Initial Report(part3): Daiichi Sankyo (4568.T), 67% 5-yr Potential Upside (VIP GC, 谭天禹)

Daiichi Sankyo breaks through in ADC areas with blockbusters by continuous innovation

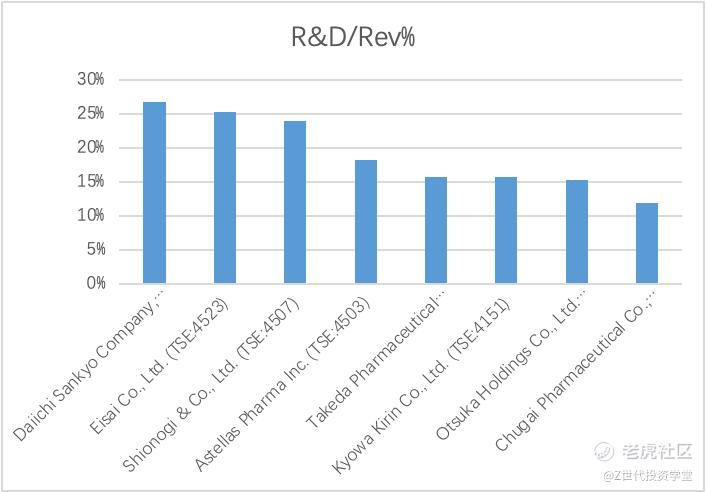

Daiichi Sankyo has positioned itself into a global pharma innovator several years ago and focus on an innovation in oncology. It keeps sustainable innovation and maintain leading positions in the pharmaceutical area. It has outstanding products to provide sufficient cash flow and keeps investing them on research, development and licensing in the best novel medicines. For oncology, the company has brought forth groundbreaking treatments that have revolutionized cancer care such as Enhertu and other products such as acute myeloid leukemia (AML) treatment with its novel FLT3 inhibitor called quizartinib. Daiichi Sankyo invested the highest proportion of R&D/Rev among the eight biggest Japanese companies.

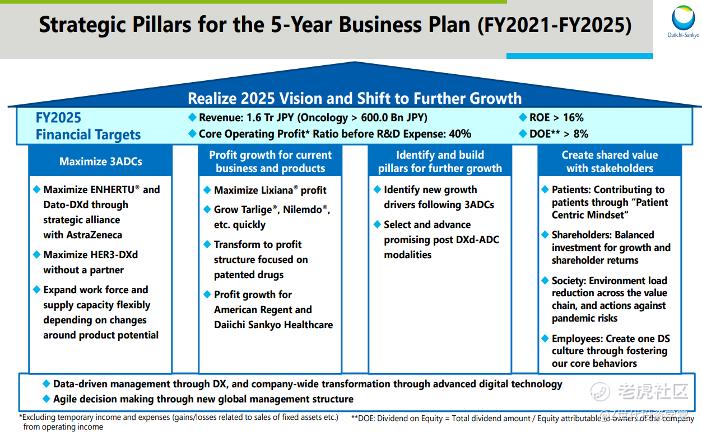

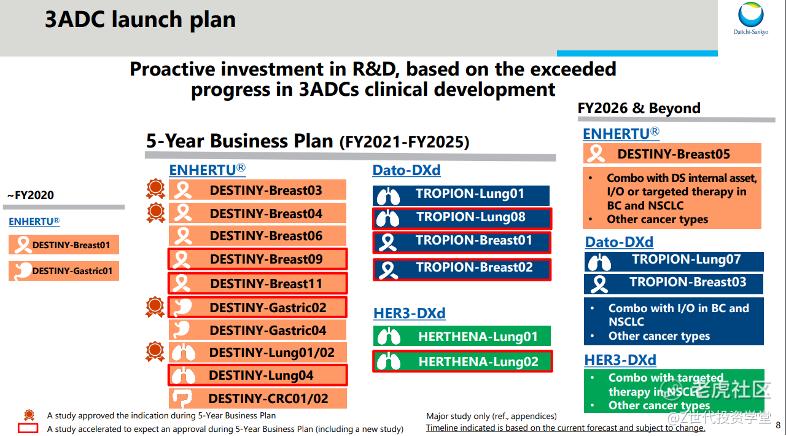

Daiichi Sankyo has ambitious 5-year business goals with targets for significant growth, aiming for a 40% increase in both revenue and core operating profit. A key focus is maximizing the value of its 3 leading ADCs, especially Enhertu and Dato-Dxd. The company also aims to drive growth across its existing businesses and products such as Tarlige, Nilemdo, and Lixiana. To achieve these targets, Daiichi Sankyo will leverage its strengths in oncology and pipeline of novel targeted therapies while continuing to expand globally and capitalize on other core product franchises. This well-balanced strategy combines revenue generation from current brands with forging new standards of care through the next wave of innovative ADC medicines.

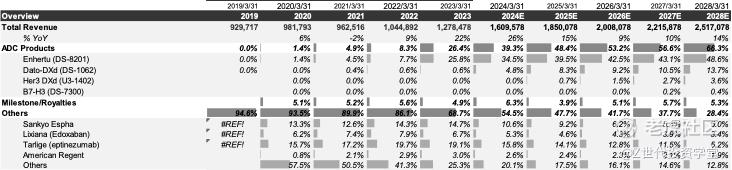

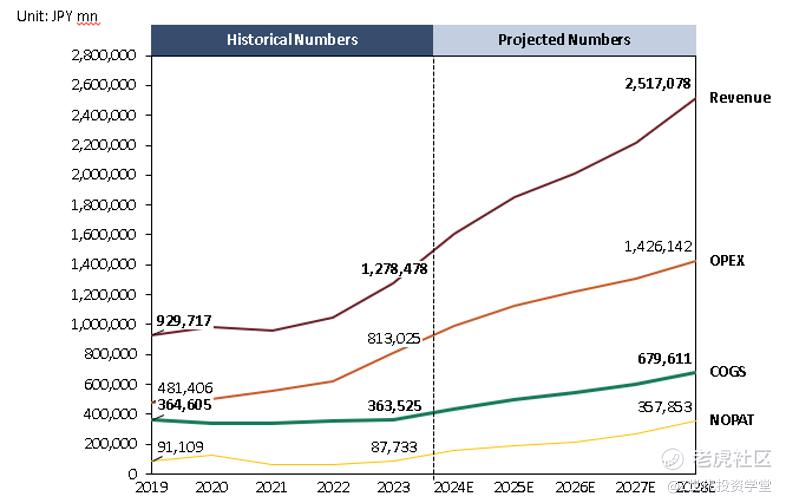

Daiichi Sankyo's revenue from 2019 to 2028 showcases a steady growth trajectory. Total revenue increased from 929,717 in 2019 to 2,517,078 in 2028, with consistent year-over-year growth rates ranging from -2% to 26%. The company's ADC products, such as Enhertu (DS-8201) and Dato-DXd (DS-1062), demonstrated remarkable growth, accounting for a rising percentage of total revenue over the years. Enhertu specifically showed significant growth, increasing from 1.4% of total revenue in 2020 to 48.6% in 2028. Other revenue sources, including Sankyo Espha, Lixiana (Edoxaban), Tarlige (eptinezumab), and American Regent, maintained a significant portion of total revenue, though their percentages decreased as the LOE issue.

3 ADCs

Daiichi Sankyo's three flagship ADC programs that are key parts of their strategy include:

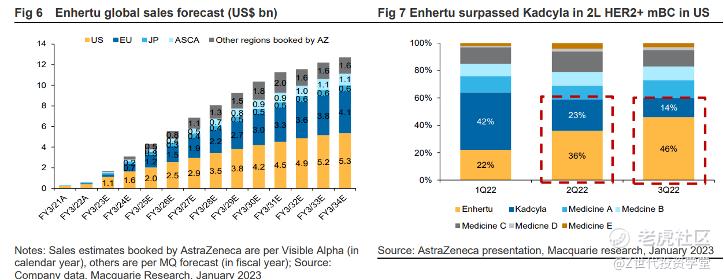

Enhertu (trastuzumab deruxtecan) - An HER2-directed ADC approved for metastatic breast and gastric cancers. It is their lead product and has demonstrated significant tumor shrinkage and overall survival benefits in clinical trials.

Dato-Dxd (datopotamab deruxtecan) - A TROP2-targeted ADC in late-stage development for multiple cancer types including non-small cell lung and breast cancer. Early data shows promise as a potential new standard of care.

DS-1062 (milciclib-cetuximab conjugate) - A c-Met/EGFR bispecific ADC currently in Phase 1 trials for various solid tumors. It combines targeted delivery of two different chemotherapies via a single agent.

Daiichi Sankyo's ADC (antibody-drug conjugate) technology stands out for its unique features and capabilities, which contribute to its potential to outperform other ADC technologies in the field. Here are some key aspects that distinguish Daiichi Sankyo's ADC technology:

Payload Innovation: One crucial element of ADC technology is the cytotoxic payload, the drug component DXd that is attached to the antibody. Daiichi Sankyo has developed a portfolio of potent cytotoxic payloads that exhibit high efficacy in targeting and killing cancer cells. These payloads are designed to be stable during circulation in the bloodstream and selectively released upon reaching the tumor microenvironment, maximizing their therapeutic impact while minimizing side effects.

Site-Specific Conjugation: Daiichi Sankyo employs a site-specific conjugation approach, which allows for precise attachment of the cytotoxic payload to the antibody. This method ensures consistent drug-to-antibody ratios, resulting in a more homogeneous and predictable ADC product. By maintaining a defined drug-to-antibody ratio, the efficacy and safety of the ADC can be optimized, leading to improved therapeutic outcomes.

Enhanced Antibody Design: The selection and engineering of the antibody component are critical in ADC technology. Daiichi Sankyo focuses on developing high-affinity antibodies that specifically target tumor-associated antigens. By selecting the right antibody and optimizing its properties, such as binding affinity and internalization rate, Daiichi Sankyo's ADC technology can effectively deliver the cytotoxic payload into cancer cells, enhancing the precision and potency of the therapy.

Robust Linker Technology: The linker serves as the bridge connecting the antibody and the cytotoxic payload in an ADC. Daiichi Sankyo has developed proprietary linker technologies that provide stability during circulation and controlled release of the cytotoxic payload within the targeted cancer cells. This ensures that the payload is released at the right time and location, maximizing its therapeutic effect while minimizing off-target toxicity.

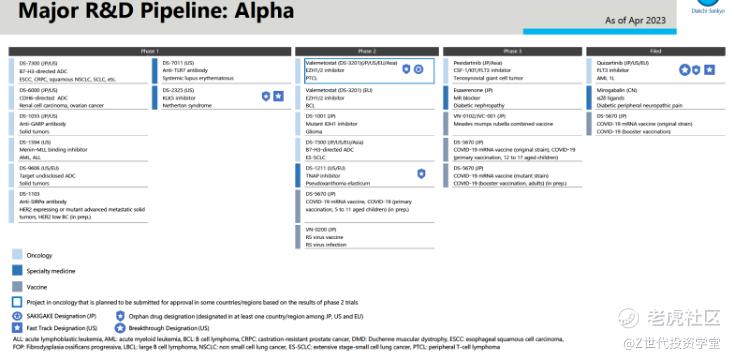

Alpha

Daiichi Sankyo's commitment to innovation extends beyond its focus on antibody-drug conjugates (ADCs) in oncology. The company has also implemented an Alpha strategy R&D pipeline to explore additional opportunities in the fields of oncology, specialty medicine, and vaccines. This strategic approach demonstrates Daiichi Sankyo's dedication to expanding its portfolio and addressing unmet medical needs across various therapeutic areas.

Within the Alpha strategy R&D pipeline, Daiichi Sankyo aims to identify and develop novel therapies that have the potential to make a significant impact on patient care. By exploring opportunities in oncology, the company continues to seek out innovative targets, pathways, and treatment modalities that can enhance the understanding and management of cancer. Additionally, Daiichi Sankyo's focus on specialty medicine highlights its efforts to develop therapies for specific diseases or patient populations where there may be limited treatment options available.

Rising ROIC with increasing margin and stable capital efficiency

Operating expenses have been stable at 60% of total revenue, higher than its peers due to it is expanding globally. The company guides an improving margin profile to 10% in 2025 There is further room for the decrease in S&M cost and we believe the SG&M/Rev ratio will decrease from 37% in 2023 to 33% in 2026. R&D costs will keep high but decrease from 27% to 24% of the total expenses to keep its leading positions.

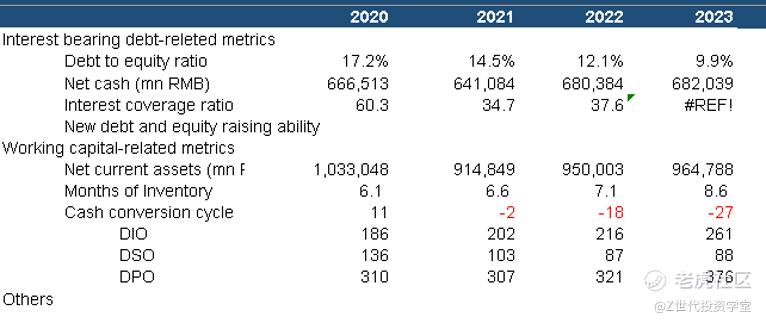

Capital efficiency of Daiichi Sankyo will keep high at around 2.5 as its incremental capital expenditure won’t fluctuate much and the solid position in the value chain ensures its working capital efficiency.

Strong resilience to withstand cycles

Resilient balance sheet with low debt profile and improving working capital metrics. Its net cash keep high at around 0.7tn JPY while its cash conversion cycle has become negative due to its improving bargain power with suppliers, thanks to the popularity of Enhertu.

Long commitment of the management team with aligned interest

Valuation

Both CCA and DCF valuation methods are applicable to Daiichi Sankyo.

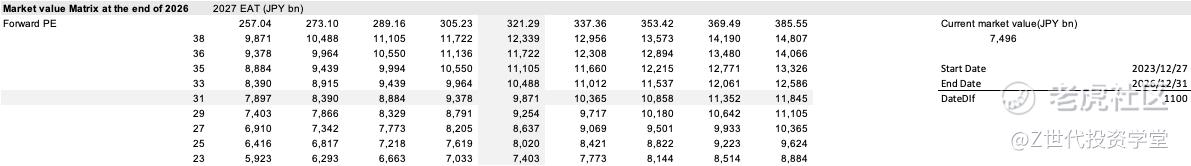

For CCA, we give a PE of 40x in three years. With the estimated net profit growth of 30% in 2027, we will have the forward PE of 31x. In the model, the EAT in 2027 is 321.3bn JPY. So the implied valuation is 9871bn JPY, which is a upside of 39%.

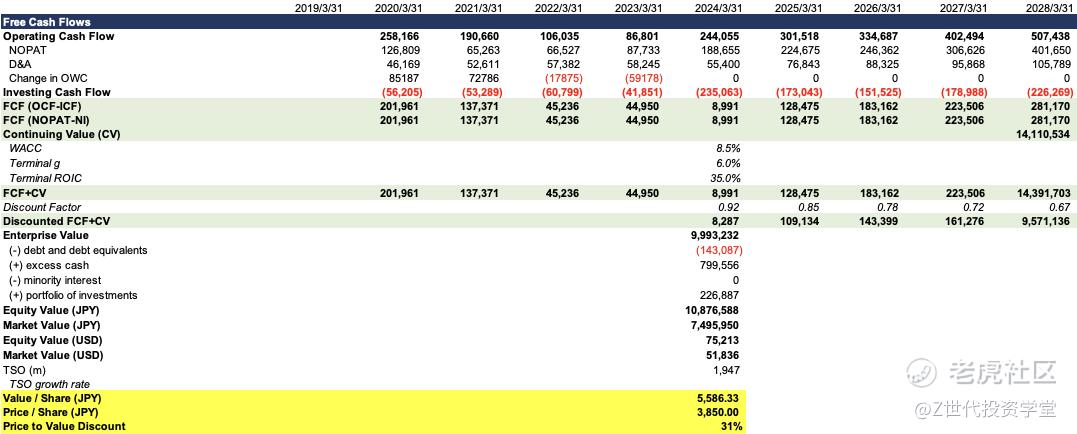

For DCF, the free cash flow projection and valuation are as follows. We give the WACC of 8.5% and 6% terminal growth after 2028. We will get the market value of 7496bn JPY, with an implied 31% price to value discount.

Risks and Mitigation

Late-stage R&D failures or disappointments

Daiichi Sankyo’s long-term value is underpinned by its deep pipeline. If there are R&D failures on the key products, the NPV will be discounted.

Mitigants:

Diversify its pipeline to reduce reliance on a single product

Active partnerships to reduce risks and decrease development costs

Manufacturing accidents of biologics

Manufacturing of biologics are hard and accidental, espeically for ADC. Problem with manufacturing may do harm to patients’ health and affect the company’s reputation

Mitigants:

High standard of quality control

Balance in-house manufacturing and CDMO to mitigant risks

Disruptive biology technologies that replaces existing products

Cancer screening, mRNA, cancer vaccine may replace the ADC methods in the long run

Mitigants:

Partner with frontier players

Acquire disruptive technologies

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

如果你想了解有哪些前沿科技的投资机会,想学习真投资大佬们的投资秘籍,想投资自己的人生,那就快来购买《大赢家》漫画吧!漫画中采访了许多职业投资人和上市企业,通过有趣的故事传达投资理念,我们相信在阅读的过程,你一定会有所收获。

修改于 2024-04-01 22:40

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。