华尔街最爱的“现金牛”

高估的股票在利率上升的环境下充满风险,拥有高现金流的公司可以给投资者一些保护。

在过去六个月里,价值股的表现一直优于成长股,部分原因是美联储政策的变化正预示着利率上升的时间会延长。在价值股领域,投资者可能通过关注现金流获得丰厚收益。

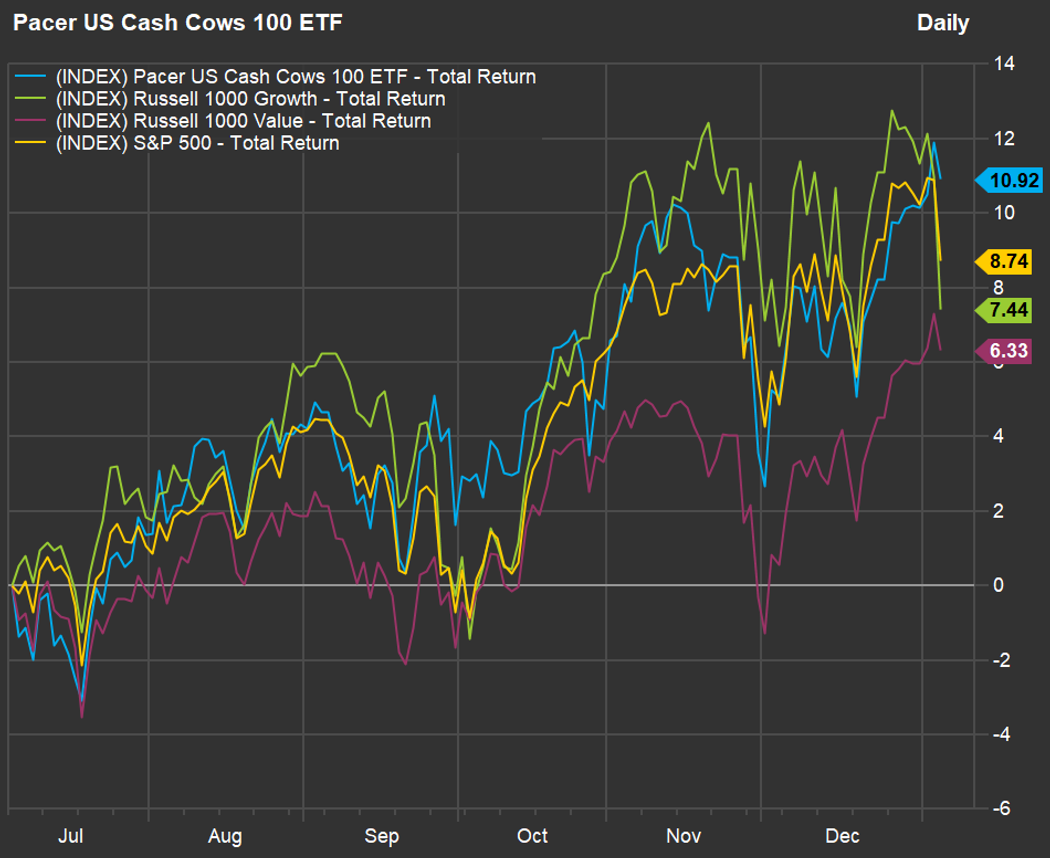

在新冠病毒大流行的大部分时间里,低利率使得买成长股的策略效果最好。但是,从下图可以看出,有一只现金牛ETF跑赢了一些主要股指。下图根据过去六个月的数据对比了规模为13亿美元现金牛ETF——Pacer US Cash Cows 100 ETF (COWZ)的总回报与罗素1000成长股指数、罗素1000价值股指数、标普500指数的总回报。

在过去六个月里,COWZ击败了其它三个指数,而且这种跑赢势头可能会继续下去,因为以高市盈率股票——包括长期领跑牛市的科技公司——可能一如既往地相比价值股对利率上升更敏感。

COWZ每季度进行一次调仓,以持有罗素1000指数中在12个月滚动期内拥有最高自由现金流收益率的100只股票。在投资组合进行再平衡时,这些股票的权重是相等的。

Pacer将一家公司的自由现金流定义为扣除资本支出后的运营现金流,资本支出包括费用、利息、税收和长期投资。每季度在再平衡投资组合时,将过去12个月的运营现金流除以当前市值,这意味着近期高估值股票可能会从投资组合中被剔除。

寻找现金牛

COWZ策略可能会吸引那些希望在市值加权指数之外进行多元化投资的投资者。例如,价值4560亿美元的SPDR S&P 500 ETF Trust(SPY)持有的前五家公司——苹果公司(AAPL), 微软(MSFT), 亚马逊(AMZN),Alphabet Inc.( GOOGL)和特斯拉(TSLA)——占投资组合的23%。

但有些投资者想寻找的是个股。以下是从三个角度对包括了100只股票的COWZ ETF进行的筛选。每一个角度的筛选都包括市值、股息收益率和FactSet覆盖的分析师给出的目标价及评级等指标。

COWZ中市值最大的10只现金牛

COWZ中股息收益率最高的10只股票

华尔街最爱的现金牛

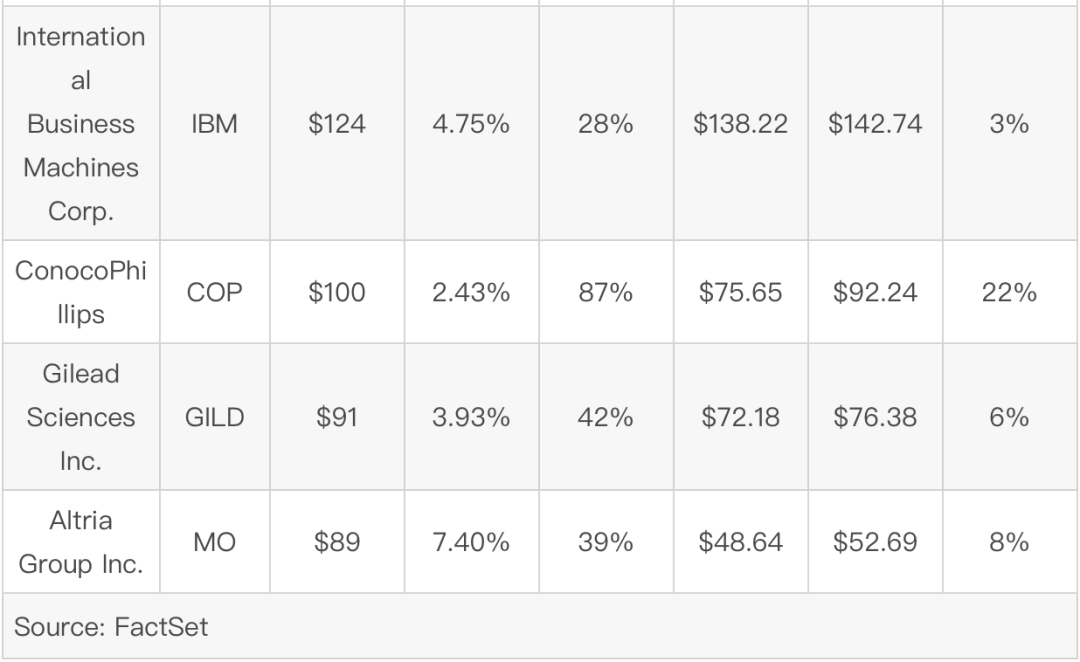

以下是COWZ中获得FactSet跟踪的分析师给出的"买入 "评级比率最高的12只股票。这一组包括12只股票,而不是10只,因为有三只股票的“买入”评级比率都为82%。

文 | 菲利普·范·多恩(Philip van Doorn)

编辑 | 郭力群

翻译 | 郭慧萍

版权声明:

《巴伦周刊》(barronschina)原创文章,未经许可,不得转载。英文版见MarketWatch2022年1月10日报道“This ‘cash cow’ value-stock strategy can fatten your portfolio even if you fear the Fed”。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

这篇文章不错,转发给大家看看