2021年我的投资小结

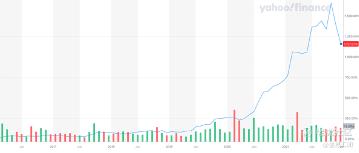

2021年是资本市场梦幻的一年,国内资本市场上,年初互联网、教育、传统消费白马股被给予的无限希望,在各种政策,消息中被打的找不到北。美股市场在美国国内社会如此撕裂的背景之下,同样也是一个魔幻的一年,资本市场如同疫情一样,再次创下了历史新高。

对于今年的一些思考,收获与错误简单做一些的总结。

- 选择大于努力

在去年的总结里,我对比了中美国两个资本市场中自己的看法,也解释了为什么会将投资的重点放在美国资本市场的原因。去年底,周围很多的朋友对于国内资本市场是充满期待的,对于中概股也有很高的热情,但当中,却很少有人对于公司进行细致的研究与分析,美国的一些企业也许听起来陌生,但业务简单清晰,业绩预测也相对容易,是个适合躺平的“地方”。今年伊始,美股再次站到了历史的高位,但毫无疑问,美股中的美国公司依然会是我的主战场。这样的观点,在过去10年没有变化过,在未来的3、5年估计也很难改变。

虽然我也曾想将一部分的研究重心,放回到研究国内的企业之中,但确实是,以现有的投资研究框架,要在国内找到合适的投资标的,却异常困难。在已有合理回报的同时,今年犯下的错误依然不少,以下捡重点的说。

- 错误的总结

李录曾讲过价值投资的过程中,有一条是非常重要的,就是关于知识诚实(intellectual honesty)。 而对于错误的总结,也是一个痛苦的过程,但仔细想想,有些错误早点发生未必是坏事情。

错误1:教育股的雷

今年年中,港股教育股的踩雷,是一次特别明显的投资错误,对于国内监管环境变化的忽略,唯市场、需求角度来去考虑问题,却忽略了资本市场中最为底层的逻辑,当资本利益受到不可抗力的阻击时,估值的逻辑往往要重新全面的思考。

价值投资,投的是资本回报,但前提是对于未来不确定的回报,是否有足够的法律基础做保障。

错误2: 隐性的错误-需要不断复盘来积累经验

芒格曾经对于伯克希尔哈撒韦在漫长而卓越的投资历程中提到,伯克希尔可以看得到的投资错误虽然并不多,但是很多理解的,没有把握住,潜在的少赚的投资,却是损失更大的投资。芒格当年的举例包括了Google公司,因为GEICO每年都在Google大把大把的花钱打广告。而即便对于Google有了长期的研究,伯克希尔却从来没有买过谷歌的股票。

美国电力能源市场的变革很多年前已经开始,而中国电力市场从2015年九号文的颁布后也拉开序幕,当时我在关注国内电力市场改革的同时,为了对标国内行业未来的发展,对于美国这一行业做过一些研究,在朋友的介绍下,对于一家美国公司进行了相对深入的研究,这家公司不论在业务上还是公司治理上都堪称好公司,但却迟迟都没有下手。就这4、5年的时间,错过了一支10倍股。

今年初,一家本打算重点研究的大牛股,被日常的一些临时工作所打断,等到今年四季度深入研究投资之时,付出了超过50%的成本。本该抓住的一些简单的机会,却被紧急而不重要的事情所打断。这确实是不应该发生的事情。

客观来讲,隐形的错误实际上比显性错误带来的损失要大的多,但从朴素的情感上讲,确实是显性的错误对于情感的冲击,相对于隐性的错误要大的多。希望通过这种文字的总结方式,可以长期纠偏情绪所带来的不理性因素。

- 对于接下来市场的看法(敲重点)

“美股贵吗?是否已经有了巨大的泡沫”是否会崩盘?;

“未来加息,市场震荡怎么办?”

这是年底这段时间,我被问到的最多的,关于美股市场未来的两个问题

Q1 关于崩盘问题

先说说崩盘的问题,绝大多数人所谈及的崩盘,只的是市场的大幅的波动,而传统金融观念中,对于熊市的定义也是只市场超过20%的回撤。从这个角度看,过去十年间,疫情让美股进入了一个短暂的熊市。而如果从单一的个股公司的层面看,在我们长期的观察与复盘中,任何一家公司在长期基本面没有太大变化的情况下,一年之中的波动20%到30%都是很正常的事情。但是从2,3年,或者5年,这样中长期的时间来看,资本市场整体还是比较好的反映出公司基本面的变化。美国市场整体上确实不便宜,在部分领域也确实存在着大量的泡沫,但如果单从指数来看,也不算事贵的离谱。我们拿几个典型的公司在微观层面来进行比较,这样对于投资者来讲可能会更有直观的感觉。

例如,苹果公司$苹果(AAPL)$ ,3万亿美元的市值,全球市值最高的公司,但是公司在2021财年的净利润已经过千亿美元,考虑到其供应链在此期间出现的问题,以及支付,生态的潜力,你很难说这样的估值已经是很大的泡沫,大象在跳舞的故事,在美国资本市场持续上演,新一代的优秀企业一定程度上在不断克服者大企业病的问题。

又例如,AT&T$美国电话电报(T)$ ,传统的运营商,有着连续数十年长期支付每股股息,且股息不断增长的传统的运营商,目前股息率在8%-10%(股价20-25元/股,过去12个月每股股息收入2.08元/股)。

在例如Zoom$Zoom(ZM)$ ,视频会议的龙头公司,疫情下的受益股,在疫情期间的涨幅最高时近8倍,看起来泡沫无限的背后是公司在2020年,公司的净利润增长约25倍,自由现金流增长超过12倍。而在2021年,疫情逐步平息,人们逐步重新回到办公场所后,公司在2021年前三季度,相对于2020年的高业绩基准下,依然实现了翻倍的利润增长,以及超过30%的现金流的增长。如果按照今年全年的业绩评估达约13亿的净利润,而对于目前580亿的市值来讲,大约是不到50倍的估值。

。。。。。。。。。

当然,这里面的标的并不一定会是我投资的标的,只是我们研究对象的一部分,而我们对于每一个投资标的投资,都会进行更为细致的投资研究分析。但从这些简单的公司案例出发,从微观层面看美国资本市场,我们依然坚持认为在美国资本市场,依然有不少有利可图的长期投资机会,对于一个短期的市场波动加大的环境下,这可能会形成更具吸引力的长期投资机会。

Q2 美联储加息,通货膨胀的问题

加息对于市场未来的影响,是不少投资者对于美股担心的重要因素。事实上,加息确实可能会给资本市场短期带来较大的波动,但从长期看,我认为未来1,2年的加息幅度可能会极其的有限,这主要是由于美国巨大的债务问题带来的,过于迅猛的加息,可能会引发美国政府的实质性破产。

在接下来的5年里,美国**需要偿还约16万亿美元的债务本金,占其债务本金的60%,而目前国债利息支出每年约3000亿美元,债务总量近30亿美元,融资成本大约是1%。而5年内16万亿美元的债务利息成本约0.13%。如果整体融资水平提升到2%,那么美国**的利息支出将创纪录的达到6000亿美元,占联邦收入的近20%,超过军费开支,成为美国财政最大的成本支出。所以在我看来,如果按照以往每次0.25%的加息力度,美国联邦财政部可以承担3-4次的加息。所以在未来很长的一段时间里,低利率环境并不会发生本质的逆转。但如果短期利率即便从零增长到2%的水平,相对于成长股目前的潜力来看,股票市场,依然是具有吸引力的。

- 投资管理-知行合一的新的开始

今年年底,开始在筹备自己的私募产品,由于近些年国际市场的利率大幅降低,国内通过跨境收益互换的方式投资美股的成本被大幅降低,考虑到外汇管制的问题,通过人民币私募产品,来进行美股投资,变得比几年前更有吸引力。对于我来说,终于有机会可以做个机构化的产品了。资产管理的事情,除了给我一个践行投资者教育的知行合一的平台外,由于开始涉及到OPM(Other People’s Money),于我,也有了更大的责任。下面,对于这个行业里,充斥的各种利益冲突,谈一谈我自己的一些思考。

受托责任(fiduciary)是资产管理行业的道德基石,投资者将个人财富,受托于基金经理,管理人是对于管理者莫大的信任。特别是相对于其他的新私募来讲,我们在平仓线,预警线,持仓的容忍程度,要大的多,我们唯一设定的投资刚性条件就是不能加杠杆。这样的信任不仅仅是局限于专业能力,更加是对于我们道德观念的信任。对此,我们心存感激。当然在极大的信任背后,我们对于激励制度也做了对应的安排。目前市场上的大多数的基金,都会收取固定的管理费用,而不论业绩。而在这种安排之下,对于基金经理以及管理公司,或多或少都会有相对稳定的收益。但对于我们这样基金管理人以及基金经理来讲,我们抱着一个朴素的观点,作为管理人,如果客户没有赚到钱,我们是不能够从基金获得任何的收益。考虑到我们基金是通过券商的跨境收益互换服务来投资于境外市场,具有一定的刚性成本,对于管理人来讲,大体上我们需要做到2%以上的投资回报,才有可能从基金运作与投资中获得收入。这样的模式,基本上是套用了巴菲特早期做合伙企业时,所采用的收费模式。

我们所投资的方式,对于公司的研究的框架,与我们投教的内容是完全一致,围绕“好业务”与“好意愿”对于公司的发展历史、公司治理方式进行综合的判断并对未来进行审慎的判断,并由此给出公司的合理估值。这个评判的周期通常会是3年、5年以及10年的时间。

而我们的最终目标,并不是赚到最高的回报,而是拥有良好的客户关系,同时持久运营的基金。

- 2021年,收尾的话

港股,中丐,不少行业已经是地板价了,如果上市公司老板,在道德上是愿意对于中小股东负责任的态度,大概率是完全见底了。但港股市场中从来不缺的就是老千,只是吃相上各有不同而已,但也不乏一些极其具有吸引力的投资机会。我想2022年,港股,中丐中出现一些1年3、5、10倍的投资机会,我不大会有意外,但这并不会是我的主菜,这些机会都需要极其深度的研究,以及与市场完全不一样,又符合简单常识的投资逻辑。

美股依然会是我的主战场,但对于普通个人投资者来讲,要放低短期投资收益的预期,对于短期的波动要有所准备,而对于长期投资者来讲,如果预期回报不高,美股依然是性价比不错的选择,而对于不愿意研究个股的投资者,买Vanguard的指数ETF,然后完全躺平,也会是不错的选择(这也是巴菲特长期对于普通投资者的建议)。

投资中最为重要的事就是,选择对了,然后躺平。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

是的