1季度投资总结 - Q1 Trading Review

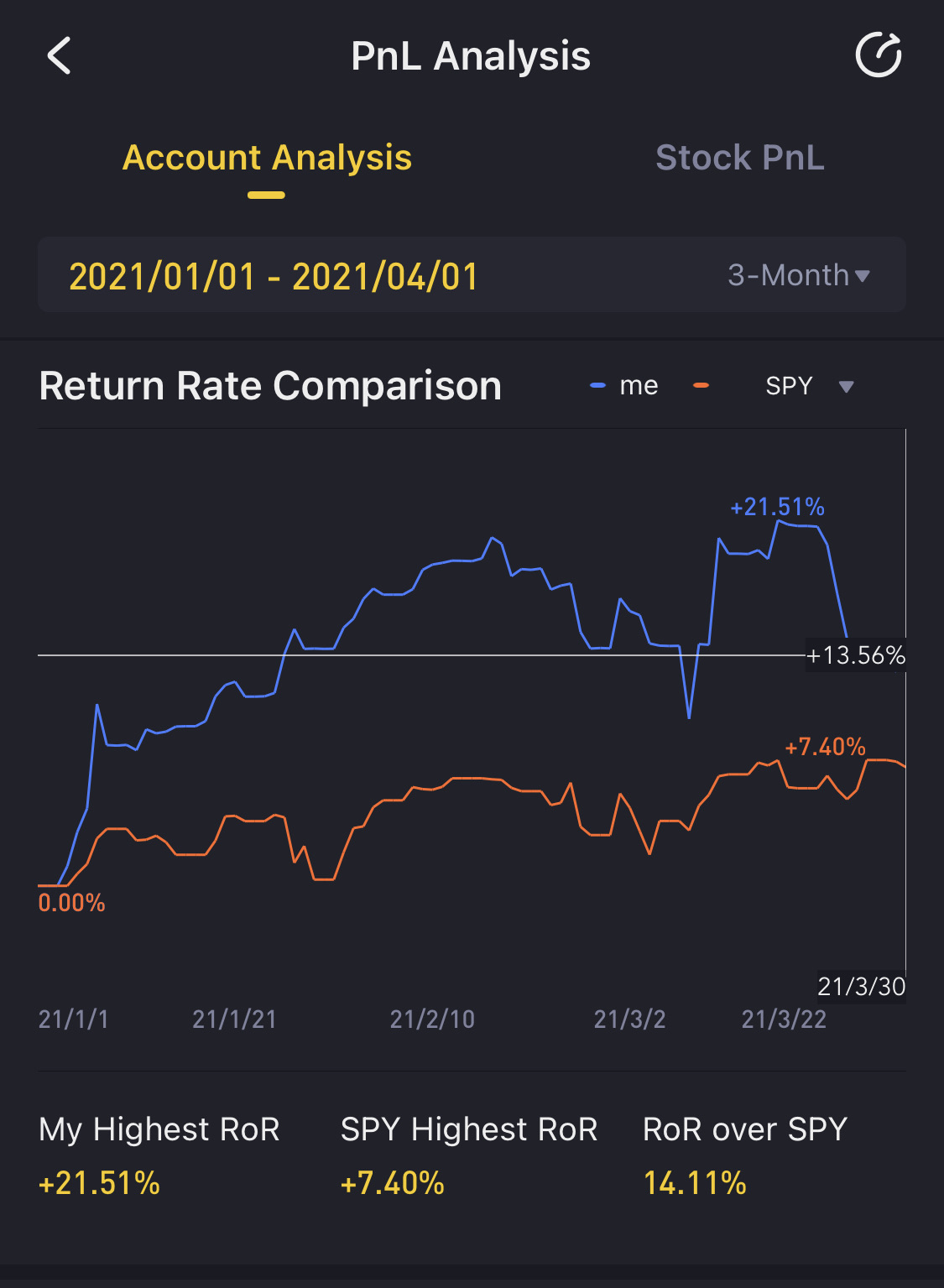

My target is to always do better than the $S&P500 ETF(SPY)$. If we can't, we should just DCA/Invest into SPY. Luckily, this Q1, I outperform, the SPY by about 14.11%. It could have been even better if I stick to my strategy and take more profit during the small revert spike before the dips in smaller tech stocks.

3 Things that helped me:

1. Selling Cash Secured Put

Consistently taking realized profit by selling Cash Secured Put and closing it before assignment at a profit has helped me well. I often look to sell a put during the small dips that tend to give a good premium. Most of the time, I am always willing to be holding it at assignment if it ever reaches the price. Then I will take profit usually above the 75% profit mark and rinse and repeat for new put trade.

You can see that it take up almost 25% of my realized profit. It helps to consistently generate premium profit while not using up any of my available cash balances. Unfortunately, the covered option is not handled well by Tiger and it eats up a lot on my buying power despite already covered the position with shares. Hopefully, Tiger can look into implementing this soon.

Taking Profit on Position even when Market looks very green.

Seeing the ARK bought into $Workhorse(WKHS)$ after the dips in early Dec, I decided to do more in-depth research and also go into WKHS anticipating that there will be another wave of the contract win hype. I went in with a bigger position than usual. Took my first profit a bit too early, but luckily still have more than half to run and spread out over the tops and finally before it came crashing down.

Holding Fundamental Strong Stocks

I am about 60% weighted on smaller tech growth stocks and about 40% into the larger cap and fundamental strong company like $Microsoft(MSFT)$and $FB (Recently Closed). I can't profit at 100% during the big spike for the growth company in early Feb, but they help to hold my portfolio during these dips.

I think that growth tech stocks will continue to do well. Especially those with good revenue. But we still have to be wary of the short term sentiment to take full advantage of it.

How did your Q1 trading goes?

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

阅

这篇文章不错,转发给大家看看