Digital Core REIT meltdown!?

$DigiCore Reit USD(DCRU.SI)$ , the only pure-play data centre REIT that was listed on the Singapore stock exchange last year has seen its unit price tanking down the past few days.

Even though its IPO got oversubscribed by 19.4 times and the unit price closed around USD1 per unit after IPO at USD 0.88, many would have bemoaned their luck for missing out on the IPO.

However, fast forward to today, where the unit price is currently trading at USD 0.95 per unit, unitholders that have bought it at the high price might be uncomfortable with the recent bankruptcy of its fifth-largest tenant - Sungard.

Here are some important points you need to know before making any investment decision.

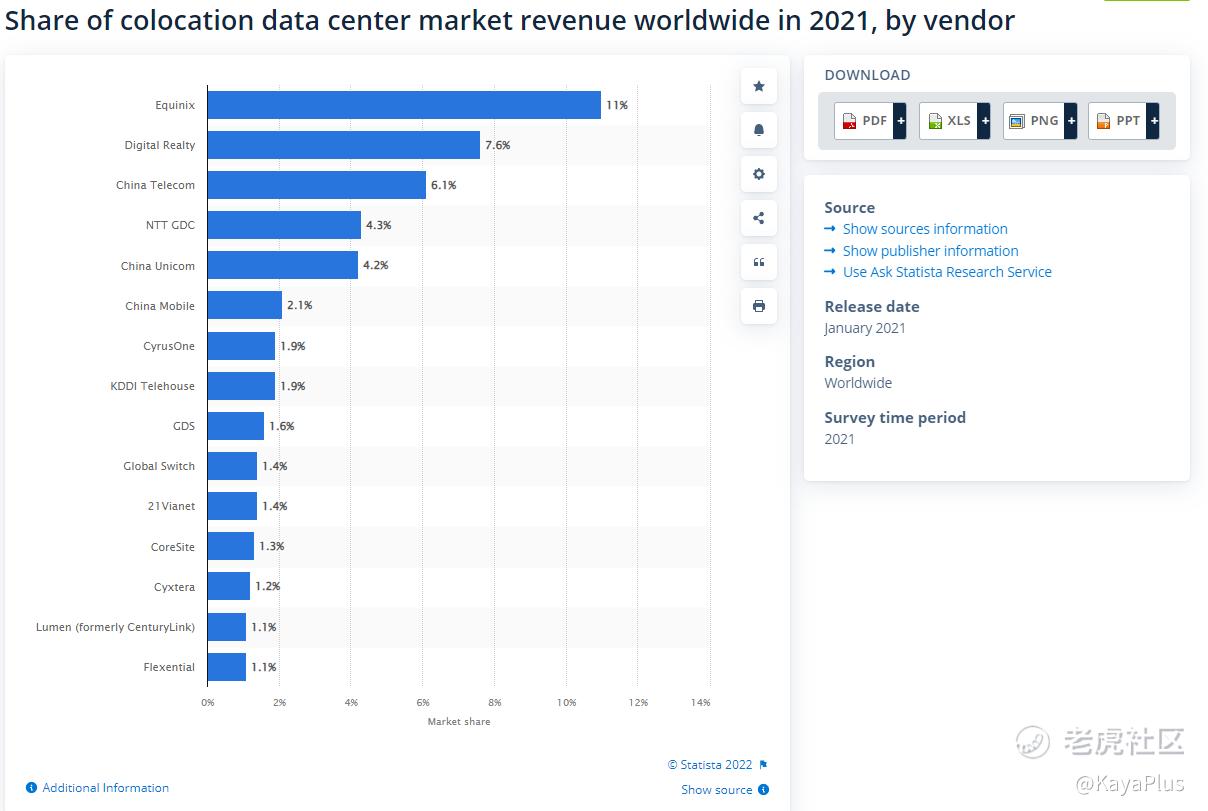

1. Digital Realty, Digital Core REIT's sponsor, is one of the world's largest data centre REIT

As of the latest market share numbers, Digital Realty owns around 7% of the world's data centre revenue.

Digital Realty has injected some of its properties into the formation of DIgital Core REIT and will continue to inject its data centre properties to Digital Core REIT in the future at the right time.

Hence, there is no shortage of growth prospects and opportunities for Digital Core REIT.

2. It has a solid portfolio of properties

DCRU might be the new kid on the block. But it's not a newbie in terms of experience. DCRU started its status as an S-REIT with 10 data centres with an appraised value of $1.4 billion. It has a 100% occupancy and all of its properties are 100% freehold.

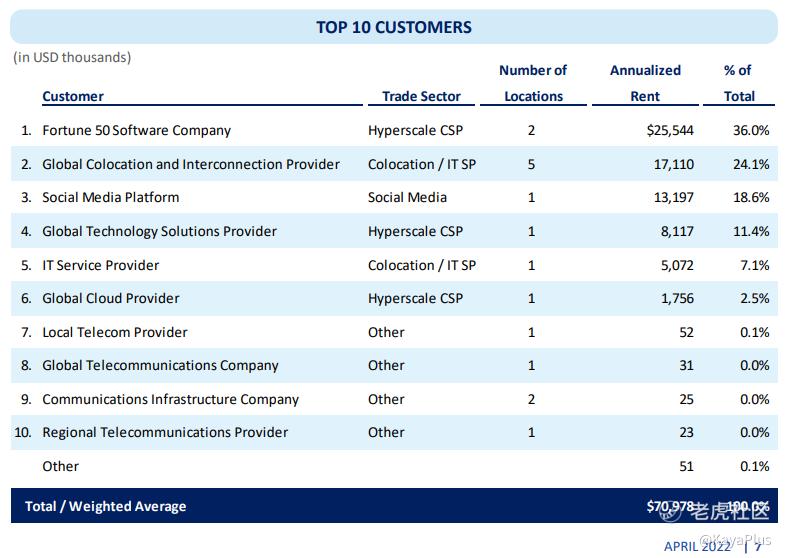

3. Sungard is only 7.1% of its exposure

The news that shook the unit price is likely due to the bankruptcy of Sunguard, DCRU's fifth-largest customer. A deeper look at its customer concentration shows that Sunguard, as big as it might be, will only potentially affect 7.1% of DCRU's revenue moving forward due to its unprecedented bankruptcy.

4. Digital Realty provides a cash flow guarantee

Investors might be afraid that a vacuum might be left in the wake of Sungard's bankruptcy. But swiftly after the news broke out, $Digital Realty Trust Inc(DLR.US)$ carried out its responsibility as a sponsor by reassuring a cash-flow guarantee to DCRU.

What it means is, that Digital Realty will guarantee the rental income stream to Digital Core REIT in the event of a near-term cash flow shortfall due to the customer bankruptcy. Hence, that means Digital Realty will pay back any sum that DCRU might be owed should the bankrupt customer is unable to fulfil its obligations.

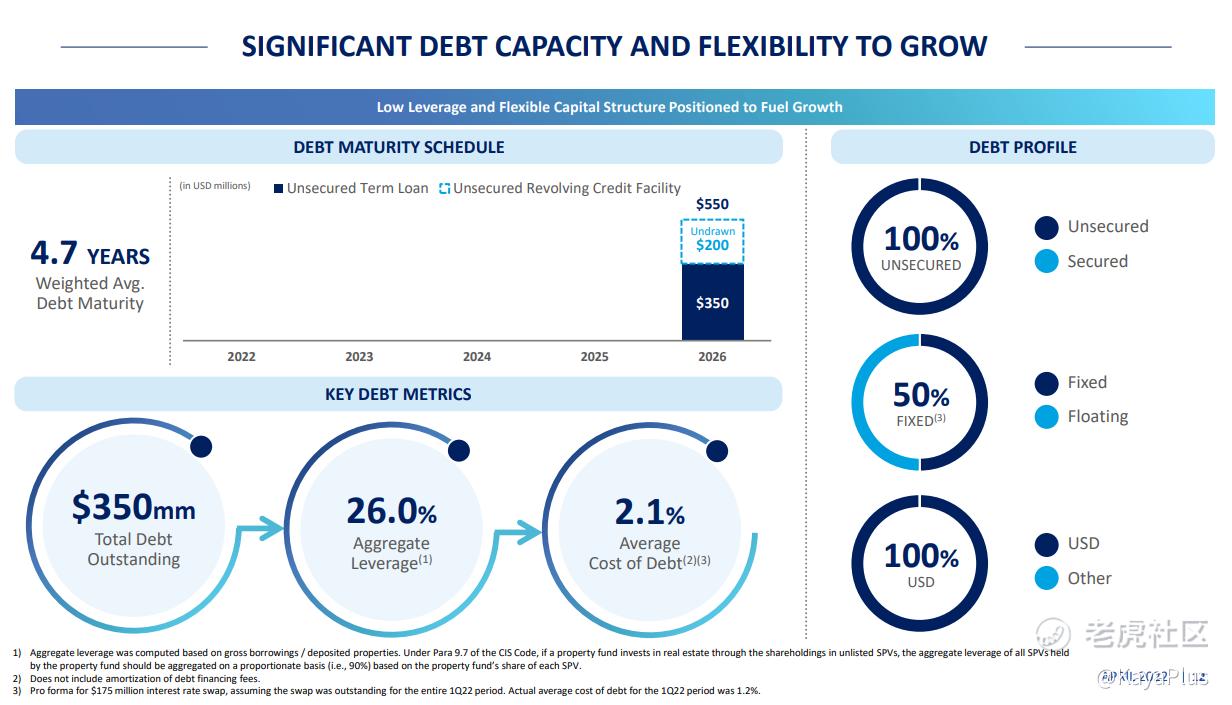

5. Interest expense scare

Lastly, many brokers and analysts are wary of the increased interest rates that might hurt DCRU. While REITs are naturally affected by interest rates, this should not come as a major scare.

If rental escalation and reversion work out in favour, any impending interest expense can be nett off and still provide accretive and growing earnings and distributions to investors.

Moreover, with DCRU being relatively low in leverage, it has plenty of debt room to still grow via acquisition at the right price and time.

MyKayaPlus Verdict

Stock always reacts violently whenever any negative news breaks out. But, a good stock or REIT will always find ways to boost investor confidence even when unforeseen circumstances arise.

While no one can predict how low will DCRU's price move in the near term if all of its current headwinds come to pass, prices might rebound back up to their historical high.

DISCLAIMER

The information available in this article/report/analysis is for sharing and education purposes only. This is neither a recommendation to purchase or sell any of the shares, securities or other instruments mentioned; nor can it be treated as professional advice to buy, sell or take a position in any shares, securities or other instruments. If you need specific investment advice, please consult the relevant professional investment advice and/or for study or research only.

No warranty is made concerning the accuracy, adequacy, reliability, suitability, applicability, or completeness of the information contained. The author disclaims any reward or responsibility for any gains or losses arising from direct and indirect use & application of any contents of the article/report/written material.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 他二哥加油·2022-04-26这篇文章不错,转发给大家看1举报

- 吉吉祥祥·2022-04-26好文1举报

- 反复抄底·2022-07-10这家跟美股的dlr是同一家公司吗?点赞举报

- 给梦想一双翅膀·2022-04-27这篇文章不错,转发给大家看点赞举报

- Melinda2021·2022-04-27谢谢 分享点赞举报

- 史小锐·2022-04-27阅点赞举报

- 那就好呵呵·2022-04-26好的记得记得点赞举报

- 方达利源·2022-04-28额额点赞举报

- 船舱米·2022-04-27不错点赞举报

- 血亮帅哥·2022-04-27666661举报

- 叶汀·2022-04-27👀点赞举报

- 北正峰·2022-04-27好点赞举报

- 初生小牛不怕虎·2022-04-27666点赞举报

- 杨俊峰·2022-04-27好点赞举报

- 乱拳头·2022-04-27阅1举报

- 霜哥·2022-04-27好1举报

- 奈何桥de旋律·2022-04-27666点赞举报

- 家豪Lee·2022-04-27😀点赞举报

- doudoumi·2022-04-27GG1举报

- Miaow miaow·2022-04-27危险哦点赞举报