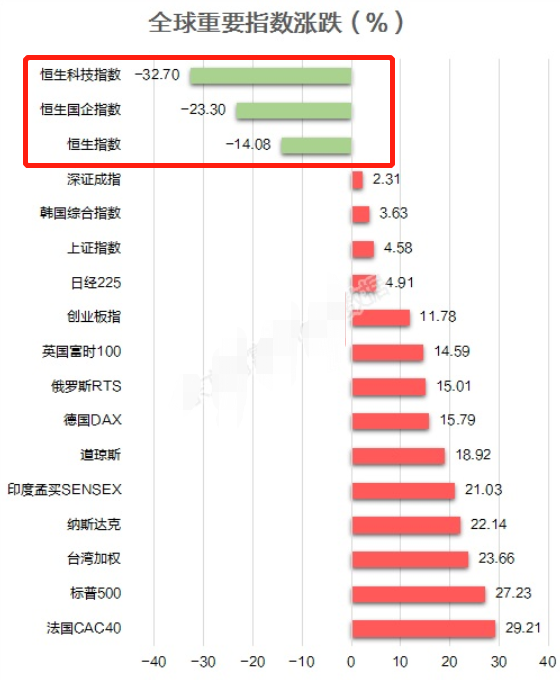

3700多亿资金南下,机构高喊:2022年积极做多港股!

- $阿里巴巴-SW(09988)$,年跌48.88%,市值缩水超2万亿港元;

- $腾讯控股(00700)$ ,年跌18.79%,市值缩水超万亿港元;

- $中国平安(02318)$ 、$美团-W(03690)$ 、$小米集团-W(01810)$ 等市值也缩水超三千亿港元。

如今,港股市场情绪极度悲观,流通性也开始下降,甚至有人认为港股市场已经到了“无药可救”的地步。然而,就当散户们哀声一片时,机构们却开始看好2022年港股的反弹行情,并且开始抄底。

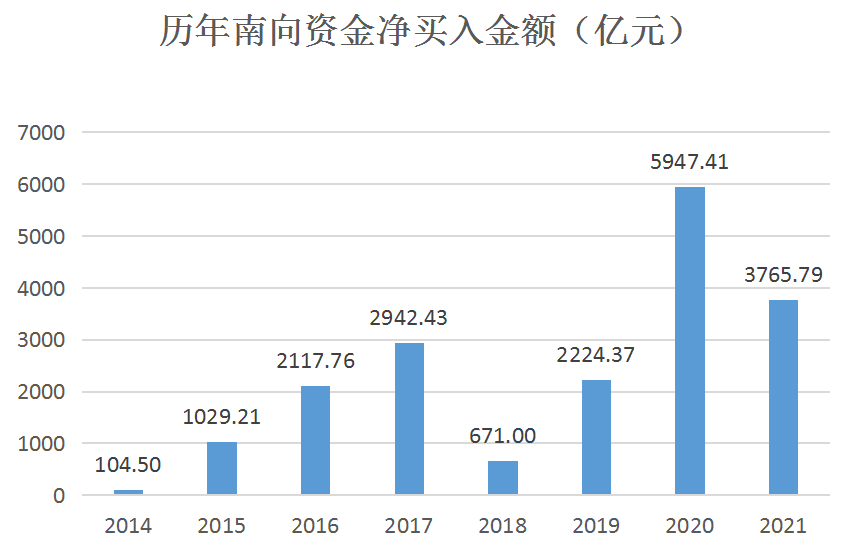

据统计,2021年南向资金累计净买入3765.79亿元,虽然不及2020年,但仍位列历年流入金额第二:

在当前港股市场底部区域应该更为乐观, 以合理的股息率为价值锚,应积极做多港股。

同时,东吴证券给出了2022五条布局主线:

1、出海:突破内需天花板

在内需疲软的情况下,国际竞争力强、具备国际化视野的企业估值中枢有望得到提升。看好家居、五金工具、汽车及零部件、高端制造、出海物流、跨境电商等。

2、能源:能源转型下「风光」之外的期待

国务院发布《2030年碳达峰行动方案》指出,2030年非化石能源占比要达到25%左右,风电、光伏将显著受益。风光的机会是长期性的,建议逢低布局,此外建议关注核电、氢能产业,以及原油产业链和努力转型的煤炭和火电企业机会。

3、国潮:国货崛起正当时

借鉴日本的本土品牌的崛起历程,日本人对本土文化的认同感随着国民经济发展不断加深,而在对海外品牌的模仿追赶过程中,日本品牌的设计感、产品性价比不断提高,自1970年后,日本本土的美妆、纺服品牌市占率快速提升。

事实上,我国国货崛起的趋势也已在华为、$安踏体育(02020)$ 、$波司登(03998)$ 等品牌上体现,建议关注当前渗透率较低、符合消费升级方向的纺服、日化等板块中的优质国货标的。

4、数字化:数字经济大发展

在数字经济领域中,以大数据、云计算、物联网、人工智能、5G 通信等为代表的应用领域持续蓬勃发展,建议关注计算机、通信等行业机会。

5、疫情受损:低景气低估值逢低吸纳

经济活动常态化趋势不可逆,建议对疫情受损的酒店、航空、文旅等板块逢低布局,除了获得经济活动常态化后利润估值修复的回报,还能够获得供给出清和自身扩张带来量价齐升的成长型回报。

... ...

最后,大家聊一聊:

- 你是否认为,2022年港股的投资机会更好呢?

- 你打算抄底什么?

精彩留言用户可获得888社区积分噢!

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

现在的主要问题是 加息对科网股杀估值会持续多久? 是几个月还是几年? 按照11年和15年 18年的经验 会持续1年左右 然后随着企业盈利的增加而抵消 再加政策风险底下 适当减仓或者空仓是比较好的选择