Pricing Next Weekend from by this One

Pricing Next Weekend from by this One

08.31.2018, Fri, Sunny, Air Perfect

Summary:贸易紧张和意大利预算以及评级更新问题掌控欧美市场,土耳其阿根廷继续遭受冲击.乏闷得夏季交易时间就要结束了!

Euro Session:

Another slow summer Asia session after the carnival in previous US time while A share plummeted again. With the impeding of Sep 5th, the probability of 25% tariff on 200bn exports could be the main factor. Beyond that, we could see the hike by the end of next month which was already priced 100% via OIS means.

EU equities opened weak and EGBs in bid tone. The headlines of Fitch due to review Italy's rating today hit the tape, shadowing the market. Fitch says measures planned by the new Italian government on taxes, basic income and pensions for 2019 may cost as much as EU75 billion yearly.

Italian auctions (5y and 10y as well as CCTs) went smoothly but post-auction things went a little pear shaped. The 2y BTP yield was up 16bps and 10y yield up 10bps. Attention then turned to Fitch ratings review today after market close which may partially explain why BTPs sell-off.

Economy data:

3:55, GE Aug unemployment rate 5.2% vs 5.2% , prior 5.2%.

5:00, EU Aug consumer confidence -1.9 vs -1.9, prior -1.9

EU Aug economic confidence 111.6 vs 111.9, prior 112.1

8:00, GE Aug HICP 0.00% mom vs 0.2% , prior 0.4%; 1.9% yoy vs 2.1%, prior 2.1%

US Session:

Another uneventful trading session in the US Thursday as Personal Income and Spending Data continue on their overall solid trend, providing little market reaction although the slump-down of EU market continue its negative effect on US market. IT could be not too bad session until headlines hit the tapes that the Trump Administration will back $200bn of Tariffs as early as next week. US Equities and US Treasury yields slipped while the Dollar gained against the majority of its G10 peers, USDJPY being a key exception as the pair fell by about 0.60% in typical risk-off fashion to finish the day at 111.03.

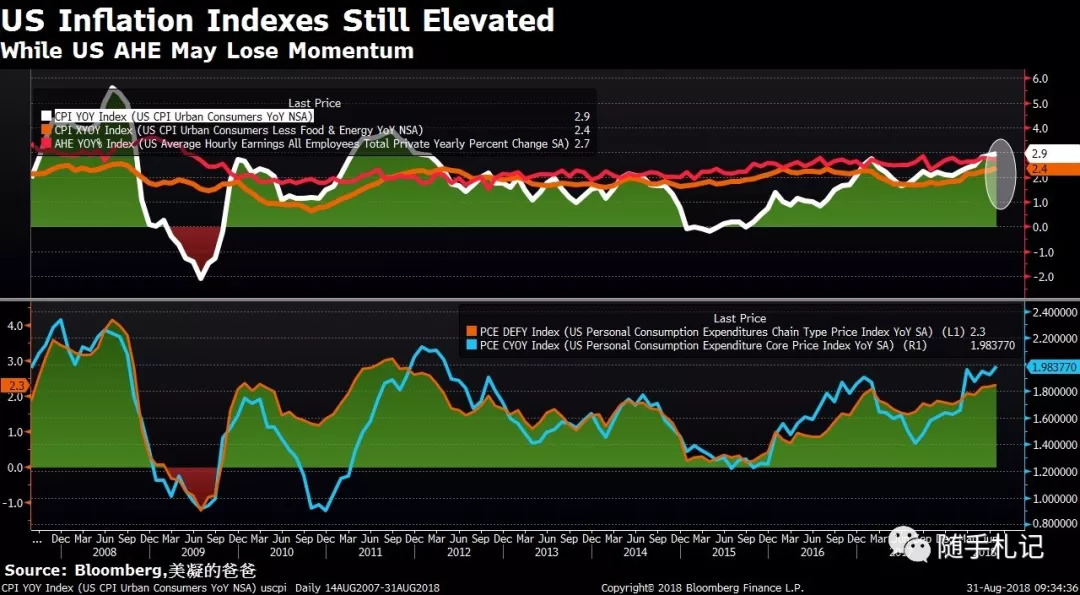

As US is very close to full employment, employment growth will slow down; if the oil price continues to rise, the rise in inflation will permanently eliminate the rise in real wages and wage income will slow down markedly as a result of weaker job creation. No wonder why Trump criticized OPEC again and again. Right now ,AHE is already at a slower pace while PCE at a firm and steady up-trend.

Economy data:

Jul. Personal Income was +0.3% m/m vs. +0.4% expected, Spending was +0.4% m/m as expected. The core PCE deflator was as expected at 2.0% y/y, headline as expected at 2.3% y/y.

Q2 Canada GDP was 2.9% vs. 3.1% expected, but Q1 was revised from 1.3% to 1.4%. June monthly GDP was flat m/m, +2.4% y/y.

Key Data And Events Ahead:

USA: U of M consumer sentiment (Aug F), Chicago PMI (Aug);

EMU: CPI (Aug A), Unemployment rate (Jul);

UK: GfK consumer confidence (Aug), Lloyds business barometer (Aug), N'wide house price index (Aug);

DEU: Retail sales (Jul);

FRA: HICP (Aug P), PPI (Jul);

ITA: GDP (Q2F), HICP (Aug P), Unemployment rate (Jul P);

JPN: IP (Jul P), Jobless rate (Jul), Housing starts (Jul);

AUS: Private sector credit (Jul);

Comments:

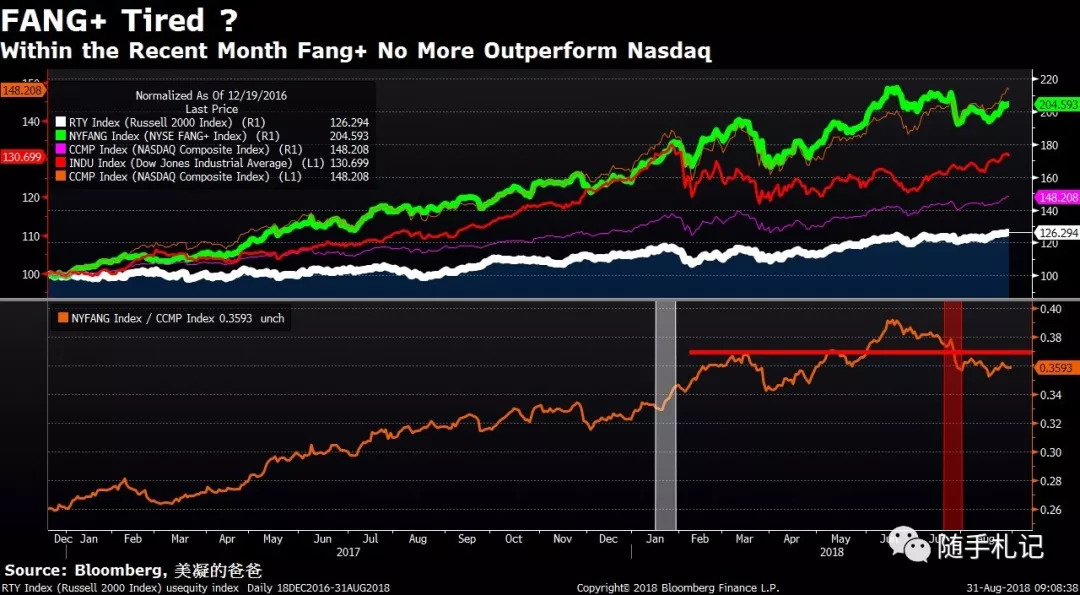

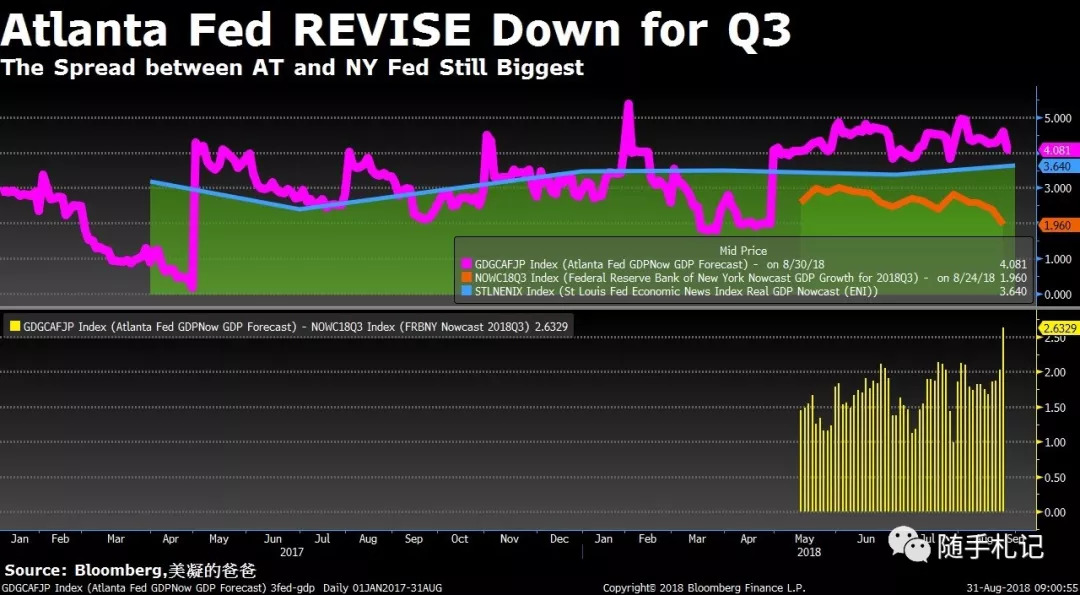

There is one question having puzzled me since this year is how 10yr yield is well kept under 3% with Q2 figure as 4+%? Last night, The Atlanta Fed thinks 2018Q3 GDP growth will be 4.08% and the New York Fed thinks it will be 1.96%. It is always difficult to forecast what will happen over the medium term but this dramatic difference raises some questions about the Fed’s ability to forecast even near-term developments. Since YANGMAs are always those front-runners, they could know we don't . Besides, I kept the checking list as below cautiously, trying to figure out the market pulse especially at the potential entry opportunity.

1、 Italian budget fears

2、US recession around the corner at some point

3、Trade wars

4、Brexit

5、Turkey and the risk of EM contagion

6、ECB delay QE exit

When the autumn finally come, the logic should change somewhat. Due the tax cut/reform, US corporations have been incented significantly to pull forward expected contributions to their pension plans, in some cases perhaps even overfund pensions relative to their target level. But it was said the window for doing this should be closed on September 15th. And with the tension of some EMs(ARS/TRY last night , even till now) bleeding, the sell-off pressure of USTs holds in their reserve to compensate cash liquidity shall continue. We are about to see 10yr yield to rocket in September. 200bn is not a done deal while some others say it may enact in installments. Obviously this kind of propaganda could be categorized as psychological means. But who has the upper hand really?

PS:where does the title of today's notes come from? It could included in the news post as below. What's should be well noted is to rebate tariff , which equals to reverse tariff.

【国务院常务会议决定再推新举措支持实体经济发展】会议指出,对因去产能和调结构等政策性停产停业的企业、社保基金和基本养老保险基金有关投资业务给予税收减免;从今年9月1号到2020年底,对符合条件的小微企业和个体工商户贷款利息收入免征增值税;完善部分产品出口退税率;对境外机构免征三年境内债券市场利息所得税和增值税等。(央广网)

个人微信zhangke8639,欢迎同业交换名片。公众号更新速度快一点儿....排版也好一点点儿....

近期重要时间点:

9月3日,第二批A股纳入MSCI

9月5日,200bn听证会后申诉材料提交截止日

9月13日,ECB议息

9月18日,EU A50会议

9月20日,EU非正式峰会,日本LDP选举

9月26日,FOMC

9月,日本LDP选举,半岛峰会在平壤

9月27日,意大利提交财政预算案

10月16日,EU A50会议

10月25日,ECB议息

10月31日,BOJ议息

11月6日,美国中期选举开始

11月8日,FOMC

11月11日,美国阅兵 (取消了,说是因为预算问题)

12月13日,ECB议息,EU 峰会

12月20日,FOMC

12月22日,改革开放40周年

2019年3月21日,EU 峰会

2019年3月29日,脱欧谈判截止

Appendix:his t overnight

0830 0946 “Ohr told the FBI it (the Fake Dossier) wasn’t true, it was a lie and the FBI was determined to use it anyway to damage Trump and to perpetrate a fraud on the court to spy on the Trump campaign. This is a fraud on the court. The Chief Justice of the U.S. Supreme Court is in......

...charge of the FISA court. He should direct the Presiding Judge, Rosemary Collier, to hold a hearing, haul all of these people from the DOJ & FBI in there, & if she finds there were crimes committed, and there were, there should be a criminal referral by her....” @GreggJarrett

0830 1031 Watch: Kanye West Says Trump Wants to Be the ‘Greatest President’ for Black Americans https://t.co/ECxTzVNZeG via @BreitbartNews

0830 1851 The hatred and extreme bias of me by @CNN has clouded their thinking and made them unable to function. But actually, as I have always said, this has been going on for a long time. Little Jeff Z has done a terrible job, his ratings suck, & AT&T should fire him to save credibility!

0830 1906 What’s going on at @CNN is happening, to different degrees, at other networks - with @NBCNews being the worst. The good news is that Andy Lack(y) is about to be fired(?) for incompetence, and much worse. When Lester Holt got caught fudging my tape on Russia, they were hurt badly!

0830 1916 I just cannot state strongly enough how totally dishonest much of the Media is. Truth doesn’t matter to them, they only have their hatred & agenda. This includes fake books, which come out about me all the time, always anonymous sources, and are pure fiction. Enemy of the People!

0830 1921 The news from the Financial Markets is even better than anticipated. For all of you that have made a fortune in the markets, or seen your 401k’s rise beyond your wildest expectations, more good news is coming!

0830 1946 Ivanka Trump & Jared Kushner had NOTHING to do with the so called “pushing out” of Don McGahn.The Fake News Media has it, purposely,so wrong! They love to portray chaos in the White House when they know that chaos doesn’t exist-just a “smooth running machine” with changing parts!

0830 2001 The only thing James Comey ever got right was when he said that President Trump was not under investigation!

0830 2016 I am very excited about the person who will be taking the place of Don McGahn as White House Councel! I liked Don, but he was NOT responsible for me not firing Bob Mueller or Jeff Sessions. So much Fake Reporting and Fake News!

0830 2056 Wow, Nellie Ohr, Bruce Ohr’s wife, is a Russia expert who is fluent in Russian. She worked for Fusion GPS where she was paid a lot. Collusion! Bruce was a boss at the Department of Justice and is, unbelievably, still there!

0830 2121 The Rigged Russia Witch Hunt did not come into play, even a little bit, with respect to my decision on Don McGahn!

0830 2151 Will be going to Evansville, Indiana, tonight for a big crowd rally with Mike Braun, a very successful businessman who is campaigning to be Indiana’s next U.S. Senator. He is strong on Crime & Borders, the 2nd Amendment, and loves our Military & Vets. Will be a big night!

0831 0102 CNN is working frantically to find their “source.” Look hard because it doesn’t exist. Whatever was left of CNN’s credibility is now gone!

0831 0231 Kevin Stitt ran a great winning campaign against a very tough opponent in Oklahoma. Kevin is a very successful businessman who will be a fantastic Governor. He is strong on Crime & Borders, the 2nd Amendment, & loves our Military & Vets. He has my complete and total Endorsement!

0831 0401 Throwback Thursday! #MAGA https://t.co/8slzITa1l6

Disclaimer:This material was prepared in private name and out of pernaonal hobby,definitely based upon facts and robust analysis with delicate consideration of highly professionality.But with no means to conduct any trade , and before using the contents of this note in any internal or external communication, please ensure you are comfortable and fully aware this could not be sufficient enough as any action base.

Up till now, Subscribers have amounted to 3994 !

$(.IXIC)$, $(.INX)$, $(.DJI)$

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- fishinglo·2018-09-03近期数据需要好好解读啊点赞举报