Initial Report: MapMyIndia (NSEI:MAPMYINDIA), 55% 5-yr Potential Upside (EIP, Jianling NG)

You can't use an old map to explore a new world - Albert Einstein

Company Description:

C. E. Info Systems Limited (NSEI:MAPMYINDIA), provides digital mapping, geospatial software, and location-based Internet of Things technology solutions in India. MapMyIndia derives majority of their revenue from B2B and B2B2C customers. The company reports across two revenue segments, Map-led and IoT led and obtains its revenue mainly in India, with plans for international expansion. MapMyIndia was founded in 1992 and is headquartered in New Delhi, India.

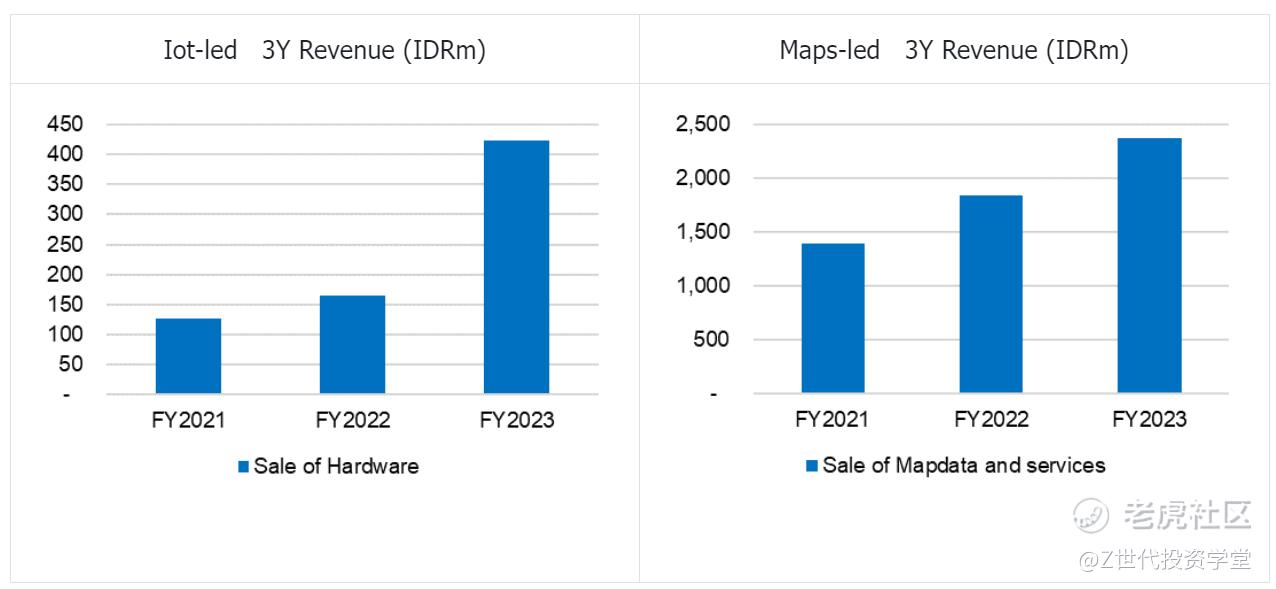

Revenue breakdown:

Business Segments:

Map-led: This is the legacy and core business of MapMyIndia.

This business involves the sale of map data and services, including royalty, annuity, subscription, software and projects.

IoT-led: This is a newer segment for MapMyIndia.

This business involves the sale of IoT hardware devices followed by SaaS subscription revenue.

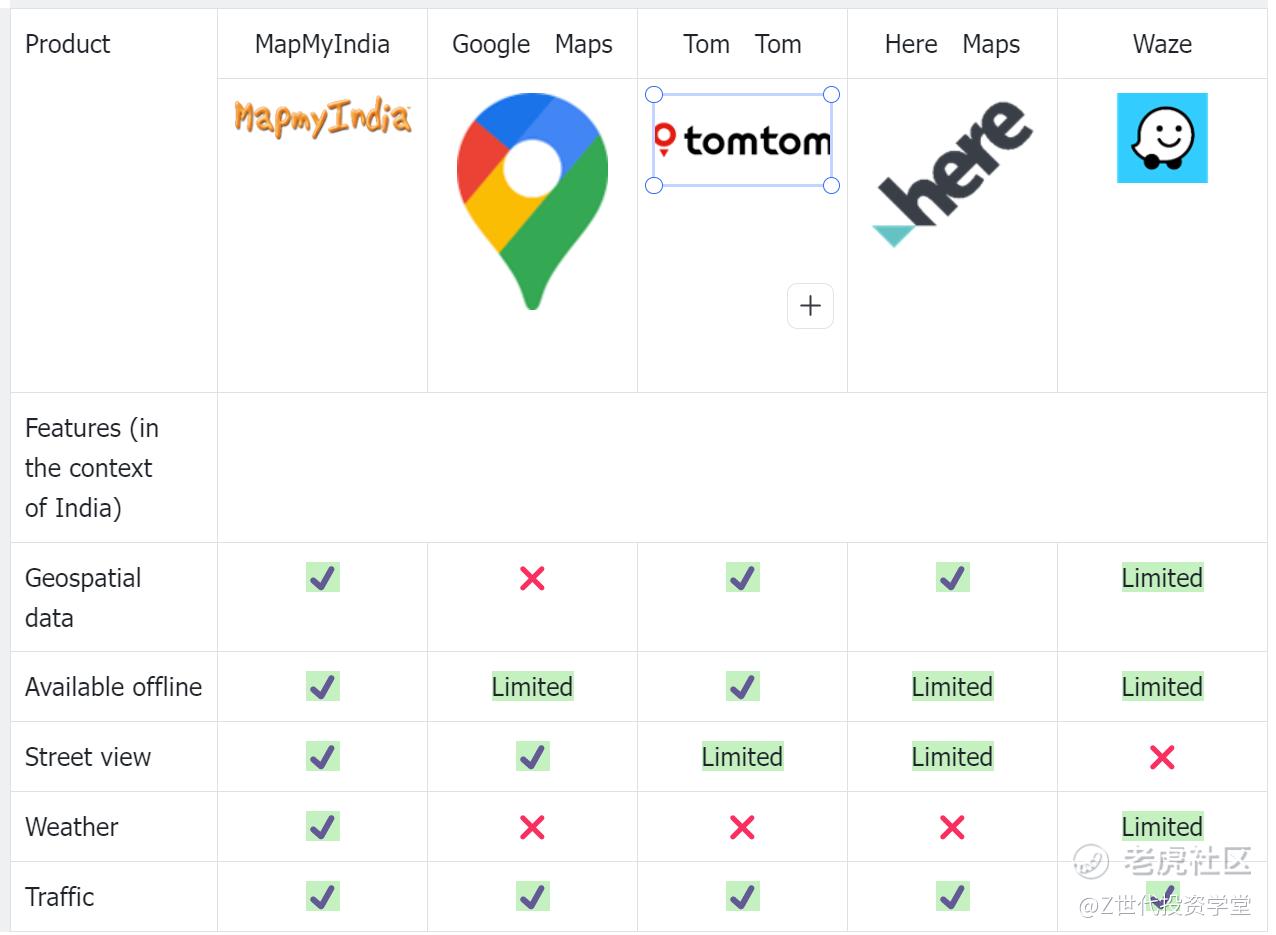

Competitor Analysis and Industry Overview:

MapMyIndia is in the Digital Maps and Navigation Services industry.

Modern maps are made using a combination of physical surveys with GPS and other sensors, aerial pictures and satellite imagery in a process called photogrammetry. This may also be combined with crowd sourced feedback and data, government records, in Geographic Information Software (GIS) to produce maps and graphic or presentation displays for geospatial analysis.

Other features such as navigation routing, traffic conditions, nearby businesses, toll costs, and street view were then added as an additional layer and are part and parcel of maps today.

Investment Thesis:

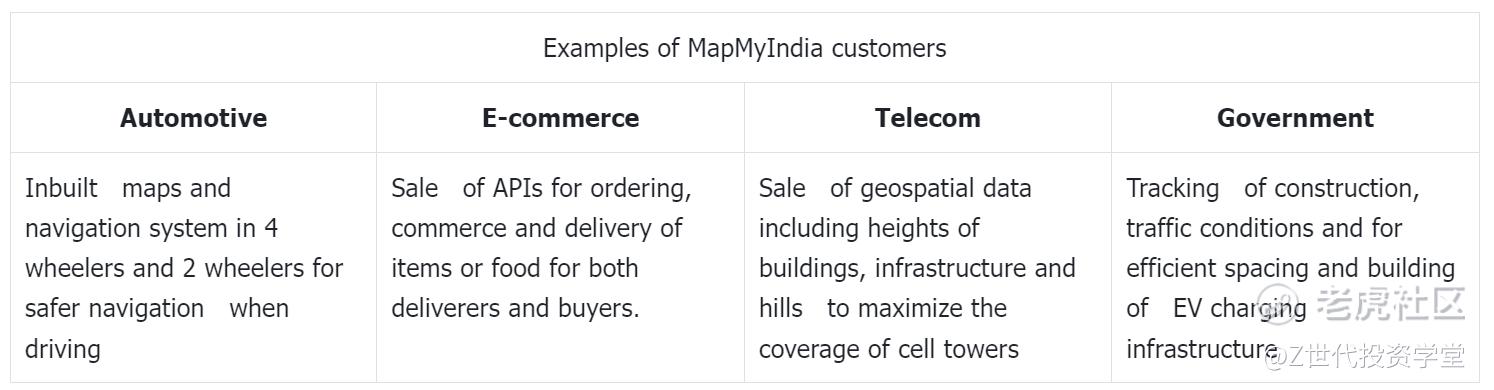

Large TAM that is expanding with increasing number of end use cases

MapMyIndia is the leader for B2B sales in India. The number of industries and verticals the map data can be used is endless and growing as India’s economy grows. We believe MapMyIndia will be able to capture this growth and this will lead to revenue and high quality earnings from subscription contracts and license sales from quality customers.

Underrated drone segment. Drone mapping allows a level of highly detailed data collection across a large area that isn’t possible through satellite images or take too much time using traditional ground surveying.

Ultimately drone mapping has the following advantages over traditional map making and surveying:

Reduces field time

Requires less surveying costs

Requires less manpower

Ability to access inaccessible areas such as unsafe or harsh terrain

Quality aerial imaging without flyovers using a plane

Even though this drone segment is still very new and a new pillar of focus for MapMyIndia, MapMyIndia has already secured contracts such as topographical mapping and survey for an energy company and for the government. The lessens costs for MapMyIndia and improves margins.

Product superiority over Google Maps and competitors with a wide moat against new entrants.

More features and better map coverage[JL1] . MapMyIndia has better map coverage than competitors, especially in rural areas and also has more languages available. This deeper and more extensive coverage leads to increased revenue opportunities for MapMyIndia and use cases such as paid site assessments of unmapped areas.

Barriers of entry and network effects.

The Indian government introduced new laws in 2021 and 2022 to reduce the monopolistic dominance of Google Maps and foreign maps.

The street mainly noticed regulations barring access to the precision of the collection of data, which barred foreign entities such as Google Maps from collecting up to 3m accuracy as compared to local players. Foreign entities were also barred from collecting street view which Google Maps popularized.

However, the street missed out on the actual amount of disadvantages Google Maps was dealt, and also missed out on crucial regulatory advantages that further disadvantage foreign players.

Google relies on its street view to make sure that routes and business are updated. Stopping Google from collecting this will not only reduce the important feature of Google Maps Street View but also affect other features such as live businesses and navigation routing on Google Maps.

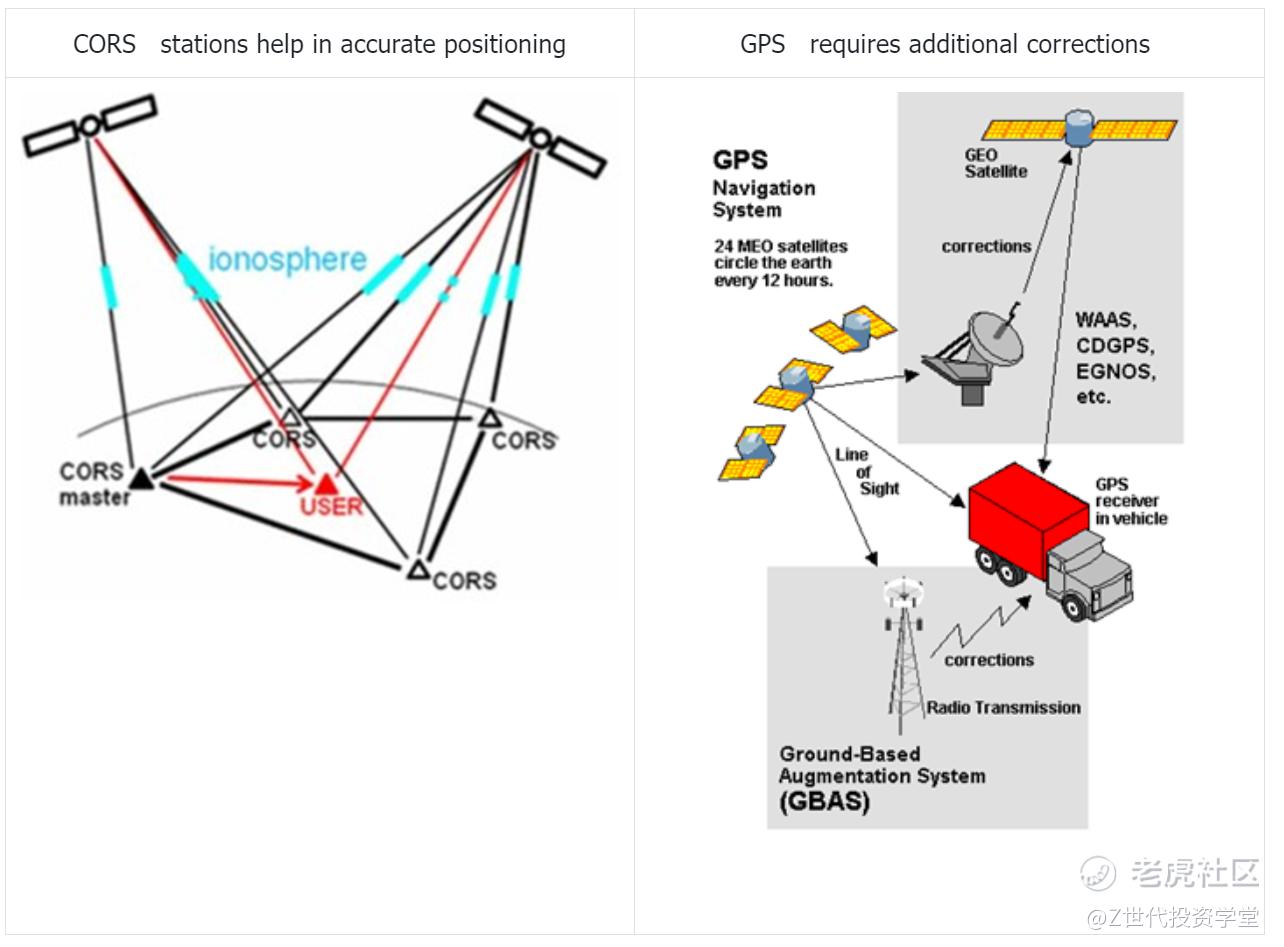

The next area is in accurate map making. Regulations now prohibit foreign entities from ground truthing, verification, access to Indian ground stations and augmentation services for real time positioning. Continuously Operating Reference Stations (CORS) and their data shall be made available and with the ease of access to Indian entities only.

CORS stations are used in surveying, mapping and providing high precision positioning information for global navigation satellite systems such as GPS. These augmentation systems are crucial to accurate mapping and particularly in areas with obstruction or vertical heights.

This is material as end use cases such as engineering projects require fine tuning and very precise information measure to the millimeter and also for future use cases such as autonomous vehicle driving which require precise mapping. This translate to a bigger TAM and more revenue opportunities for MapMyIndia.

Strong feedback loops and network effects help to build and make the existing map better.

MapMyIndia relies on the feedback and anonymized data from its thousands and millions of users everyday. This enables strong network effects where more users make the product better for other users and creates a wide moat.

Margin expansion

Sales from IoT temporarily depress margins but will increase margins in future. The IoT hardware is sold upfront at a low margin and the subscription fee is recovered from the clients in later years. As a result, margins are lower in earlier years and recover later as subscription revenues startcontributing. We see this from FY2022 to FY2023 where margins were temporality depressed partly as a result of higher mix of lower margin IoT sales. This is expected to inflect with more sales and higher margin SaaS revenue coming in the future.

Margins from Map-led business segment is expected to continue.

The Maps business is MapMyIndia’s legacy business and is traditionally high margin due it’s inherent nature of being a software-based business. Margin benefit coming in from increasing economies of scale for the map-led business is expected.

ESG:

As a software company, their impact to the environment is very minimal. Their social impact is most material:

MapMyIndia contributes to the progress of India as a whole, to local communities and individuals.

With better map development and coverage of India as a country, foreign investors, local businesses, and the government of India would be able to better access areas of opportunity and facilitate better planning and land use.

Mapping of rural areas also uplift communities and individuals as accurately mapping out areas allows the possibility of end use cases such as Credit borrowing and loans with land title deeds as collateral. All these lead to increased business activity and uplifts rural and less developed communities.

Risk and Mitigations:

Their biggest risk is in competitor Google Maps, which is the market leader in B2C, as compared to MapMyIndia being the leader in B2B. There is the risk of Google Maps going through Indian entities to buy the data needed for their Maps. We believe the extra cost in doing so and potential illegality of it will mitigate this risk.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

修改于 2024-04-10 23:37

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。