1/9 2022第二周美股分析和预测!(必看!)

大家好,我是九千君。今天是2022年1月9号周日,明天迎来了2022年的第二个交易周,上周我们说过SPY有可能会回调。

如果下周没有跌破464的话,我认为大概率周内会有反弹,跌破464的话,我个人建议大家可以观望为主。

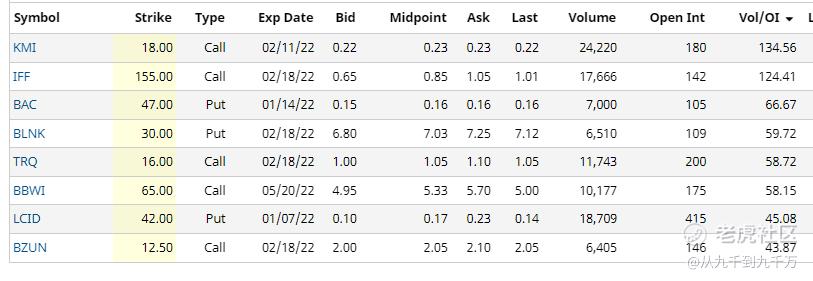

下周可以关注的异动期权如下,结合K线可以参考一下。

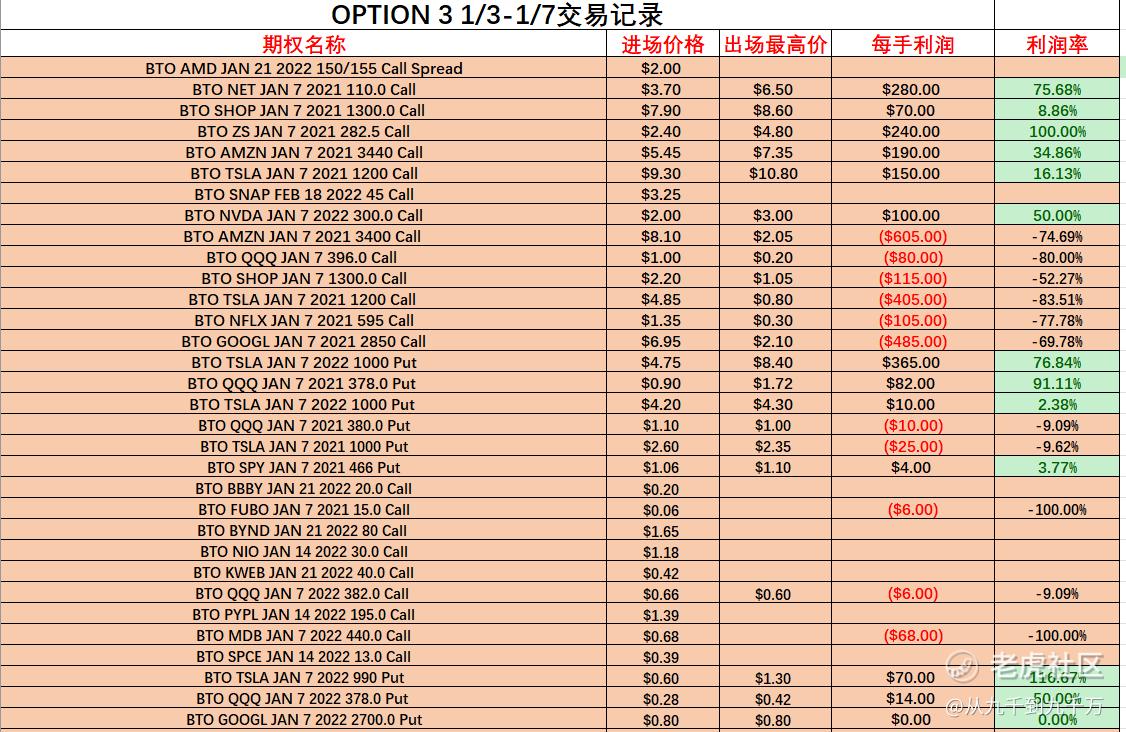

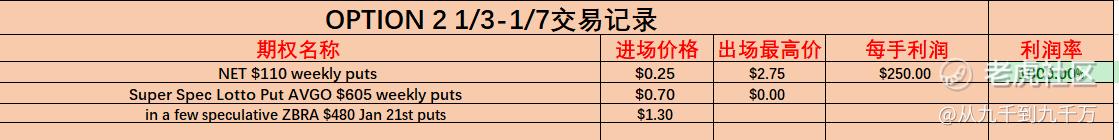

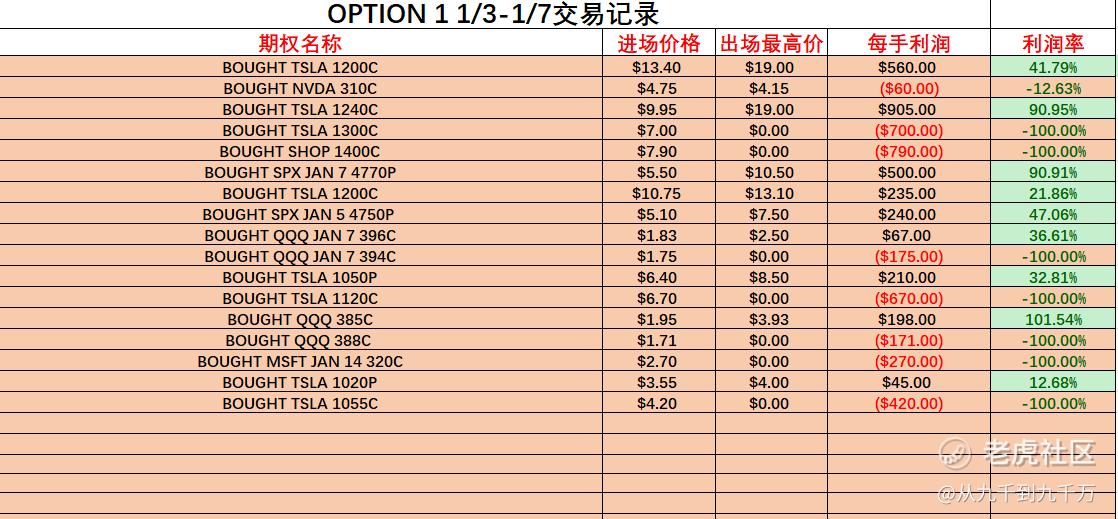

2022年第一个交易周喊单服务的交易记录

(以上交易均为“从九千到九千万美股社区”实时交易喊单,仅供参考。对我们的VIP服务感兴趣,可以关注公众号:从九千到九千万,获取更多资讯。)

说到个股,我们先从AAPL$苹果(AAPL)$ 说起,上周苹果收盘172.19,周四周五两天跌的太狠直接从历史新高182的位置下来,如果下周不能在170进行有效支撑,我认为可以小小看空,有望跌至165-167的位置。目前来看,小级别上165是一个强支撑,如果明天能高开突破173-174,本周还是有机会回到177上方的,我建议结合SPY来看,毕竟上周TECH科技相关的板块表现并不理想。

AMZN 上周是真的没有发挥好,收盘价格3251,从去年7月份以来,一直都在大区间内做整理,11月份的时候测试了历史新高但是一路跌了500多点下来。如果下周不能支撑住3242的位置,可能会向下测试3188,到时候面临的抛售可能会更严重,甚至会逼近3000的位置,日内跌破3242我就会考虑买put来进行投机,突破3300可以日内买一些call来做day trade,总体来说我不建议在这个价格交易AMZN,直到amzn回到3600上方。

NVDA$英伟达(NVDA)$ 上周收盘272.47,从去年12月份到现在,NVDA已经跌了76点,过去七周整体都是下行趋势,如果下周不能守住272的话,下跌趋势的目标会是260附近,杀估值的情况在这些科技股票上非常明显。并且,272也是上一个跳空高开的位置的起始点,如果这个位置能支撑住(我倾向于这种情况),下周应该会朝着287-290的位置反弹。

RBLX是我去年十月以后最喜欢的股票之一(毕竟我上次买的RBLX期权最高有过50倍的回报),上周收盘84,最终还是跌破了90,如果下周不能守住83的位置,可能会跌破80。目前没有什么合适的机会,等待行情是最好的选择。

TSLA$特斯拉(TSLA)$ 上周收盘1026,过去一周不怎么样从1208一路跌下来,日内还有多空双杀的情况,给广大交易者来说,非常不好操作。如果本周TSLA跌破1000,我觉得结合大盘来说,很有可能会跌落到950附近。如果在1021附近支撑住并且反弹,有望在这个位置整理震荡,我不建议目前去购买太多的周内期权,直到小级别的底部建立确定以后再说。

QQQ上周收盘380附近,直直的跌下来看起来这个位置又是一个支撑反弹,大概率会守住然后反弹,跌破的话要小心370,下周三之前回到388上方有望冲刺392,重点是要看能否在379的支撑位守住。在此之前,不要轻易做多。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 豆腐王中王·2022-01-11QQQ一直都是我比较喜欢的标的,感谢老师的分析。1举报

- 灯塔国02·2022-01-11老师的技术图画的真棒,我一个小白看着感觉很受益。1举报

- 银河小铁骑00·2022-01-11上好像看见过老师说SPY可能会回调,这点我可以作证。1举报

- 揭人不揭短·2022-01-11好久不看社区了,登录老虎就看到了博主的文章。1举报

- 刀哥拉丝·2022-01-11SPY接下来会怎么走?大佬有没有什么好的操作建议?1举报

- 福斯特09·2022-01-11看短线趋势,amzn想要回到3600上方感觉还是需要不短的时间。1举报

- 低买高卖谁不会·2022-01-11我感觉大神挑出来 的股票也是我比较关注的标的,猿粪呐。1举报

- 低买高卖谁不会·2022-01-11大神的名字真的不错,就是那种比较有底气的人才敢用的名字。1举报

- 玉米地里吃亏·2022-01-11$特斯拉(TSLA)$ 这个位置短线看上去应该也没有太大的风险吧?1举报

- 德迈metro·2022-01-11我也觉得RBLX目前没有什么合适的机会,英雄所见。1举报