Initial Report(part2): AutoZone (NYSE: AZO), 46% 3-yr Potential Upside (EIP, Louis TEE)

Investment Thesis

1. Defensive positioning amidst unfavourable economic backdrop in 2024 and beyond:

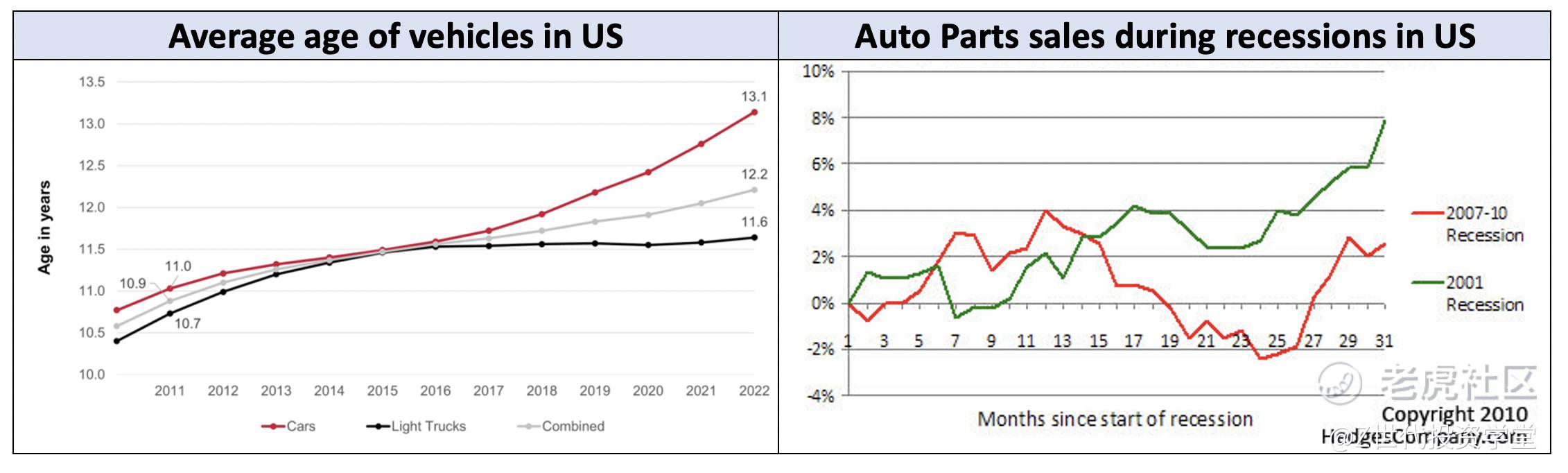

The nature of AZO’s demand is countercyclical – as the economic growth weakens, unemployment rises, real disposable wages decline – hence, consumers push back new car purchases during an economic downturn. As a result, used car numbers will increase after a recession which leads to more customers needing repairs and maintenance of their older cars.

As seen in the 2008 Great Financial Crisis and the 2020 Covid Pandemic, AZO’s same-store-sales (aka organic sales that are created in existing stores), grew the following years post-recession by high single digits to mid-teens.

The Covid Pandemic in 2020 caused new car sales in 2020-2022 to dwindle, making the average age of vehicles in the US to rise to an average of 13.1 years for cars, and 12.2 years for light trucks.

As a result, I am projecting that AZO’s SSS growth in 2024E to 2026E to grow at 3.1 to 3.4%, which is slightly higher than its pre-covid SSS growth trend from 2016 to 2019. In my opinion, I believe my projections are slightly higher than the street as I think AZO’s dominance in the US and share expansions in Mexico and Brazil would boost its SSS growth relatively higher than AZO’s competitors.

2. Aggressive store count expansions in Mexico and Brazil – I expect these emerging countries to contribute to AZO’s sales with a CAGR of ~10%:

AZO’s management aims to open 200 new stores annually in Mexico and Brazil by 2028, up from ~70 new stores annually in 2023.

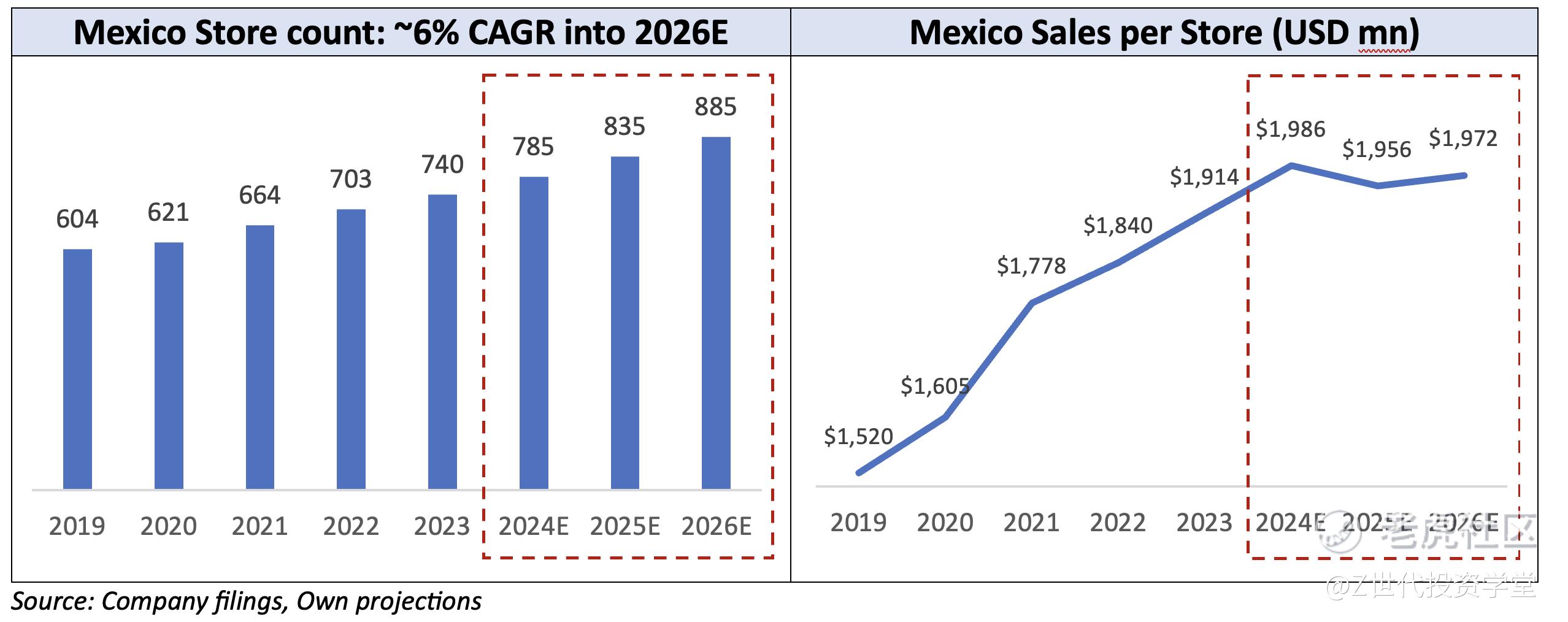

Mexico – Attractive operating margin structure with a good product-market fit

Mexico offers AZO incremental margin gains due to its lower wage rates.

In Mexico, cars are a lot older than US cars, and Mexican manufactured vehicles tend to break down faster and more easily. AZO recognizes this product-market fit along with a fragmented aftermarket retail market to allow it to capture more white spaces in the Mexican regions.

AZO has seen a massive growth in sales per store in Mexico from 2019 to 2023 as it scaled its SKUs and offer commercial programs to customers.

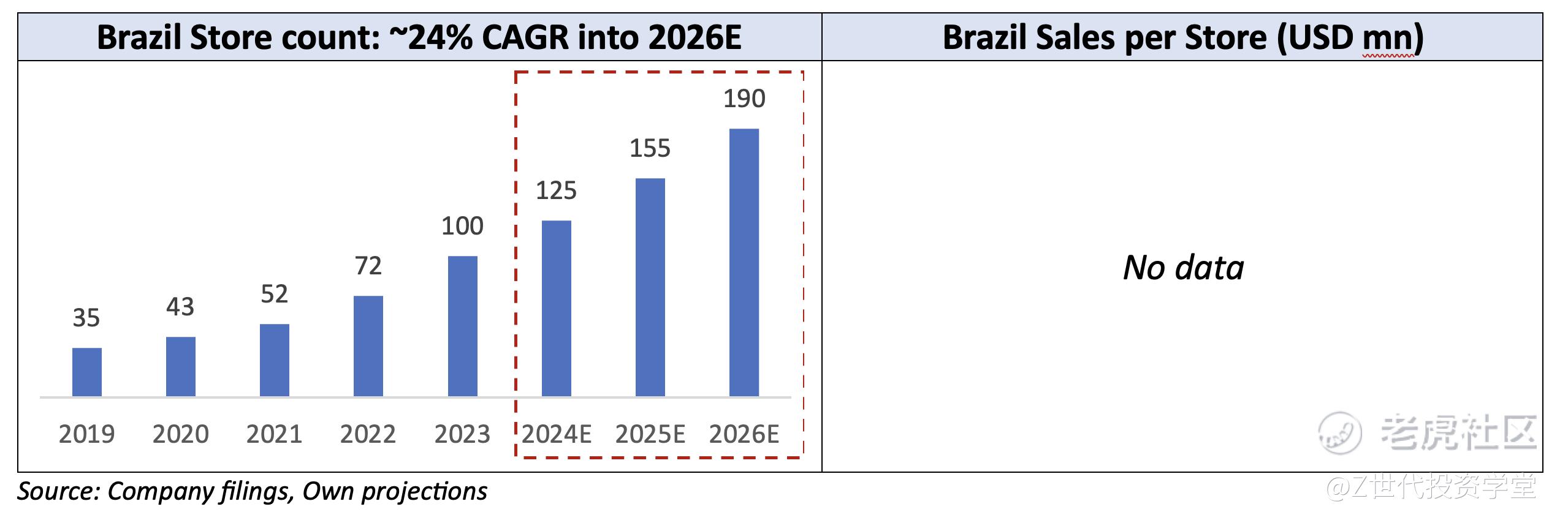

Brazil – Investment phase, ramping up store count aggressively

In the latest quarter earnings call by AZO’s management, it is noted that AZO is still losing money in Brazil as it is still in an investment phase as they are aggressively ramping up store count.

In Brazil, vehicles are ostensibly smaller compared to Mexico and US vehicles. Most Brazil vehicles are 1.4 litres instead of a typical 2 litre vehicle. AZO believes that this creates a tailwind for Brazil vehicles to breakdown more often as vehicles are often overused over its engine capacities.

Valuation

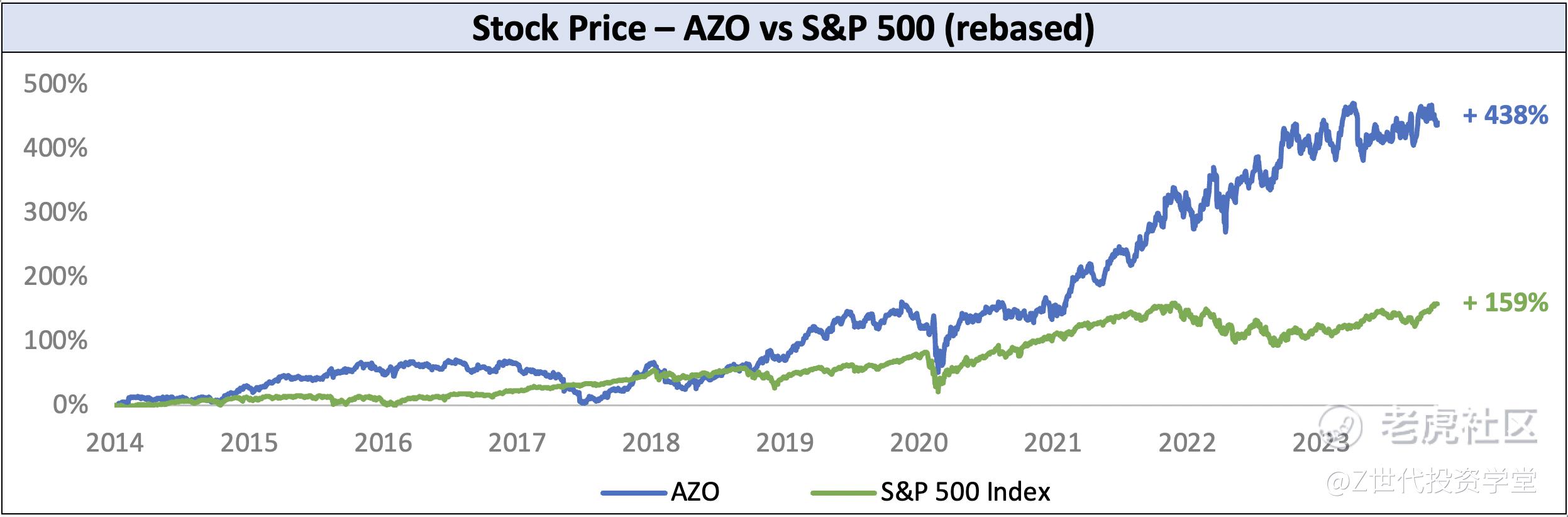

Recent Stock Price Movement

AZO stock had bled 5% in December attributed to consumer pullback in Commercial segment tire repair centers due to maintenance deferral of big ticket items due to an industry-wide softer discretionary performance. I believe this is seasonal as AZO’s management along with its competitors mentioning about a warmer winter in December (bad for afterpart sector as cars are more prone to breakdowns in colder temperatures).

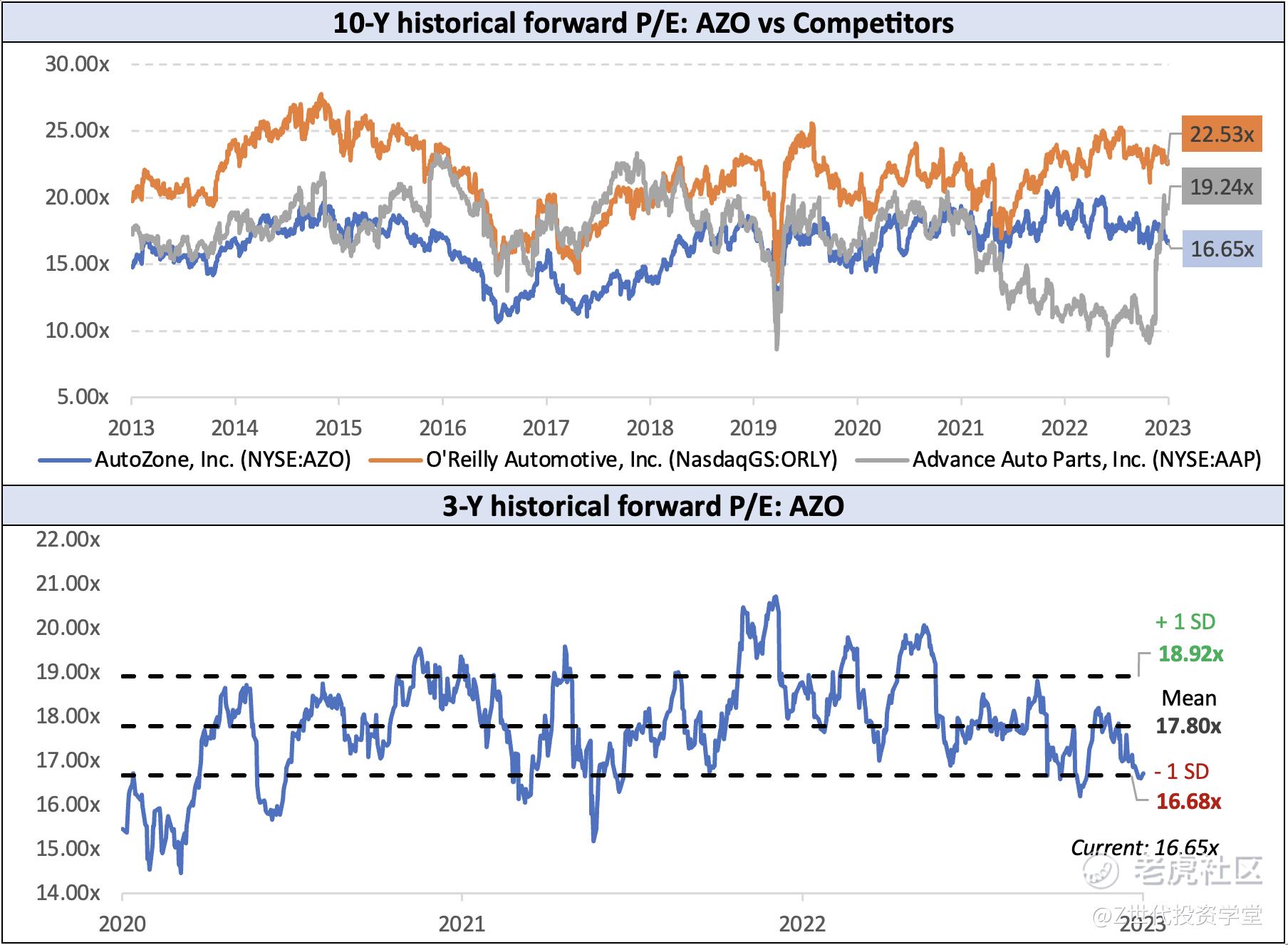

Forward Multiples

Owing to AZO’s December share price correction, its P/E ratio has declined to a current of 16.65x, which is below its 3-Y historical forward P/E of 17.80x. I believe AZO equity is currently attractively priced relative to its peers as well as to its own historicals.

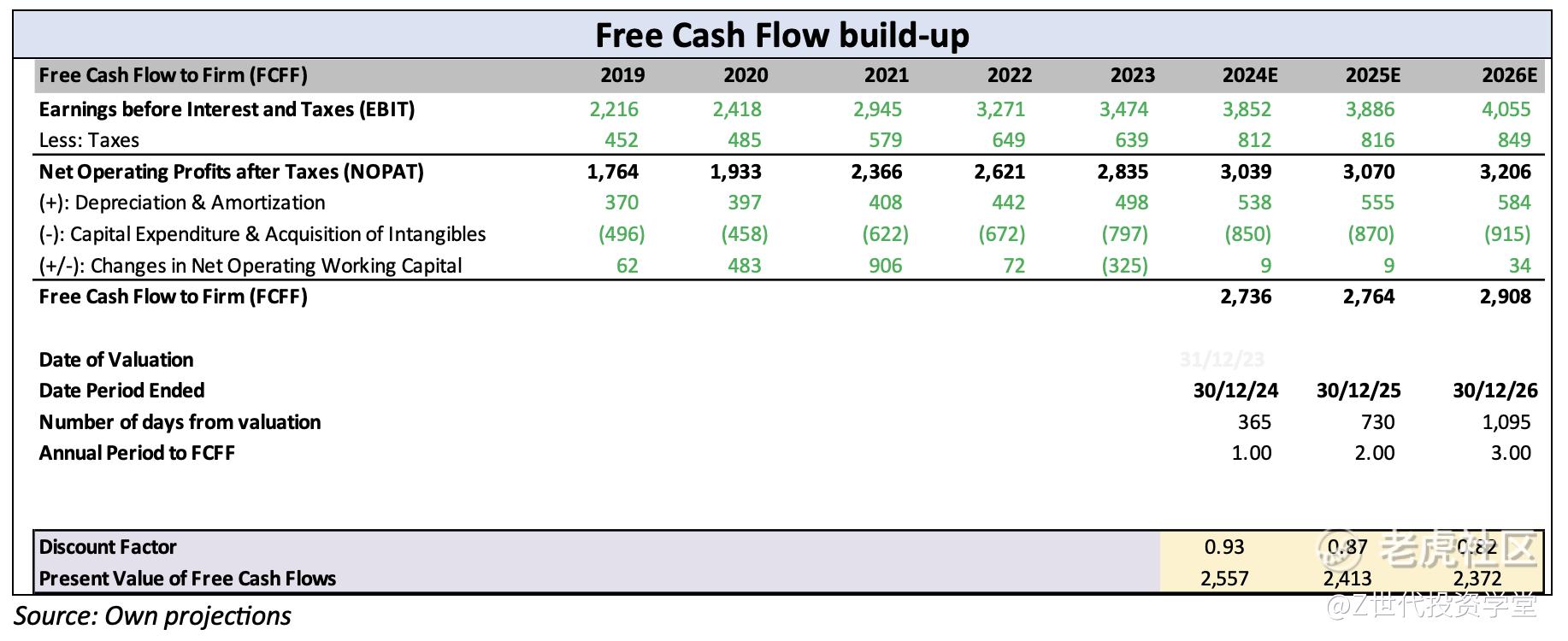

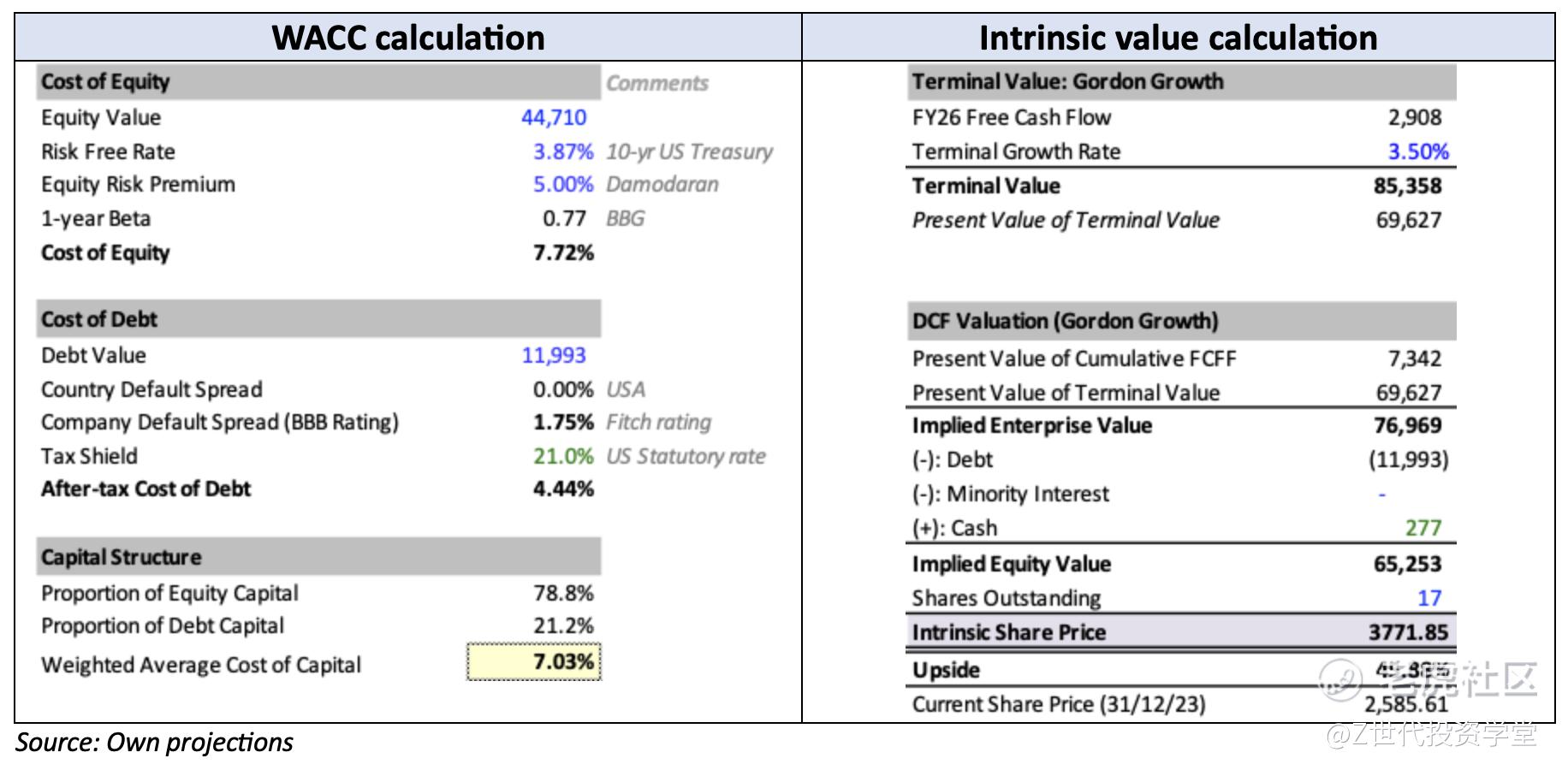

Discounted Cash Flow Valuation

In my discounted cash flow valuation of AZO, I decided to base my analysis on a 3-year projection horizon, because I believe the next 3 fiscal years would be most pertinent, given AZO's terminal growth rate depends on its execution risk in Mexico and Brazil as mentioned in its management's strategy for international expansion from 2024 to 2026.

My DCF valuation of AZO gives me an intrinsic share price of $3,771.85, an upside of 45.88%.

Risks & Mitigations

Rise of the Electric Vehicle

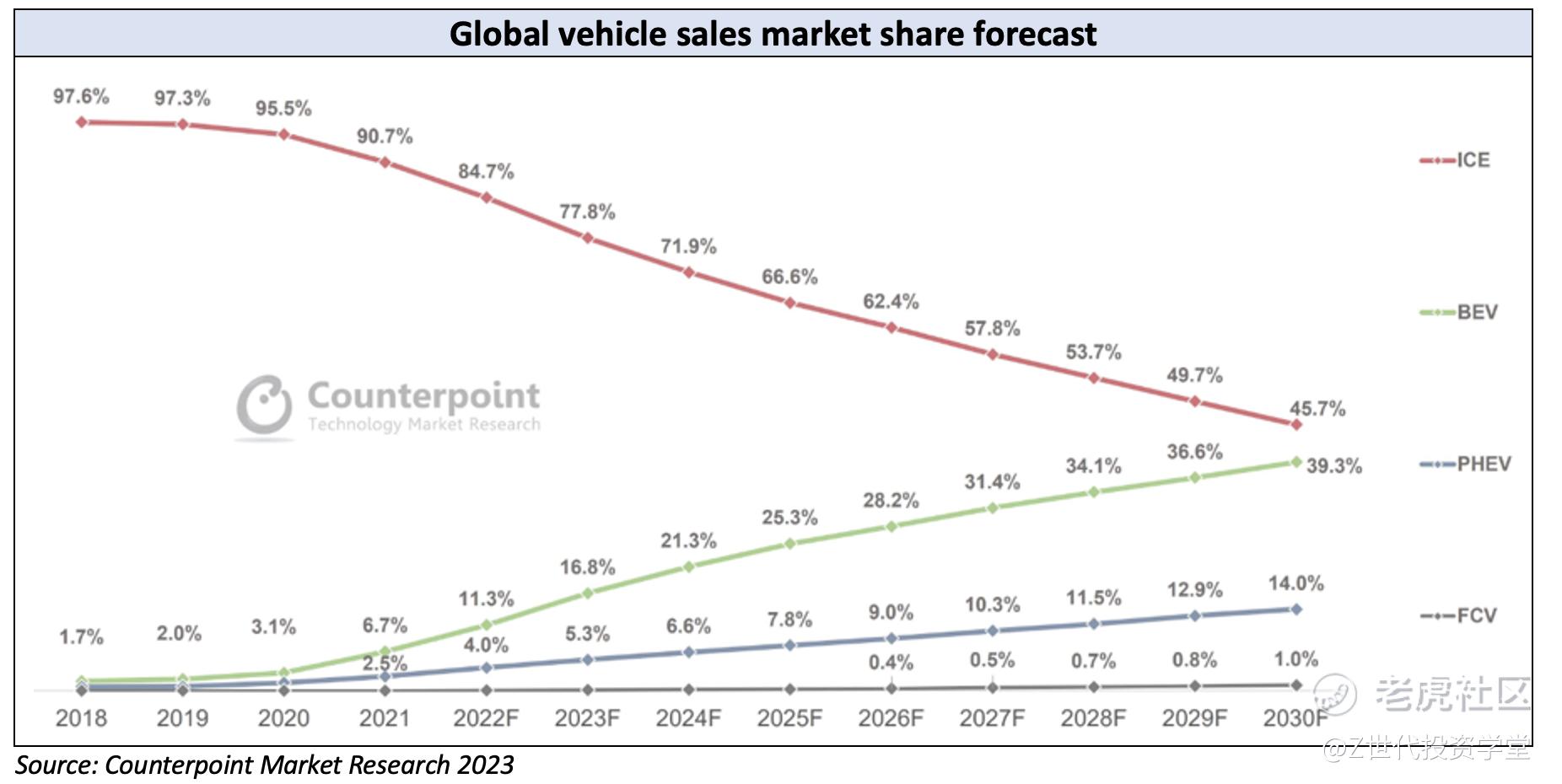

Investors might be concerned about the macro shift away from Internal Combustion Engine (ICE) vehicles, towards Electric Vehicles (EV), because EVs have significantly lesser moving parts compared to an ICE vehicle (20 moving parts in EV vs 2,000 moving parts in ICE). Would this adversely affect AZO as EVs have lesser need for repairs and maintenance? I believe not, at least for the next two decades.

According to Counterpoint Market Research, EV sales are not expected to overtake to ICE sales in the next decade. Nevertheless, even if ICE vehicles lose share to EVs, ICE vehicles will still remain in the market at a significant market share of 40%+.

Mitigations:

AZO’s international expansion strategy in the emerging markets such as Mexico and Brazil hits the nail on the head – these countries have EV share of less than 1%, which is a far cry away from the 6% share in US.

AZO’s management should begin to look at creating a new line of EV-focused aftermarket auto parts to cater to EVs that are no longer under the original manufacturers’ warranties.

In addition, AZO could increase their line of products to offer technology products such as safety parts, comfort parts, which are increasingly common in EVs.

ESG assessment

Environment

Low risk: While I believe this area poses a low risk, environmental issues could still impact AZO.

Carbon footprint: High reliance on transportation for product delivery and customer travel increases emissions. (Data not readily available in reports).

Waste management: Concerns about hazardous waste from batteries, oils, and automotive chemicals. (AZO reports a 76% recycling rate for used oil).

Packaging: Large amounts of packaging materials create additional waste. (AZO reports no specific data on packaging reduction efforts in reports).

Social

Medium risk: Some social risks warrant attention, particularly labour practices and diversity.

Labour practices: Concerns about employee safety in warehouses and stores, along with potential for long hours and low wages. (AZO reports a Total Recordable Case Rate (TRCR) of 1.08, below industry average).

Diversity and inclusion: Lack of diversity in leadership positions and potential gender pay gap. (AZO reports 22% women in senior management and 74% white managers).

Product safety: Risks associated with selling car parts, potential for recalls or accidents due to faulty products. (AZO has a product safety recall process but data on recall frequency not readily available).

Governance

Low risk: Governance aspects seem robust, but transparency and risk management could be improved.

Executive compensation: Concerns about high CEO pay compared to average employee wages. (AZO CEO received $16.8 million in 2021, while the average store employee made $42,000).

Board diversity: Lack of diversity on the board of directors. (AZO reports 2 out of 10 board members are women and 1 is Hispanic).

Risk management: More details needed on specific ESG risks identified and mitigation strategies. (AZO reports on general risk management processes but lacks specific ESG risk analysis).

Link to model:

暂时无法在Lark文档外展示此内容

Updates

25th Jan 2024 - Rental Car Company Hertz sells off 1/3 of its EV fleet citing expensive repair costs, and weak consumer demand:

https://www.reuters.com/business/autos-transportation/hertzs-ev-sale-fan-cost-concerns-dampen-used-car-market-2024-01-16/

27th Feb 2024 - Q2 Earnings Call - Key Takeaways:

TOPLINE

US sales (~90% of total sales): SSS growth 0.3% vs 5.3% last year.

DIY (70% of US sales): First 4 weeks of Q 0.7%, second 4 weeks of Q -6.2%, last 4 weeks of Q 4.8% (due to harsher winter that causes more car breakdowns). Mgt expects next Q to not have much weather impact.

Traffic down 2.2%

Ticket up 1.7%. Discretionary sales down. Mgt expects more improvements as inflation goes down, with aging cars.

Commercial (30% of US sales): For first half of the Q, winter storms caused many shutdowns of commercial customers.

Mexico & Brazil sales (~10% of total sales): SSS growth 23.9% vs 30.6% last year.

Mgt reiterates that they will continue deploying capital to Mexico & Brazil and this will be the growth story.

MARGINS

Gross margin: 53.9%, up 160bps yoy

+100bps, driven mainly by core business margins

+63bps from LIFO benefit. Mgt models $2mn LIFO headwind next Q (<30bps headwind)

EBIT margin: 19.3%, up 110bps yoy

-49bps from SG&A deleverage from higher expenses in store payroll and IT

Remaining margin expansion driven by +ve SSS and GPM improvements

BOTTOMLINE

Net income up 8.1% yoy, EPS up 17.2% yoy

Driven by higher net income, and share buybacks (share count in 2Q was 7.8% lower yoy)

My opinion:

Thesis remains intact.

Remain bullish on International stores, and steady on US DIY and fast-growing commercial segment.

US DIY SSS growth on a good momentum considering that last 4 weeks of Q was up highest (+0.7%, -6.2%, +4.8%).

Watch out for new competitors in Mexico and Brazil due to attractive margins from AZO. However, barriers to entry should remain high due to economies of scale and high SKU count needed.

Macro - Latest US consumer sentiment (Feb 24) released yesterday was weak - this reiterates my thesis on the counter-cyclical benefit for AZO.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

如果你想了解有哪些前沿科技的投资机会,想学习真投资大佬们的投资秘籍,想投资自己的人生,那就快来购买《大赢家》漫画吧!漫画中采访了许多职业投资人和上市企业,通过有趣的故事传达投资理念,我们相信在阅读的过程,你一定会有所收获。https://product.dangdang.com/29564921.html#ddclick_reco_reco_relate

修改于 2024-04-01 22:46

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。