Why this 3 Index Funds should be the core of your portfolio?

In 2008, $Berkshire Hathaway(BRK.B)$ Warren Buffett issued a challenge to the hedge fund industry, which in his view charged exorbitant fees that the funds' performances couldn't justify. Protégé Partners LLC accepted, and the two parties placed a million-dollar bet.

The bet is that is any Hedge fund could beat the S&P500 for a period of 10 years, they will win $1M. Its safe to say, in 2017, Buffett has won the bet.

Buffet has always been vocal and an advocator of low cost index fund. He mentions that anyone who invest in a low cost index fund will always outperform the market.

Why should you invest in Index-Fund?

Low Cost

Index fund have expense ratio as low as 0.03%. Compared to picking Individual Stocks and hedge funds where you pay so much of fees and brokerage.

0 Risk.

Yes, you read that right. Index fund have so little risk that its negligible. Index fund are a diversified basket of stocks with all types of sectors and companies.

High Consistent Return

When you combine consistent returns compounded over a long period, you get extraordinary returns!

This 3 index funds below should be the core of your portfolio, which means at least 50% allocation. This will safe-proof your portfolio and give u a good return.

1. $Vanguard S&P 500 ETF(VOO)$

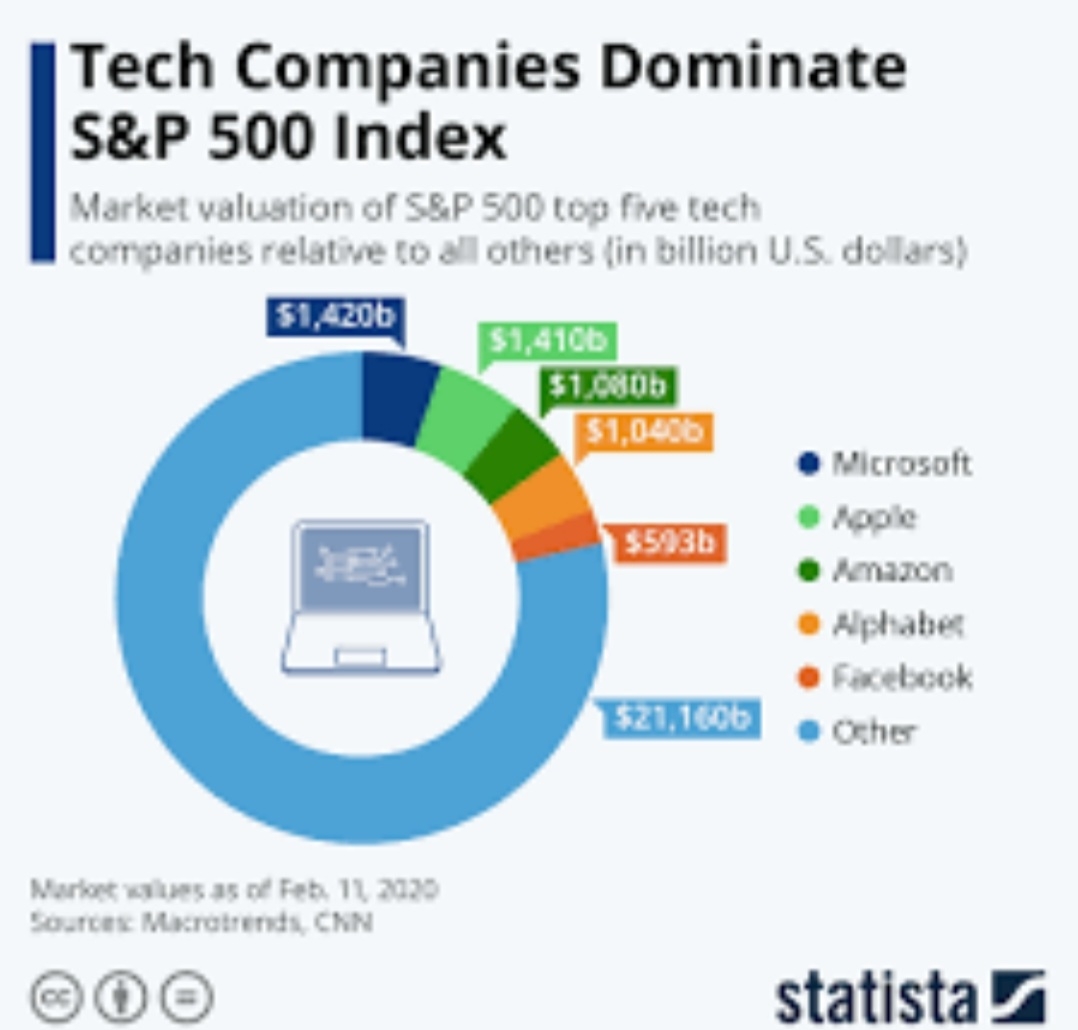

S&P500 has given a consistent return of 11% since inception for the past 100 years. No other funds has been as consistent and great. Up to this date, this fund has 278 Billion Asset Under Management. This fund has 500 top companies in the world including Google, Tesla, Berkshire and

2. $Vanguard Russell 1000 Growth Index Fund ETF Shares(VONG)$

This fund is more concentrated. It has 500 top growth companies. It has returned 19% since inception. It has an expense ratio of 0.08%

3. $ISHRS CORE S&P 500 UCITS ETF USD (ACC)(CSPX.UK)$

This is similar to #VOO fund, except that ur has a accumalating style dividend. The dividend is automatically reinvested to buy more stock. With the reinvestment of dividend, ur return is higher than the normal S&P500 fund. It has a expense rstio of 0.07%.

Bottom line:

This funds should be the core of everyones portfolio. Ur returns will be amazing and youll outperform the market. Let me know what u think!

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

是