Does Equity – Capitulation Lies Ahead?

Is Retail De-leveraging yet to take place?

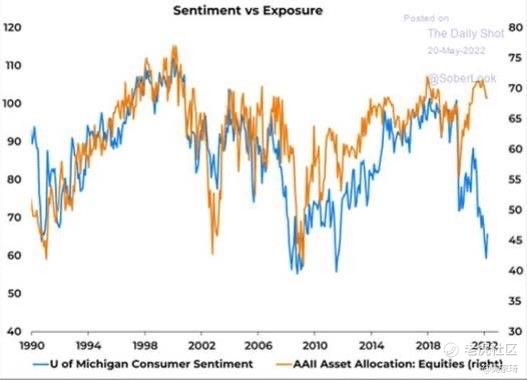

Whilst sentiment is clearly lower, positioning inertia means equity exposure still remains high and is just beginning to come off. Real yields turning further positive and equity portfolio drawdowns triggering panic sell-offs will lead to a further washout in equities.

PE correction nearing bottom of range. Will EPS revisions/ contraction to drive next leg lower?

The direction of earnings revisions has turned negative. There’s nothing particularly surprising about this; it’s the natural way of things for earnings estimates to be talked down as companies look to give themselves a lower bar to clear. But this follows an unusually protracted period when earnings were forever being revised upward.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。