东英金融:上调361度目标价至6.0港币,维持买入评级

1H23 net profit rose 27.7%, resumes dividend payout

1H23 net profit rose 27.7% yoy to RMB703.6mn. Meanwhile, revenue rose 18.0% yoy to RMB 4.31bn.

361 Degrees restarted dividends since the outbreak of the Covid pandemic.

Interim DPS was HK$0.065, representing dividend payout ratio of 17.6%.

Maintain BUY and lift TP to HK$6.00, representing a PER of 12.0x in FY23E.

1H23 net profit rose 27.7% yoy. The robust growth in net profit was mainly driven by (1) the strong sales growth, (2) a jump in government grant (+4.4x yoy to RMB107mn), (3) a reversal of expected credit losses allowance on trade receivable of RMB40mn as compared to a provision of credit losses allowance of RMB15.3mn in 1H22, and (4) a stringent control of staff costs (+0.4% yoy to RMB306mn). We are impressed by the strong growth in footwear. The segment reported a 28.4% increase in sales. In particular, sales of running shoes and basketball shoes grew by 40%/20% yoy. This is partly driven by its collaboration with professional athletes and basketball stars, and the enhancement of professional sporting functionality in its products.

Kids’ wear and e-commerce shine. For Kids’ wear, the segment’s revenue rose 33.4% on the back of double digit growth in both the sales volume and the average wholesale selling price. In addition to the integration of professional functionality and health technology in kids’ wear, it adds trendy elements through co-branded IP collaboration. Meanwhile, 361º Kids continues to expand the offline sales network (+160 in 1H23 to 2,448). For e-commerce, it reported a 38.0% yoy growth in sales of web exclusive products. Of which the company reported a 43% yoy increase in cumulative sales during the “618” Shopping Festival.

Restart paying dividends. 361 Degrees declared an interim DPS of HK$0.065 in 1H23, the first time since the outbreak of the Covid pandemic. 361 Degrees explained the adoption of a conservative dividend policy due to uncertain retail market sentiment and to reserve cash for potential M&A. It promises a gradual increase in the dividend payout ratio in the future.

Promising outlook. 361 Degrees said retail sales in Jul and Aug posed double- digit growth, which is similar to that in Q1 and Q2. We think 361 Degrees can deliver the revenue growth guidance of 15-20% this year on the back of continuous effort in product upgrades and brand building. The company explores business opportunities in more segments, such as women’s fitness.

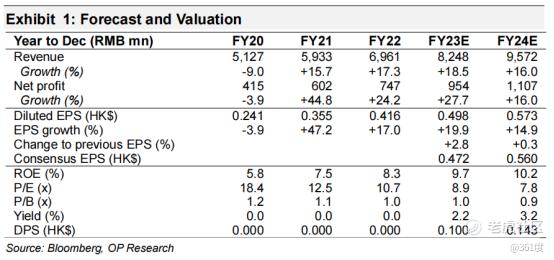

Maintain BUY and lift TP to HK$6.00. This is based on the 12.0x FY23E PER. We slightly tune up our EPS estimate on 361 Degrees by 2.8%/0.3% for FY23E/24E. We think the market has overreacted to a stingy dividend payout in 1H23. The strong retail performance in recent quarters is believed to narrow the price discount toward leading domestic sportswear peers.

Risks: (1) Weakening retail market, (2) brand damage.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。