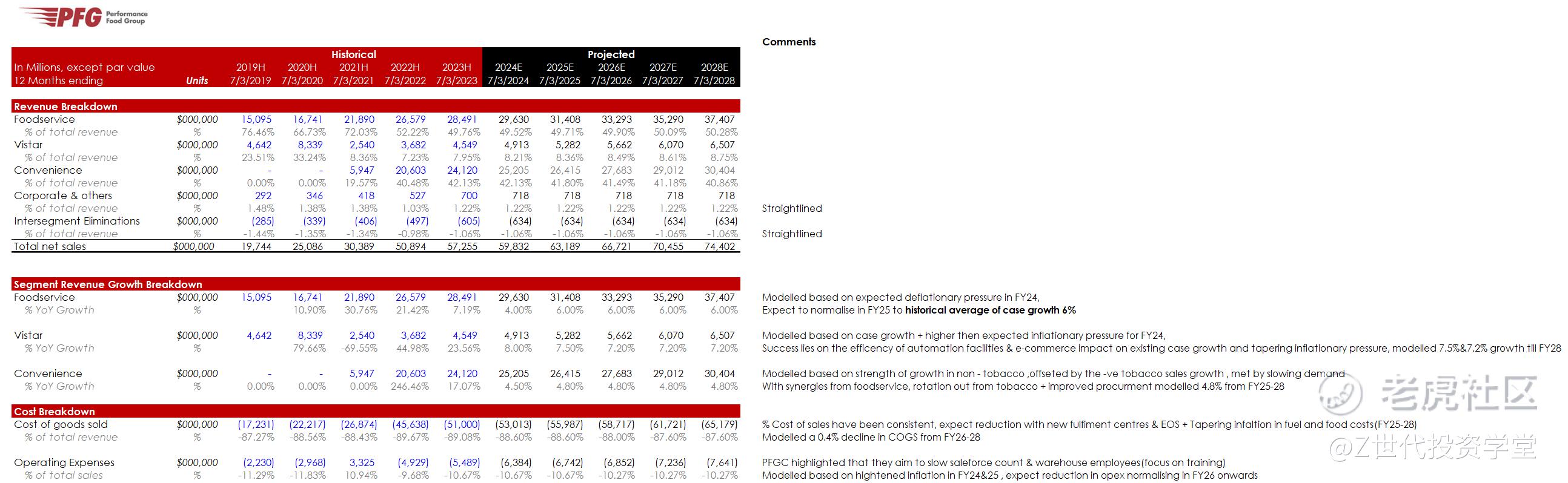

Initial Report(part2): Performance Food Group (NYSE:PFGC), 51% 5-yr Potential Upside (VIP SEA, Julian LEE)

Tech enabled fulfilment centres with last mile delivery

Vistar has automated significantly its 3 retail centres (small parcel shipments) . With leverage on technological capabilities with automation in picking and packing parcels, Vistar allows products to be able to deliver to 96% of the population in 1-2 days.

With the tech-enabled fulfilment facilities , this helps boost PFGC E-commerce & Q-Commerce segment.Given PFGC scale and supply chain, they could act as fulfilment service centres for manufacturers and customers alike. Even if its clients utilises a third party website , PFGC would still be able to capitalise on fulfilment opportunities for them.

For Q-commerce, it capitalises on customer inclination towards fast delivery for smaller sized orders. The quick commerce segment is expected to grow at 10% reaching a market volume of US$77Bn in 2028. In order to fulfil the order PFGC has strong relationships with DoorDash and especially GoPuff to supply them with food solutions, and Go-puff helps achieve the last mile delivery for PFGC in a direct sale to end customers.

The strong synergies between each of the three segments , combined with strong industry tailwinds, make PFGC poised to continue to achieving strong topline growth.

Investment Thesis 3: Strong levers to manage inflationary pressures & strategic initiatives to supercharge PFGC growth

Expenses Management

Cost Management

While on whole, strong deflationary pressure on food prices is undesirable for PFGC , neither is spiking inflation. However, in terms of operating expenses , PFGC has many levers to manage inflation in terms of food, fuel and labour. Food is mainly managed through pricing analytics and forward buying. Labour, it is mainly through cost to serve analytics and inflation indexation clauses. Fuel, PFGC has adopted costless collars (allows PFGC to pass on fuel surcharges) and route efficiency software to determine optimal fuel efficiency usage.

Strategic Expenditures supercharging PFGC growth

Diversification with strategic investments to drive sustained business growth

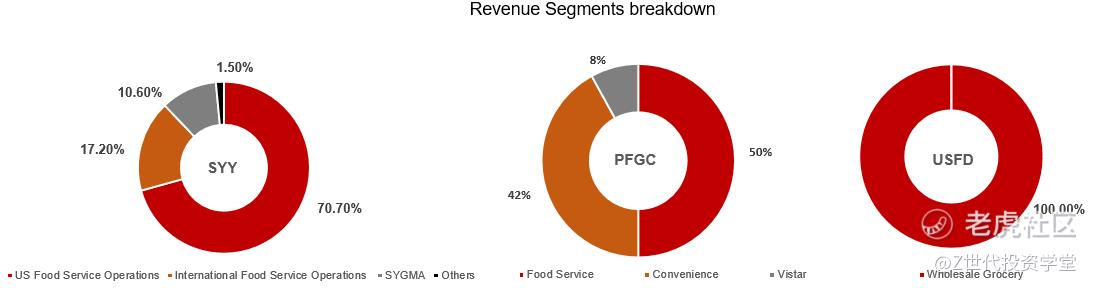

Unlike its larger peers, such as SYY or US Foods, PFGC has the largest diversification across customer segments and product mix, better insulating itself to macro trends and shifting customer preferences. As seen from the chart below, although SYY has the most subsegments, the items mix generally are segregated by customer locations and business operations of similar products offering limited category mixed as opposed to PFGC, which offers a much more diversified mix across the 3 subsegments serving very different product lines with exclusive collaborations that offer significant cross-selling opportunities to clients on a single platform.

Customer centric focus to drive topline growth

PFGC has focused on growing its salesforce with technologies and focusing on customer pain points even during the Covid pandemic resulting in gaining market share, despite a challenging environment for its restaurant clients. PFGC has grown its salesforce by nearly 50% from 2020 to currently 35000 associates as of FY24 Q1.

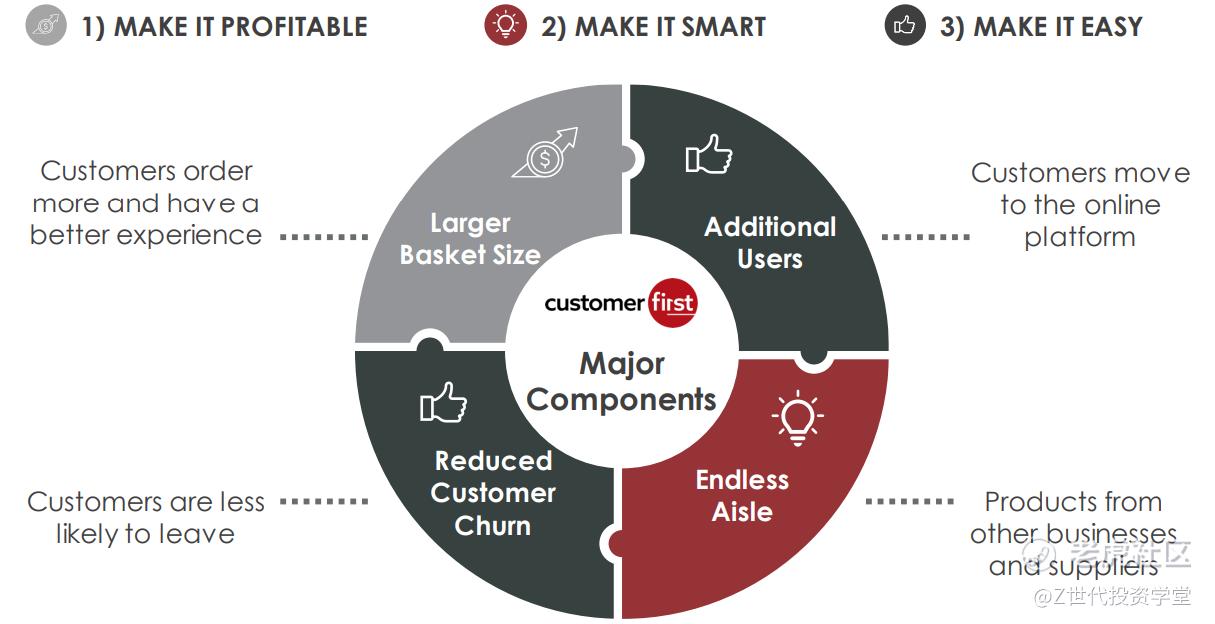

Such a platform allows customers to order their products with ease. Unlike previously, there were multiple applications in place for each business segment . It has now been streamlined into a single platform to improve customer experience and has an "endless aisle" feature, which leverages PFGC cross selling capabilities, where a customer from food service can tap on products from Convenience or Vistar as complementary products for their business needs. This would help reduce churn rate of its customers and drive higher basket sizes as well , aiding it topline margins. The success can be seen via a report by wReport , which shows PFGC ranking first ahead of its peers on mutiple key customer engagement metrics. This reflects its strong brand value for customers and allows PFGC to capture greater market share.

Strategic expenditures supported by prudent debt management

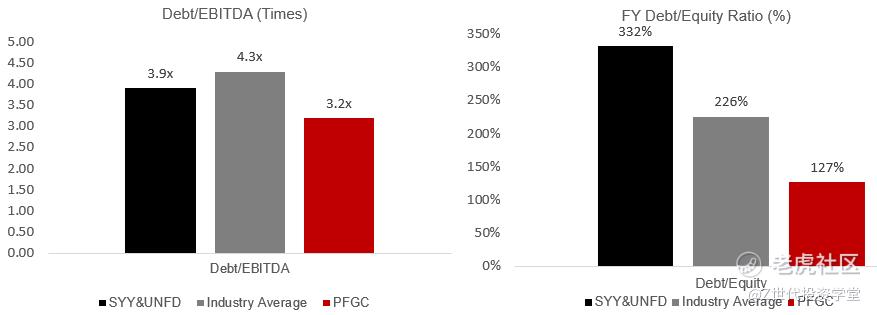

In terms of debt management, PFGC has been consistently managing its debt well, with a debt to EBITDA of 3.2x lower than that of its two closest peers at 3.9x and similarly for debt to equity ratio PFGC is less levered then its two key peers.This reflects PFGC prudent debt management , despite its thirst for M&A and facilities expansions to drive EBITDA growth, giving it the flexibility to expand its operations and buyback of shares to raise shareholder value.

Valuation

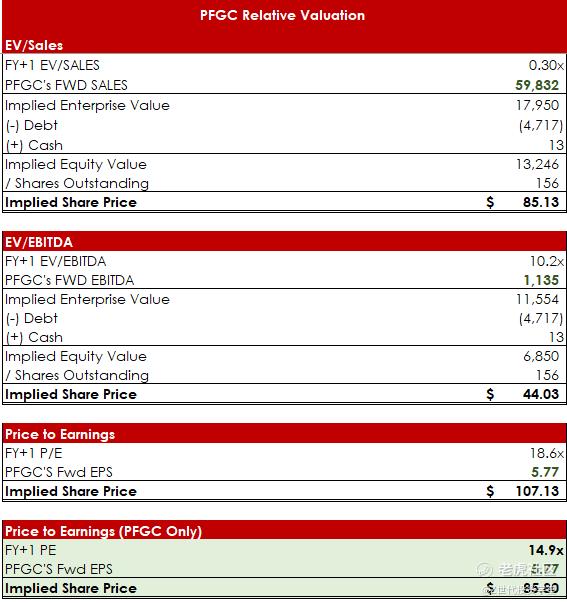

Relative Valuation

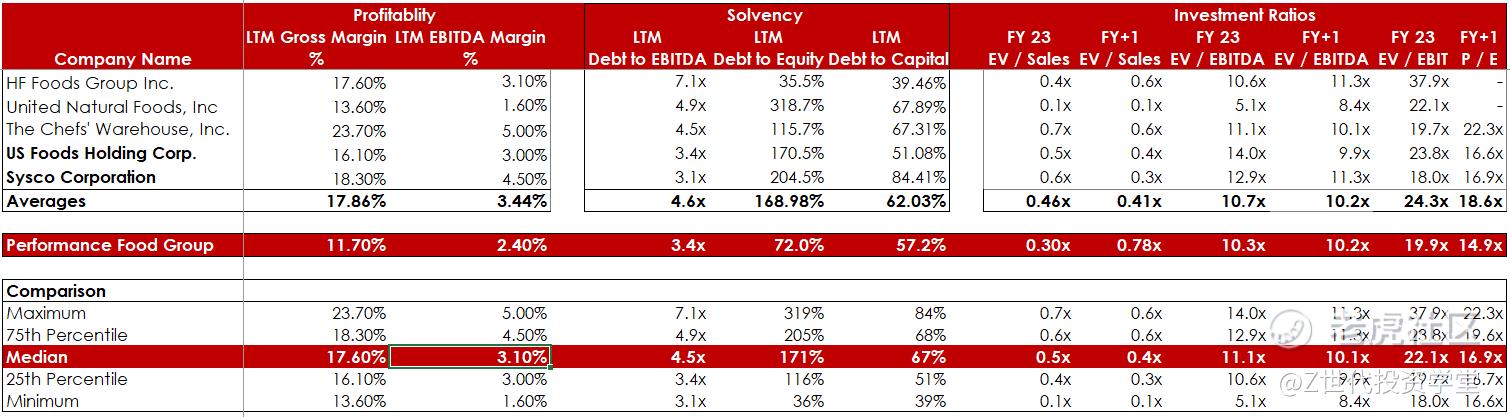

Using relative valuation, we can see the range of implied stock prices ranging from $44 to $107 representing range of downside of 45% to upside of 68%.

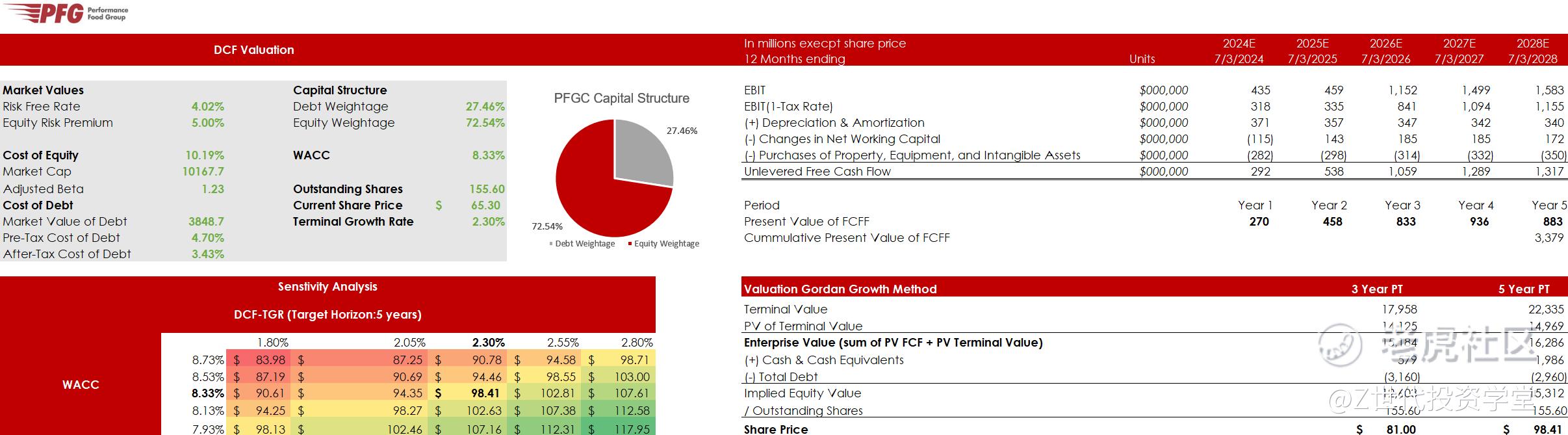

Discounted Cashflow Model (3 & 5 Year Price Target)

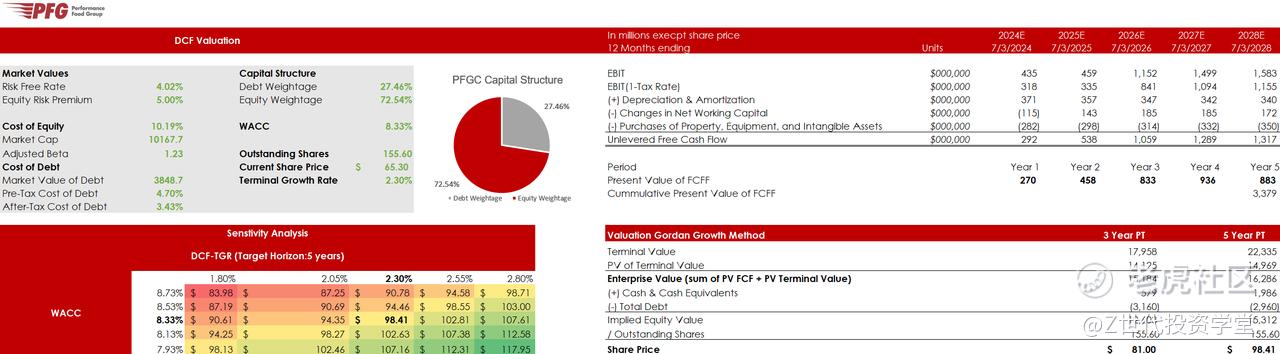

For the model, using the CAPM method , with a COE of 10.19% & an after tax COD of 3.43%, I derived a WACC of 8.33% as the discount rate. Next, using the Gordan Growth Terminal growth method of 2.3% , I derived a stock price of $98.41 (5 Year PT) representing an upside of 51%.

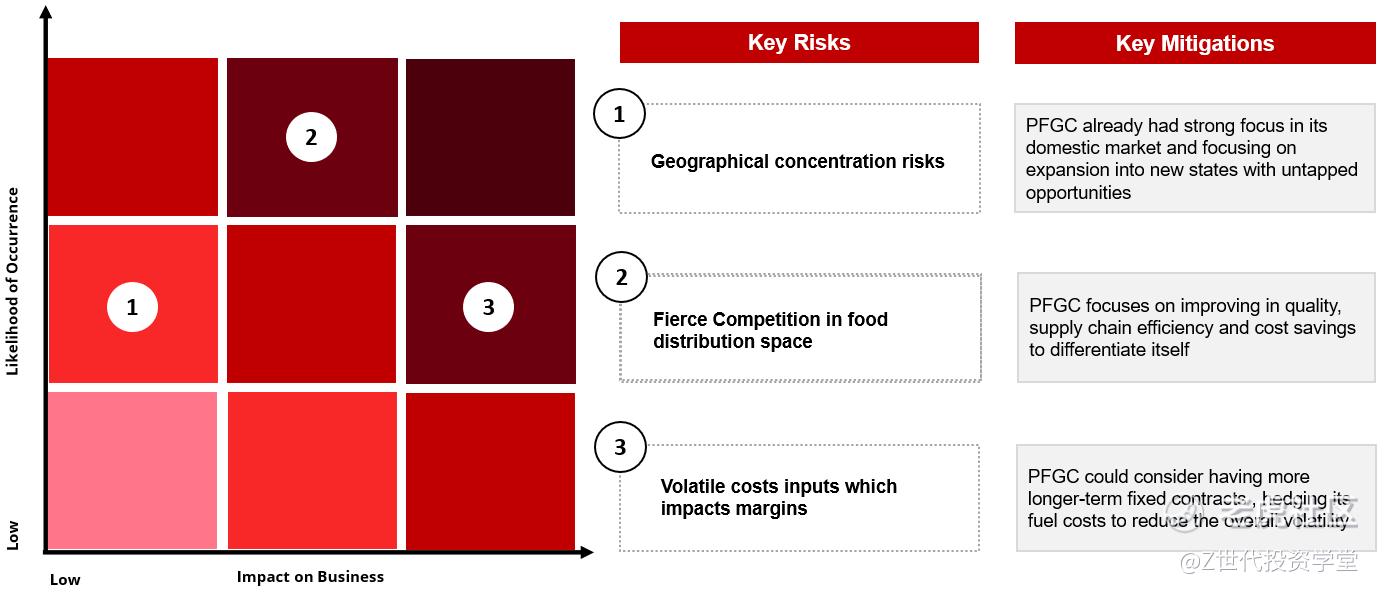

Key Risks and Mitigations

Conclusion

In conclusion, I would reiterate a buy call of target price $98.41, representing an upside of 51% on PFGC based on its strong industrial tailwinds combined with management's focus on EBITDA expansions across all three segments supported by the three theses. I certainly believe that PFGC will continue to expand and command more market share in a highly fragmented industry with tight margins.

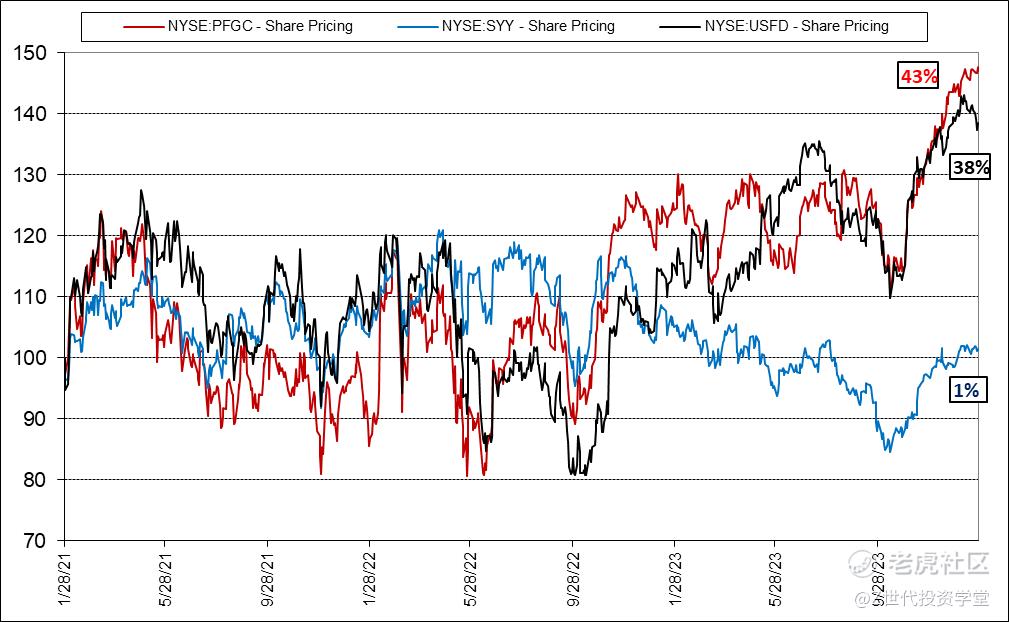

Share Price Comparison between the 3 largest players

Updates to PFGC (Key Notes) - Q2 FY24 Earnings

Basing off the recent earnings transcript on 7 Feb 24 , for Q2 Earnings : Overview Organic case volume grew 2.1% for Q2 2024 --> driven by organic independent growth , performance food brands and growth in the Foodservice + Vistar segments. Net sales rose by 2.2% to $29.2B due to increased cases , offset by decreased selling prices/cases due to deflation of 1.4% Operating Expenses rose 4.8% YoY on the back of accelerated depreciation of acquisitions , repairs & maintenance and salaries Adjusted EBITDA rose by 9.9% , with Net Income rising by ~20% Yoy By segment Foodservice YoY sales increased by 2.4% , driven by independent and chain businesses , although hurt by declined case prices.However securing new independent customers resulted in 8.7% increase in independent case growth. Q2 2024 independent sales % of total sales is 39.1%. EBITDA YoY growth 4.6% supported by favourable shift of more Performance brands to independents. Convenience Yoy sales increased by 1.3% , due to increased selling price of cigarettes and inflation of food and food service related products. EBITDA YoY growth of 20.5% supported by pricing improvement from procurement efficiencies and opex reductions due to lower overtime and personnel expenses. Vistar YoY sales increased by 7.4% , due to higher selling prices due to inflation and case volume growth. EBITDA YoY growth 1.5% supported by 9% growth in GP , offsetted by 14.7% increase in OPEX. This is largely due to better procurement efficiencies and case growth , although offset by higher rental expenses and expected reduction in inventory holding gains.

Adjustment to Model Inputs (Unchanged) Given management kept its forward guidance unchanged, at the moment given its YoY growth momentum across all 3 segments coupled with deflationary pressure still lurking and affects its topline growth drivers partially, my stance remains unchanged, at least in the near term.

Earnings Growth

Latest Updates

Dual Prong Approach in reaching new customers Driving brand image under its convenience segments Partnership with GPM subsidiary of ARKO - one of the largest convenience store operators in the US --> offering premium pizza at an affordable price , benefiting PFGC in terms of this partnership to be able to deliver to over 1000 GPM stores , strengthen their relationship of more than a decade.

Premiumization of its product lines

Performance food group is pleased to announce it is the first food distribution company to enter a partnership with The Hershey Company to incorporate a variety of well-known Hershey products into its desserts.PFG’s premium line of dessert offerings, Sweet Encore, will now feature Hershey ingredients including chocolate, caramel, Reese’s Peanut Butter Cups, Reese’s Pieces and Heath Bar bits. Conclusion This could potentially represent PFGC consideration towards premiumisation of its product, elevating its products for its customers on top of its own performance brand products, which could open the floor for stronger partnership with both independent and chain restaurants and institutions to supply Hershey-linked dessert products to its end customers. Overall this measures

Partnership with Hyzon (Four Fuel Cell Electric Vehicles ) ~ ESG foucused + Potential for cost and delivery efficencies.

Hyzon’s hydrogen FCEVs have an expected travel range of up to 350 miles today and an expected refueling time of fifteen minutes with fast fill dispensing. PFG plans to insert the vehicles into its fleet and put them in service to deliver snacks, candy, and beverages to its customers. The vehicles will be fueled with hydrogen delivered by Pilot Travel Centers LLC, a leading fuel and energy provider with the largest network of travel centers in North America. Hydrogen vs BEVs (Battery EVs) FCEVs have numerous advantages over battery electric vehicles (BEVs) in terms of payload, range, and refueling time. FCEVs are expected to be around 6,000-8,000 pounds lighter than BEVs, have a longer range, and can be refueled in as little as 15-20 minutes compared to up to three hours for BEV. These factors make FCEVs a natural choice for distribution and heavy-duty freight companies.

Appendix

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

如果你想了解有哪些前沿科技的投资机会,想学习真投资大佬们的投资秘籍,想投资自己的人生,那就快来购买《大赢家》漫画吧!漫画中采访了许多职业投资人和上市企业,通过有趣的故事传达投资理念,我们相信在阅读的过程,你一定会有所收获。https://product.dangdang.com/29564921.html#ddclick_reco_reco_relate

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。