2021年投资总结:正确的抄底方式

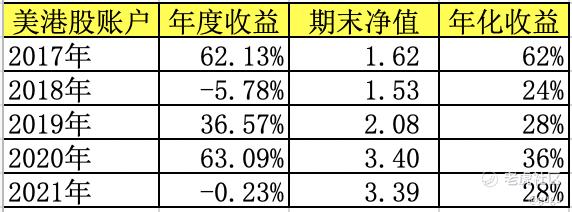

2021年是我投资的第5个年头,老虎账户盈利-0.23%,5年年化收益28%。每次我的年度收益达到60%之后,第二年的收益就会比较惨淡。这现象也容易理解,股价涨幅主要由企业的盈利增速贡献,另外来自公司估值的变化。大多数个股,二者叠加勉强支撑一年60%的涨幅,第二年的股价犹如强弩之末。

2021年1月底,美国十年期国债收益率从1.071%开始急剧上升,到了3月飙升至1.744%。资本开始从各个风险度较高的板块撤离,中概差不多在2月10日附近的高点跌落;实际上,这波也影响到A股,外资占比较高的消费和医药板块,过年后的第一周开启狂跌模式。纳斯达克指数3周内回撤8.5%,标普2周内回撤3%,第三周止跌上扬。在这之后的9个月,标普和纳指只在9月和11月的个别周中有过几次回撤,整体上二者一路上扬,全年标普和纳指分别收涨27%和26.8%。

我的持仓,在四季度中概仓位已达40%,特别是腾讯,自2020年末持有至2021年底,浮亏3%。靠着“已实现损益”的交易,全年账户收益-0.23%,跑输2大指数。目前美股和A股持仓:

A股:$中国中免(601888)$12.8%,陕西煤业8.8%,东财3.5%

美股:$苹果(AAPL)$ 7.7%,meta11%,$InMode Ltd.(INMD)$13.5%

中概:$腾讯控股(00700)$31.5%,$阿里巴巴(BABA)$8.6%

第一部分,剖析一下今年对账户起正向贡献的几笔交易。

今年靠着“已实现损益”的3笔交易提升10.4%收益率,才勉强保住了-0.23%的收益率。

第一笔:年初卖出美团,提升账户收益+2.4%。

自从20年5月开始建仓美团,一共持有11个月。2021年初,在355-406港币之间,卖出美团。卖出原因:即将迎来美联储退出宽松货币政策预期,没有盈利的成长股估值更易会被打压。这些成长股的内在价值不易被丈量,市场风险大的时候,最先被抛售。

第二笔:4季度卖出阿斯麦,提升账户收益+5.5%。

我从2020年1月开始买入阿斯麦,一共持有1年11个月。9月底到11月底,在838-863美元之间,全部清仓卖出。卖出原因:太贵。21年全年盈利66亿美元,股价到达当年净利润的50倍pe。管理层给出未来4年业务预估,每年收入增长12%,净利润增长20%。阿斯麦在这轮芯片设备采购周期高峰前,年盈利增长维持在20%左右,与芯片行业其他公司相比,这个稳定增长率足以证明阿斯麦是一家非常优秀企业。我认为管理层的预估是合理的,21年63%的盈利增速不可能长期维持。基于管理层对2025年业绩的预期,我预计2023年净利润96亿美金,45倍pe的话,我给予市值最高4300亿为卖出点。当时虽然距离卖点有15%的差价,因为开始建仓中概,我把阿斯麦的仓位都平掉了。

反思和下一步操作:阿斯麦享受到美联储放水+芯片上升周期2大红利。2019年美联储由鹰转鸽,当年降息3次。2020年更是大放水降息至0,启动7000亿美元的量化宽松。阿斯麦核心产品光刻机,一直处于供给跟不上需求。即便在芯片行业最不景气的时期内,台积电、三星和intel的“先进芯片产能的军备竞赛”脚步不停歇。这两年,再加上中国开始布局40nm和28nm的成熟制程,芯片生产设备的采购大军中又添一员。疫情暴露全球芯片供应链的脆弱性,成熟制程的设备采购,将让阿斯麦的收入和利润增长好于预期。阿斯麦的股价如果跌下来,可以再买回来。我按照2024年预估的净利润*45pe/2=2578,股价到635美元左右买回来。

第三笔:波段操作阿里港股,提升收益2.5%。

买入阿里就是一次投机行为,我以为可以利用市场先生草包的脑袋。9月底在151-133港币之间买入阿里港股,10月26日171港币卖出,盈利15%。阿里港股仓位止盈后,我还继续保留阿里美股仓位,希望剩余仓位获得更高收益。结果,阿里股价在10月底反弹到高位后,又跌去40%,剩余的仓位从最高盈利20%到最大亏损28%。原计划这笔交易持仓6-18个月,等仓位全部卖出后我再做个复盘。

第二部分:复盘亏损最大的2笔交易

上半年交易非常频繁(详见《2021年上半年复盘:不愿意持有1年以上的票,就不要买入》 ),下半年很注意纠正这个毛病。在已实现损益的交易中,最大的一笔亏损,发生在下半年,抄底好未来。

这笔交易亏损60%,拉低账户收益率3.92%。一开始建仓的时候,我做好这笔投资全部归零的心理预设。虽然意识到风险极大,但实际操作的时候还是记性不好。1)建仓前,没有黑字白纸的具体计划,只有一个简单要求,不超过总仓位的3%。2)仓位慢慢买重了。因为没有计划,在不断下跌中,为了摊破成本,一共买入20次,买入价格比较随机,最终把仓位提升到了6.5%。8月中下旬,我读了一遍第10次中央经济委员会会议内容后,对政府监管的方向有了大致理解。最终,我痛下决心将好未来在4.9美元附近止损。

第二笔亏损是神华H。

6月底以17.1港币成本买入神华H,原计划持股吃股息。扣除10%股息税后,股价涨幅+股息,估计持有一年收益在15%。8月,腾讯股价跌到450港币附近,我卖掉神华H,开始加仓腾讯。好在分红除权日是7月9日,股息大约在2个月后到账,这笔投资微亏出局。如果持有到21年年底的话,以18.66港币收盘价,这笔投资半年实现20%的盈利,远高于前期预估。今天复盘来看,当时是在腾讯和神华H之间做了一个比较,以我的投资模型,放在更长周期,我更看好腾讯未来的发展。

投资感悟1:正确的抄底方式,就是没有抄底一说。

认真回想一下,我之前很少抄底。

我是个典型的右侧交易选手,结合行业趋势买入优质成长股,除非高的离谱,一直坚定持有。今年遇到难得一见的中概爆跌,忍不住手痒痒。第一次好未来,巨亏收场;第二次是阿里。

最近几个月一直读巴菲特股东信,1987年致股东信中的有段话让我印象深刻。“市场先生是来给你提供服务的,千万不要受他的诱惑反而被他所引导。你要利用的是他饱饱的口袋,而不是草包般的脑袋。如果他有一天突然傻傻地出现在你面前,你可以选择视而不见或好好地加以利用。要是你占不到他的便宜反而被他愚蠢的想法所吸引,则你的下场可能会很凄惨。事实上若是你没有把握能够比‘市场先生’更清楚地衡量企业的价值,你最好不要跟他玩这样的游戏。就好比打桥牌,如果你不能在上桌前半个小时找到那条鱼,你就是那条鱼。”

巴菲特在这段讲的是2件事。第一,卖出的逻辑。我们要利用是市场先生饱饱的口袋,在高高的价位上把过度高估的仓位卖给它。第二,如果你想以很低的价格买入股份,占市场先生的便宜,那么就需要计算清楚企业的内在价值。

在现实操作中,大家都非常喜欢占“市场先生”的便宜,受到它的诱惑,欺它为草包,贪图便宜买入股票。实际上,占“市场先生”便宜的难度很大,“抄底”是个高难度投资策略。首先)估算出公司内在价值区间,比如某块业务在未来的盈利能力和市场地位、扣除债务后现金资产。其次)需要长期的钱,2-3年以上,甚至更久。期望赚15%或30%就离开牌桌,其实是赌博,很难把握离开牌桌正确时机,总是忍不住想要在牌桌上多呆一会儿,再多赚一些。

经过这次教训,对我而言,正确的买入,就是“以折扣价格,买入好公司”。这个公司本身是符合我一贯的选股逻辑,幸运的行业+能干的管理层,在出现“合理的价格”的时候,我出手了。只有这样的抄底,我的成功概率才高。默默地,我在“检查清单中”中加了一条“不抄底”。

投资感悟2:耐心地等待好股票打折,然后买入;尽量更长时间拿住,享受复利。

好公司,也要注意买入的价格。价格是我们支付的,价值是我们得到的,任何认真的投资者必须都是一个价值投资者。价值投资并不是说将自己限制在购买具有低估值的公司,而是以相对内在价值的折扣购买股票。要像自己创业或者投资实业一样选公司,通过持有公司的内在价值增长以及价格对价值的回归,获取长期、良好、可靠的回报。做到这些的难点在于:

1)内在价值的计算。

看懂行业趋势和理解公司的商业模式,并不容易,这造成公司内在价值具体的值很难估算。在我心中,内在价值没有清晰的值,只有一个模糊的区间范围。

2)有一定折扣的股价。买入时,股价低于内在价值。

优质好公司,往往估值比较贵。希望买到一定折扣的好公司,这时候,好公司一定处于行业的低点、甚至负面缠身,所以股价相对历史来看比较便宜。能够拨开云雾,找到真正的宝藏,而不是抱一坨“屎”。除了看懂之外,坚韧和耐心也格外重要。

3)业务能保持长期复利者是非常罕见和特殊的,查理·芒格说过:“复利的第一条法则就是,永远别不必要地打断它。”目前,我以第三年盈利*45pe,作为卖出点。用这个策略,尽量更长时间地拿住好公司。我拿中免来做演算,中免2024年净利润220亿,今年如果达到9900亿市值,市场先生扛着厚厚的口袋,异常兴奋地来敲门,我就把股票卖给它。毕竟2021年,中免最高价是402元,今年冲到507元也是有可能的。当然最好的情况是,这一切没有发生,我继续持有中免。毕竟找到我能看懂、市场空间大、且能长期保持增加的公司,非常困难的。

经过这段时间的反思,把自己买入和卖出的模型梳理一遍。

投资感悟3:重视资产负债表的修复,资产负债表往往比收入更早反应业务改善或恶化。

今年投资陕西煤业时,把山西焦煤、中远海控、中国船舶和中国动力的资产负债都看了一遍。中国船舶2021年Q1财报中,预付款项增长82%、存货增长222%、货币资金增长28%。我推测是船公司订金和预付款激增,带来预付款和现金激增,因为船还未最终交付,存货波动很大。可惜我第一次接触周期股,没有能坚持到黎明,7月底在股价爆发前把仓位抛了。

投资感悟4:供给型产品比需求型产品,市场地位稳定。

当一个行业长期资本开支不足,供给常常跟不上需求,行业竞争就放缓。目前石油和动力煤,处于类似大环境下。

一个公司因自身原因,产品和服务形成供给垄断,毛利率有更大改善空间。苹果硬件产品、阿斯麦光刻机、台积电芯片代工和53度飞天茅台,都有类似特质,而单纯靠需求拉动的inmode,业务稳定性更差。我的股票仓位,尽量多拿前者。

2022,凭借“知道的事”,做容易的决策。放松预期,让投资过程更加愉悦!

我最大担心是自己的投资年限还是太短,有些过去5年和10年一直正确的观点,将来未必正确。

未来走向何方、市场高点在哪里、何时会回落,这些无法预测。但是,我们通过观察可以大致知道“现在身在何处?”。搞明白身在何处,我们可以审视仓位,少做一些高风险动作。我们知道1)美股2022年面临美联储货币政策收缩、市场高估和增长3大因素。货币政策收缩指的是加息和缩表,2022年美国经济增长很好,GDP增速预测3.7-4%。那么当泡沫挤掉之后,收紧的货币政策落地后,股市还是跟随增长的内因。我们也能知道2)中概跌了一年,属于低位。我们也知道3)国内疫情政策偏紧影响消费,疫情后业绩修复是可知的。国内我看好,中免、上机和锦江酒店这类休闲旅游类方向。我们可以凭借“知道的事”,做容易的投资决策,不过联储政策何时落地不可知,中国疫情政策何时放松不可知,不可知的东西,我们就放轻松降低些预期,让投资过程愉悦些。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

值得一看

这篇文章不错,转发给大家看看

抄底