Hedge Funds Aren’t Crazy About Pinduoduo Inc. (PDD) Anymore

Do Hedge Funds Think PDD Is A Good Stock To Buy Now?

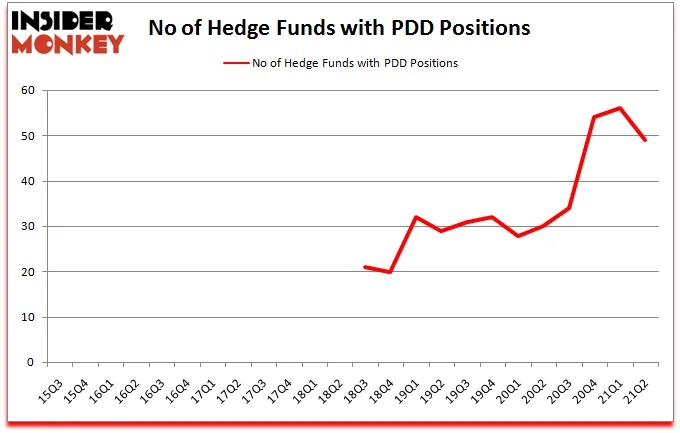

At second quarter's end, a total of 49 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -13% from the previous quarter. On the other hand, there were a total of 30 hedge funds with a bullish position in PDD a year ago. So, let's review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds,Tiger Global Management LLCheld the most valuable stake in Pinduoduo Inc. (NASDAQ:PDD), which was worth $1785 million at the end of the second quarter. On the second spot was Hillhouse Capital Management which amassed $876.7 million worth of shares. Fisher Asset Management, SCGE Management, and Tairen Capital were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Tairen Capital allocated the biggest weight to Pinduoduo Inc. (NASDAQ:PDD), around 42.85% of its 13F portfolio.Panview Capitalis also relatively very bullish on the stock, earmarking 18.45 percent of its 13F equity portfolio to PDD.

Due to the fact that Pinduoduo Inc. (NASDAQ:PDD) has faced a decline in interest from the entirety of the hedge funds we track, it's safe to say that there exists a select few fund managers that decided to sell off their positions entirely in the second quarter. It's worth mentioning that Alex Sacerdote'sWhale Rock Capital Managementdumped the largest position of the "upper crust" of funds tracked by Insider Monkey, comprising about $93.8 million in stock. David Costen Haley's fund,HBK Investments, also dumped its stock, about $63 million worth. These moves are intriguing to say the least, as total hedge fund interest dropped by 7 funds in the second quarter.

Let's now review hedge fund activity in other stocks - not necessarily in the same industry as Pinduoduo Inc. (NASDAQ:PDD) but similarly valued. These stocks are AstraZeneca plc (NASDAQ:AZN), Philip Morris International Inc. (NYSE:PM), Royal Dutch Shell plc (NYSE:RDS), Unilever PLC (NYSE:UL), Honeywell International Inc. (NASDAQ:HON), Linde plc (NYSE:LIN), and Bristol Myers Squibb Company (NYSE:BMY). All of these stocks' market caps are closest to PDD's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position AZN,37,2772286,3 PM,46,5973614,-2 RDS,38,2444791,2 UL,19,844216,-1 HON,57,1834599,1 LIN,55,5920316,12 BMY,73,5202516,-8 Average,46.4,3570334,1 [/table]

View table hereif you experience formatting issues.

As you can see these stocks had an average of 46.4 hedge funds with bullish positions and the average amount invested in these stocks was $3570 million. That figure was $5277 million in PDD's case. Bristol Myers Squibb Company (NYSE:BMY) is the most popular stock in this table. On the other hand Unilever PLC (NYSE:UL) is the least popular one with only 19 bullish hedge fund positions. Pinduoduo Inc. (NASDAQ:PDD) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for PDD is 52. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we'd rather spend our time researching stocks that hedge funds are piling on. Our calculations showed thattop 5 most popular stocksamong hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 22.9% in 2021 through October 1st and beat the market again by 5.6 percentage points. Unfortunately PDD wasn't nearly as popular as these 5 stocks and hedge funds that were betting on PDD were disappointed as the stock returned -30.6% since the end of June (through 10/1) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out thetop 5 most popular stocksamong hedge funds as many of these stocks already outperformed the market since 2019.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。