This Time is Really Different !

This Time is Really Different !

09/10/2018, Mon, Sunny, Air Polluted

Summary:欧美股市均因Trump贸易战言论收跌,而美债收益率则受超预期的AHE数据大幅上行。本周长端美债发行加速,周末税法关于美国公司加大养老金投资的条款过期,但警惕利率下行。

Euro Session:

The surprising weakness of Germany July trade and IP punched down EUR and GBP at the moment Tokyo closed. Soon after that, EUR and GBP reversed losses and reached day-high, which astounded me quite a lot. EURUSD seemed to find itself in the middle of no man’s land once again, which resisted to any external incentives naturally.

During the early part of EU session, here came he news that EU is open to discussing other backstops to withdrawal agreement helped GBP to gain territory. It seems that the UK and EU will attempt to get agreement on the Withdrawal Agreement even if the goal for a deal having slipped to November from October.

As to rate, another day of rallying for BTP across the curve but on the longer-end the 30y yield closed a touch wider. 2y BTP is the performer tightening by 5.1bps. For core/semi-core and peripheral bonds it was a day of higher yields. Further weakness was evident after a stronger than expected US payrolls report.EU risk assets edged lower again throughout the morning session after Trump trade comments

Economy data:

2:00, DEU July trade balance SA 16.5bn vs 19.5bn, prior 21.8

DEU July IP -1.1% vs 0.2% mom, prior -0.9% revised up to -0.7%; 1.1% yoy vs 2.6%, prior 2.5% revised up to 2.7%.

2:45, FRA July IP 0.7% vs 0.2% mom, prior 0.6% revised up to 0.7&; 1.8% yoy vs 1%,prior 1.7% revised up to 1.8%

3:30, UK Aug Halifax housing price index 0.1% vs 0.1%, prior 1.4% revised down to 1.2%

4:00 ITA July retail sales -0.1% mom, prior -0.2% revised up tp -0.1%

5:00, EMU Q2 GDP final 0.4% qoq vs 0.4%, preliminary 0.4%; 2.1% yoy vs 2.2% , preliminary 2.2%

US Session:

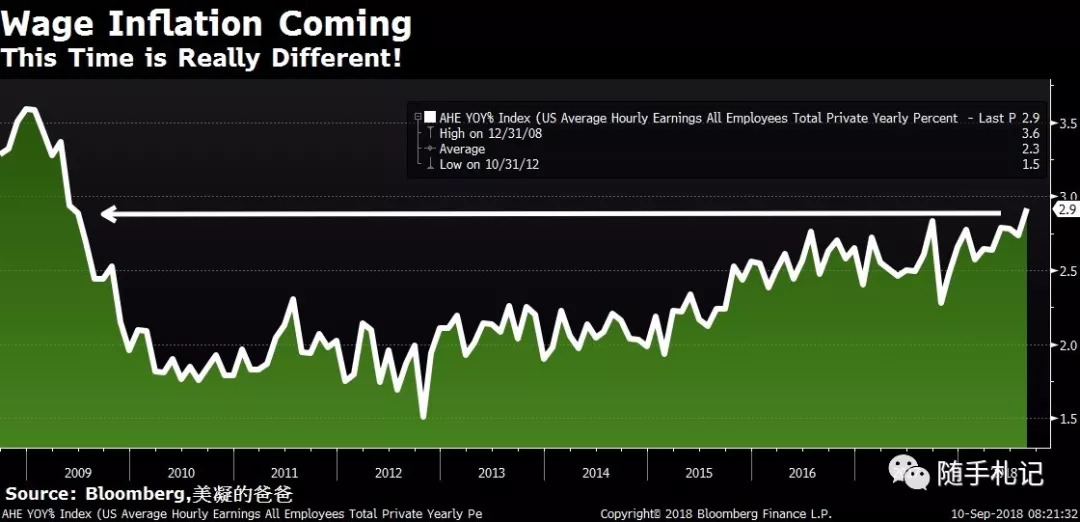

Two themes dominated US session. The first is NFP at 8:30, and the second is Trump speaks to reporters on Air force one about China tariffs around mid-night. As to NFP, the big news in Aug jobs report was a 0.4% rise in average hourly earnings, coupled with upward revisions to June and July. As a result, year-on-year earnings growth is running at 2.92% and three-month annualized AHE growth is 3.06%, which reflects a combination of base effects plus a bit stronger than seasonally normal August gains. With payrolls and the unemployment rate both close to expectations, the focus falls on average hourly earnings, where a bigger-than-expected rise combined with revisions suggests wage pressures are finally evident. That's exactly what the title of today's notes is about.

Around mid-night, Trump casually told reporters on Air Force One that implementation of tariffs against China “will take place very soon depending on what happens.” But it was his following comment that hit risk markets (but had little impact on USTs) – Trump added that “behind [the $200bn proposed] there is another $267 billion ready to go on short notice if I want.” It's hard to tell what his comments really mean, or just out of strategy purpose. But we can clear feel that the Washington game of guessing who wrote the op-ed is at an all-time high. Everyone around town is buzzing about who it might be. Even AXIOS reported trump ordered DOJ to find out who is sitting truly behind the story. While Tomorrow , Sep 11th, could be the day the book of "Trump in the White House" get published.

Before NFP, the market seemed content with the idea that the number was going to be a complete non-event. Well that was clearly not the case as an above consensus AHE caused the market to finally crack that 2.91 support area and push us up towards 2.95. When Trump comments jumped out , TY once bounced a little and closed out the NYT around the day low. While US equities got hit by such words and closed in green.

Economy data:

As above.

Key Data And Events Ahead:

Tue: DEU ZEW, UK JOBLESS CLAIMS

Wed: US ppi , IT, EMU IP

Thur: US core CPI, ECB , BOE

Fri: US IP, CAPACITY UTILIZATION, U.of Mich.Sentiment

Brainard (neutral), Quarles (neutral), Bostic (voter/neutral) Bullard (non-voter) Rosengren (non-voter/hawk) speak

Treasury will auction $35bn 3-years on Tuesday, reopen $23bn 10-Years on Wednesday and reopen $15bn 30-years on Thursday.

Comments:

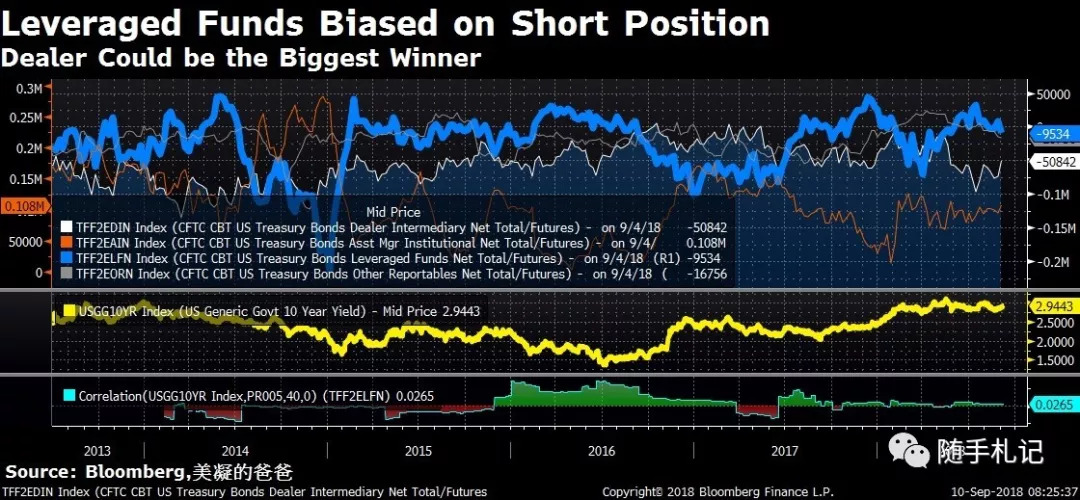

I know very few expect anything interesting next week from the ECB and it seems likely very little new is said. If ECB stay low or complacent with their status quo, UST yields will go no-where. Right this morning, Assad still acted as a black goat with the report of "U.S. OFFICIALS SAY ASSAD HAS APPROVED GAS ATTACK IN IDLIB". Could 2.97 trigger the UST rallying? Especially before Sep 15th, there could be a major tax cut shift which will not incent US Corporates allocate pension investment anymore. What' more , there are 73bn supply need to be absorbed by the market in this week!

According to CFTC data, Speculators were bearish on Treasury **res over the week ending on Tuesday, September 4, extending their net short position in TY equivalents by 317K contracts. They boosted their net short position in TY, FV, US, WN and TU by 153K, 87K, 35K, 10K and 5K contracts, respectively.

ps:

个人微信zhangke8639,欢迎同业交换名片。公众号更新速度快一点儿....排版也好一点点儿....

近期重要时间点:

9月11日,Fear: Trump in the White House预计出版

9月13日,ECB议息

9月18日,EU A50会议

9月18-20日,半岛峰会

9月20日,EU非正式峰会,日本LDP选举

9月26日,FOMC

9月,日本LDP选举,半岛峰会在平壤

9月27日,意大利提交财政预算案

10月16日,EU A50会议

10月25日,ECB议息

10月31日,BOJ议息

11月6日,美国中期选举开始

11月8日,FOMC

11月11日,美国阅兵 (取消了,说是因为预算问题)

12月13日,ECB议息,EU 峰会

12月20日,FOMC

12月22日,改革开放40周年

2019年3月21日,EU 峰会

2019年3月29日,脱欧谈判截止

Appendix:his t overnight

(偷懒了呃,太多了!)

Disclaimer:This material was prepared in private name and out of pernaonal hobby,definitely based upon facts and robust analysis with delicate consideration of highly professionality.But with no means to conduct any trade , and before using the contents of this note in any internal or external communication, please ensure you are comfortable and fully aware this could not be sufficient enough as any action base.

Up till now, Subscribers have amounted to 4008 !

$(000063)$$(00763)$

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 富贵在天生死有命·2018-10-19太上皇点赞举报