A blue Chip's down? Will Beijing Universal Studio help Camcast?

In information industry of media, $康卡斯特(CMCSA)$ is such a conservative and traditional company. Although the streaming platforms are in full swing, it is not every company making the right turn as $迪士尼(DIS)$ did, who benefits from Marval IP from time to time.

Comcast, on the other hand, only plays the role of goalkeeper in the media industry.

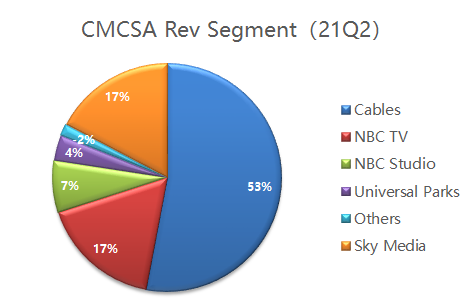

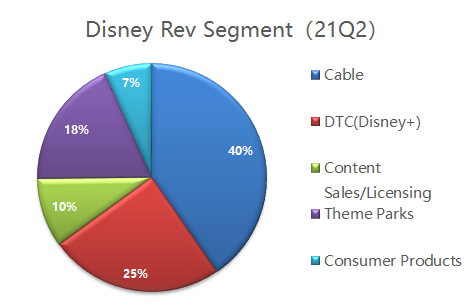

Disney's paid a lot on its streaming platform (Disney+, Hulu), while Comcast still relies heavily on traditional cablenet business. Now, everybody knows streaming is the trend.

Comcast's chief financial officer made a commentary on subscriber additions lagging those in 2019. he also warns about the profits of Theme Parks

For a company with monthly fluctuation of 3%, it is a disarster that stock price dropped by 7% in one day. In CMCSA's history, it occurs with less than 1%.

But who to blame ?

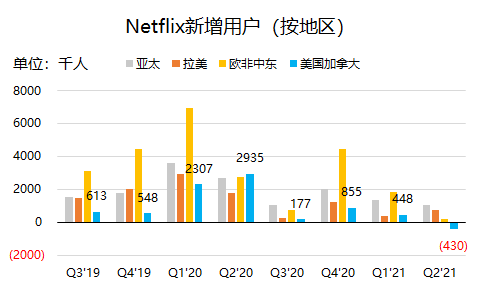

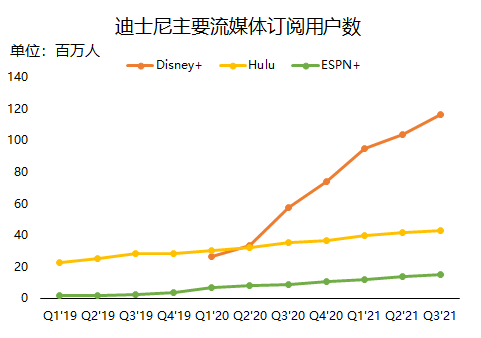

Streaming companies like $Netflix, Inc.(NFLX)$ had a sufferring Q2, but still gained more than 1.5 million new subscribers, while the number flied to 116 million in Disney+.

Comcast's extremely traditionary, seems wasting the asset of Universal Studios either.

Theme Park is one of the important assets of Universal, and the newly opened Beijing Park also includes almost all popular IPs

However, theme parks only contributes less than 4% of Comcast's total revenue.

While Disneyland collected more than 18% of its revenue.

So, How profitable is it to open a theme park in China?

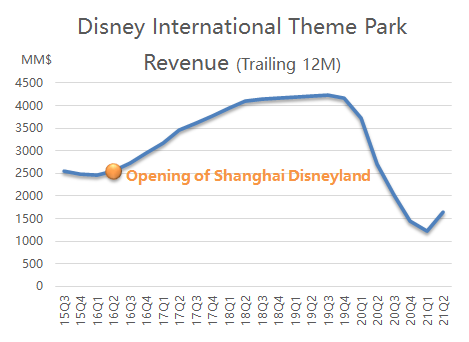

I have summarized the changes of Walt Disney's income of its international theme park business, especially after the opening of Shanghai Disneyland in 2016. Q2.

In terms of revenue for trailing 12 months, the revenue of international theme parks of 2015Q4 was about 2.5 billion US dollars, but rose to 4.1 billion US dollars in 2019Q4 just before the pandemic, with CAGR of 14% . The whole company's revenue CAGR is only 6% in the same period.

That is to say, the growth brought by the opening of Walt Disney is more than twice the growth of the company's revenue!

Enthusiastic Chinese consumers, with the spirit of entertainment, almost contributed all the overseas growth of Walt Disney theme parks.

According to Beijing Universal Studio's price, I bet the business will be properly pumping CMCSA's earnings, as long as no pandamic threatening in China.

So, CMCSA's concerning about theme park profits could be largely alleviated by the opening of Universal Studios in Beijing. However, the lack of streaming business will be constantly affects it's business.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- Snickahsnick·2021-09-16The univeral theme park in Beijing is pretty fun, harry potter zone is particulrly amazing, Other zones are good but sometimes lack detail i would have expected gIven what I have seen at parks abroad4举报