Initial Report(part3): Big Lots (BIG), 387% 5-yr Potential Upside (EIP, Ryan ANG)

Naturally, one might question why close-outs were abandoned as a strategy in the first place. Specifically, why did Bruce initiate this transition initially if this was the right path all along? A clue might be found in the fact that when Bruce joined, close-outs represented less than 10% of the sales mix. This indicates that the decision to move away from close-outs had already begun before Bruce's tenure. Consequently, I don't believe the blame can be solely placed on Bruce for this strategic shift. A simpler explanation could be institutional imperative and the pressure to align with the prevailing trends in the retail sector. As Buffett noted, institutional imperative is often a key factor leading great companies to make unwise decisions. As the saying goes, it's better late than never. I would prefer that Big Lots made a mistake, recognized it, and is now rectifying it rather than not rectifying it at all. This would instill the further conviction needed to execute on this strategy.

Do I believe the opportunity for close-outs still exists? After a quick look across renowned off-price retailers, it seems that in apparel, furniture, and home goods, off-price retailers like TJ Maxx have a strong presence, making competition much tougher. However, there are opportunities for off-price in products that existing retailers cannot carry, such as animals, food and consumables—the segment Bruce mentioned where they plan to be more aggressive in pursuing such deals. In short, yes, the opportunity remains, but it is undoubtedly much tougher in other segments now.

What are the key factors that enable a successful close-out strategy?

A close-out strategy hinges on 4 key factors: 1. Dry Power (Financial Liquidity), 2. Fast Decision Turns, 3. Supply Logistics and most importantly 4. Supply Networks.

These factors are what will enable the company to capitalize on an opportunity. Given that close-out opportunities are often random, the off-price retailer must possess enough liquidity or have access to capital to seize these chances. Secondly, the off-price retailer must be able to react and decide quickly, as these suppliers often face tight deadlines themselves. Therefore, the faster and more seamless the decision-making process, the more likely a supplier will want to collaborate with you in the future. Thirdly, supply logistics should be arranged for speed and flexibility rather than for cost optimization. Why? Because suppliers need to offload these inventories quickly, and therefore, significant consideration is given to how swiftly the buyer can move their inventory off their channels. The key idea here is to understand that the supplier holds the decision of whom to work with, and buyers need to be cognizant of how to best provide a "service" and appeal to these suppliers.

The last and most important factor is the supply of vendor networks. In a close-out model, successful close-out strategy depends on how wide and how strong your vendor networks are. It pays to always be the #1 or #2 retailer that vendors approach when looking to offload their inventories. However, it is hard to build this network and is heavily dependent on past experiences and word-of-mouth in the community. For example, important consideration must be given on how the buyer negotiates the contracts - Does the buyer request further discounts and allowances? Is the vendor flexible in accepting smaller quantities despite higher logistics costs?

How is Big Lots equipped with respect to executing a close-out strategy?

Based on the Big Lots vendor website, it has a capital exceeding 2 billion open-to-buy calls to vendors globally. CEO Bruce Thorn seems to be aware of supply logistics and fast decision making requirements for a close-out strategy. Therefore, we could at least comfortably agree that Big Box checks 3 out of 4 requirements for a close-out strategy. The last and most important is the breadth of the supply networks. This is the segment that I have the most trouble finding hard data and evidence on. If we exclude the potential networks that Seth Marks has, Big Lots only worked with about 500 - 3,000 vendors globally. This level of vendor network is about 1/7th of what TJ Maxx has in order to execute this "Just-In-Time" strategy. Big Lots does have some edge in terms of being able to carry items such as furniture, food and consumables, pet foods, toys which perhaps other close-out players are less inclined to do so, which gives it a unique positioning that may appeal to a larger set of vendors, but this remains a category that is hard to ascertain until we get further information.

Turnaround Factor 2 - Improved Messaging and Store Relevance

This is where the narrative takes an interesting turn. The prevalent view on Wall Street regarding Big Lots is that it predominantly serves lower-income groups, facing similar challenges to dollar stores but lacking their execution capabilities. Admittedly, this was also my initial perspective, considering the common portrayal in sell-side reports and news, highlighting near-term weaknesses in furniture sales and a structural vulnerability in lower-income demographics. However, a closer look at Big Lots' management statements reveals a different story. They define their core customer as "Jennifer," a woman with a household income of approximately $100k USD. This core customer group significantly differs from dollar stores, which typically target individuals earning less than $40k annually. An estimated 70% of Big Lots' sales come from middle-income customers, around 15%-20% from lower-income customers, and 10%-15% from higher-income groups. Therefore, the lack of sales growth at Big Lots cannot be attributed to customer demographics weakness but rather to something more fundamental.

Key reason why Big Lots struggles to perform today

The core reason behind Big Lots' inability to perform and grow its sales can be distilled into three key factors: 1. Awkwardly designed and incoherent Big Lots stores. 2. Unsurprisingly poor management and maintenance of stores, especially given their 4x larger size than discount stores. 3. A non-existent core messaging strategy for Big Lots on why customers should visit Big Lots. These insights were gleaned from a recent article published by Business Insider. The reporter visited a local Big Lots’ store to investigate the reasons behind its weak sales. I've included a link at the end of this paper, and I highly recommend checking it out. You'll gain a clear understanding of the issues plaguing Big Lots.

The essence of Big Lots' performance challenges is succinctly captured by this quote from the article: "It's a store for everything, but a destination for nothing." This encapsulates the crux of the issue—beyond poorly organized shelves, a lack of manpower for such a sizable store, and the absence of coherence in store design. It's not that Big Lots lacks deals and popular items; it's that customers don't know what to come to Big Lots for. Do I think this is an easier issue to fix compared to a lack of a fundamental value proposition? Perhaps. The creation of a new position, "Chief of Stores," filled by Kristen Cox, formerly the SVP of Burlington Stores for six years, leaves me somewhat optimistic about potential improvements in store layout and messaging.

Initiatives taken by Big Lots

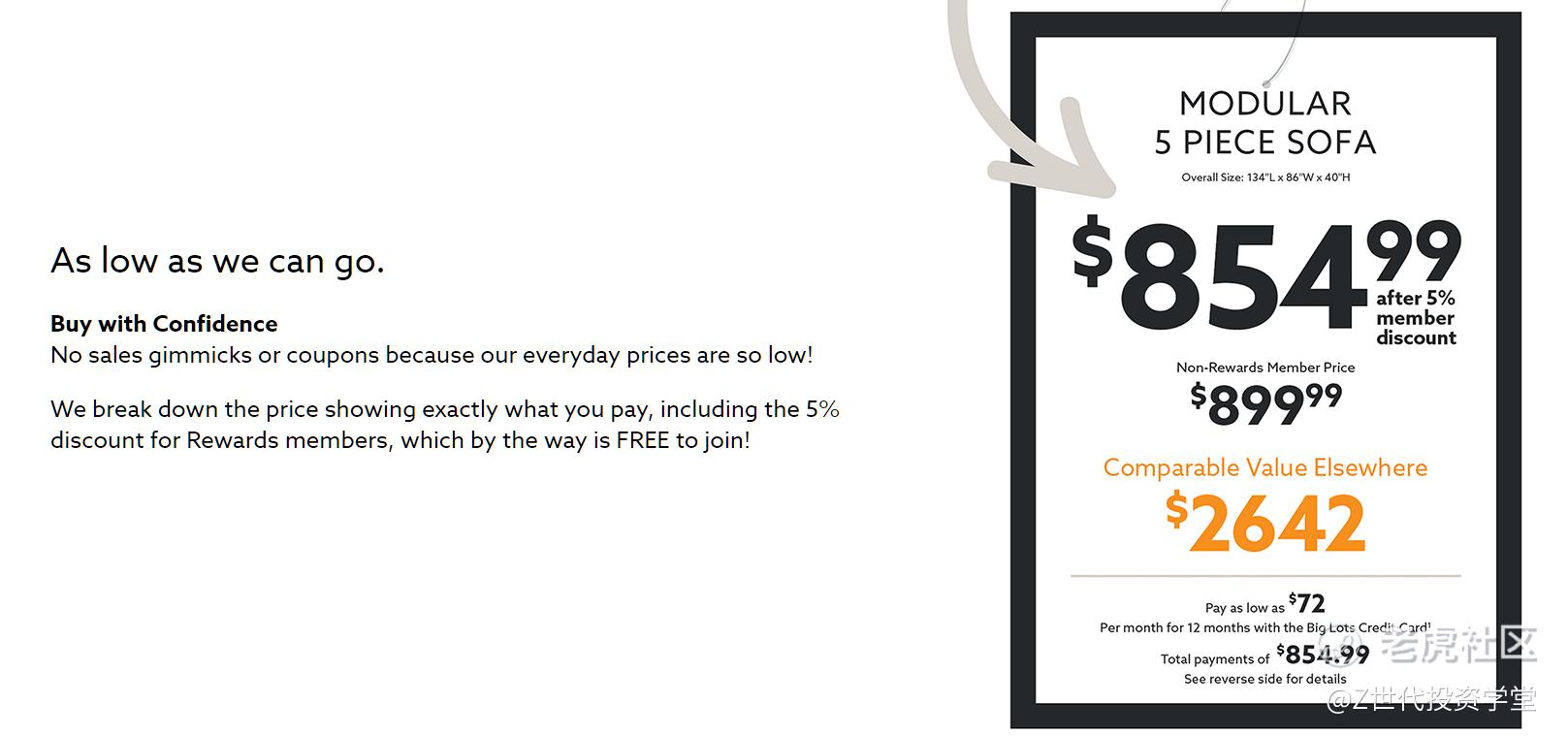

In the latter pages of the report, I explained why discounting strategies are such a bad approach, especially for the branded players. I cited the strategy of Ikea, where discounts are directly reflected in the listing price rather than as an added-on, as the correct strategy moving forward as it does not condition the customer to wait for a discount period. Initially at my time of writing, I wrote that I am not convinced that Big lots would move to this strategy in the near future, but to my surprise, their recent new initiative "Big Lots Home", has actually implemented this strategy. (https://www.biglots.com/homestore/approach-to-pricing). Under their new "Big Lots Home" website, it is shown that their approach to pricing is now "As low as we can go, no sales gimmicks or coupons as our everyday prices are so low!"

Big Lots Home - Approach to Pricing

This is a pleasant surprise to me because it is a clear indication of the right steps moving forward and at such a rapid pace too. Furthermore, massive improvements across retail messaging and store format can be seen in its new Big Lots Home. Take a look at this video that I have recorded for the new Big Lots Home website.

Firstly, the website for the new Big Lots home is in many ways, beautiful. I never expected a discount retailer to have such a high quality website promoting their stores. Secondly, the remodel store format places the furniture segment in the middle, with adjacent verticles nearby and other peripheral segments spread across the perimeter of the store. This allows for the random close-out categories to be placed across the whole segment, without disrupting the flow of the store format. This remodel store format makes the stores much more integrated and sensible, with clear messaging and an overall cleaner look as compared to its older stores.

暂时无法在Lark文档外展示此内容

Big Lots Home - Website. Click to Play Video.

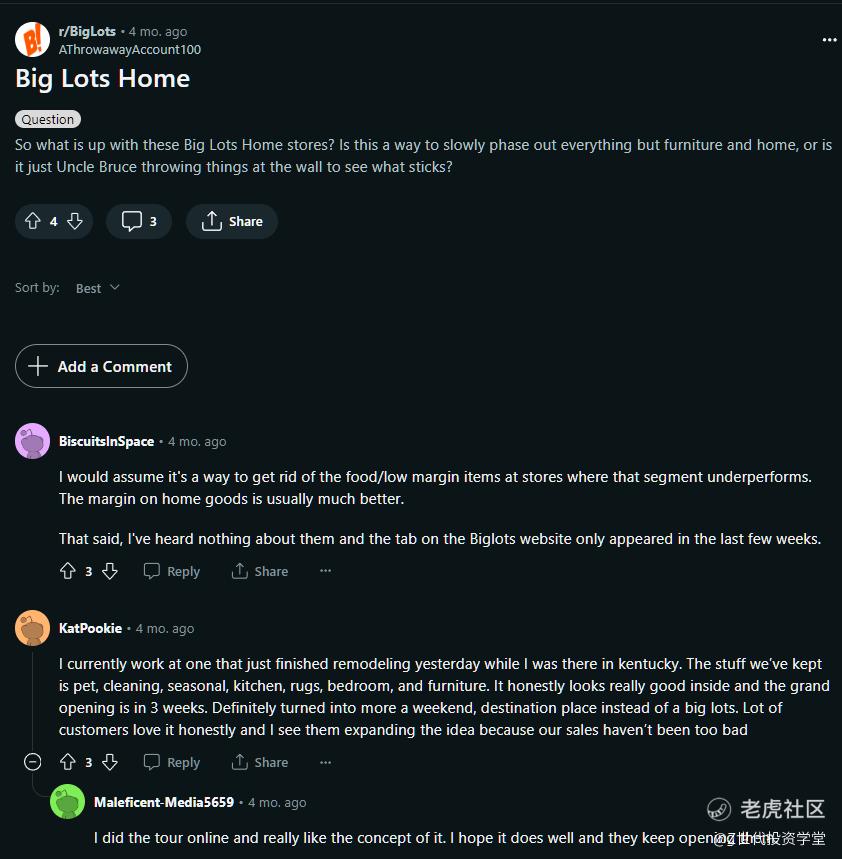

Big Lots Home - Remodel Store Format and Reddit Page on Big Lots Home.

A recent post on Reddit shows positive feedback on the new Big Lots Home format. Management has noted that key learnings in these new store formats will be rolled out to its stores nationwide over time. I believe this is another critical initiative that would help Big Lots on capitalizing its unique positioning.

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。