Initial Report(part2): Johnson & Johnson (JNJ), 212.61% 5-yr Potential Upside (EIP, Xinying CHAN)

3.1 Economic moat

Global Presence and Strong Brand Loyalty

JNJ has a strong global presence, operating in over 60 countries. The company's renowned brands, including Tylenol, Band-Aid, and Johnson's, are widely recognized and trusted by consumers. This expansive global reach and strength of its brand gives JNJ a competitive edge, establishing a positive reputation and fosters customer loyalty.

Innovative Research and Development (R&D) Focus

JNJ places significant emphasis on advancing research and development, making substantial investments in pioneering healthcare solutions. This steadfast commitment to R&D empowers the company to introduce cutting-edge products to the market, which gives the company an advantage in the fast evolving healthcare industry.

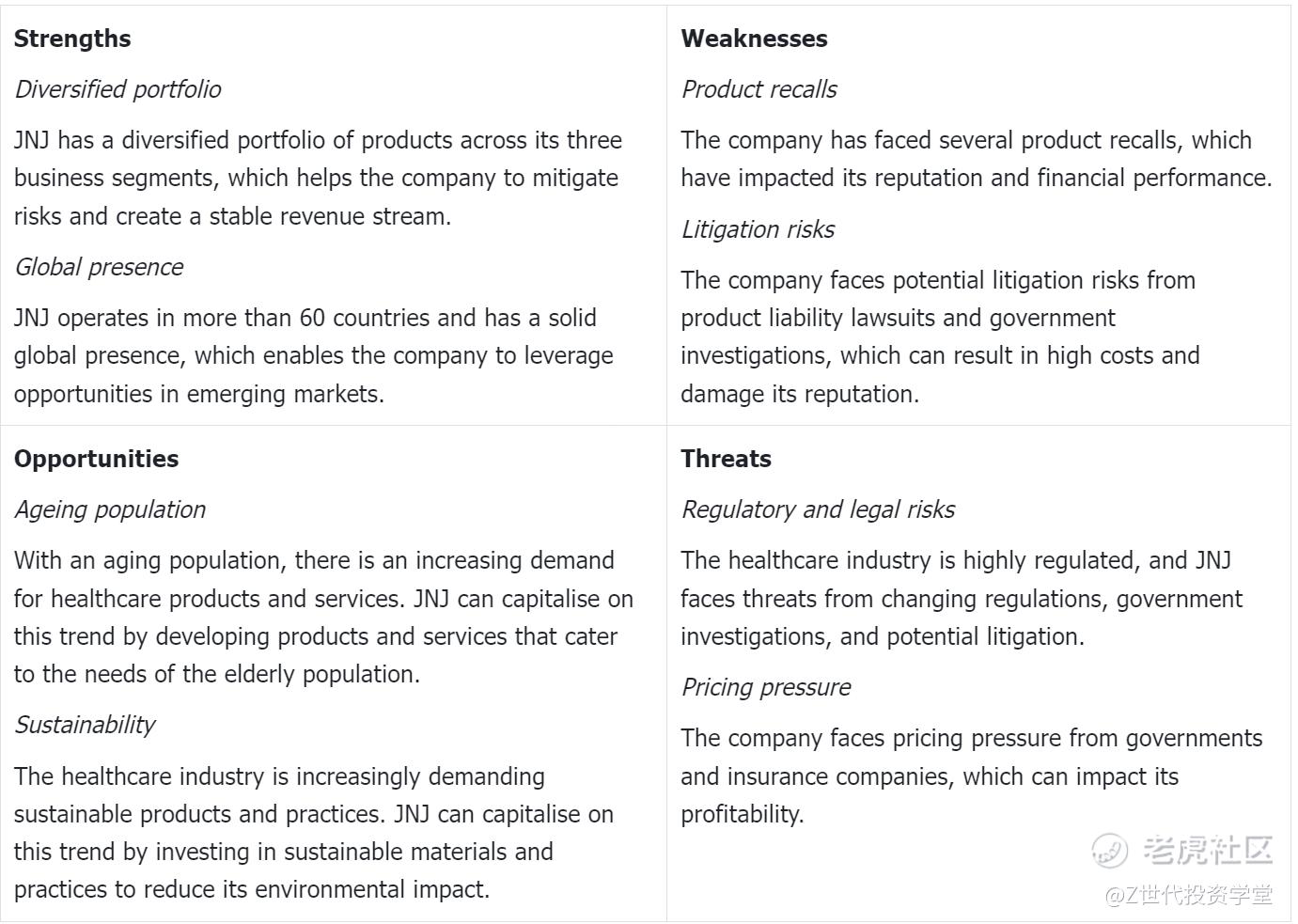

3.2 SWOT analysis

Investment Thesis

Investment Thesis 1: JNJ spin off of Kenvue

After the separation of JNJ’s consumer health segment, the company will only be left with 2 segments, namely its Pharmaceutical, and MedTech segment. The spinoff holds several advantages. Firstly, by removing the consumer health segment, which is the slowest growing sector among the 3 segments, JNJ can focus its growth on other faster growing sectors. In 2022, the Pharmaceutical and MedTech businesses each grew sales on an adjusted operational basis by more than 6%, while consumer health sales rose less than 4%. Consumer health also had a much smaller share of sales. In 2022, it brought in about $14 billion, while Pharmaceuticals and MedTech generated $52 billion and $27 billion respectively. Hence, without the consumer health segment, JNJ can allow for more investments in the other 2 higher growing sectors.

Additionally, the spinoff also generated over $13 billion for JNJ which can provide resources for internal pipeline enhancement or growth through collaborations and acquisitions. Even though the spinoff led to a decline in JNJ's sales and earnings forecasts for the year, the company's shares have fallen about 9%, making it an attractive investment at around 16 times forward P/E estimates.

Investment Thesis 2: Promising outlook in pharmaceutical segment with new Medicines

Johnson & Johnson is planning to introduce 20 novel therapies for cancer, immune, and neurological diseases by 2030. This will form the foundation of the company’s ambitious outlook on its forecasted sales growth, targeting a substantial 5% to 7% increase throughout the decade. In a recent business review, JNJ revealed that seven of these anticipated drugs hold the potential for peak annual sales exceeding $5 billion each.

The separation of the consumer segment has streamlined JNJ and allows it to focus on its more lucrative Pharmaceuticals and MedTech businesses. JNJ has a slightly lower expected growth rate of 5% to 7% for its pharmaceuticals segment, compared to the impressive 8% compound annual growth reported from 2017 to 2022, which was due to substantial sales spikes for key drugs such as Stelara and the multiple myeloma medicine Darzalex. Looking ahead, JNJ remains optimistic about its Pharmaceutical segment, citing strong prospects for existing key drugs like Stelara, Imbruvica, and Darzalex.

Investment Thesis 3: JNJ's Stable Dividend Yield and Diverse Portfolio

JNJ is positioned as a stable and low-risk investment among the "Big 8" US pharmaceutical companies. With the largest market cap and revenue in the industry, JNJ's stock is characterised by its resilience, evident in a relatively small spread between its high and low share prices over the past 12 months (20%). JNJ will be an attractive choice for investors looking for a dependable, dividend-paying stock, given its history of consistent dividend payments, a dividend yield of 2.62%, and a share price that tends to weather market fluctuations.

Moreover, JNJ maintains a diverse portfolio and continues to pursue growth opportunities. The company's revenue growth of 13.5% in 2021 and a forecasted 5% growth in the current year demonstrates its ability to adapt and evolve. JNJ's focus on adjusted earnings per share (EPS) growth, with a forecasted increase of nearly 10%, suggests a commitment to financial performance. While its size may limit the excitement of overnight gains, JNJ remains a solid investment option, offering incremental growth, a resilient share price, and a reasonable dividend.

Valuation

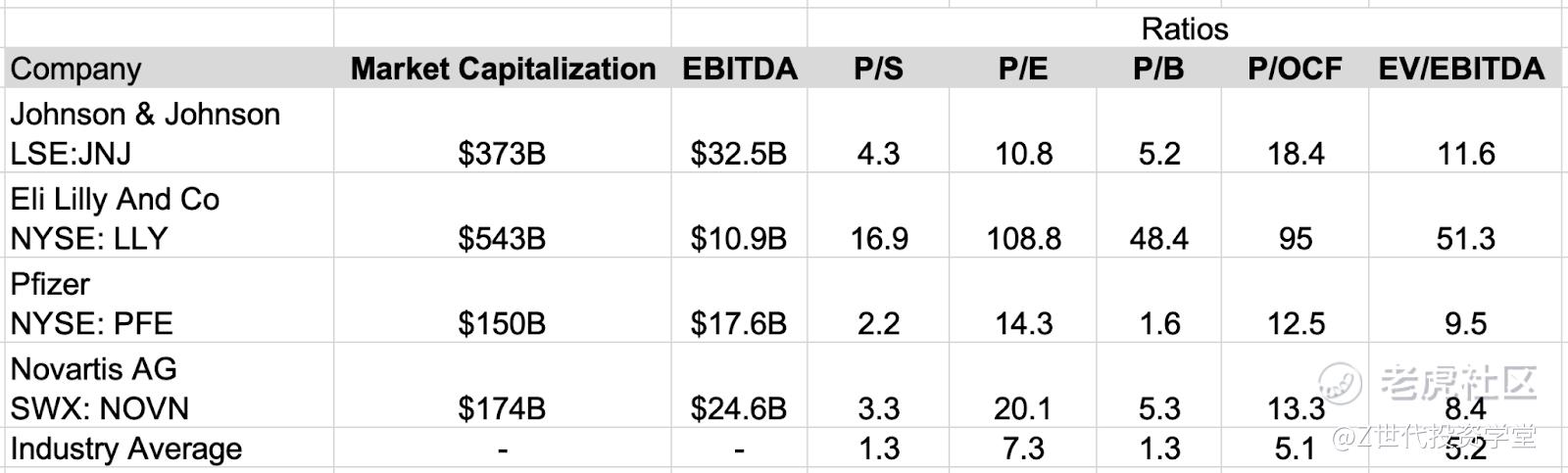

5.1 Comparables

Using financial indicators such as the Price to Earnings (P/E) ratio, Price to Sales (P/S) ratio, and EV/EBITDA multiples shows that JNJ is positioned above its industry peers in terms of trading metrics.

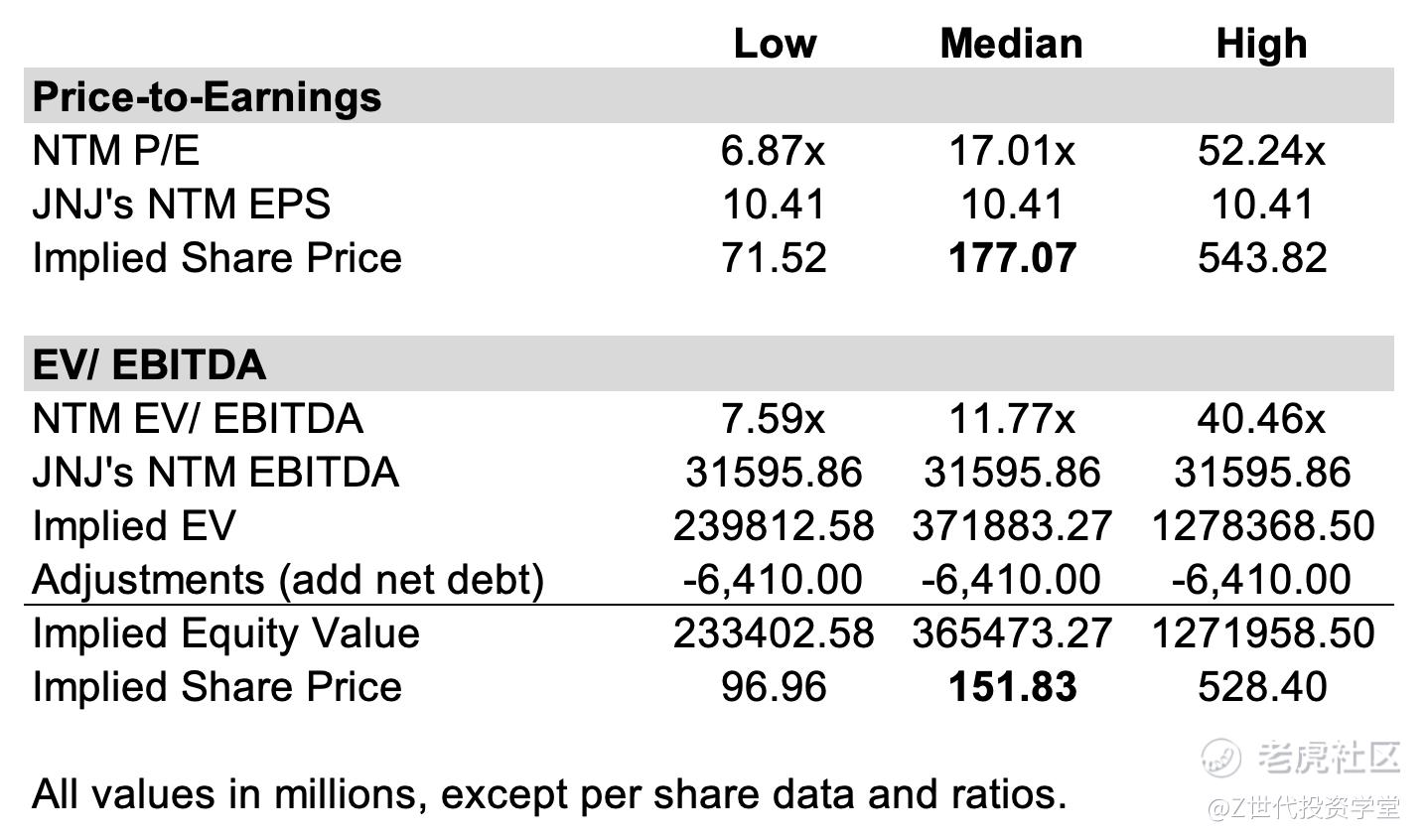

5.2 Relative Valuation

I recommend a BUY for Johnson & Johnson, setting a 3 year price target of $191.97, and a 5 year price target of $212.61. These targets indicate potential upsides of 25.25%, and 38.72%, respectively, from its closing price of $153.27 on December 20, 2023. These projections are based on forward multiples of JNJ. The significant potential for the five-year target is driven by anticipated higher revenue resulting from the Spin-off of Kenvue Inc. and promising prospects in the pharmaceutical sector with new upcoming drugs.

Risks and Mitigation

Risk: Tens of thousands of plaintiffs have sued JNJ, alleging that the company’s baby powder and other talc products sometimes contained asbestos and caused ovarian cancer and mesothelioma. The company's attempt to use its subsidiary's bankruptcy to halt these lawsuits was rejected by the court. It was ruled that neither the subsidiary nor JNJ were in financial distress.

Mitigation: In April, JNJ's subsidiary, LTL Management, filed for bankruptcy in Trenton, New Jersey. The filing includes a proposed settlement of $8.9 billion to address over 38,000 lawsuits and prevent the initiation of new cases. This marks the company's second endeavor to address talc-related claims through bankruptcy, following the rejection of an earlier attempt by a federal appeals court.In early Dec 2023, JNJ’s VP, Erik Haas, said the company had resolved all but one of the cases scheduled for trial in 2023, "significantly curtailed" trials in 2024 and did not require the company to record any new charges against earnings. It was also reported that JNJ had reached settlements covering about 100 people.

Conclusion

In conclusion, Johnson & Johnson (JNJ), a leading global healthcare and pharmaceutical company, strategically streamlined its focus by separating its consumer health segment into Kenvue. This shift, fuelled by a commitment to innovation and corporate responsibility, allows JNJ to focus on its pharmaceuticals and MedTech segments, particularly the promising pharmaceutical division with strong growth projections and a reliable dividend yield. JNJ also invests heavily in R&D which will allow it to anticipate and keep up with the rapidly growing industry, while at the same time maintain product safety for consumers.

Additionally, despite facing legal challenges related to talc products, JNJ's solid market capitalization of $373B, a 2.62% dividend yield, and recent revenue growth of 13.5% position it as a stable and potentially lucrative investment. Investors should carefully consider the litigation risks alongside JNJ's robust fundamentals and growth potential.

修改于 2024-04-01 22:43

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。