理想汽车2021年三季度营收、毛利率创历史新高,增长后劲略显不足

摘要:2021年11月29日,理想汽车发布三季度财报。财报显示,理想汽车营收为人民币77.8亿元,同比增长209.7%;其中,毛利为人民币18.1亿元,毛利率为 23.3%,去年同期为 19.8%;三季度汽车销售额为人民币73.9亿元,同比增长199.7%,共交付Li ONE25116辆,同比增长190.0%。三季度理想取得了强劲的业绩,其中营收、汽车利润率、经营现金流创历史新高。受消息刺激,理想盘前大涨9%。

理想汽车首席执行官李说到:“在全行业范围芯片短缺的背景下,理想汽车在第三季度交付了25116辆理想ONE,同比增长190.0%,实现季度新高,再一次凸显了2021款理想ONE对家庭用户的强大吸引力。为缓解持续的供应链风险,我们将继续与我们的供应链合作伙伴共同寻找解决方案。我们对理想汽车的增长前景充满信心。我们会继续加大研发资金投入以推动增程式电动车及纯电动车的并行发展。加大销售和服务网路建设,为我们业务的持续增长做好准备。

2021 年第三季度营收、利润分析

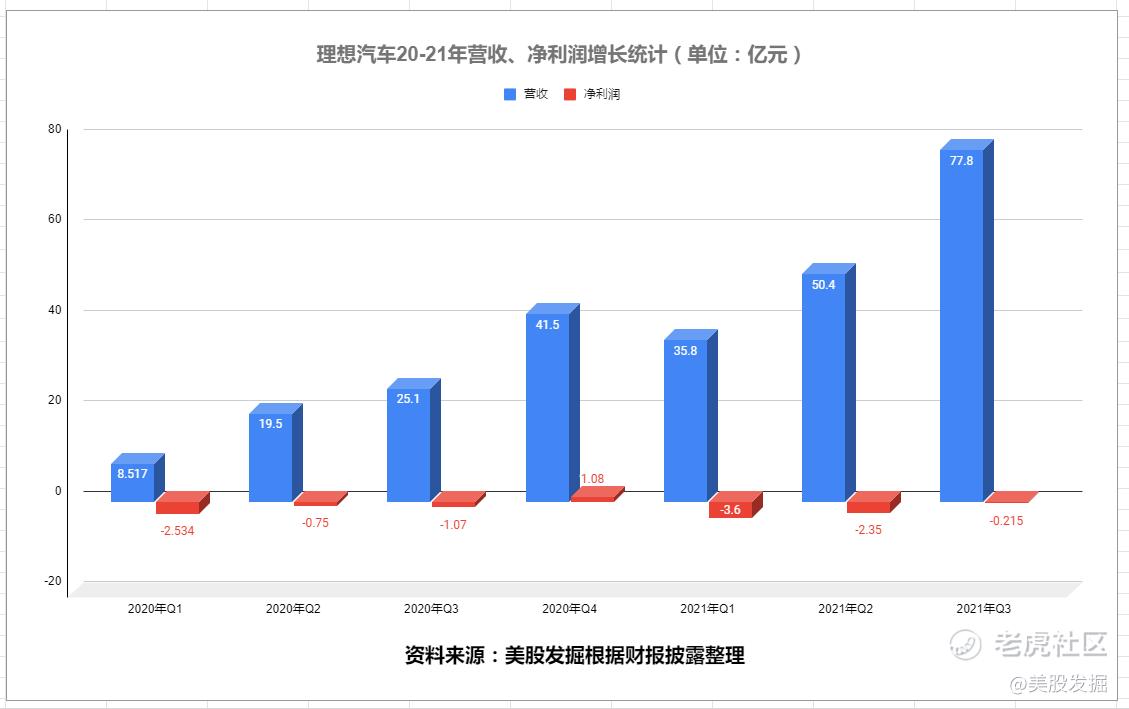

2021年第三季度总收入为人民币77.8亿元,较2020年第三季度的人民币25.1亿元增长209.7%,较第二季度的人民币50.4亿元增长54.3% 。

从财报看,理想汽车的收入来自汽车销售和服务,车辆销售收入为73.9亿元,占比总营收的95%,较2020年第三季度的24.6亿元增加199.7%,较2021年第二季度的49.0亿元增加50.6%。车辆销售的大幅增长,得益于强劲的汽车交付,三季度共交付Li ONE25116辆,同比增长190.0%。

其他销售及服务收入为3.9亿元,较2020年第三季度的0.46元增加745.1%,环比增加187.0%。服务的大幅增长得益于,新能源汽车积分的销售,以及汽车累计销量的增加使得充电桩、配件及服务的销售增加。

2021 年第三季度净亏损为人民币 2,150 万元,较 2020 年第三季度的人民币 1.069 亿元减少 79.9%,较第二季度的人民币 2.355 亿元减少 90.9%。理想在三季度中概股环境如此困难的环境下,亏损环比减少90%,可以说超出了大家的预期,不过,理想目前只有一款车型,研发和营销费用都相对比较低,这也是理想取得亮眼的三季度财报原因之一。

进入2021年,在面临芯片短缺和疫情双重影响之下,理想汽车依然交出了不错的成绩,随着产业链逐渐成熟,营收继续将维持高速增长。

理想汽车三季度交付亮眼

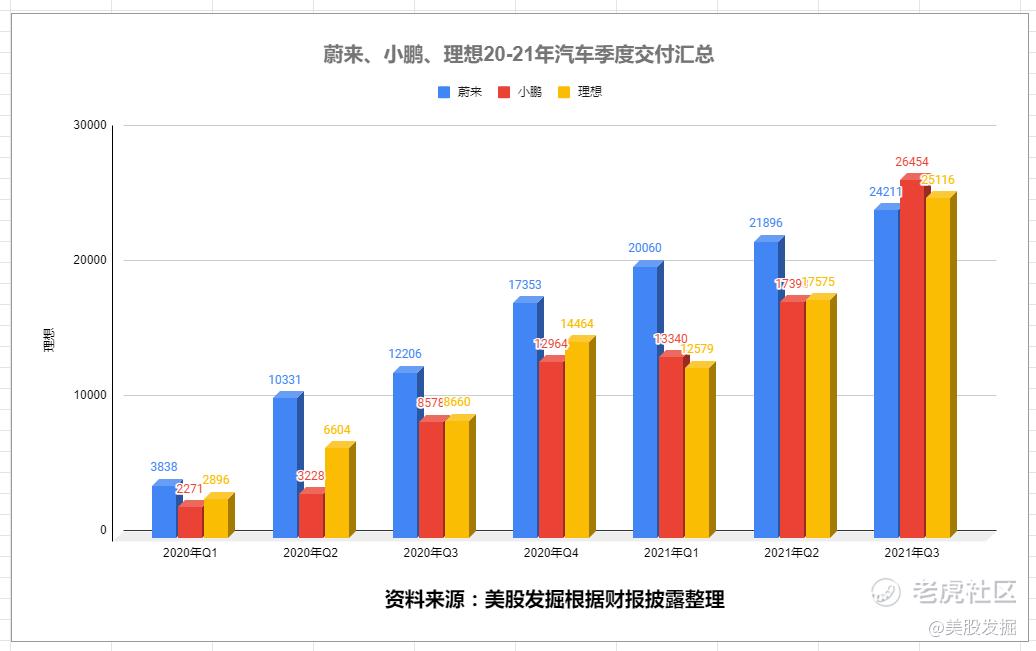

三季度蔚来、理想、理想都披露了三季度交付数据,各自取得了不错的成绩。2021年第三季度,理想ONE的交付量为25116辆,同比增长190.0%。2021年第二季度为17575辆,2021年第一季度为12579辆,表现十分优秀。小鹏汽车总交付量 2.57万辆,同比上升 199.2%。蔚来共交付新车2.44万辆,同比增长100%。

2021年10月,理想汽车交付了7649辆理想ONE,较2020年10月增长107.2%。截至2021年10月31日,公司拥有162家零售中心,覆盖86个城市,并于165个城市运营223家售后维修中心及理想汽车授权中心。

理想汽车三季度毛利率再创新高

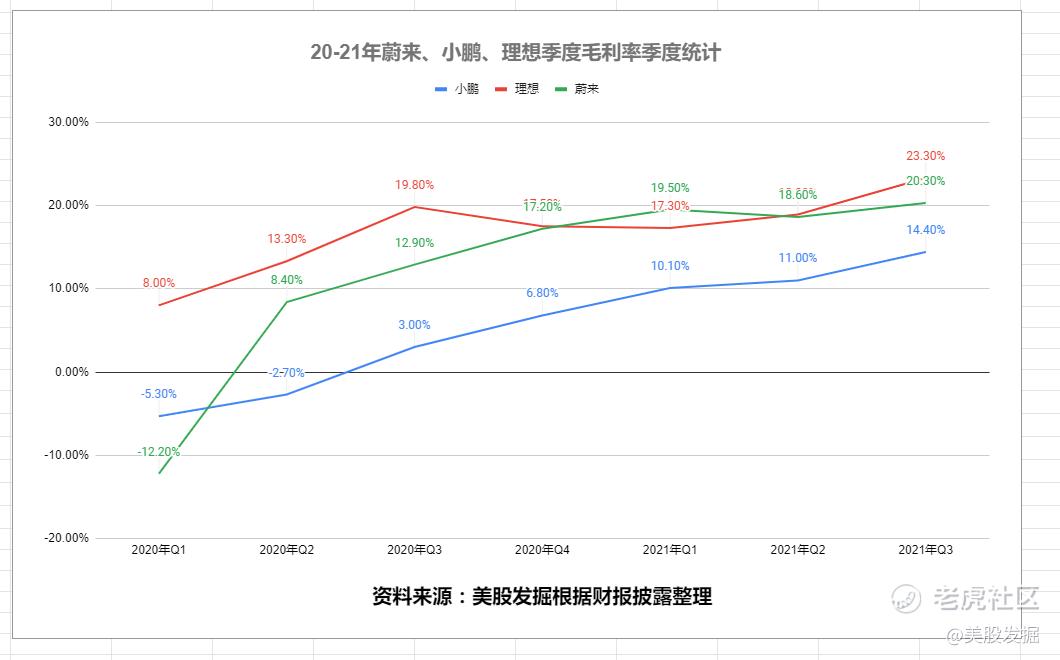

毛利率是上市公司的重要经营指标,能反映公司产品的竞争力和获利潜力。理想汽车三季度毛利为人民币18.1亿元,较去年同期的4.968亿元增长264.8%,较第二季度的9.528亿元增长90.2% 。三季度的毛利率为 23.3%,去年同期19.8%,2021 年第二季度为 18.9%。与友商相比,理想汽车的毛利率最高,其中蔚来三季度毛利率为20.3%,小鹏毛利率最低为14.4%,不过小鹏汽车相对于去年同期大幅增加11个百分点。

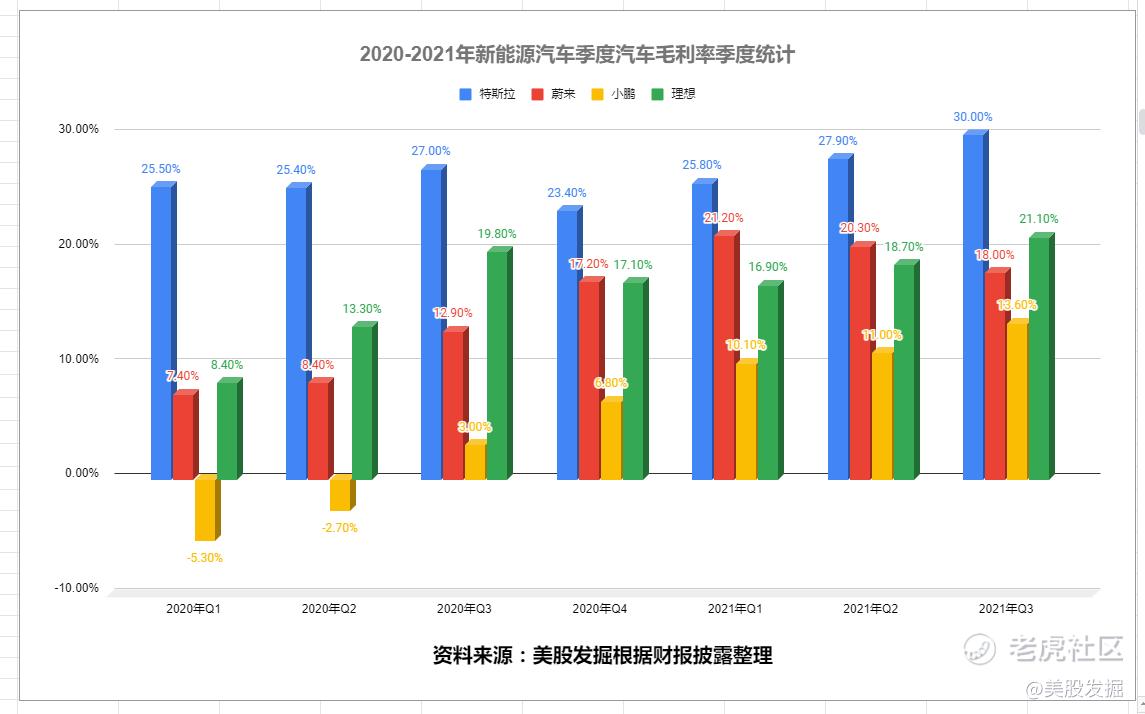

对于新能源汽车来说,汽车销售是公司主要收入来源,整车毛利率也是我们主要关注的指标之一。新能源龙头特斯拉三季度整车毛利率达到了惊人的30%,蔚来汽车三季度毛利率从二季度20.3%下滑至18%。小鹏汽车2021年第三季度汽车毛利率为13.6%,2020年同期为3.2%,增加了10个百分点,可以说十分亮眼。

理想汽车在2021年第三季度整车毛利率达到了21.1%,去年同期为19.8%,而在2021年第二季度为18.7%。预计随着理想的汽车生产规模的增加、产业链的成熟,毛利润将进一步提高。

理想汽车三季度财务分析

理想汽车三季度的收入总额为77.8亿元,同比增长209.7%。理想汽车三季度的营业费用为19.1亿元,同比增加182.2%。营业费用主要分为研发费用和营销费用。研发费用为8.885亿元,同比增加165.6%,环比二季度的6.534亿元增加36.0%。研发的增加主要由于研发人员增加导致雇员薪酬增加,及本公司新车型研发像关开支增加。营销费用为10.2亿元,同比增加198.5%,环比二季度的8.353亿元增加22.3%。主要是营销及推广活动增加以及随著本公司分销网络的扩大,雇员薪酬及租金支出增加。

在研发投入上面理想汽车远低于和小鹏、蔚来。理想汽车研发费用仅为8.885亿元,小鹏汽车三季度研发开支为12.64亿元,同比上升99%,环比也上升了46.4%。蔚来在第三季度研发费用为11.93亿元,同比增长101.9%,环比增长35%。

而在营销费用上面,三季度理想汽车营销费用为10.2亿元,环比增加22.3%;小鹏汽车投入了15.38亿元,环比上升49.3%;理想汽车三季度营销费用,达到了18.25亿亿元,环比增长22%。从财报看这主要是由于支持汽车销售的营销、促销、广告开支等增加所致。可以说,三家公司,在营销上面都大量投入资金。

理想汽车三季度亏损大幅缩减,三季度的经营亏损为9780万元,较2020年第三季度的1.80亿元减少45.7%,较2021年第二季度的5.359亿元减少81.8%。净亏损为人民币 2,150 万元,较 2020 年第三季度的人民币 1.069 亿元减少 79.9%。

由于理想汽车在港股上市,目前现金流充沛。三季度经营性现金流21.7亿,环比二季度的14.1亿的同比增长54.1%。三季度的自由现金流为人民币 11.6 亿元,同比元增长 55.4%。

理想汽车四季度展望

10月份,理想汽车交付了7649辆理想ONE,预计接下来两个月理想月交付将突破1w量。2021年第四季度,理想汽车预计:车辆交付量为30000至32000辆,较2020年第四季度增长107.4%至121.2%。营收为88.2亿元至94.1亿元,较2020年第四季度增长112.7%至126.9%,环比增长13%-21%。

小鹏汽车预计四季度交付指引34,500-36,500台,营收 71 亿元人民币至 75 亿元人民币,环比增长36%-44%。蔚来预计四季度的交付量在 23,500 至 25,500 辆之间,总收入在人民币93.8亿元至人民币101.1亿元之间,环比增长约在-4.4%-3.1%之间。

从四季度指引看,四季度小鹏汽车仍然将高歌猛进,蔚来、理想目前仍然受到芯片影响,四季度环比增速将会出现下滑,特别是蔚来汽车,10月份产品升级,仅交付3600台,据报道,ET7首批预生产车正式下线,蔚来也将度过最困难的时候。芯片短缺是暂时的,相信随着供应链的拓展,产业链的升级,三级公司将继续维持高速增长。

理想新车计划

在2022年,理想将推出增程式X平台,基于该平台打造的全尺寸SUV也将在明年亮相。 新车依旧采用了增程式的技术,虽然消费者对于增程式这种油电混用的老技术比较易于接受,但是考虑到时代的飞速发展,淘汰增程式技术或许只是时间问题。而理想的纯电动汽车将在2023年推出。

到2023年,理想将推出5款全新车型。具体来说,理想将于明年推出全尺寸增程SUV,后续将于2023年推出两款纯电动SUV,同时还将在全新平台上推出两款增程式SUV。

理想汽车的北京制造基地正式开工建设,并计划于2023年投入运营。该基地将成为理想汽车重要的豪华电动车制造基地。

点评

理想汽车三季度财报,还是有不少亮点,其中新车交付了25116辆,超越蔚来,基本和小鹏汽车持平。毛利率达到了23.3%,整车毛利率达到了21.1%。都远超过蔚来和小鹏。另外三季度理想其他收入也表现亮眼,收入3.9亿,环比增加184.7%。汽车销售收入占比从去年同期98.2%降到三季度的95%。考虑到理想目前只有一款车型,研发费用和营销费用是三家最低的,也在情理之中。总体来说,三季度理想还是交出了一份不错的财报。

理想汽车三季度受到资本的青睐,目前前五大持仓机构依次为贝莱德、柏基投资、先锋领航、FMR LLC、道富银行。三季度贝莱德增持313.73万股,位列增持榜首位;高瓴加仓了108万股理想汽车;桥水基金增持95.97万股,增持幅度约132.6%。高盛三季度减持132.94万股,减持幅度约18%。

虽然目前理想汽车取得了不错的成绩,但是目前小鹏已经在10月份正式开始交付,首款激光雷达P5也预计将在2022年一季度产能开始爬升,另外2022年,小鹏还计划推出一款全新的SUV车型,新车或将定位一款中大型SUV,与蔚来ES8、理想ONE形成对标。蔚来ET7首批预生产车正式下线,预计将在2022年一季度开始交付,蔚来将推出中低端副品牌,该品牌将独立存在,预计售价在15万元-25万元之间,副品牌车型预计将在明年上半年发布。反观理想2022年仅有一款大型增程式的SUV发布,中低端市场基本为零,在竞争激烈的市场下,显得有限后劲不足。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 迪士尼迪斯尼·2021-11-30中国造车三傻里面也就理想的财务数据看着最健康。4举报

- 玉米地里吃亏·2021-11-30整车毛利率达到了21.1%。都远超过蔚来和小鹏,怪不得股价飞起来了。3举报

- 刀哥拉丝·2021-11-30账面还有488亿现金,还可以烧很久很久。3举报

- 哎呀呀小伙子·2021-11-30现在都不算是新能源车子了,还挂着新能源的牌子。1举报

- 丹尼尔加·2021-11-30趁着现在有钱不加快跑马圈地,把钱放在账面,不聪明。2举报

- 灯塔国02·2021-11-30我也比较喜欢理想,这个公司的股票现在还能买吗?2举报

- 以肉克刚·2021-11-30车子是不错,就是研发的进度有点慢,这个不是很看好。2举报

- 灌饼高手00·2021-11-30新能源车子的核心是生态,一个车子包打天下,短线还行,后面可能就不行了。2举报

- 梅川洼子·2021-11-30现在的三傻,理想和小鹏轮流当大哥,就是蔚来什么事。1举报

- 权力的游戏厅·2021-11-30增长后劲略显不足股价还能这样涨,真的有点不可思议。1举报