Initial Report(part2): Sony Group Corporation (SONY), 14.4% 5-yr Potential Upside (VIP SEA, 张嘉育Olivia)

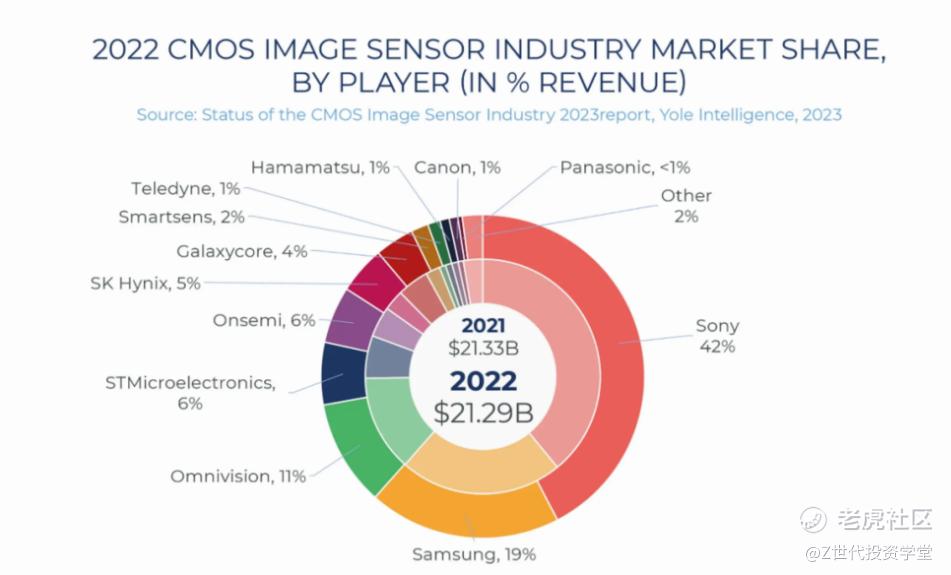

In the 2023 CIS market rankings, Sony continues to maintain its first position with a market share rebounding to 42%. Samsung secures the second spot with a reduced market share of 19%, and Omnivision Group's market share falls to 11%, approaching pre-pandemic levels. Currently, the global automotive CMOS image sensor market is dominated by three key players: ON Semiconductor, Omnivision Technologies, and Sony, shaping the competitive landscape.

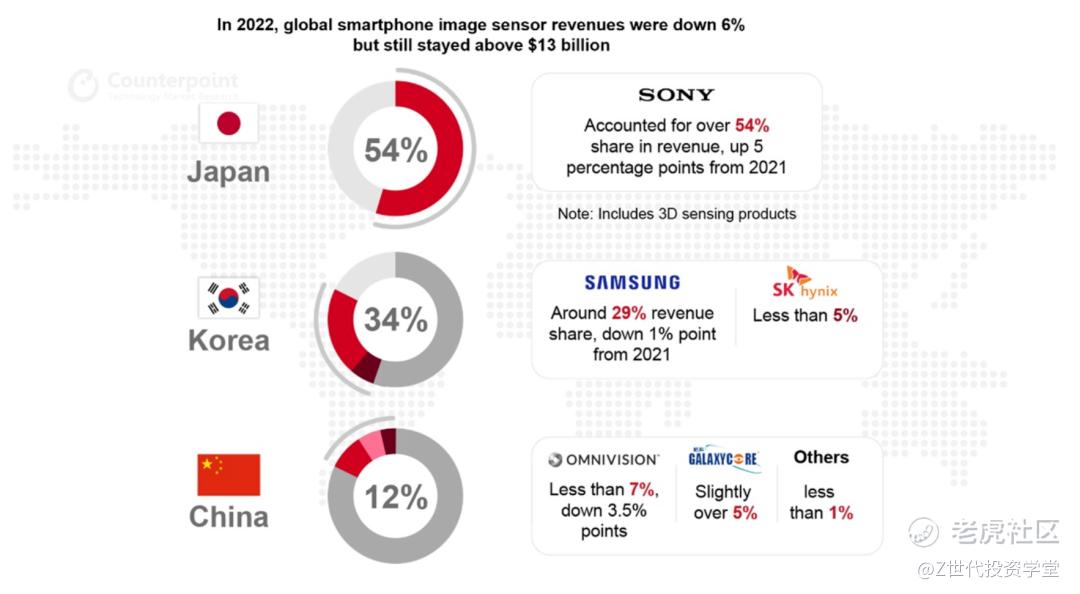

Sony has achieved record-breaking revenue in the smart imaging sector, securing the top position with an impressive 55% market share.

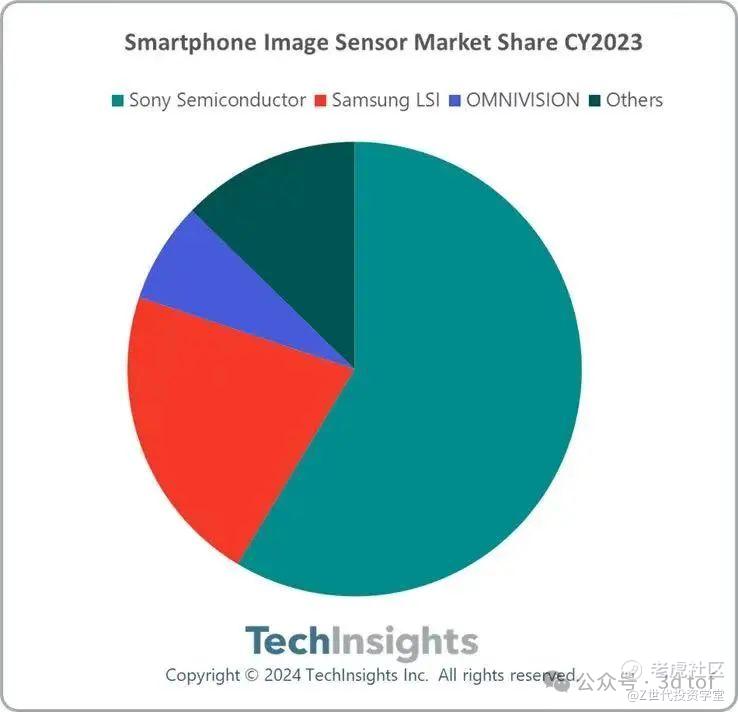

According to the latest research report released by TechInsights in 2023, the smartphone image sensor market has experienced slight growth, surpassing a total revenue of over $14 billion. This indicates a continued strong demand for image sensors in the smartphone market.

In terms of market rankings, Sony secures the top position with an impressive 55% market share. This achievement not only highlights Sony's robust capabilities in the field of image sensors but also further solidifies its leading position in the industry. Sony's success can be attributed to its high-quality large-format CIS (Complementary Metal-Oxide-Semiconductor) product portfolio and precise targeting of the high-end smartphone market.

Following closely is Samsung, with Omnivision in the third position. The report also mentions that the demand for 50-megapixel CIS (CMOS Image Sensor) is approaching saturation, with emerging competitors such as SK Hynix and another 50-megapixel CIS supplier for a Chinese smartphone OEM gradually gaining prominence. This suggests that future competition in the smartphone image sensor market will intensify.

Overall, while the smartphone image sensor market faces various challenges, the continuous technological advancements and sustained growth in market demand suggest significant potential for development. Major manufacturers need to focus on continuous innovation and enhancing their capabilities to stand out in the competitive market.

3 investment thesis

Sony leverages its IDM (Integrated Device Manufacturer) advantage, and CMOS technology plays a crucial role in the smart automotive perception industry chain, particularly in the context of autonomous driving.

Sony's ability to excel in the development of CMOS technology is attributed to its significant advantage as an IDM (Integrated Device Manufacturer) in the field of image sensors. As an IDM, Sony possesses complete vertical integration capabilities in the semiconductor industry. This allows Sony to have both production and research capabilities in-house, enabling rapid iteration of technology and swift adaptation to changes in the market. On the other hand, companies like Omnivision, operating as Fabless manufacturers (responsible for chip design without in-house production), rely on foundries like TSMC for manufacturing, making it challenging for them to iterate technology quickly and keep up with the rapidly evolving smartphone market.

As Sony starts to focus on and strategically position itself in the automotive CMOS image sensor market, its expertise from the smartphone sector is likely to shine through. The advantage gained in the smartphone domain, combined with Sony's integrated approach to research and production, positions it well to rapidly introduce corresponding products tailored to the evolving automotive market. This strategic move is anticipated to lead to a swift increase in market share, making Sony a potential leader in the field of automotive CMOS image sensors.

The development of VR has been a success for Sony, and Apple's creation of the Apple Vision could serve as a significant catalyst for Sony.

Sony generates approximately 10-15% of its annual revenue from imaging and sensing solutions. The new Apple Vision Pro, which includes 12 cameras and 5 sensors, relies on Sony's supply. Sony possesses some of the most advanced sensing solutions. Even Samsung, with the capability to manufacture camera lenses, uses some Sony sensors for the Galaxy S23 Ultra. Whether it's Apple, Meta, or any company that emerges victorious in the VR/AR race, Sony stands to benefit as it manufactures essential and fundamental components for these technologies.

4 Risk

Intense Market Competition:

Xbox has consistently been a competitor to PlayStation. Despite PlayStation's consistently higher sales, Xbox continues to exert pressure on Sony, urging them to continue investing in PlayStation to maintain a competitive edge. Microsoft's acquisition of Activision Blizzard indicates Microsoft's ongoing commitment to its gaming division. Even in the realm of cloud gaming, both companies are weighing the pros and cons, with Sony offering PlayStation Plus and Microsoft focusing on its GamePass.

Supply Chain Risks:

Another risk factor is Samsung in the imaging sensor space. While Apple uses Sony sensors, Google Pixel phones and other devices use sensors from Samsung. The success of Sony's imaging sensors is significantly tied to Apple being its customer. However, if Sony loses this advantage, Apple could easily turn to Samsung sensors or even decide to manufacture its own sensors, similar to their recent move away from displays manufactured by Samsung and LG.

Legal and Regulatory Risks:

As a global corporation, Sony is required to comply with the laws and regulatory requirements of various countries and regions. Changes in the regulatory environment across different markets, especially concerning intellectual property, data protection, and antitrust laws, could impact its operations.

Currency Exchange Rate Fluctuations:

Since Sony operates globally, fluctuations in currency exchange rates can have a significant impact on its revenue and profits. In particular, the fluctuation of the Japanese yen against the US dollar and other major currencies could affect its financial performance.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

如果你想了解有哪些前沿科技的投资机会,想学习真投资大佬们的投资秘籍,想投资自己的人生,那就快来购买《大赢家》漫画吧!漫画中采访了许多职业投资人和上市企业,通过有趣的故事传达投资理念,我们相信在阅读的过程,你一定会有所收获。

https://product.dangdang.com/29564921.html#ddclick_reco_reco_relate

修改于 2024-04-01 22:50

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。