Initial Report(part2): Palantir Technologies (PLTR), 162% 5-yr Potential Upside (EIP, Kenny CHENG)

The main goal of any share repurchase program is to deliver a higher share price. This buyback

announcement could signify that the board may feel that the company's shares are

undervalued, making it a good time to buy them. Meanwhile, the announcement could also be

perceived as an expression of confidence by the management.

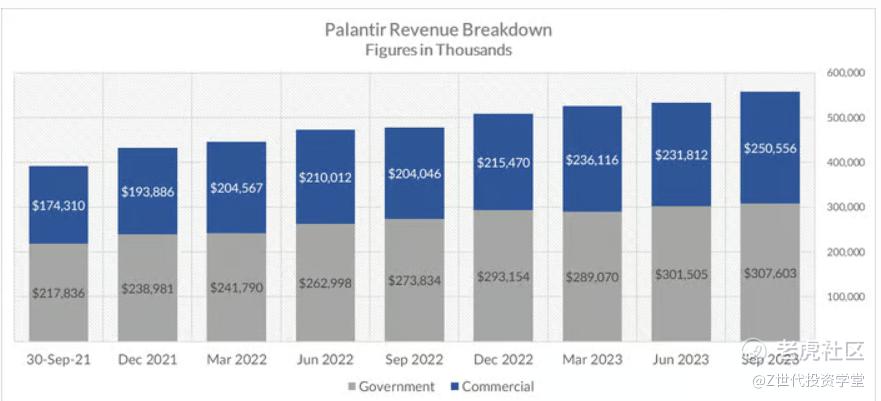

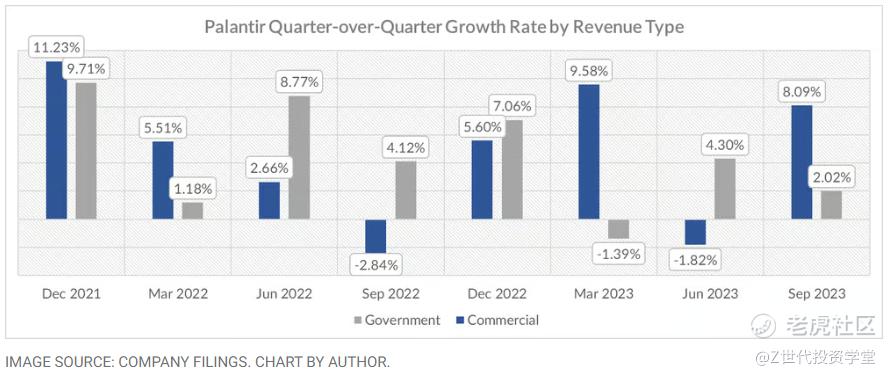

Changing Revenue Mix toward the Commercial Segment

In Palantir's most recent quarterly results, the company's government revenue totaled a little

under $308 million, which was 23% (compared to 25% in 2021) more than the $251 million in

revenue its commercial clients brought in.Customer count grew 34% year-over-year. US commercial customer count grew 37%

year-over-year, from 132 customers in Q3 2022 to 181 customers in Q3 2023.

Commercial revenue grew 23% year-over-year to $251 million. US commercial revenue grew

33% year-over-year to $116 million. Government revenue grew 12% year-over-year to $308

million.

With the diversification toward the commercial segment, Palantir is able to seize opportunities

from a recurring and consistent source of revenue from the public sector and also tap on

increasing demand for AI amongst enterprises.

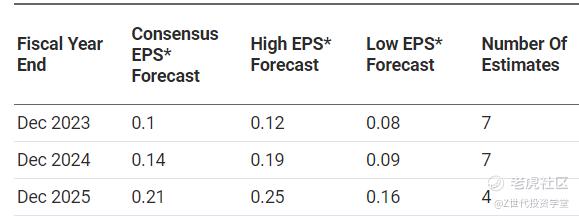

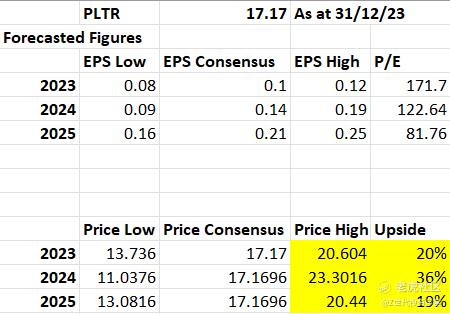

Valuation [12]

PLTR’s Forecasted EPS and P/E

1Y: Upside of 20% in 2023

2Y: Upside of 36% in 2024

3Y: Upside of 19% in 2025

Risks and Mitigation [14]

Risk(s)

Palantir has a significant revenue concentration.

Majority of the company’s revenue is derived from the public sector with its early success in

helping the US government. Hence, the company is highly dependent on the public sector and

this might limit Palantir’s growth in the future. With rising tensions between different countries

and worsening geo-political climates, Palantir’s access to governments around the world might

be restrained due to national security issues.

Palantir's top three and top twenty customers accounted for 17% and 52% of its revenue in

2022. While these relationships are reasonably stable due to high software switching costs,

having too much revenue concentrated within a few clients could be problematic. The

sustainability of such revenue streams is heavily dependent on the renewal of the contracts.

Hence, Palantir needs to have a strategy to drive at high client retention rates to ensure

continuous revenue streams.

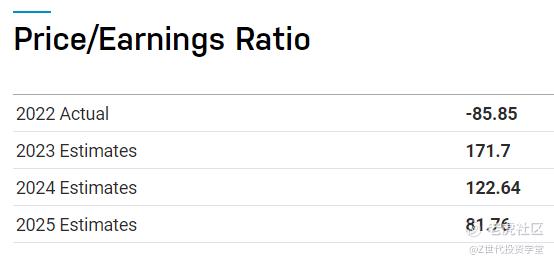

Palantir’s valuation might not be reasonable.

The stock trades at price-to-sales (/PS) and price-to-earnings (P/E) ratios of 18.7 and 303,

respectively. This valuation could be justified to some as Palantir stands to benefit tremendously

from the increased AI demand, as Generative AI is forecasted to be a $1.3 Trillion market by

2032.

However, the very high valuations still might deter investors from investing in the company as it

provides no safety margin, in the event that the good prospects change.

Privacy concerns around clients’ information

Patient privacy fears as US spy tech firm Palantir wins £330m NHS contract.

Doctors’ organisations and human rights charities have expressed concerns about the contract

and Palantir, including whether patient data would be suitably protected.

Privacy concerns have also been raised, by groups including the British Medical Association,

about whether confidential data will be seen by Palantir and other organisations outside of the

NHS.Mitigation(s)

Palantir is trying to diversify revenue streams toward the commercial segment

The top 20 customer revenue concentration was high at 52% in 2022, it declined from 67% in

2019 as Palantir grew its client base.

Since the start of 2023, it is clear that the commercial business has been doing much better,

with at least 8% quarter-over-quarter revenue growth in two of the past three quarters.

Palantir has recently launched AI bootcamps in a bid to help businesses find use cases for AI by

trying out Palantir's software and this is a trend that would very well continue into the future.

Such business strategies could help Palantir rapidly expand its commercial client customer

base.

Palantir can justify its valuation

With a forward price-to-earnings multiple of 61, the company trades at a substantial premium to

the S&P 500's average of 26. This valuation could be justified by the company’s solid

bottom-line momentum as the third-quarter net income jumped from a loss of $123.9 million to a

gain of $80 million. This is also Palantir’s first four consecutive quarters of profitability under

generally accepted accounting principles (GAAP).

Commitment to law and regulation [15]

Palantir is committed to complying with data protection legislation, including the data protection

regime introduced by the General Data Protection Regulation (EU Regulation 2016/679, the

“GDPR”), California Consumer Privacy Act of 2018 (the “CCPA”) as amended by the California

Privacy Rights Act of 2020, and other applicable US consumer privacy laws.There are a limited number of circumstances where Palantir may share its clients’ information

with third parties (for example, pursuant to a court order, for our marketing purposes, if we are

part of a merger, or with our business partners and service providers who support our business

or collaborate with us).

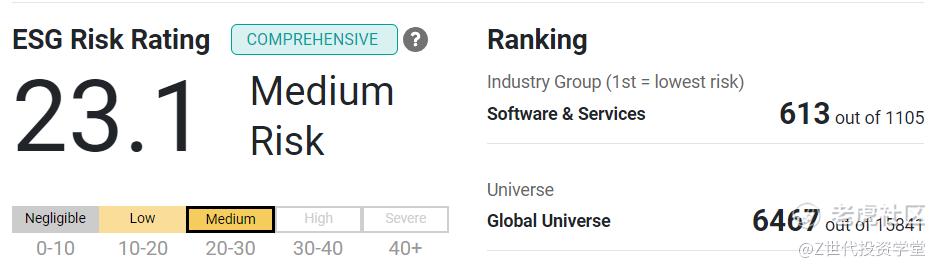

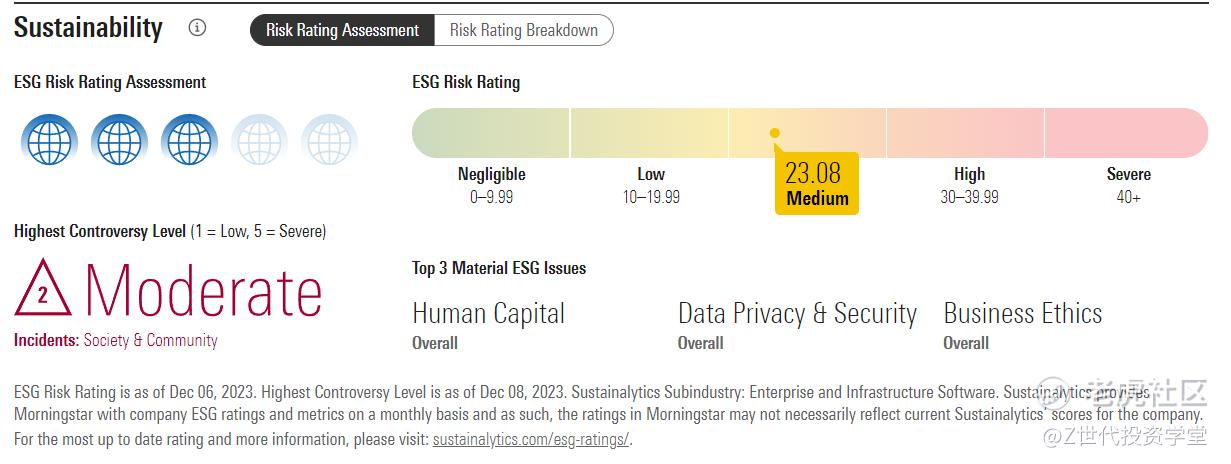

ESG Assessment

Sustainalytics [16]

Morningstar [17]

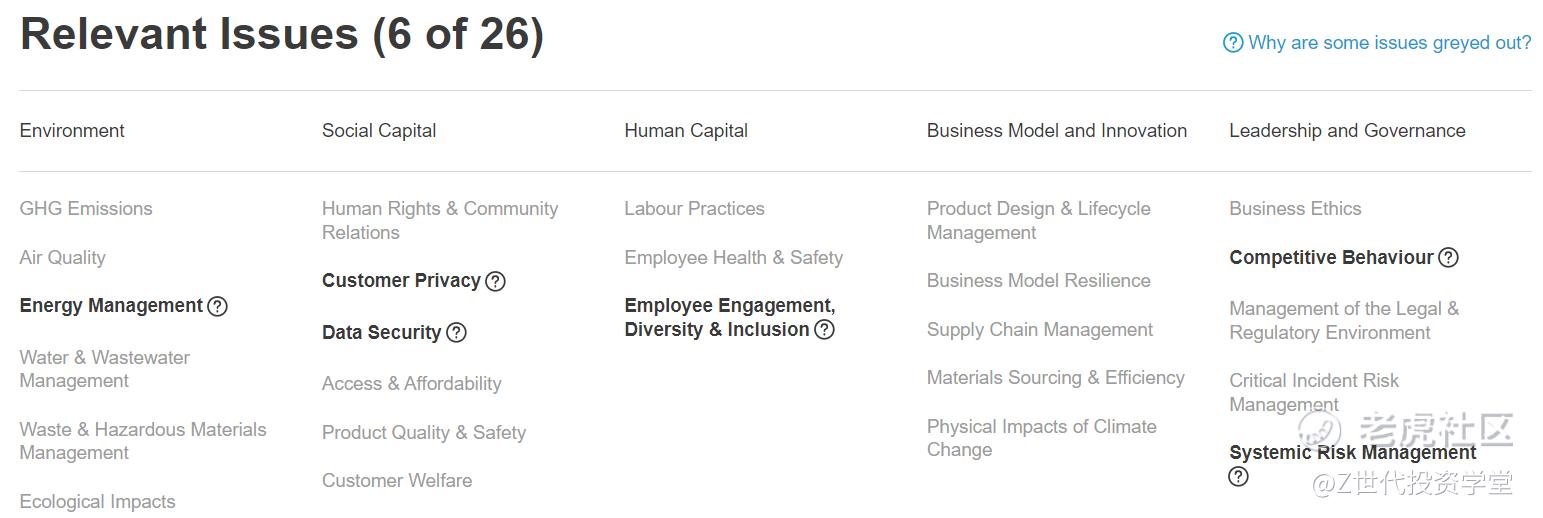

Materiality: Material ESG Issues for PLTR [18]

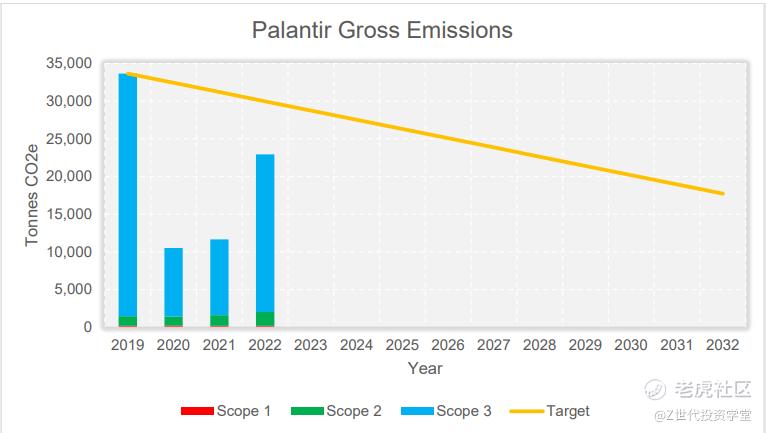

Energy Management [19]Palantir achieved carbon neutrality across its global operations in 2022 and sought to reduce or eliminate greenhouse gas (carbon) emissions across Scopes 1, 2, and 3, as defined by the Greenhouse Gas Protocol. Where emissions cannot be reduced or eliminated, it purchases credible, scientifically-verified carbon offsets to achieve carbon neutrality each year.

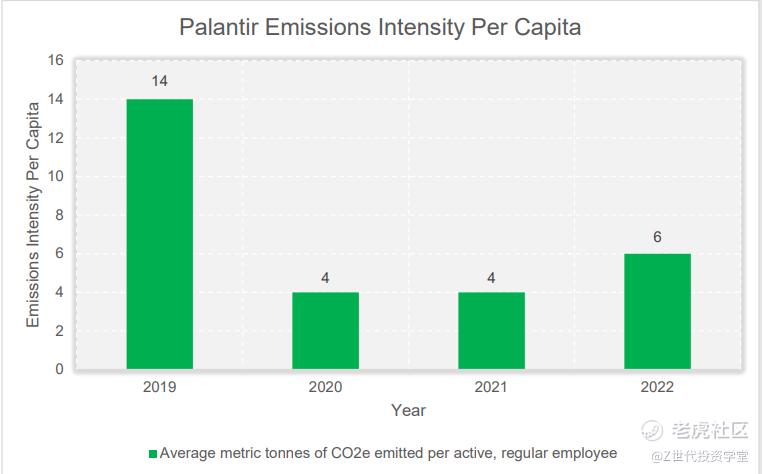

There was a 57% decrease in emissions intensity per employee in 2022 compared to its

baseline year of 2019. This is a significant sustainability advancement for 2022, as Palantir grew

its global headcount by 31% relative to 2021.

In 2022 as in prior years, PLTR took additional step of disclosure and transparency by including carbon emissions tabulations for hotels and lodging, which are not required by the Greenhouse Gas Protocol Corporate Accounting Standard (achieves signalling effect).

As seen, Palantir Global Emissions is well below its SBTi aligned targets for 4.2% YoY linear reduction in emissions. These are emissions excluding offsets.

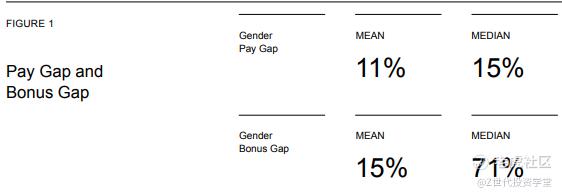

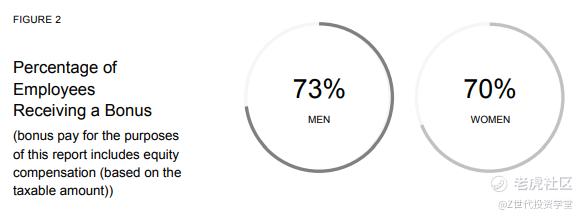

Unfortunately, there remains a pay and bonus gap between men and women at Palantir.

However, the percentage of employees who received a bonus is almost identical for both men and women. PLTR also made a lot of progress in closing the gender gap in our hiring, and as a result of our continued progress, had more women than men new UK hires during the bonus period of 2022. PLTR has put measures in place to ensure equal wages and inclusivity for employees across different demographics (Equitable hiring process, key partnerships, scholarships for women in tech etc.). Global compensation data is generally reviewed on a biannual basis to ensure that employees are paid appropriately based on their role, experience, and performance, regardless of gender. PLTR also standardised their offer packages for interns and new grads to help reduce pay gaps that historically impact members of underrepresented communities, levelling the playing field more. Customer Privacy and Data Security [16] Palantir currently offers the following data protection modules, which were specifically developed to help our customers comply with data subject rights requests under the EU General Data Protection Regulation (GDPR) and comparable privacy laws in other jurisdictions (e.g., Brazil’s Lei Geral de Proteção de Dados Pessoais (LGPD), the California Consumer Privacy Act (CCPA) and its recent amendments through the California Privacy Rights Act (CPRA), the Virginia Consumer Data Protection Act (VCDPA), etc. As a company, it does not collect data, sell data, or facilitate unauthorized sharing of data among customers or any other parties. Measures which have been implemented to ensure customer privacy and data security would include: 1. Targeted Search and Discovery 2. Granular Access Controls & Dynamic Data Minimization 3. Data Provenance Tracking 4. Audit Logging and Analysis5. Data Retention and Deletion Conclusion All in all, this report recommends a “buy” on PLTR for a short term investment horizon of about 3 - 5 years. With expected increase in demand for AI as interests around AI and technology continues to grow stronger, PLTR, which has established itself in the AI software space should be able to ride on this wave of opportunity. As PLTR continues to roll out initiatives and smart business strategies to capture new potential clients and convert them into customers, PLTR commercial revenue streams are expected to rise and continue in the coming years. Not forgetting its sticky revenue streams from the public sector, PLTR’s strong economic moat of long standing relationship with the US government should continue to play out well as new contracts are still being signed. With increasing clients and greater economies of scale, PLTR should ideally be able to increase its cost savings and increase its net income, after achieving its first four consecutive quarters of GAAP net income, suggesting that its business model actually works. The 3Y target is an upside of about 20 - 30%. Considering ESG, PLTR has addressed most of its material ESG issues and has committed to making good progress in the coming years. Justifications have been made for poor performance and should PLTR demonstrate that it is enroute to reaching its targets, I think PLTR is still a worthy investment.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

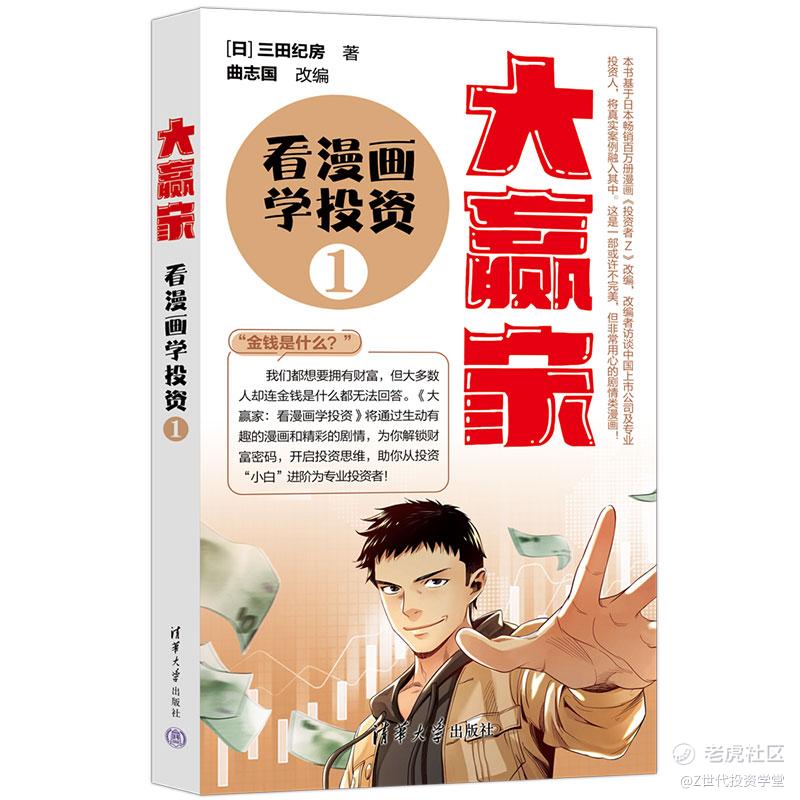

如果你想了解有哪些前沿科技的投资机会,想学习真投资大佬们的投资秘籍,想投资自己的人生,那就快来购买《大赢家》漫画吧!漫画中采访了许多职业投资人和上市企业,通过有趣的故事传达投资理念,我们相信在阅读的过程,你一定会有所收获。https://product.dangdang.com/29564921.html#ddclick_reco_reco_relate

修改于 2024-04-01 22:45

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。