A $2.2 Trillion Asset Manager's Failed Big Bet on Russia.

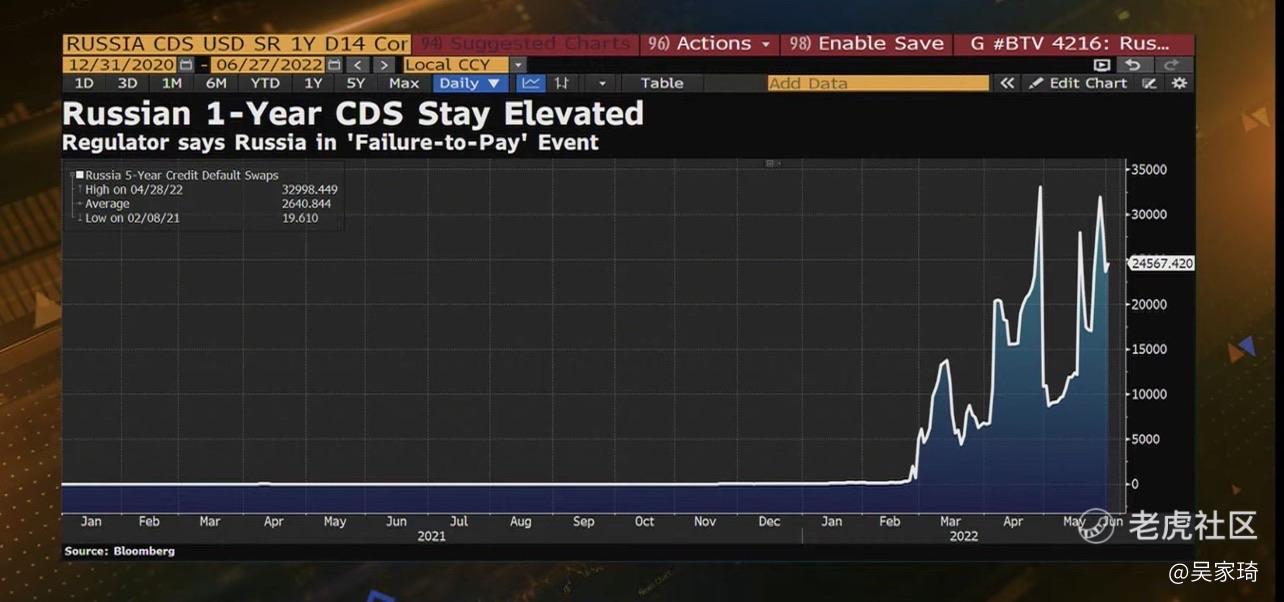

It was reported on the 10th of March that asset manager PIMCO had $1bn in credit default swap exposure (CDS) - essentially betting that Russia will not default. Not only that, they doubled down and also had $1.5bn in Russian sovereign debt exposure.

What does that mean?

Going long a CDS product provides investors with insurance against default. Whereas selling a CDS (as PIMCO did) is effectively them going long credit risk and would have allowed them to collect a premium if Russia didn't default.

Did it pay off?

No, Pimco lost a reported $400m on the trade. Russia defaulted last night on its sovereign debt for the first since 1998. This loss represents one-third of a percent of the total $124bn value of Pimco’s Income Fund where the EM bets were concentrated.

Painful.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

[财迷]