What is the greatest investment on earth?

How to be a millionaire in the stock market?

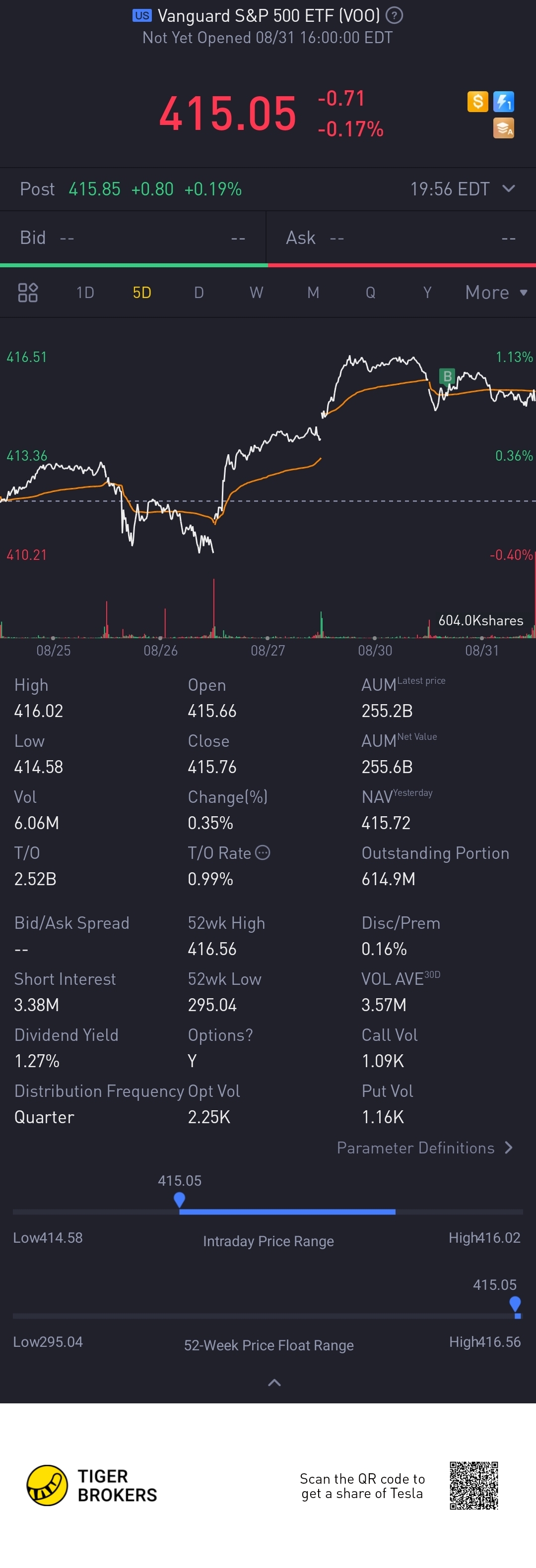

The answer: $Vanguard S&P 500 ETF(VOO)$

Key Takeaways:

1. S&P500 Index has returned an average of 11% since its inception in 1920. (100 years).

2. Only a handful of investors have beaten the market over the long run. Even Warren Buffet, the God himself, has been lagging the index in the past decade. It is extremely hard to ever beat the index.

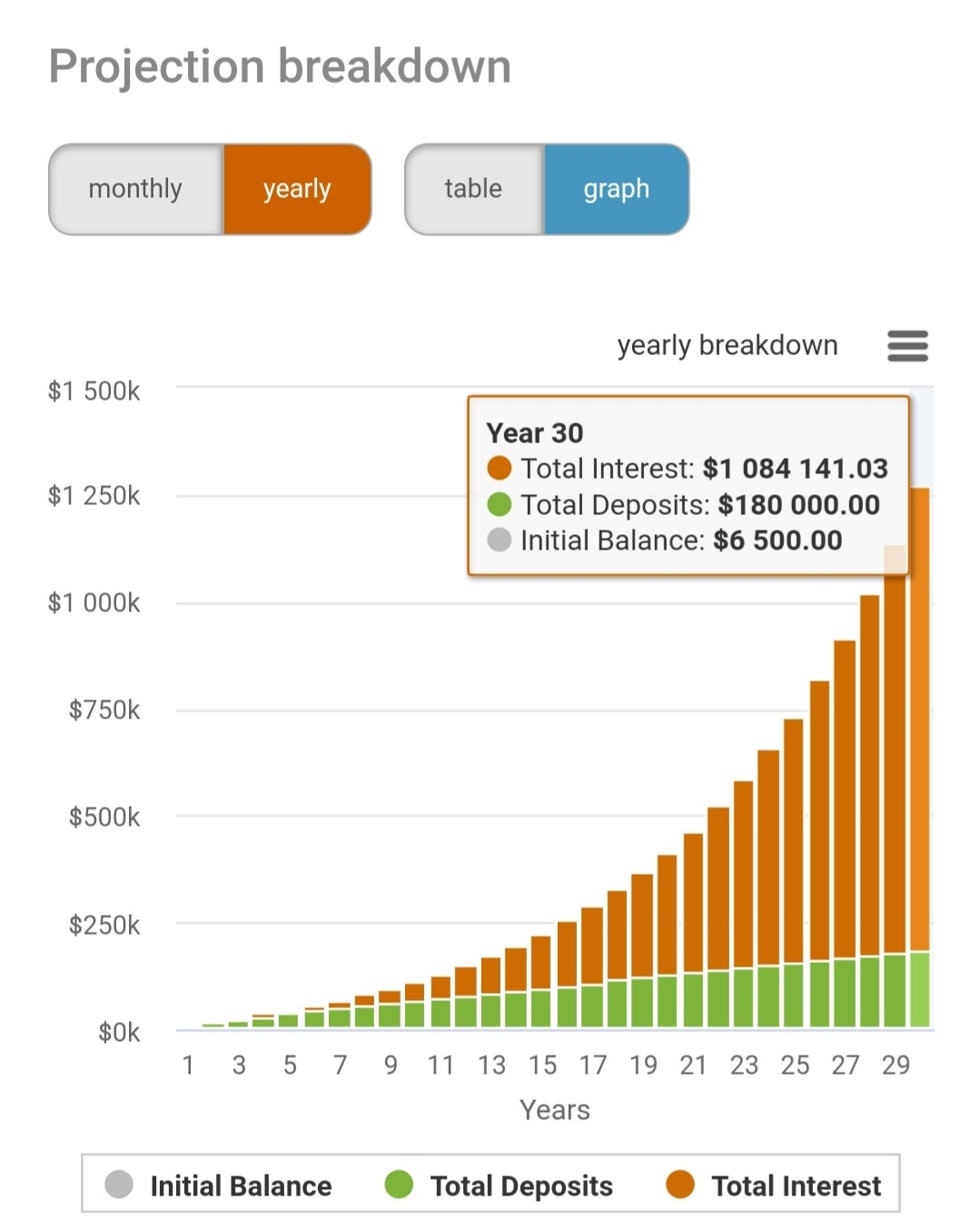

3. With a constant investment of just 500 a month for 30 years, you are able to make $ 1.26 million due to the compound interest. And the best part is, you would've only invested $180K, and the interest earned is $1.084 Million

4. The S&P500 has had a correction (10% Decline) almost once every year on average, a bear market (20% decline) every 3.5 years on average. But each time it declines, it is the best to buy. The market has always gone all the way up in the long run. As Warren Buffet always says: Be greedy when others are fearful.

4. The reason the index always goes up, is becaude the 500 companies within the index are top companies such as Apple, Microsoft and Facebook. These top companies are always increasing revenue and share price is always increasing.

5. Now that the market is at All-Time-High. Should you invest? Absolutely! Time in the market beats timing the market!

My comments:

●Make the S&P500 Index fund the core of your portfolio. It is the most low risk and safest bet you could ever make.

● Wanna be a millionaire easily? Just invest into the S&P500 and let compound interest does the job for you. Let money work for you.

●Among all S&P500 Index Funds, VOO is the best as it has the lowest expense ratio.

●Own a peice of America today! Make sure to buy the S&P500! Investors win, savers lose!

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 得失缘·2021-09-01沃伦·巴菲特常说的:当别人恐惧时,要贪婪。 很有道理,屡试不爽!6举报

- 不离亦不弃·2021-09-01如果可以重来,只有一次机会,我一定会在疫情3月份标普大跌的时候买入看涨期权,因为什么都会变,但是标普创新高不会变,它就是这样波浪形的不停前进。6举报

- 搞钱树·2021-09-01早期沃伦·巴菲特肯定是跑过这个指数的, 最近的十年里也一直落后于该指数是科学的,资产规模大了,没办法。2举报

- 老夫追涨杀跌·2021-09-01哟西,标准普尔500指数自1920年创立以来,平均回报率为11%。100年费复利?2举报

- 宝宝金水_·2021-09-01良心推荐呀,良心之作,感觉还是很靠谱的,回头买点。2举报

- 哎呀呀小伙子·2021-09-01要真是每一年百分之十多的复利,那就厉害了。2举报

- 奶粉侠·2021-09-01跑赢大盘,买后安稳税后收入,不错的推荐!2举报

- 赢在中国V·2021-09-01标准普尔500指数基金作为你投资组合的核心。这是你所能做的风险最低、最安全的赌注。真的吗,怎么买?1举报

- 短线机遇·2021-09-01现在大盘涨的真凶,太高了,我都怕了,生怕哪天来个暴跌1举报

- 沙漠追光大海逐风·2021-09-01要是巴菲特也买这个会是个什么情况?不敢想呀。2举报

- kgb·2021-09-11什么都吃不准的时候,就投指数吧,机会是跌出来的,每次回调就是进场的好机会,正常的回调才能稳定地上涨1举报

- 风x云·2021-09-13关键是需要十年以上的时间,你有那个耐心吗?点赞举报

- PeaceMaker·2021-09-29nice analysis!!点赞举报

- Eric1128·2021-10-07👍1举报

- 可可西里的乐乐·2021-09-14阅点赞举报

- 取个昵称太南了·2021-09-13阅点赞举报

- 赵居远·2021-09-13好1举报

- Rainycui·2021-09-13已阅点赞举报

- 聪明的孩子·2021-09-12Y点赞举报

- 沃伦邹菲特·2021-09-1211举报