Initial Report(part1): Daiichi Sankyo (4568.T), 67% 5-yr Potential Upside (VIP GC, 谭天禹)

Executive Summary

ADC, or Antibody-Drug Conjugate, has emerged as a groundbreaking modality for cancer treatment, revolutionizing conventional approaches across various indications. Daiichi Sankyo has established itself as the global leader in this field, boasting an industry-leading technology platform and a robust pipeline. This places the company in a unique position as a pioneering force in the disruptive biotechnology sector on a global scale.

In terms of financial performance, Daiichi Sankyo is poised for remarkable growth, primarily driven by its Her-2 ADC and Trop-2 ADC products. Revenue is projected to double, while net profit is expected to triple over the next three years. Additionally, the company's extensive ADC pipeline ensures sustainable growth for the foreseeable future.

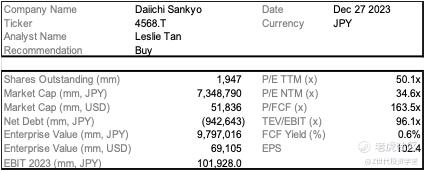

Regarding stock performance, the forward PE ratio for the next three months stands at 34.6x. Given its status as one of the few exceptional growth stocks in the Japanese healthcare market, Daiichi Sankyo is Ill-positioned to benefit from the anticipated strength of the Japanese capital market in the coming years. The three-year target price of 5334 JPY implies a PE ratio of 40x, offering a 39% upside compared to the current stock price and realizing an 11.5% IRR. Furthermore, the five-year target price of 5334 JPY implies a PE ratio of 30x, also providing a 39% upside compared to the current stock price and realizing a 10.9% IRR.

Company Overview

Founded in 1899 in Tokyo, Japan, Daiichi Sankyo has established itself as a prominent player in the pharmaceutical industry. As a leading healthcare company, it has made significant contributions in medical innovation and therapeutic advancements. Notably, Daiichi Sankyo has been involved in groundbreaking research and development, resulting in the introduction of several successful drugs and treatments. In 2006, the company acquired the Indian generic drug manufacturer Ranbaxy Laboratories, expanding its global presence and enhancing its product portfolio. With a diverse range of pharmaceutical products, Daiichi Sankyo operates in over 20 countries and is recognized for its commitment to improving global health.

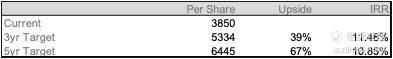

In the latest financial year, Daiichi Sankyo reported a revenue of 1,278,478 mn JPY and demonstrated a growth rate of 22%. Key stakeholders in Daiichi Sankyo include prominent institutional investors, with Capital Research and Management Company at 7.89%, BlackRock at 6.4%, Nomura Asset Management at 5.27%, and Nissay Asset Management at 4.48%.

Business segments and revenue drivers

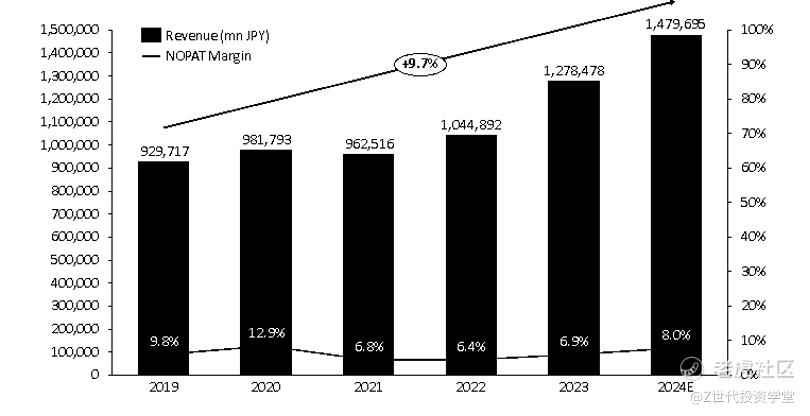

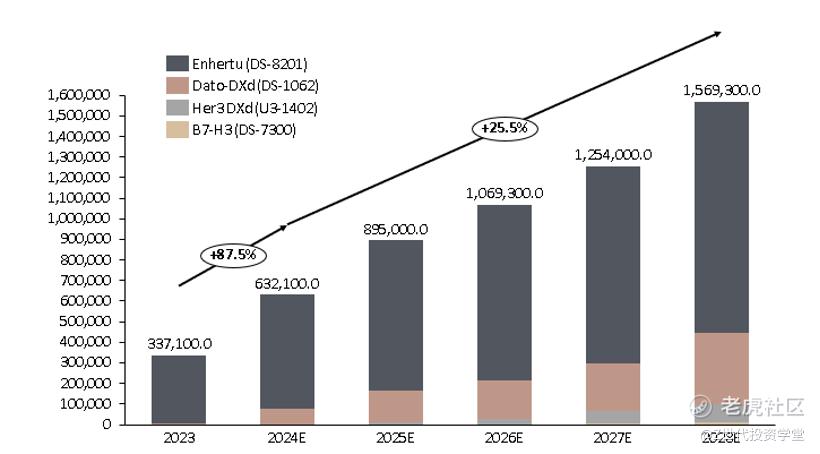

Daiichi Sankyo’s revenue consists of three segments: ADC products, Milestones/ Royalties and other drugs. As of 2023, ADC products account for 26.4%, Milestones/ Royalties account for 4.9% and other products account for 68.7%. ADC products include ADC Products, Enhertu (DS-8201), Dato-DXd (DS-1062), Her3 DXd (U3-1402) and B7-H3 (DS-7300), which are the main drivers in the coming years.

ADC Products

Daiichi Sankyo has a robust pipeline of ADC candidates that are being evaluated in clinical trials across multiple indications. These include HER2-targeting ADCs for breast cancer, TROP2-targeting ADCs for various solid tumors, and B7-H3-targeting ADCs for lung and other cancers. The company's commitment to advancing ADC technology is demonstrated by its investment in research and collaborations to explore new targets and improve clinical outcomes.

DS’s ADCs are designed to selectively deliver potent cytotoxic agents directly to cancer cells, minimizing damage to healthy tissues and reducing side effects. This targeted approach enhances the therapeutic efficacy of the treatment while potentially improving patient outcomes. The company utilizes its deep understanding of antibody engineering, linker technology, and potent cytotoxic payloads to create novel ADCs with enhanced properties, which are leading the treatment of the unmet medical needs for breast cancers globally and becoming the main growth driver for the next five years.

Daiichi Sankyo’s ADC revenue is expected to grow at a CAGR of 25.5% in the next five years. Its total revenue is expected to grow by five times to 1.5tn at the end of 2028.

Milestone and Royalties

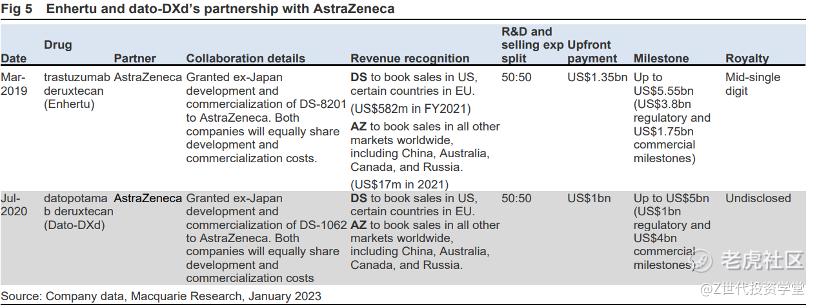

Daiichi Sankyo and AstraZeneca have formed a strategic partnership in the field of ADCs to accelerate the development of innovative cancer therapies. This collaboration combines Daiichi Sankyo's expertise in ADC research and development with AstraZeneca's global commercialization capabilities. The partnership includes exclusive global rights for AstraZeneca to Daiichi Sankyo's lead ADC candidate, DS-8201, which targets HER2 (human epidermal growth factor receptor 2) - a protein overexpressed in certain cancers, particularly HER2-positive breast cancer. Additionally, the collaboration extends to the development of Trop2-targeting ADCs, as Trop2 is highly expressed in various solid tumors.

DS-8201, the flagship ADC candidate, has shown promising results in clinical trials by specifically targeting HER2 on cancer cells, delivering a potent cytotoxic payload to inhibit tumor growth. AstraZeneca provides significant financial support to Daiichi Sankyo as part of the partnership agreement, including upfront payments, royalties, and milestone fees. Daiichi Sankyo stands to receive royalty payments based on net sales of DS-8201 and potential future ADC products resulting from the partnership. Moreover, the collaboration encompasses the development of Trop2-targeting ADCs, leveraging the high expression of Trop2 in solid tumors such as lung, breast, and bladder cancers.

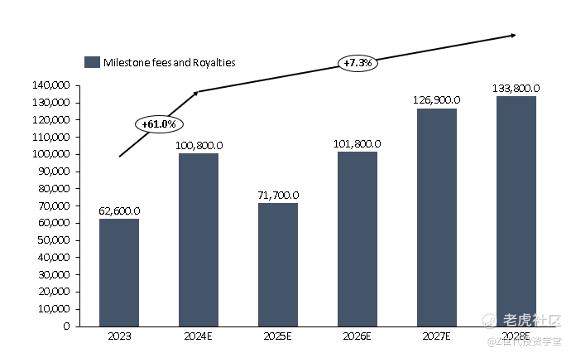

Daiichi Sankyo’s royalties and milestone fee revenue is expected to grow at a CAGR of 7.3% in the next five years. The business will contribute more than 100bn JPY cash to the company every year.

Others

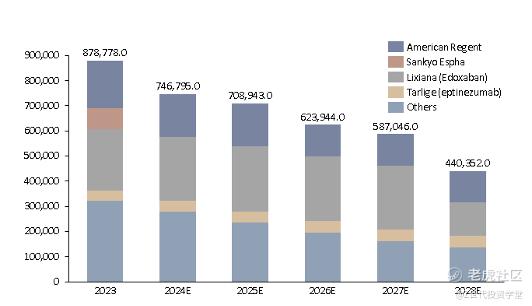

For others, Daiichi Sankyo's history of M&A has led to a diverse range of businesses and products within the company. Through strategic acquisitions, Daiichi Sankyo has expanded its portfolio, entered new markets, and enhanced its capabilities in various therapeutic areas. These M&A activities showcase the company's commitment to growth and innovation.

As a result, Daiichi Sankyo's portfolio spans multiple therapeutic areas, including cardiovascular, oncology, and infectious diseases, enabling the company to address diverse patient populations and contribute to the advancement of healthcare. Daiichi Sankyo's diverse portfolio encompasses various notable products, including American Regent, Sankyo Espha, Lixiana (Edoxaban), and Tarlige (eptinezumab). These products showcase the company's commitment to delivering innovative solutions across different therapeutic areas.

American Regent, a subsidiary of Daiichi Sankyo, specializes in pharmaceutical ingredients. With a focus on quality and safety, American Regent plays a crucial role in the production of essential pharmaceutical components.

Sankyo Espha represents an important offering within Daiichi Sankyo's pharmaceutical lineup. This product contributes to the company's commitment to providing effective treatments for a range of medical conditions.

Lixiana (Edoxaban) is another significant product within Daiichi Sankyo's portfolio. As an oral anticoagulant, Lixiana offers a valuable therapeutic option for patients with atrial fibrillation and venous thromboembolism.

Tarlige (eptinezumab) is a noteworthy addition to Daiichi Sankyo's product range. Developed as a monoclonal antibody therapy, Tarlige addresses the needs of patients suffering from migraine attacks.

Cost drivers

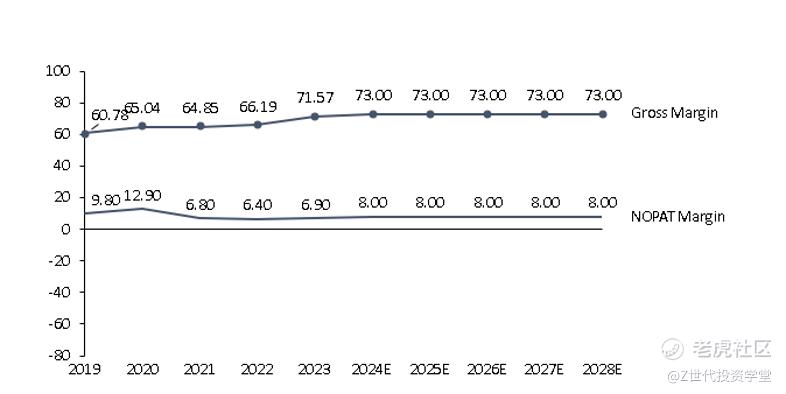

Gross margin of Daiichi Sankyo was 71.6% in 2023 and is expected to expand to 78.0% in 2028 driven by change of product mix. ADC products will contribute a higher gross margin thanks to the higher pricing of innovative drugs. NOPAT margin is stable at around 7%. I believe the NOPAT margin will grow a bit to 8.0% in 2028.

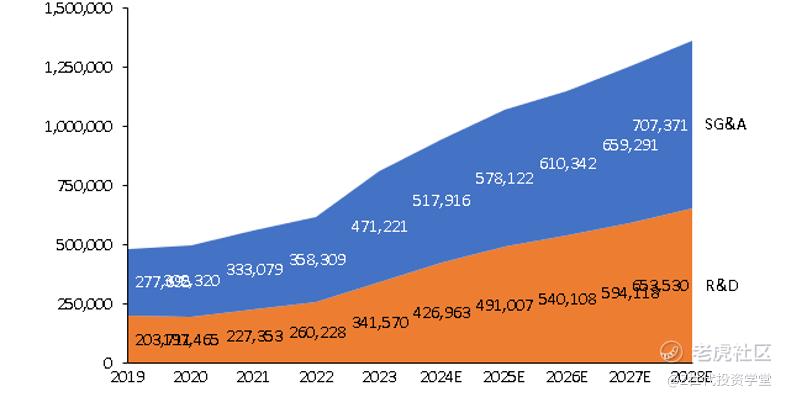

For expenses, R&D and SG&A are growing as the revenue expands, especially for the R&D, which is the main cost driver for a pharmaceutical company. I believe with sufficient cash flow and proven madality of leading products, Daiichi Sankyo will continue to invest for future pipeline by 2.5x folds.

Competitor Analysis

Companies like Seagen, ImmunoGen, and Spirogen have emerged as key players, with Seagen being involved in over 30% of the currently marketed ADC products. These companies have had a profound impact on the development of ADC technologies and patents. Choosing the right cytotoxic drug is a crucial aspect of ADC development.

Currently, most ADCs carry DNA-targeting or microtubule inhibitors. Substances like auristatin derivatives 奥瑞斯他汀衍生物 (MMAE) and maytansinoids美登木素生物碱衍生物 (Dx) are widely used, with Seagen and ImmunoGen being the owners of their respective technologies. PBDs (pyrrolobenzodiazepine) compounds, derived from Streptomyces, have also gained attention, with Spirogen being an early innovator in this area.

We can tell the patent domination of linkers and payloads in the chart below:

修改于 2024-04-01 22:38

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。