DL raise HK$223M by placing new shares for long term investors

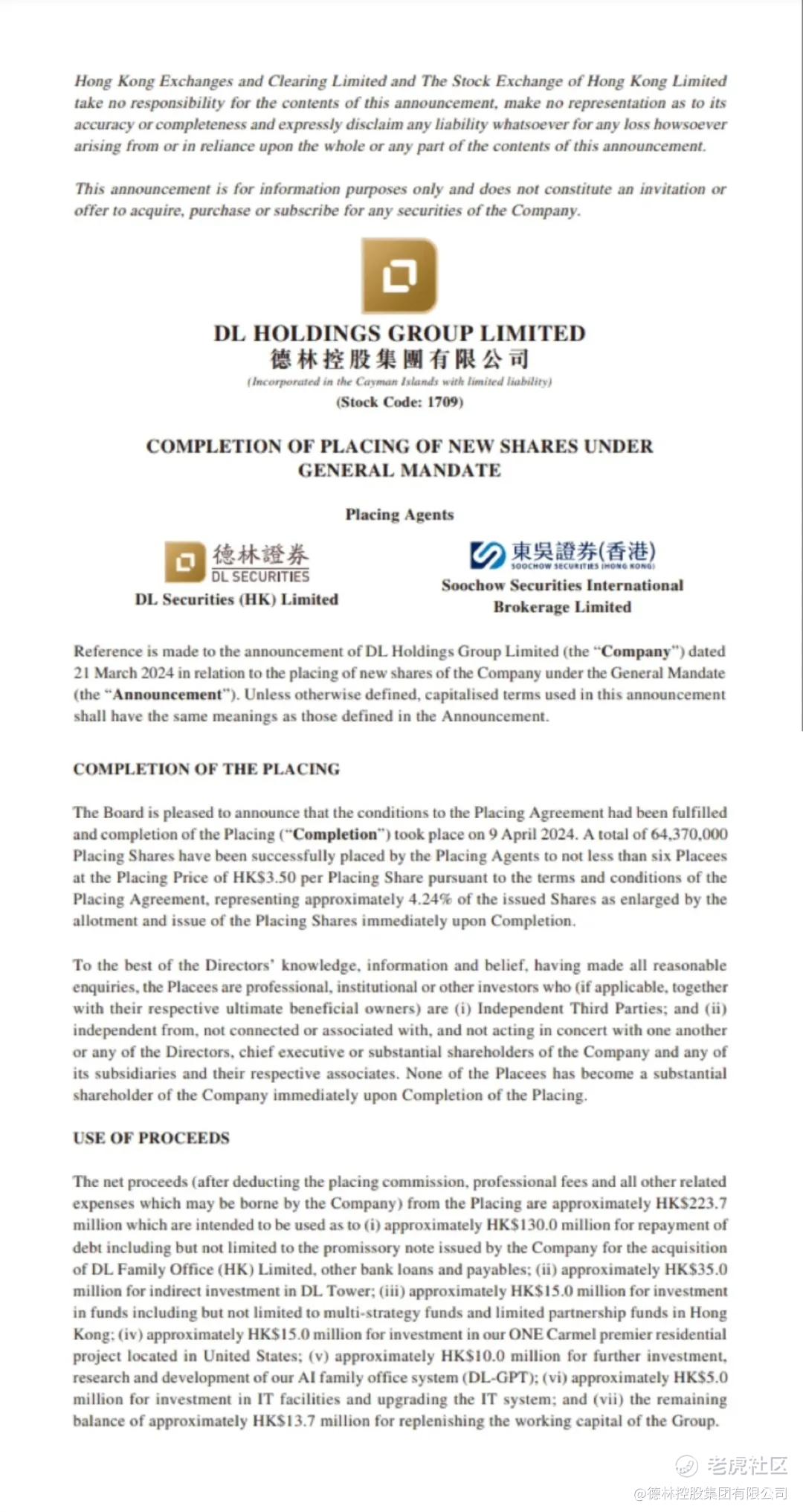

DL Holdings Group Limited (Stock Code: 1709.HK) is pleased to announce that the conditions to the Placing Agreement had been fulfilled and completion of the Placing took place on 9 April 2024. A total of 64,370,000 Placing Shares have been successfully placed by the Placing Agents to not less than six Placees at the Placing Price of HK$3.50 per Placing Share. The lock-in period is one year, and approximately 4.24% of the issued Shares as enlarged by the allotment and issue of the Placing in full. The maximum gross proceeds from the Placing are estimated to be HK$223.7 million.

This Placing Agents were jointly completed by DL Securities (HK) Limited and Soochow Securities International Brokerage Limited. The main purpose of the funds are intended to be used in the merger and acquisition of family office business; the indirect investment in DL Tower; multi-strategy funds and limited partnership funds; ONE Carmel premier residential project located in United States; setting branch office and investment in Japan; further investment, research and development of the Group’s AI family office system (DL-GPT); investment in IT facilities and upgrading the IT system; and repaying a portion of prior debts and replenishing the working capital of the Group.

Andy Chen, Chairman of DL Holdings Group, stated, "The response to the allotment of DL's new shares has been enthusiastic, and our stock price has risen rapidly in a short period of time. In order to protect the interests of existing investors, we have to end the allotment early. All funds raised will be invested in development according to the plan. I sincerely thank all new and old investors for their support and trust in DL. On behalf of the Board of Directors, I would like to pledge that we will go all out to pursue the best interests of all shareholders and continue to provide more opportunities to invest in DL Holdings. "

Since established in 2010, DL Holdings adhere to the global asset allocation strategy with family offices as the core, and has gradually developed into a fully licensed, full-chain financial listed group integrating DL Securities, DL Global Capital, DL Digital Family Offices, DLiFO and DL Institute for New Economic Research. The group's AUM exceeds 4 billion US dollars last year, serving more than 50 HNW family customers and their corporate groups in the Asia-Pacific.

Headquartered in Hong Kong, China, DL Holdings also have offices in Shanghai, San Francisco, and Singapore. To further expand influence in the Asia-Pacific, the group will set up a global display and reception center in Tokyo, Japan soon.

For details of the announcement, please visit the website of HKEX

免责声明

本文章仅供参考,投资者应仅依赖公司公告所载资料作出投资决定。

未经本公众号授权,任何人不得擅自转载。

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。