Netflix Raises Price Hike Again Right Before Earnings

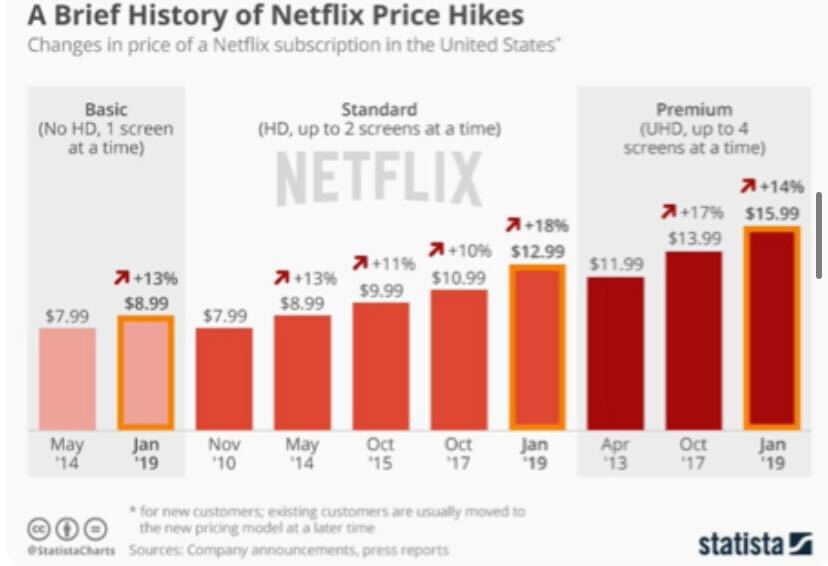

Following up on my previous article on Netflix, the company announces a significant news of a price hike yet again to as much as $20 a month in the US region where they have most control over with.

Barely just a week before earnings, Netflix is doing their regular habits of hiking prices early to the consumers every two years or so, citing inflation as one of their main reasons for doing so.

The service’s top tier is now 42% more expensive than it was in late 2018 and a significant increase bump to the topline numbers assuming subscription numbers remain constant.

They have been very successful in the past price hikes which led them to where they are today but with competitors sizing up, we may not know if subscription numbers will drop or fall off to these recent changes. The company has been reducing their prices in regions where it struggles like India, so this move may make sense given the US has just recently announced a record breaking inflation month earlier this week.

Wall Street appears happy as the stock price rose 1.25% on the announcement of this news, closing green last night.

The stock price has been on a jitters since the start of the year, trending along the weakness in all other tech stocks with a rotation play back to value.

Netflix’s revenue will get an immediate term lift with this news which will increase their topline by more than $1b annually but we’ll have to see if growth stalls because of this.

While they have been successful with doing so in the last few years, a good reminder also for for a case study of cable who has last market share over the past decade by making itself price expensive that forces people to re-evaluate the need for the subscription.

With competitors sizing up, there are now plenty of alternatives to online streaming today with the likes of Amazon Prime Video, Disney+, Apple TV and many more.

In terms of technical chart, the stock price has hit my short term target of around $514 on the weekly EMA100 last night which I have taken a part of profits from my short/buy puts position. I’ll leave the other half in anticipation for the earnings announcement next week.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- RudolfKennedy·2022-01-16Netflix,Inc.有太多独家溢价内容,比如去年的鱿鱼游戏。我看好这家公司,价格上涨意味着业绩增长。如果用户数量保持稳定增长,Netflix,Inc.将实现戴维斯双杀1举报

- MalcolmEmily·2022-01-17我认为价格上涨是个好消息,这意味着他们有信心对抗竞争,订阅量很大,加上更多的收入。请记住,他们在必要的时候降低了印度的价格。点赞举报

- maroketo·2022-01-16提高Netflix,Inc.订阅费价格将是对用户忠诚度的考验,也是美国运通通胀的缩影。除非能够继续推出独家、高质量的视频内容,否则Netflix,Inc.订户数量将会下降。1举报

- AmosBellamy·2022-01-17很多熊潜伏在这里。从我目前所能观察到的情况来看,在过去的一年里,每次我们看到下降到500点时,它都回到了550点左右。点赞举报

- BenedictMill·2022-01-17This board is bountiful with uneducated bears please do your own research and DD. Most of the time you will find better information when conducting your own search.点赞举报

- AprilBridges·2022-01-17NFLX一直处于卖压之下,已突破支撑区域下方。该股一直处于超卖区间,可能会出现短暂的缓解反弹。点赞举报

- EdithHardy·2022-01-17谢谢分享!他们从不固步自封点赞举报

- waipoin·2022-01-16Netflix,Inc.主要依赖北美国运通和欧洲市场。涨价是对它的考验。1举报

- RonaldNixon·2022-01-16Every subscription fee increase is a test for Netflix.1举报

- qingg123·2022-01-16我相信Netflix,Inc.能通过这次考验。1举报