速扩张。

我们认为数字化时代投资的核心是要把握住“流量”这一关键核心,数字化加速,各种生活场景的线上迁移,直接导致流量爆发,而流量的存储、传输、处理等都需要各种芯片,而这些芯片的生产尤其是高端的处理器芯片都是台积电的菜,因此,台积电则在数字基底层面成为流量爆发的最大受益者。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

😂哈哈哈

哈哈