dLocal($DLO)研究笔记

作者:Manta

报告时间:2021年1月3日

投资模型:长期核心价值

研究笔记概要

1. 巨大市场规模&低渗透

新兴市场正在经历着由信用卡支付替代现金支付,线下购物转到线上电商的巨变。2020年整个新兴市场的电商TPV在1.3万亿美金左右,预计2025年会达到3.3万亿美金。在已经进入的29个地区中,dLocal跨境电商TAM的渗透率仅为2%,拉美地区的跨境电商TAM渗透率为4%。

2. 竞争格局

dLocal所处在一个竞争非常激烈的赛道,面对的竞争有

(1)当地银行或者金融机构(更多资源,更熟悉当地的合规);

(2)相对成熟的支付赛道的龙头玩家(如Stripe,Adyen);

(3)成长型初创公司(如Ebanx)。

面对这三者的竞争,dLocal覆盖更广的国家地区,更专注于为新兴市场提供更垂直的解决方案。dLocal的护城河并非牢不可摧,长期我们可以从市占率和take rate的变化来判断,dLocal是否能达到支付软件的规模效应。

公司介绍

dLocal(股票代码: $DLO)是2016年成立于乌拉圭的数字金融公司,主要提供新兴市场的基于云的跨境支付服务,可以处理超过600种不同的支付方式。

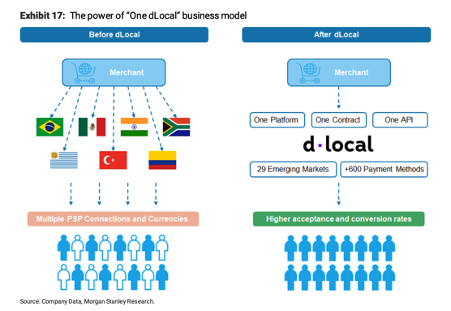

dLocal的服务优势主要在于one d-local一站式,即一个API接口,一个平台,和一次对接,能让跨国公司通过dLocal直接在不同的国家进行收付款和结算。省去了跨境商家进入这些新兴国家会面临的外汇结算,税收,合规还有支付习惯不同的问题。降本增效,提高了支付转化成功率。

dLocal的一站式API服务

01 三刀:市场空间

根据调查显示,新兴市场2020年到2025年GDP的复合年增长率可以达到4.9%,几乎是发达国家的3倍左右,同时这些国家的银行服务覆盖的人群比例极低,几乎70%以上人口没有银行卡。比如在巴西,受到当地政策的影响,当地居民更喜欢用现金/本地的数字钱包或者直接转账进行付款。这些年随着新兴市场互联网渗透率变高,金融科技公司在拉美等地区的迅速发展,新兴市场正在经历着由信用卡支付替代现金支付,线下购物转到线上电商的巨变。

1. 新兴市场万亿级市场空间

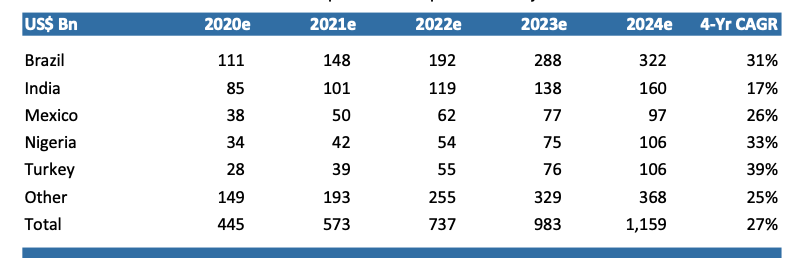

新兴市场的电商交易支付量增速预期

上图显示了未来三年几个新兴市场国家的电商交易支付量的增速预期,2020年整个新兴市场的电商TPV在1.3万亿美金左右,预计2025年会达到3.3万亿美金。巴西电商交易支付量未来三年的年复合增长率可以达到31%,尼日利亚可以达到33%。尽管这些国家电子商务增长率非常高,跨境商家在这些地区开展业务的时候却面临着很多挑战,比如外汇汇率,政府监管合规,税收等等。种种复杂的本地化程序拖慢了商家的发展,在1.3万亿电商TPV中,跨境交易仅占了6%。

2. 跨国公司的快速扩张需求

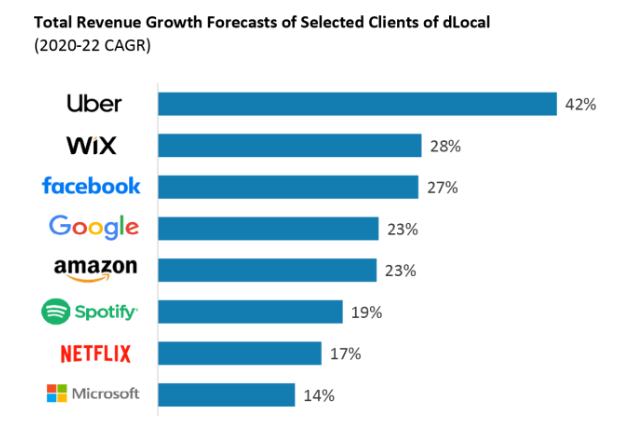

随着新兴市场的电商化,线上打车化,流媒体化等大的趋势,欧洲和美国的公司也试图将在发达国家已有的成功产品打入这些市场,根据Morgan Stanley的预测,Facebook, Google还有Uber等公司未来两年在新兴市场国家的收入增速在30%左右。

dLocal顾客在新兴市场的增速预期(来源:Morgan Stanley)

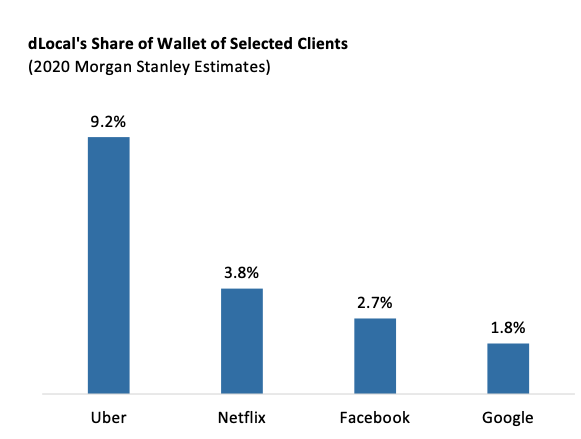

当巨大的市场机会遇上了跨境电商快速扩张的需求,就给dLocal这类提供跨境支付解决方案的公司造就了机会。跨境电子商务交易占dLocal处理的交易量的三分之二。dLocal帮商家省去了进入新兴国家会面临的各种琐碎问题,减少了运营成本,提升了经营效率,提高了支付成功转化率。上文提到的巨头,如Facebook, Uber等等,他们都是dLocal的顾客,dLocal 处理这些商家的跨境支付,相当于乘着这些行业和巨头增长的东风。从dLocal远高于同行的净收入留存率(NRR)也可以看出来(2021 Q3NRR为185%),dLocal客户的留存和满意度都很高。而dLocal 在已有的合作商家中的钱包份额(share of wallet)仅为3-5%,还有很大的发展空间。

dLocal在客户中的钱包份额 (来源:Morgan Stanley)

3. TAM渗透率低

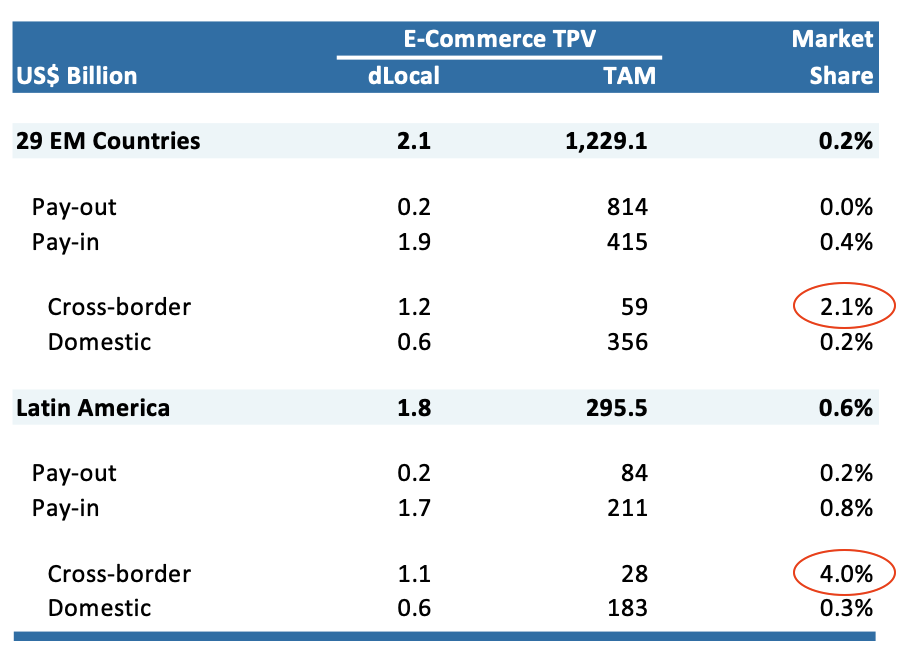

在已经进入的29个地区中,dLocal跨境电商TAM的渗透率仅为2%,拉美地区的跨境电商TAM渗透率为4%。

dLocal 在电商市场的TPV 渗透率

02 三刀:竞争格局

dLocal 所处在一个竞争非常激烈的赛道,目前面对的竞争主要来自以下三个方面。

1. 当地银行或者金融机构

由于dLocal同时在几十个国家和地区经营,会面临不同地区的本地收单机构和银行的竞争。当地金融机构有更多资源,并且更熟悉当地的合规,在dLocal每次进入一个新的国家的时候,本地金融机构的竞争都会是一个很大的挑战。但同时,由于dLocal的一站式服务的方便性和与已有客户建立的良好的合作关系,在跨国商户进入新的地区时,也会先考虑使用dLocal的服务。

2. 相对成熟的支付赛道的龙头玩家

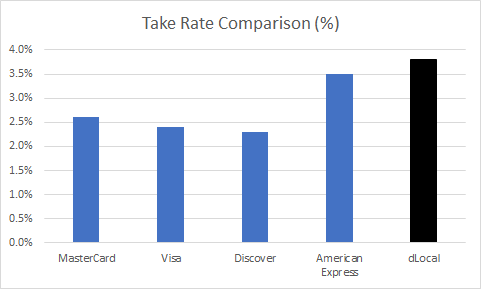

如Stripe,Adyen等。Adyen 主要是在墨西哥和巴西与dlocal竞争,其他小国家Adyen并没有进入, Adyen主营的是CNP(card-not-present)既无卡支付,take rate 0.23%;相比Adyen,dLocal提供与本地支付方式对接的解决方案,dLocal 业务利润很大程度上来自大企业的跨国外汇收款,所以dLocal的take rate 更高,接近4%。dLocal提供的解决方案会更加垂直,更偏重新兴市场。以后Stripe和Adyen是否会开始为新兴市场提供类似的服务,也值得继续关注。

3. 成长型初创公司

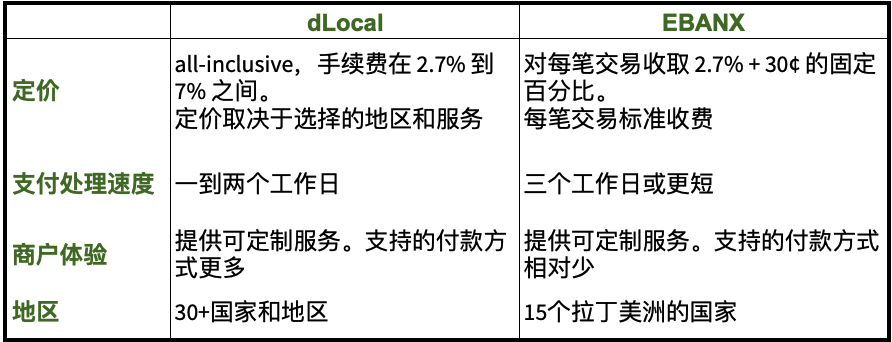

Ebanx 成立于2012年,是一家巴西的金融科技公司,提供端到端的支付解决方案。它的业务和dLocal有很大的重叠部分,顾客包括了Spotify,Uber,Airbnb,Shoopee,WordPress, Courera等等。根据消息称,Ebanx最近也开始公开募股,可能会在2022年上市。由于Ebanx还未上市,我们无法将Ebanx和dLocal做一个非常详细的数据对比,以下是简单的功能和价格对比。dLocal服务的国家更多,支付处理速度更快,支持的付款方式更多,但是Ebanx的交易手续费更标准化。

dLocal vs EBANX

dLocal的竞争优势

一站式:一个api解决所有支付问题;

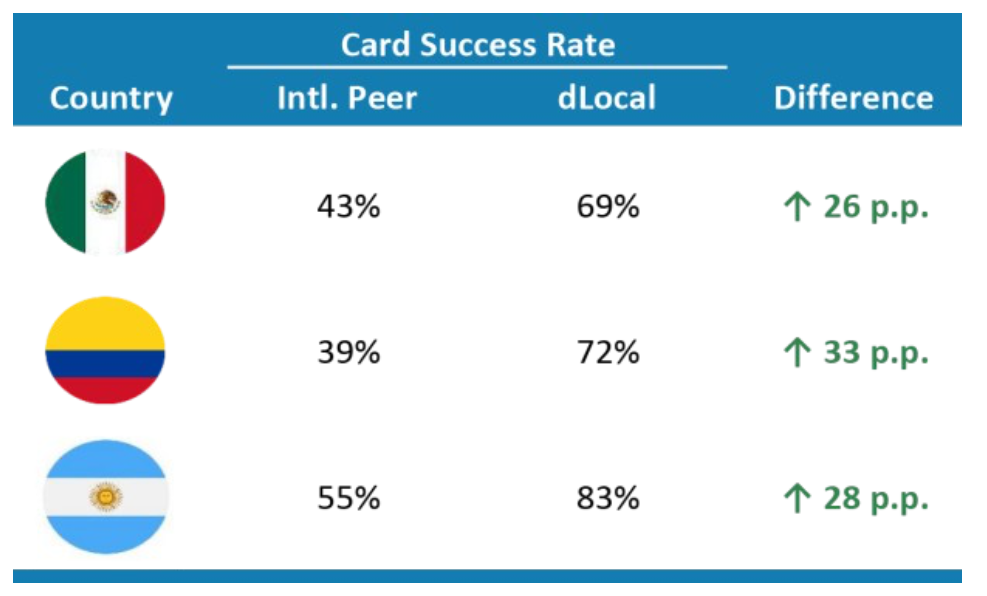

智能导流:支付的交互流畅,交易成功率更高;

支付软件的规模效应:随着渗透率升高,会吸引越多的商户使用dLocal的产品(收入上升),同时dLocal会越有议价权(take rate 和毛利上升),根据目前dLocal的NRR 和 Take Rate来看,的确都高于同行。但是,随着更加激烈的竞争,如果dLocal提供的服务并没有明显优于竞品,take rate 和市占率可能会有所下降,可以继续追踪这两项数据来判断dLocal的行业地位。

dLocal交易成功率高于同行竞品

03 商业模式和财务状况

1. 商业模式

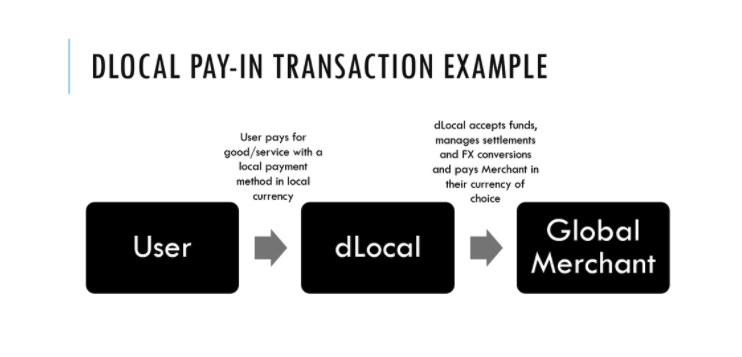

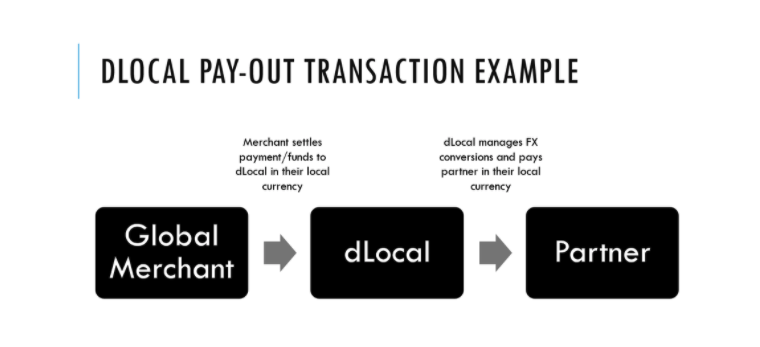

dLocal的业务主要分两部分,Pay-in部分和Pay-out部分。目前的收入主要来源于Pay-in 部分。

Pay-in:dLocal协助跨国商户接受来自新兴国家的付款,支持不同地区的不同支付方式。根据交易金额收取交易手续费+外汇交易手续费。

Pay-in 流程

举例:在巴西,现金支付的形式占据了19%的线上消费,消费者可以通过票据凭证在线下的指定网点,比如ATM,网上银行,邮局,超市等等完成线上服务或者商品的付款,而这些付款方式都是通过dLocal提供的API,以更快的速度更高的转化率进入到dLocal合作的跨境商户的账户里。

巴西消费者看到的付款页面

Pay-out:商户如果需要和本地合作伙伴进行付款,也可以通过dLocal 提供的Pay-out服务。dLocal和遍布新兴市场的 200 多家银行都有合作关系,从而帮助商户进行付款,处理外汇兑换等相关的业务。

Pay-out 流程

2. TPV (Total Payment Volume) 分布

所在的地区:89%来自拉丁美洲,其中最大的占比的分别是巴西29%,阿根廷12%;

收入的来源:2/3来自跨境转账;1/3来自境内转账。境外大商户更愿意使用dlocal的一站式服务,而境内的中小商户却更愿意选择dLocal以外的价格更低的支付系统,因为手续费更低但是没有附加服务。

3. 收入增速 &财务状况

- 2019 $55 M

- 2020 $104 M yoy +88.36%

- 2021 $238 M yoy +128.9%

- 2022E $400 M yoy +68% (华尔街预期)

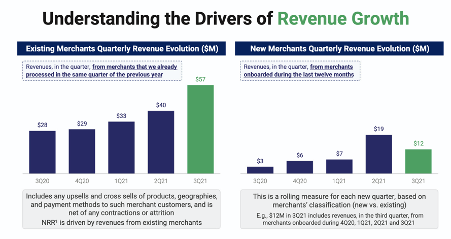

dLocal财报亮眼之处在于远高于同行的净收入留存率,即NRR (Net Revenue Retention) 。2021 Q3 NRR为185%,(vs Q2 196%),2020年大约为 159%,2019年为151%。

但是相对于已有用户的留存收入的增长,Q3 新用户贡献的收入QOQ呈现负增长(见下图)。

左:留存商户的收入增长 vs 右:新客户的收入增长

由于dLocal的业务涉及到换汇,相较于同行业的公司,dLocal的take rate 更高,在4%左右。如果我们将dLocal 和传统信用卡公司的take rate进行比较时,dLocal 显然从 TPV中获取了更高的价值。

不同公司 take rate 对比

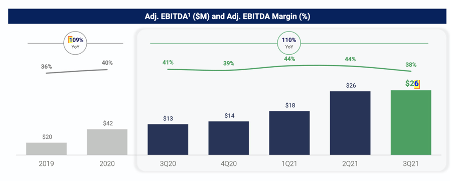

dLocal的EBITDA Margin Q2 2021为 44%,Q3为 38%。

dLocal Adj. EBITDA 同比增长110%

4. 估值

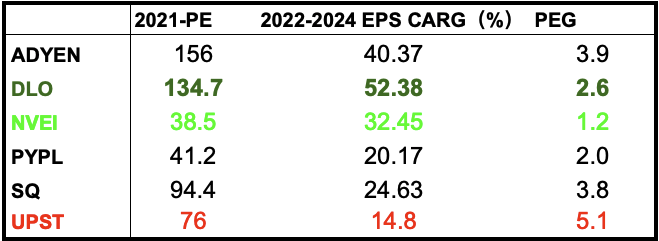

我们将dLocal和市场上的其他几家数字金融公司的PE和未来三年的EPS年复合增长率放在一起,做了一个PEG的对比,dLocal的估值处于中游水平。

dLocal 估值对比

04 Q3财报股价回调的原因

1. 利润率下降,长期收入净留存率指引下降

EBITDA Margin环比下降,上季度44% ,这季度 38%;take rate环比下降, 上一季度4.1% 这一季度 3.8%。公司对NRR预期下降,在接下来的12-18个月会维持在150%-160%,长期会下降到120%-130%。管理层没有给Q4 Guidance,态度上也并未表现得非常bullish,反而很多sandbagging;

2. 新兴市场宏观影响

宏观经济的影响,巴西收入占dLocal总收入的30%,阿根廷占12%,这两个地区通胀指数都非常高,最近服务于拉美地区上市公司的股价回调也反映出市场对新兴市场经济的担忧。

05 万木评级

万木三评体系

评星 ( 行业地位及竞争力)

4星:dLocal (跨境支付)

评级(三年后预估市值比现市值涨幅)

A级:3倍以上

评风险(任何因素可能导致半年内的股价下跌)

红色:30 % 以内

投资风险

1. 宏观风险:巴西通胀走高,市场对新兴市场的经济的担忧;

2. 政策风险:支持多种支付方式的风控,进入新的国家和地区需要获得牌照,会面临很多不确定性;

3. 对大客户依赖较强:收入的64%来自前十大客户,跨国企业在拉美的增长很大程度上决定了dlocal的收入的增长。

-全文完-

作者免责说明:

本报告的信息来源于已公开的资料,本人对该等信息的准确性、完整性或可靠性不作任何保证。本报告所载的资料、意见及推测仅反映本人于发布本报告当日的判断,本报告所指的证券或投资标的的价格、价值及投资收入可升可跌。过往表现不应作为日后的表现依据。在不同时期,本人可发出与本报告所载资料、意见及推测不一致的报告。本人不保证本报告所含信息保持在最新状态。同时,本人对本报告所含信息可在不发出通知的情形下做出修改,投资者应当自行关注相应的更新或修改。在任何情况下,本报告中的信息或所表述的意见均不构成对任何人的投资建议。在任何情况下,本人不承诺投资者一定获利,不与投资者分享投资收益,也不对任何人因使用本报告中的任何内容所引致的任何损失负任何责任。投资者务必注意,其据此做出的任何投资决策与本人无关。市场有风险,投资需谨慎。投资者不应将本报告为作出投资决策的惟一参考因素,亦不应认为本报告可以取代自己的判断。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。