Initial Report(part2): Beyond Meat (NASDAQ: BYND), -30% 5-yr Potential Upside (EIP, Pyae Phyo SHUN)

estment thesis

5.1. A growing number of evidence about the environmental benefits of consuming plant-based food, coupled with a lack of consumer awareness presents Beyond Meat with an opportunity to capture greater market share.

Beyond Meat stands at the intersection of an expanding body of evidence highlighting the environmental advantages of plant-based diets and the existing lack of consumer awareness regarding these benefits. The convergence of these factors presents an opportune moment for Beyond Meat to significantly increase its market share within the plant-based food industry. By leveraging the growing awareness of environmental sustainability and the health benefits associated with plant-based diets, the company can capitalize on this momentum, educating consumers, and strategically positioning its innovative products as a viable, environmentally conscious choice. Through targeted marketing, education campaigns, and continued innovation, Beyond Meat has the potential to not only expand its consumer base but also drive broader adoption of plant-based alternatives, securing a stronger foothold in the market.

5.2. Inflation-driven consumers veer back to lower-priced animal meat and Beyond Meat products are still priced higher than meat.

Amidst inflationary pressures prompting consumers to revert to lower-priced animal meat options, Beyond Meat faces a pricing challenge, as its products remain positioned at higher price points compared to conventional meat. This pricing disparity could potentially hinder consumer adoption or retention of Beyond Meat's offerings, especially when economic uncertainties drive purchasing decisions toward more cost-effective choices. Overcoming this obstacle requires strategic pricing initiatives, perhaps through economies of scale, process optimizations, or innovative cost structures, enabling Beyond Meat to narrow the pricing gap between its plant-based products and traditional meat options. Additionally, emphasizing the long-term health and environmental benefits of plant-based diets might aid in justifying the higher price point, thereby fostering continued consumer interest despite short-term economic fluctuations. Although these inflationary pressures affect the whole plant-based food industry, the revenue of Impossible Foods grew but the other company shut down after 2 years.

5.3. A history of losses unhealthy cost-cutting measures and low revenues weaken the positioning of Beyond Meat in the market.

The financial situation at Beyond Meat reflects a history of losses and a recent decline in revenues, marking a challenging period for the company. Despite a decrease in revenues to $92.2 million and a drop in product sales by 7.3%, the company managed to cut its net losses significantly, down to $59 million from $100.5 million the previous year. This reduction in losses is promising, and aligned with the company's aim to achieve positive cash flow by the end of 2023. Beyond Meat has made strides in cost-cutting measures, trimming operating expenses by $34 million compared to the previous year, representing a 35% decrease. The company's disciplined cash management is evident, with total cash use reduced to $48.6 million, marking a substantial 74% decline from the year-ago period and showcasing prudent financial management in a challenging market landscape. Thus, we need to continue monitoring cash flows of Beyond Meat for the upcoming quarters.

Valuation

When comparing against its peers in the market, Beyond Meat’s profitability ranks at the bottom of this peer group. Beyond Meat’s NOPAT margin and return on invested capital (ROIC) are below each of the competitors listed above, and well below the market-cap-weighted average of all the Food Processing firms under coverage. This indicates the low efficiency of its operations. Low margins in an increasingly competitive industry leave Beyond Meat with less flexibility to compete on price or invest in marketing and R&D. Given its negative PE ratio too, this presents a downside.

ESG Components

Environmental:

Beyond Meat has emphasized reducing environmental impact through its plant-based products, which require fewer natural resources like water and land compared to traditional meat production. The company's plant-based meat alternatives aim to lower greenhouse gas emissions, conserve water, and mitigate deforestation associated with animal agriculture. They have also shown commitment to sustainable sourcing of ingredients, although more transparency in their supply chain could be beneficial. They've made strides in reducing their carbon footprint by opting for renewable energy sources in manufacturing facilities. However, a detailed and comprehensive sustainability report could enhance transparency in their environmental efforts.

Social:

Beyond Meat's focus on providing plant-based alternatives aligns with societal health concerns and animal welfare. By promoting a shift toward plant-based diets, they contribute to improved public health and potentially reduce animal suffering. However, scrutiny regarding fair labor practices within its supply chain or manufacturing units could be beneficial. The company could further enhance social impact by actively engaging in initiatives related to fair labor practices, diversity, and community development.

Governance:

In terms of governance, Beyond Meat has an opportunity to strengthen board independence and diversity. Currently, the board does not have a separate Chairman and CEO, potentially creating concerns over concentrated power and decision-making. Establishing stronger oversight mechanisms and ensuring independence in board leadership might enhance governance practices. While there's a focus on sustainability within the company's structure, greater transparency in reporting on ESG metrics and initiatives could improve their governance profile.

This ESG analysis highlights Beyond Meat's positive efforts toward environmental sustainability and social impact but also identifies areas where they can further develop their ESG practices, particularly in enhancing transparency and governance structure.

Risks and mitigation

History of Losses and Financial Uncertainties:

Beyond Meat has continuously reported net losses since its inception, including substantial figures in recent years - $366.1 million in 2022, $182.1 million in 2021, and $52.8 million in 2020. Plans to reduce operating expenses in 2023 might be offset by rising expenditures due to growth initiatives, risking potential impacts on revenue growth and margins. The company faces significant costs in product development, facility expansion, and marketing, which pose uncertainty about achieving profitability in the future. Mitigation involves stringent cost controls, phased expansion, and transparent communication to balance growth aspirations with financial management.

Supplier Reliance Risks and Supply Chain Vulnerabilities:

Beyond Meat's reliance on limited suppliers, particularly for raw materials like pea protein, poses substantial operational and financial risks. Dependency on specific vendors might result in sourcing challenges, pricing issues, and disruptions due to supplier or natural disasters, impacting production and sales. Mitigation involves expanding supplier networks, risk assessment protocols, and technological investments to enhance supply chain resilience.

Ingredient Availability and Distribution Dependence:

Beyond Meat faces risks due to challenges in securing plant-based protein that meets quality standards and relies on a limited number of distributors for sales. External factors impacting ingredient availability, such as weather, economic conditions, and competition, might hinder product demand fulfillment. The loss of distributors like DOT and Zandbergen WFM could significantly impact operations. To mitigate, diversifying suppliers, fortifying supply chains and solidifying distributor partnerships are essential.

Conclusion

I recommend HOLD position for Beyond Meat. Beyond Meat is currently in a difficult position and it must address its declining growth figures as soon as possible. Quarterly growth rates are stagnating, and for a business in a particularly fertile growth industry this is not a good portent for the future. With that being said, it should also be considered that the global plant-based food market size is predicted to expand by 3x, witnessing an increase from US$ 11.3 billion in 2023 to US$ 35.9 billion by 2033. Overall plant-based food sales are poised to surge at a stupendous CAGR of 12.2% between 2023 and 2033. Thus, I believe that there is still a bit of time to afford while monitoring Beyond Meat’s financial figures and the growth strategy it plans to deploy.

References :

Forbes, Competition Will Eat Beyond Meat Alive

https://www.forbes.com/sites/greatspeculations/2020/09/14/competition-will-eat-beyond-meat-alive/?sh=7b6800ba2946

https://stockanalysis.com/stocks/bynd/financials/ratios/

https://www.marketwatch.com/investing/stock/bynd/financials

https://finance.yahoo.com/quote/BYND/financials/

https://docs.google.com/document/d/18y0A3a_XXXa7pFX76fMssLQsXRgHNYAVWKZlcYKY9OQ/edit

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

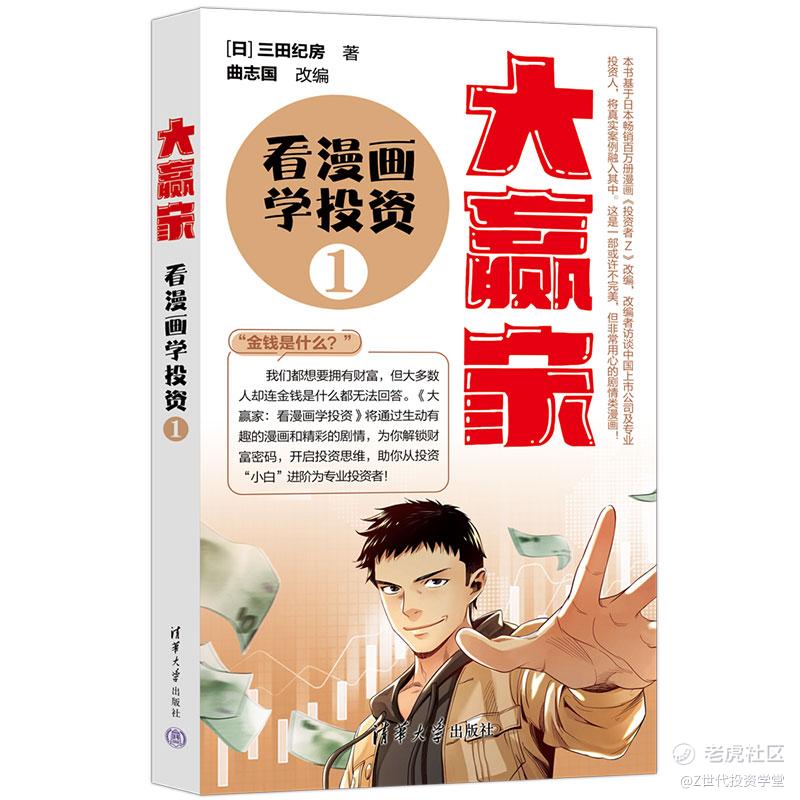

如果你想了解有哪些前沿科技的投资机会,想学习真投资大佬们的投资秘籍,想投资自己的人生,那就快来购买《大赢家》漫画吧!漫画中采访了许多职业投资人和上市企业,通过有趣的故事传达投资理念,我们相信在阅读的过程,你一定会有所收获。《大赢家:看漫画学投资(1)》([日]三田纪房 著)【简介_书评_在线阅读】 - 当当图书

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。