Sea无惧腾讯减持,三大因素将继续推动其高歌猛进

摘要:近期由于有着东南亚小腾讯之称的 “Sea” 受到腾讯的减持,使腾讯对 Sea 的股权从 21.3% 减少至 18.7%。受到市场调整、游戏用户增速放缓、腾讯减持等影响。进入 10 月以来,Sea 从最高 372 美元的位置已经跌到 187 美元,跌幅超过 50%,而且短期仍未看到企稳的迹象。尽管 Sea 短期承压,但是长期受到东南亚人口红利、经济高增长、互联网渗透率低、人口结构年轻化等利好因素,Sea 依靠在游戏 + 电商 + 数字支付三架马车飞速前进,Sea 不仅是东南亚的领导者,而且很可能成为电子商务领域国际扩 张的领导者。腾讯的减持将不会影响Sea长期的投资价值,2022年Sea值得我们重点关注。

Sea三大核心部门

Sea Ltd.是一家经营电商平台、制作数字游戏并提供在线金融服务的公司,由三个主要业务部门组成——Garena(数字娱 乐)、Shopee(电子商务)和 SeaMoney(数字金融服务)。Garena 是在线游戏开发和发行领域的全球领导者之一。其最具标志性的自研游戏是Freefire,它是2019年和2020年全球下载量最大的手游。 其次,Shopee 是 Sea 的电子商务部门。Shopee 是东南亚和台湾地区最大的电子商 务公司。在东南亚,Shopee 每月获得3.43 亿次访问,而第二大玩家 Tokopedia 获得 的网站访问量不到一半。 最后,Sea money 是 Sea 的金融服务和支付部门。它目前也是东南亚领先的金融服务和支付提供商。

近两年,东南亚互联网行业在全球的影响力有不断提升,以亚马逊、沃尔玛、阿里巴巴、腾讯等都在加大资本入局这个市场。在外部资本力量加持,推动了Sea Limited、Lazada以及本土互联网企业的飞速发展。Sea Limited 一直在积极对其业务进行再投资,以迅速占领市场份额并扩大其在每个地区的用户群。从新加坡开始,他们在东南亚、台湾以及最近在拉丁美洲取得了可观的影响力。

Sea2021年三季度财报回顾

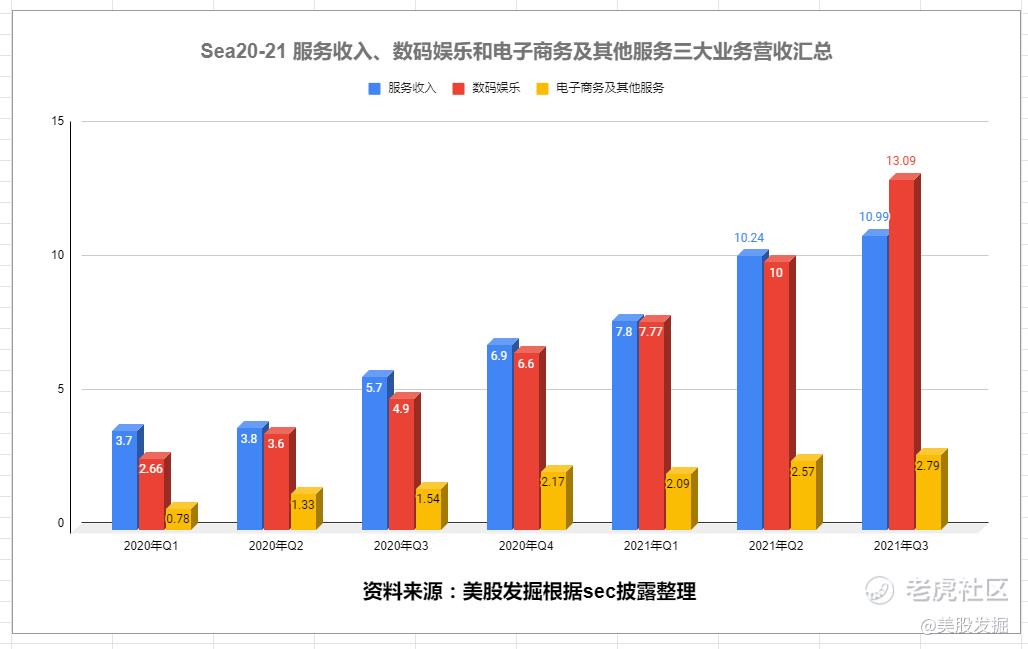

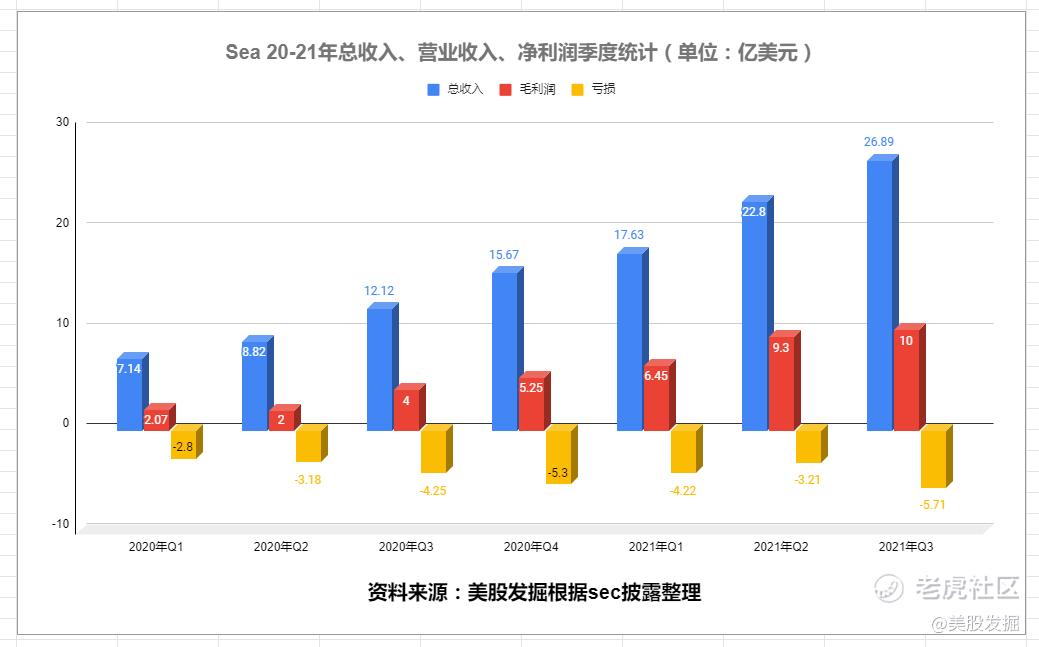

Sea 第三季度营收为26.89亿美元,同比增长121.8%。净亏损为5.71亿美元,去年同期净亏损为4.25亿美元。

Sea第三季度营收成本为16.80亿美元,去年同期为8.05亿美元;毛利润为10亿美元,同比增长147.5%。调整后的 EBITDA1总额为(1.655 亿美元),而 2020 年第三季度为 1.204 亿美元。

Sea上调今年电子商务营收指引,预计2021年电子商务营收区间为50亿美元—52亿美元,超过预期的47-49亿美元。

进入2021年,Sea第一到三季度、总营收分别为17.6亿、22.8亿、26.89亿美元,同比增长146.7%、158.6%、121.8%。亏损分别为4.22亿、3.21亿、5.71亿。进入2021年营收飞速增长,亏损趋于稳定。

Sea由三个主要业务部门组成——Garena(数字娱 乐)、Shopee(电子商务)和 SeaMoney(数字金融服务)。

Sea旗下数字化娱乐平台Garena第三季度活跃用户数达7.29亿,同比增长27%,季度付费用户达9320万,同比增长43%,Sea第三季度数字娱乐业务营收同比增长93.2%至10.99亿美元。

Sea旗下电子商务平台Shopee第三季度GMV同比增长81%至168亿美元,总订单量同比增长123%至17亿美元,电子商务和其他服务营收同比增长167.6%至13.10亿美元。

Sea旗下数字金融服务平台SeaMoney第三季度移动钱包付费用户数达3930万,较去年同期增长120%。商品销售业务营收同比增长81.9%至2.80亿美元。

三大因素将促进Sea2022年高歌猛进

东南亚互联网覆盖加速渗透,游戏成为稳定增长的摇钱树

根据DataReportal,在移动互联网在快速普及下,东南亚地区有超过90%的互联网用户使用智能手机上网。2021年,东南亚六国互联网覆盖人口达到4.4亿,相比2020年新增 4000 万互联网用户,互联网覆盖率提升至70%。受疫情期间的影响,用户在互联网上的使用时间增加,用户的互联网使用习惯也将得到进一步加强。

据报道,2020年东南亚移动游戏市场增速超30%,未来也有望保持较高速度增长。一方面,东南亚游戏市场人口红利较为充足,近年来东南亚地区移动游戏用户规模虽然快速增长,但占总人口比重不足30%,与之相较,中国、美国、韩国等多个高游戏收入国家游戏用户规模占总人口比重超过45%。另一方面,东南亚经济水平的增长潜力也将带动付费能力增长,未来在新冠疫情逐步得到控制后,东南亚地区经济有望进一步发展,游戏用户付费能力也将有所增强。

Sea旗下的Garena,是东南亚第一大游戏发行公司。腾讯作为Sea的第一大股东,Garena获得了大量来

自腾讯游戏的授权,包括《英雄联盟》、《传说对决》、《使命召唤》、《极速领域》等。Garena作为Sea主要利润贡献,经营利润率近 60%。公司长期受益于腾讯游戏出海,同时加快自研转型,预计未来三年年均复合增长40%.

根据App Annie数据,《Free Fire》是2019年和2020年全球下载次数最多的手机游戏,覆盖了全球超过130个市场。尽管三季度sea的游戏用户增速有所放缓,但是目前Free Fire无疑成为Sea的摇钱树。

东南亚电商渗透率仍极低

根据 IMF 2021 年预测,东南亚人口将达到 6.7 亿,占全球人口的 8.6%, 在全球经济体中可排到第三。由于受到“新冠”疫情的影响,电商经历了比较高速的成长,全年的GMV比2019年上升了63%,达到了620亿美元。而据最新的报告显示,东南亚 2021 年的互联网经济规模得到了进一步扩大,GMV将达到1200亿美元,到2025年预计将达到2340亿美元。

随着互联网基础设施建设推进,电商规模持续增长,近 5 年复合增速达到26%;但目前东南亚电商渗透率仍极低,平均仅有 2.5%, 相较于中国(截至 2020 年 7 月电商渗透率为 25%)存在较大提升空间。东南亚电子商务仍然处于早期的阶段,电子商务仍旧是最大的增长动力,并可能一直持续到 2025 年。

Shopee已成为东南亚最大的电商平台。据报告,预计到2025年东南亚数字支付的交易总额将达到1.1万亿美元以上,2021年将达7070亿美元。到 2025 年的 5 年内复合年增长率仍有望超过12%。 Sea 的 Shopee 也正在进入拉丁美洲、印度和欧洲的新电子商务市场,创造了一 个国际扩张故事,早期迹象显示 Sea 取得了令人鼓舞的成果。

东南亚为数字钱包增长最快市场

目前中国仍然是世界上最大的移动钱包地区,市场饱和导致中国经济增长放缓,年复合增长率仅为2.2%。 由于疫情期间的管控措施带来的消费趋势,导致人们对电子商务和移动钱包的使用呈指数级增长。在2020年至2025年期间,东南亚六国移动钱包的使用量将增长311%,在印度尼西亚、马来西亚、菲律宾、新加坡、泰国和越南,移动钱包的使用量将从2020年的1.411亿增至4.397亿。 移动钱包降低了数字支付的门槛,同时也为电子商务带来了数十亿新消费者。

根据贝恩咨询数据,到2025年,东南亚数字支付规模预计将达到1.17万亿美元,年均复合增速达到13%;数字借贷、数字投资、数字保险规模则有年均30%以上的高速增长,整体市场发展空间较大。、

由于行业增长潜力大,也吸引了众多参与者的进入。目前规模最大的是Grab,占据约20%的市场份额,SeaMoney则主要依靠ShopeePay和AirPay两款产品在东南亚获得约9%的市场份额。整体市场较为分散,各地区存在区域龙头,竞争较为激烈。凭借游戏平台Garena和电商平台Shopee在东南亚的领先地位,SeaMoney最大的优势在于拥有成熟的潜在用户群。游戏和电商业务可为数字金融业务进行导流,能够有效降低整体的获客成本,同时SeaMoney使用率的提升也能降低游戏及电商业务的支付渠道成本,实现业务间的有效协同。

腾讯减持sea

1月4日腾讯公布正进行一项交易,以减持Sea的14,492,751股A类股份,使腾讯于Sea的股权从21.3%减少至18.7%。腾讯将通过将其所有B类普通股转换为A类普通股,将其在Sea的投票权降低至 10%以下。腾讯拟长期维持其于Sea的绝大部分股权,并将持续保持与Sea的现有业务合作关系。腾讯将受限于禁售期,在未来六个月内不可进一步出售Sea的股份。如此一来,Sea 的创 始人、董事长兼 CEO 的投票权将从目前的 52% 增加到57%。

首先,由于Sea的全球扩张目标,我认为Sea减少腾讯对Sea的控制只是时间问题。早些时候有报道称,Sea 计划减少腾讯对该公司的控制,因为它设定了全球扩张的目标。第二随着腾讯在Sea投票权的减少,董事长兼 CEO 的投票权的进一步增加, Sea处于下一阶段扩张的理想位置。 第三和减持京东不同的是,腾讯仅减持了2.6%的Sea股票。腾讯因为受到中国政策监管,正在改变自己的投资组合,加大投资硬科技。可以说减持Sea和京东也是腾讯避免反垄断政策的明智之举。目前看长期对Sea的影响并不大,而且有利于加速Sea的全球化。

点评

Sea的创始人是土生土长的中国人,他们在东南亚有多年工作经历,对当地文化有所了解。但其运行方式,生意模式主要从中国大陆获得灵感,投资者也主要是来自中国大陆的资本,毫无疑问的说几乎是中国模式的翻版。特别是背靠腾讯这颗大树,商业模式基本已经成熟。

目前Sea依靠在游戏+电商+数字支付三架马车飞速前进,Sea 不仅是东南亚的领导者,而且很可能成为电子商务领域国际扩 张的领导者。其广受欢迎的 Free Fire 游戏以及游戏业务 Garena 凭借其大量 MAU 的 高参与度看起来将继续取得成功,并且看起来将继续为 Shopee 扩展到新市场提供必 要的资金并加强其在东南亚电商市场的地位。最后,Sea Money 钱包业务之外的许多 新举措似乎将进一步加强飞轮效应,并创造其他全球同行无法比拟的竞争优势。

投资 Sea 的主要有三大核心逻辑:①以东南亚为代表的新兴市场国家,受益于经济高增长、互联网渗透率 提升和人口结构年轻化等红利,孕育着比欧美、中国更具潜力的电商市场; ②核心业务游戏和电商模式已在中国得到验证,市场空间巨大;③ 核心业务游戏和电商带来横向区域扩张和纵向业务扩张,为未来提供新的增长点。 同时互联网行业的海外政策风险相对较小,预计公司收入未来三年年均复合增速 66%,保持强劲增长。

进入10月以来,Sea从最高为372已经跌到187的位置,跌幅超过50%。一方面由于前期涨幅过大,加上后半年科资金大幅流入科技巨头,成长股大幅杀估值。另一方面,Sea三季度财报核心业务游戏用户增长出现放缓的迹象。最近又受到腾讯减持的影响,导致Sea跌幅超过50%,目前看仍然没有企稳的迹象。经过大跌,Sea也给投资者提供了不错的机会。2022年我依然看好Sea,尽管短期收到腾讯减持的影响,但是长期收到东南亚人口红利、经济高增长、互联网渗透率低、人口结构年轻化等利好,预计2022年Sea将会有不错的机会,值得大家重点关注。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

😄……哈哈

哈哈