新加坡房地产投资信托基金每月更新(12月5日至2021年12月)

Technical Analysis of FTSE ST REIT Index (FSTAS351020)

FTSE ST Real Estate Investment Trusts (FTSE ST REIT Index) decreased slightly from 872.79 to 843.73 (-3.33%) compared to thelast month update. Currently the Singapore REIT index is still trading with a range between 816 and 890.

- As for now, Short term direction: Down.

- Medium direction: Sideways.

- Immediate Support at 835, followed by 816.

- Immediate Resistance at 890.

Previous chart on FTSE ST REIT index can be found in the last post:Singapore REIT Fundamental Comparison Tableon November 7, 2021.

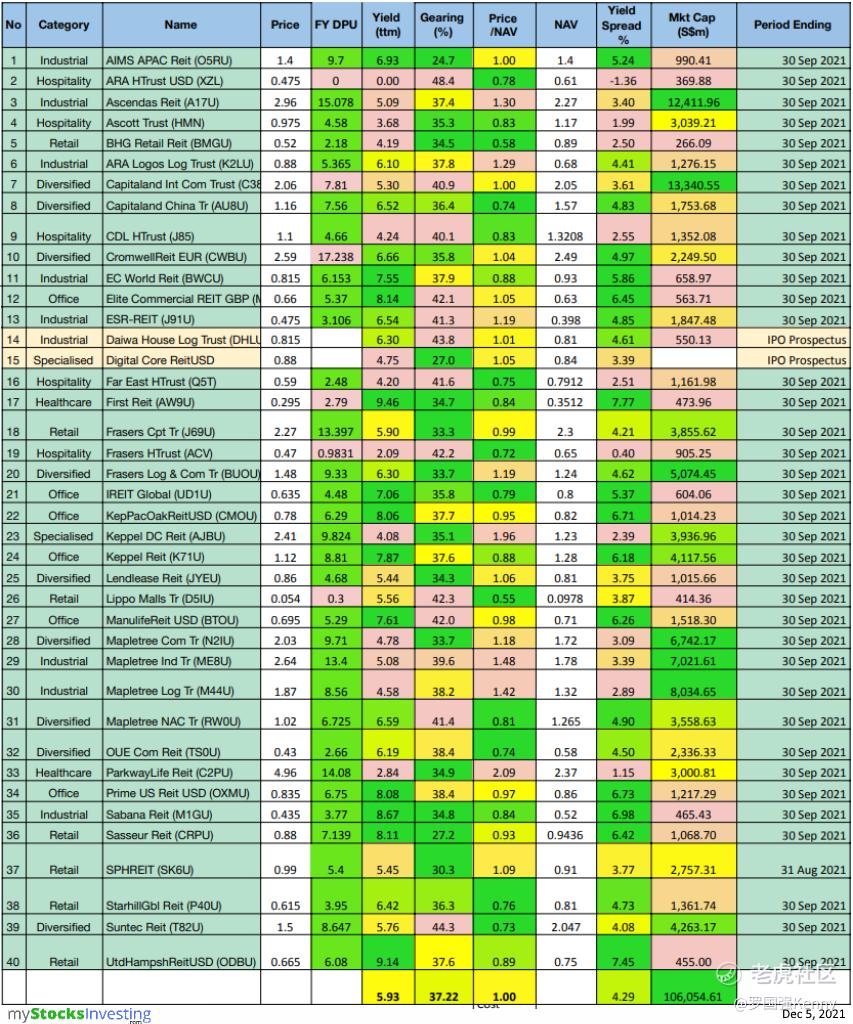

Fundamental Analysis of 40 Singapore REITs

The following is the compilation of 40 Singapore REITs with colour coding of the Distribution Yield, Gearing Ratio and Price to NAV Ratio.

- Note 1: The Financial Ratio are based on past data and there are lagging indicators.

- Note 2: This REIT table takes into account the dividend cuts due to the COVID-19 outbreak. Yield is calculated trailing twelve months (ttm), therefore REITs with delayed payouts might have lower displayed yields, thus yield displayed might be lower.

- Note 3: All REITshighlighted in greenhave been updated with the latest Q3 2021 business updates/earnings.

- Note 4: 2 REITs submitted their IPOs in November 2021. REITshighlighted in yellowhave values extracted from IPO Prospectuses. Daiwa House Logistics Trust is now trading. Digital Core REIT’s price is based on offer price, and in USD.

(Source: https://stocks.cafe/kenny/advanced)

Price/NAV decreased to 1.00

- Decreased from 1.03 in November 2021.

- Singapore Overall REIT sector is at fair value now.

- Take note that NAV is adjusted downward for most REITs due to drop in rental income during the pandemic (Property valuation is done using DCF model or comparative model)

TTM Distribution Yield increasedto 5.93%

- Increased from 5.83% in October 2021.

- 11 of 40 (27.5%) Singapore REITs have distribution yields of above 7%.

- Do take note that these yield numbers are based on current prices taking into account the delayed distribution/dividend cuts due to COVID-19, and post circuit breaker recovery.

Gearing Ratio decreased to 37.22%

- Decreased from 37.31% in November 2021.

- Gearing Ratios are updated quarterly. This takes into account the recent Q3 2021 business updates.

- In general, Singapore REITs sector gearing ratio is healthy but increased due to the reduction of the valuation of portfolios and an increase in borrowing due to Covid-19.

Most overvalued REITs (based on Price/NAV)

- Parkway Life REIT (Price/NAV = 2.09)

- Keppel DC REIT (Price/NAV = 1.96)

- Mapletree Industrial Trust (Price/NAV = 1.48)

- Mapletree Logistics Trust (Price/NAV = 1.42)

- Ascendas REIT (Price/NAV = 1.30)

- ARA LOGOS Logistics Trust (Price/NAV = 1.29)

Most undervalued REITs (based on Price/NAV)

- Lippo Malls Indonesia Retail Trust (Price/NAV = 0.55)

- BHG Retail REIT (Price/NAV = 0.58)

- Frasers Hospitality Trust (Price/NAV = 0.72)

- Suntec REIT (Price/NAV = 0.73)

- Capitaland China Trust (Price/NAV = 0.74)

- OUE Commercial REIT (Price/NAV = 0.74)

Highest Distribution Yield REITs (ttm)

- First REIT (9.46%)

- United Hampshire REIT (9.14%)

- Sabana REIT (8.67%)

- Elite Commercial REIT (8.14%)

- Sasseur REIT (8.11%)

- Prime US REIT (8.08%)

- Reminder that these yield numbers are based on current prices taking into account delayed distribution/dividend cuts due to COVID-19.

- Some REITs opted for semi-annual reporting and thus no quarterly DPU was announced.

Highest Gearing Ratio REITs

- ARA Hospitality Trust (48.4%)

- Suntec REIT (44.3%)

- Daiwa House Logistics Trust (43.8%)

- Lippo Malls Retail Trust (42.3%)

- Frasers Hospitality Trust (42.2%)

- Elite Commercial REIT (42.1%)

Total Singapore REIT Market Capitalisation decreased by 2.84%to S$106.1 Billion.

- Decreased from S$109.2 Billion in October 2021.

Biggest Market Capitalisation REITs:

- Capitaland Integrated Commercial Trust ($13.34B)

- Ascendas REIT ($12.41B)

- Mapletree Logistics Trust ($8.03B)

- Mapletree Industrial Trust ($7.02B)

- Mapletree Commercial Trust ($6.74B)

- No change in Top 5 rankings since August 2021.

Smallest Market Capitalisation REITs:

- BHG Retail REIT ($266M)

- ARA Hospitality Trust ($370M)

- Lippo Malls Indonesia Retail Trust ($414M)

- United Hampshire REIT ($455M)

- Sabana REIT ($465M)

Disclaimer: The above table is best used for “screening and shortlisting only”. It is NOT for investing (Buy / Sell) decision. If you need help to start building your own investment portfolio, or want a portfolio review,book a consultation with Kenny now!First consultation is free.

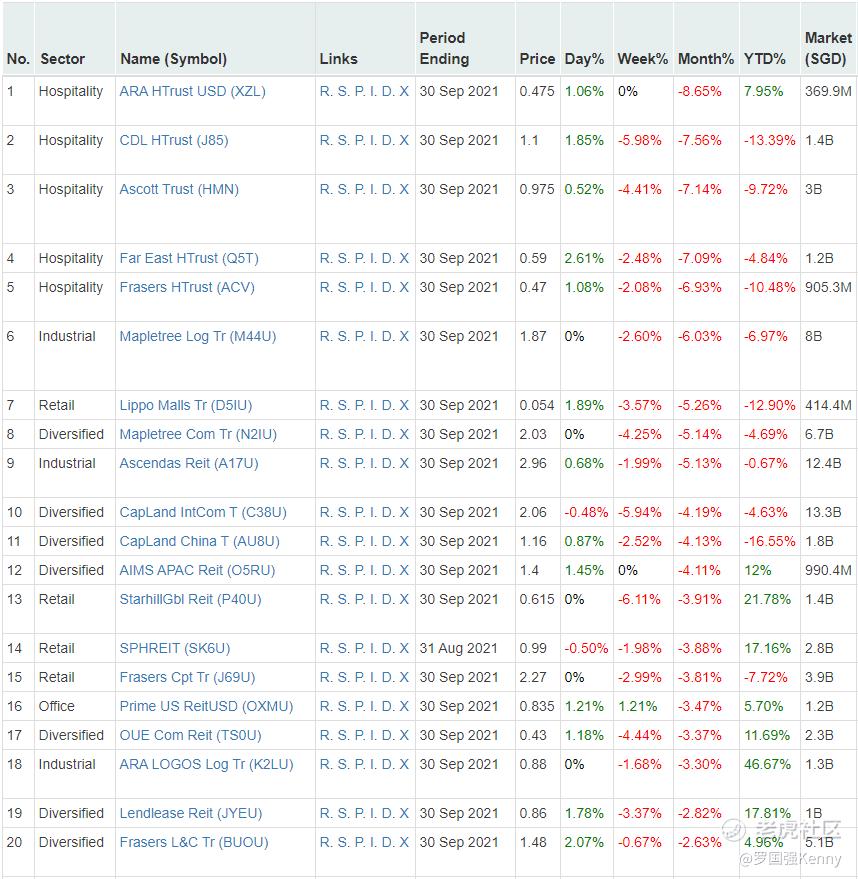

Top 20 Worst Performers of the Month (December 2021)

(Source:https://stocks.cafe/kenny/advanced)

Notably, all bottom 5 Performers are all 5 Hospitality Trusts, since the Hospitality Sector is most sensitive to post-pandamic economic recovery prospects.

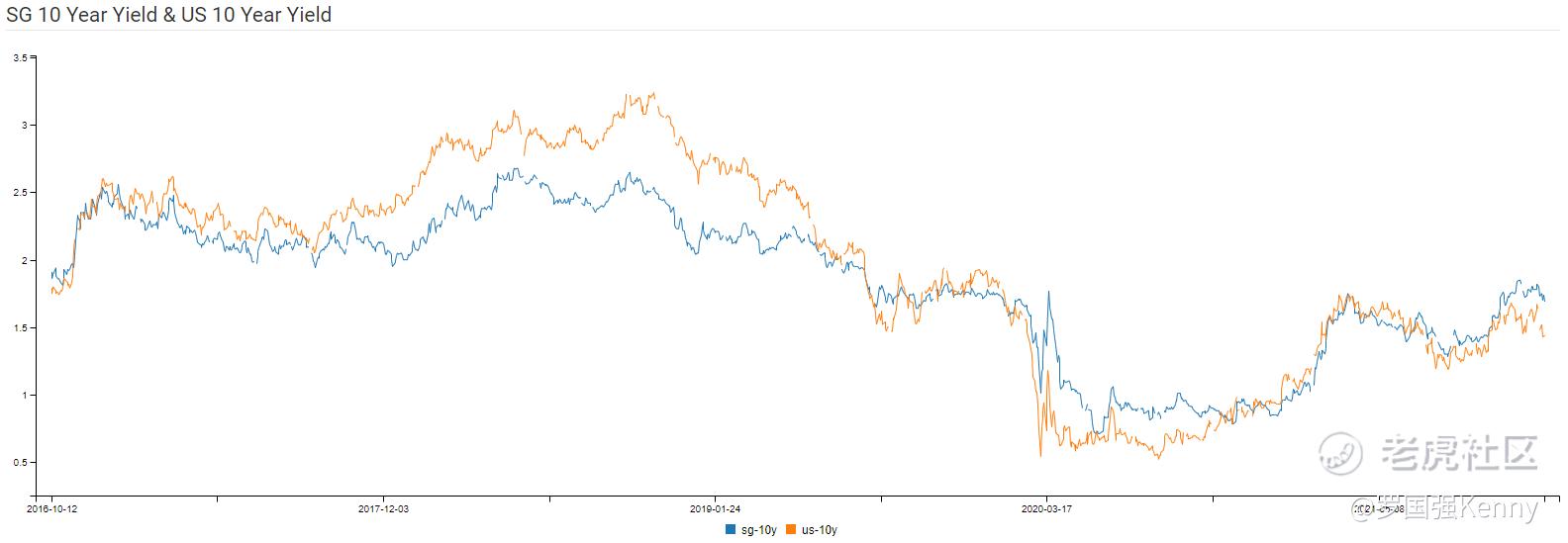

SG 10 Year & US 10 Year Government Bond Yield

- SG 10 Year: 1.69% (decreased from 1.77%)

- US 10 Year: 1.36% (decreasedfrom 1.46%)

Major REIT News in November 2021

2 REIT IPOs: Daiwa House Logistics Trust and Digital Core REIT

Daiwa House Logistics Trust (DHLT) invests in a portfolio of income-producinglogistics and industrial real estate assets located across Asia.The Sponsor is Daiwa House Industry Co., Ltd. (TYO:1925) Japan’s largest homebuilder, specializing in prefabricated houses.

It currently has 14 industrial and logistics properties across Japan, with a Portfolio Valuation of S$952.9m.

Read More here

Digital Core REIT invests in a diversified portfolio of stabilised income-producing real estate assets located globally which are used primarily for data centre purposes, as well as assets necessary to support the digital economy. The Sponsor is Digital Realty (NYSE:DLR), a global data centre owner and operator.

It will list with a portfolio of 10 data centres located across USA and Canada, with a Portfolio Valuation of S$1976.5m.

Summary

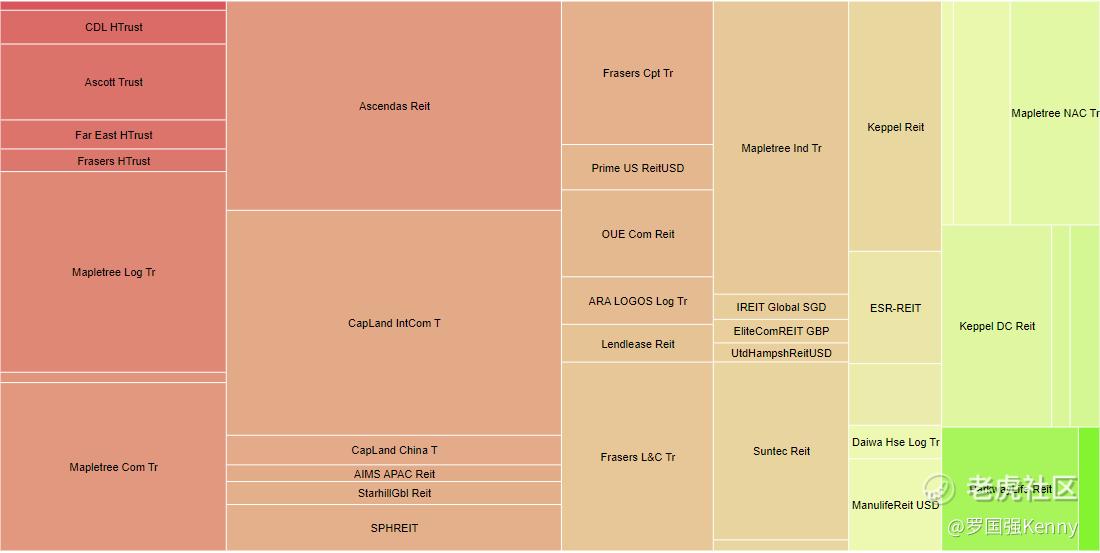

Fundamentally, the whole Singapore REITs landscape is currently at fair value due to the recent correction based on the average Price/NAV value of the S-REITs. Below is the market cap heat map for the past 1 month. Generally, most S-REITs in the past month have decreased in market cap. The Bottom 5 Performers are all 5 Hospitality Trusts, expectedly since the Hospitality Sector is most sensitive to post-pandamic economic recovery prospects, which has taken a significant hit in recent days.

(Source: https://stocks.cafe/kenny/overview)

Yield spread (in reference to the 10 year Singapore government bond of 1.69% as of 5th November 2021) widened slightly from4.10% to4.29%.This is due to the 10 year Singapore government bond rate decreasing from 1.77% to 1.69%.

The risk premium is attractive to accumulate Singapore REITs in stages to lock in the current price and to benefit from long-term yield after the recovery. Moving forward, it is expected that DPU will increase due to the recovery of global economy, as seen in the previous few earning updates. NAV is expected to be adjusted upward due to revaluation of the portfolio.

However, depending on how post-pandemic recovery plays out (which is very much dependent on Omicron’s severity), some REITs such as Hospitality Trusts, will have performances depending heavily on post-pandemic recovery.

Technically the REIT Index is currently on short term downtrend, but recently bounced back from itssupport at 835.If early signs are true that the Omicron variant is less severe, it is expected that post-pandamic recovery will continue, which can lead to the stablilisation of share prices of Singapore REITs and the return of the dividend for the next few quarters. Based on the latest earning releases, most of the REITs are growing in DPU and cautiously optimistic moving into 2022.

You can listen to mymonthly REIT radio interview on MoneyFM89.3here.

Note: This above analysis is for my own personal research and it is NOT a buy or sell recommendation. Investors who would like to leverage my extensive research and years of Singapore REIT investing experience can approach me separately for a REIT Portfolio Consultation.

Kenny Loh is a Senior Financial Advisory Managerand REITs Specialist of Singapore’s top Independent Financial Advisor. He helps clients construct diversified portfolios consisting of different asset classes from REITs, Equities, Bonds, ETFs, Unit Trusts, Private Equity, Alternative Investments, Digital Assets and Fixed Maturity Funds to achieve an optimal risk adjusted return. Kenny is also a CERTIFIED FINANCIAL PLANNER, SGX Academy REIT Trainer, Certified IBF Trainer of Associate REIT Investment Advisor (ARIA) and also invited speaker of REITs Symposium and Invest Fair.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 华尔街的花儿姐·2021-12-05我还特意去研究了一下新加坡的房地产信托基金,因为在过去的20年里,新加坡已经成为房地产信托基金(REITs)的中心,在全球都具有领先位置,自然疫情的影响也是非常大,不过不影响如果资产规模大的话,是非常优质的投资产品。点赞举报

- 罗杰斯之王·2021-12-05疫情之后新加坡本国的REIT市场也呈现出繁荣前景并且复苏很强劲,因为很多中国企业正在新加坡设立基地,所以越来越多的投资者关注。点赞举报

- Lydia758·2021-12-05阅点赞举报