The Energy crunch in Europe

1) Energy induced Recession = lower EUR

2) Recession Risk = higher credit spreads and peripheral spreads = lower portfolio inflows

3) Higher cost of manufacturing, shortage of key supply chain materials increase inflation pressure and growth pressure

4) Factory shutdowns = potential higher unemployment

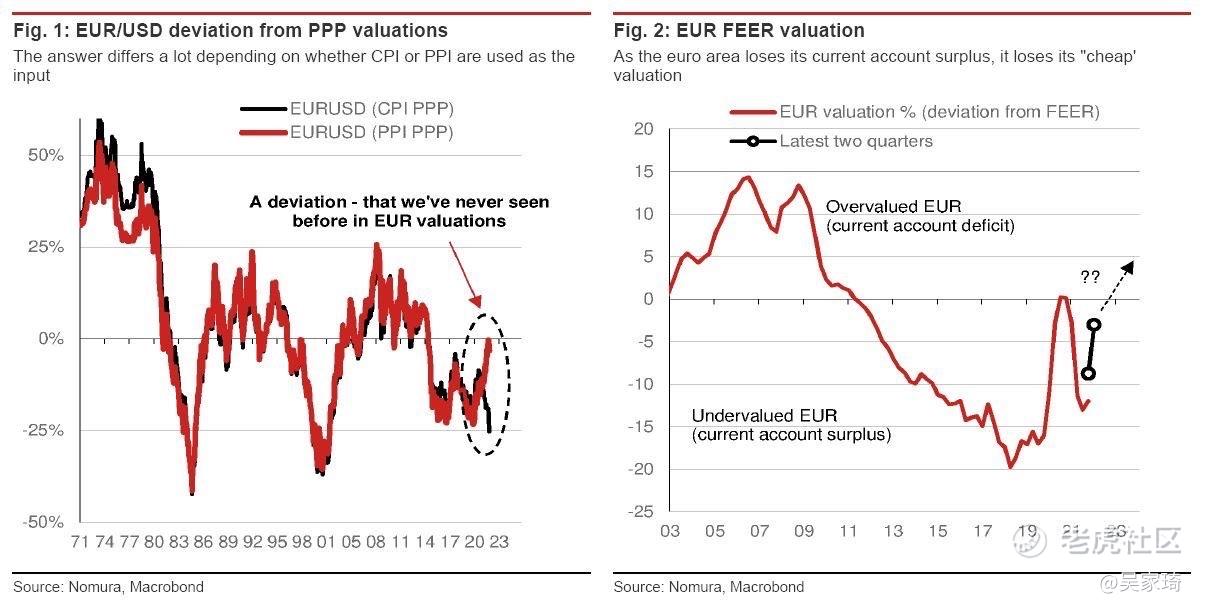

Essentially the Euro area's cost of energy is 3-4 times higher than that of the US and this key disadvantage for Euro manufacturing requires a weaker currency

ECB can make all the noise they want on FX but with 214bps priced over 2yrs already - not really much they can speak up.

Is USD parity Around the corner?

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

33

举报

登录后可参与评论

- zhihuaya·2022-07-07[开心] [开心]1举报

- 大宗猎手·2022-07-07这篇文章不错,转发给大家看点赞举报

- 波罗的海蜜蜡·2022-07-07这篇文章不错,转发给大家看点赞举报

- JemLIm·2022-07-07yes1举报

- Bigbenben·2022-07-071点赞举报

- Lasers·2022-07-07[微笑]点赞举报