Initial Report(part6): Big Lots (BIG), 387% 5-yr Potential Upside (EIP, Ryan ANG)

To add on my reasoning for why a long-term investment opportunity is lacking, these are the 2 concepts that I use to consider whether a furniture retailer holds any competitive advantages.

Branding Positioning.

An interesting thing about the furniture industry is that, outside of a few exceptions, brands are meaningless. The branding and positioning of a furniture company are not based on the type of furniture, the material of the furniture, or the collection of the furniture. Rather, it is derived entirely from the parent/retailing brand of where the furniture is sold. If you think about it, when you enter a furniture store, brands are rarely displayed. Instead, we care more about where we will be shopping for our furniture and then derive the value that we associate with the furniture.

This quote from a furniture blog tells us exactly how we should think about branding in the furniture space.

“Store names have become the de facto brands of the furniture business. Ask a consumer what furniture brands she’s heard of and she’ll likely answer Rooms To Go or Ashley. (The latter is also a supplier brand, but it has only come to the attention of customers because of its burgeoning retail chain.) That’s also why the so-called “lifestyle” stores like Pottery Barn, West Elm and Crate & Barrel—not to mention IKEA and RH at either ends of the pricing spectrum—have been able to establish footholds in the furniture business using their own store brands. So as good as the brands that Authentic bought are in the context of the furniture business, they will have their hands full getting their money’s worth on their purchase.” – Warren Shoulberg

So how does this affect Big Lots?

The thing we need to be aware of for Big Lots is that they engage in a lot of discounting. It is very common to have discounts of 15 – 20% on their furniture, and in the retail space, discounting is the worst thing you can do to a brand as it erodes its brand quality and reduces the retailer's ability to price its furniture collection. Therefore, if we were to plot out the degree of harm done to furniture retailers across the space, this is how it will look.

So, if we were to accept discounting as the natural mode of operation, then perhaps we should not be putting too much weight on Big Lots being able to build their own brand, as well as their ability to build out their private label brands.

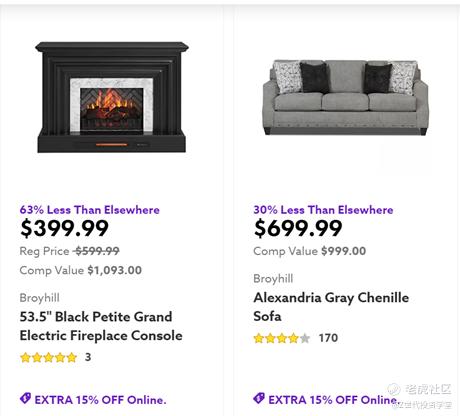

Even when we take into consideration Big Lot’s Broyhill collection, its prices are still significantly lower than competitors, and the way it is being marketed online shows that Big Lots is not trying to create any pricing power on their brands, but just a low-cost alternative to other designer labels. The problem comes, however, when players such as Williams-Sonoma start to do discounting on their off-trend products. This squeezes the value/price gap between premium players and basic players, which, in turn, moves consumer spending towards such premium players. I have no idea what Big Lots can do then to defend against such a move. The most likely path Big Lots will take is to further provide discounts, which, in turn, squeezes the profit margins of its supposedly high-margin segment, which reiterates my argument for why a long-term investment case is lacking.

A player that is rather insulated from this trend of discounting is interestingly, IKEA. The crux of their strategy is to not rely on such one-time off discounts and translate the initial savings directly into their pricing. Honestly, I believe that this is the right sales strategy which Big Lots should seek to move towards. The problem with discounting is not just weakening the brand image but conditioning the customer to wait for a sales period. This by-effect is a much detrimental impact in the long-run, regardless of brand positioning. As I think it is unlikely for Big Lots to execute such a different strategy for the foreseeable future, I just do not think they are able to compete effectively against other players. I will be cautious to have any major assumptions on advantages being built on brand recognition.

Reverse Logistics System.

An additional consideration and by-product of heavy discounting is the spillover effects on the company’s logistics and delivery system. Discounting, by nature, creates a tendency for an impulse buy. However, when consumers make purchases based on impulse, this creates a higher tendency for returns and refunds, which stresses the company’s reverse logistics. More often than not, the returned product is not sent directly back to the store but to a distribution channel where it will be seated and waiting to be re-sorted. During the process of re-distribution, there are touch-up costs, ad-hoc repair costs, and additional labor costs that will be required to reprocess this product. This process is further lengthened during periods of peak returns, which usually coincide with periods of heavy discounting.

Although it appears that Big Lots charges a 20% processing fee to the customer on the purchase price, the key problem is not so much whether the 20% processing fee covers the additional costs, but the duration it takes from the returned product to be ready for sale again. This inevitably lengthens the turnover days, reducing the cash-generating capabilities of the company. From my understanding, this solution is not as simple as introducing more distribution channels or “nodes” in the company’s logistic system. More nodes do not necessarily mean more efficiency and might actually create more bottlenecks. There is currently not much information on how Big Lots intends to deal with logistics, and I doubt this is a key concern for them now. Nonetheless, how one can factor this in is to reduce the overall furniture gross margins of 40% to a much lower steady-state gross margin to take into consideration these challenges that have yet to arise.

Conclusion (Update - 13th Feb 2024)

This company is not typically the type of company that I look for when I invest in my own portfolio. It is also not the same style that I typically utilize. However, it does look interesting from a valuation point of view, as well as from a catalyst heavy micro-cap company with multiple catalysts over the next 1 year timeline. I would use each earnings quarter to monitor the progression of its close-out strategy . In my opinion, a re-rating would occur when earnings and SSSG starts to rebound (Close outs being the key driver). The stock name has quite a limited downside to current prices (~150Mil Market Cap) and I recommend a trade on the name.

Disclaimer - This is not financial advice. Please do your own due diligence.

P.S I did not include any financial forecasting segment on how the Sales/Margins/EPS would grow over the next few years because the theoretical results would be quite misleading given the uncertainty and volatility of outcomes. The main idea of this investment case is to avoid a going-concern situation and a normalization of earnings, which by itself would justify a re-rating. This is addressed by analyzing whether there is a valid business model for Big Lots to execute upon.

Only when a clearer development in the business situation, more specifically, an indication on 1. Whether if close-out model contributes material traction, 2. Economics of close-out activities, 3. Spillover on Furniture, could we then have a meaningful forecast on the future. We could theoretically assume or use a few off-price retailers as a guiding post, but I think the efficient (though arguably lazier) method is just to wait and see.

Thank you for reading!

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。