Initial Report(part2): Haidilao International Holding Ltd.(HKSE), 42.7% 1-yr Potential Upside (EIP, Jayme YAK)

2) Popmart has established a strong economic moat by actively seeking out global artists and securing intellectual property rights. This strategic move allows Popmart to develop its own unique toys and go beyond the production of toys solely derived from existing television series, establishing a distinctive brand presence. The company's in-house design team collaborates with artists to refine designs in alignment with the distinctive style of the intellectual property figures and incorporates valuable input from consumer feedback, enhancing the attractiveness of their products. This approach allows artists to concentrate on the creative design aspect while Popmart handles the commercialization process.

A pivotal moment in Popmart's expansion was founder Wang Ning's visit to Kenny, the artist behind Molly, in March 2016. Following three months of negotiations, Popmart secured the exclusive authorization to manufacture and sell Molly in Mainland China. The company invested RMB 1 million, which was a substantial sum in the industry at that time, to develop models and produce the initial series of Molly. In contrast, many competitors, even those with their own intellectual property for toy products, hesitated to make such significant investments. However, this risky investment worked out for Popmart as Molly became one of Popmart’s best selling series.

3) Popmart effectively captures a broad audience through comprehensive marketing strategies, including partnerships with major brands like KFC and Lenovo. Several Popmart intellectual property figures, such as Molly, Pucky, Dimoo, Skullpanda, Sweet Bean, and Bunny, have engaged in collaborations with international brands. The company has also ventured into cross-border collaborations with various brands such as Lays, Haagen Dazs, vivo, Paris L'Oreal, and Kiehl's, spanning diverse sectors such as FMCG, beauty, and daily use products.

In addition, Popmart has employed image advertisements to grab the attention of its audience. For instance, the SKULLPANDA X The Addams Family Series serves as a creative and visually striking method to promote Popmart's blind box collectible figures. This collaboration merges the distinctive characters of The Addams Family with SKULLPANDA's unique style, creating a juxtaposition of quirky charm and gothic allure. Consequently, this collaboration has the potential to capture the attention of both The Addams Family enthusiasts and Popmart's loyal customer base, as well as piquing the interest of new buyers curious about the collaboration.

Popmart has also posted image advertisements that are strategically positioned across 14 regions and 5 media platforms, showcasing the company's global perspective and diverse marketing tactics. Canada and the US emerge as Popmart's primary target markets, with nearly half of all advertising through Instagram and Facebook focusing on these markets. The incorporation of various sales channels has now become an integral part of Pop Mart's toy ecosystem, catering to diverse consumer groups by providing both products and entertainment.

Competitor Analysis

The toy manufacturing industry operates within a monopolistically competitive market structure, where substitutes are prevalent due to other companies offering similar products at lower prices. Initially drawing inspiration for the blind box concept from Sonny Angel, Popmart enhanced its product variety by collaborating with global artists and international brands, including Sonny Angel, to expand its business. However, this also implies a high susceptibility to substitute products. The entry of Miniso Group, China's largest variety store chain, into the toy market poses a substantial threat. This budget retailer, renowned for its aesthetically pleasing household and lifestyle products, entered the toy industry with the introduction of the "Toptoy" chain last year. Toptoy focuses on innovative pop toy products and introduced blind box collections featuring Disney characters like Mickey Mouse and the Winnie the Pooh franchise.

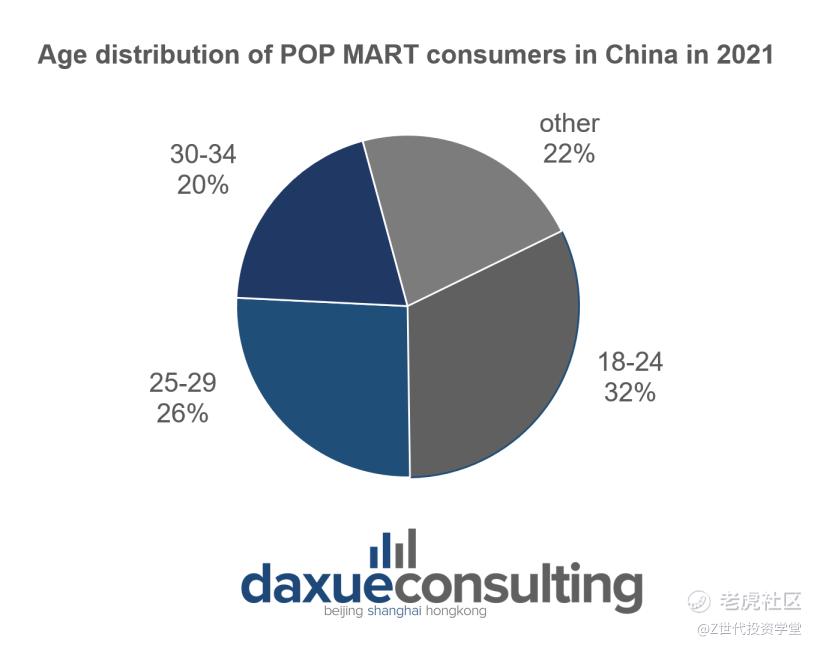

Miniso's founder and CEO, Yeo Guofu, has expressed a commitment to developing original toy brands for children, directly challenging Popmart with competitively priced blind boxes at RMB 40. As Miniso experiences rapid growth and plans to open over 100 outlets in China, in addition to its existing 4,200 global stores, Popmart encounters the challenge of retaining the loyalty of its customer base, primarily composed of females below the age of 35, amid shifting market dynamics. Nevertheless, the consideration that toy manufacturing serves as only a subsidiary revenue stream for Miniso Group suggests that Miniso may not allocate its full attention to marketing and enhancing its product, thereby allowing Popmart to retain its less price sensitive customers.

While Popmart is a part of the toy manufacturing industry, it is venturing into the theme park and mobile game sectors, entering direct competition with industry giants like Disney and Lego that also operate in the toy manufacturing industry and theme park industry. The film industry has undergone a transformation due to Covid-19, where the prevailing notion that Disney-related content would exclusively debut on its streaming service has become widespread. This has somewhat diminished consumer anticipation for the release of Disney movies and diluted its brand in recent years. As such, 12 out of the top 15 most-watched titles on streaming platforms were licensed content from previous years. Instead of entering this saturated market to create original characters that resonate with the audiences, Popmart strategically leverages the success of its competitors by closely monitoring consumer reactions to new series and creating collectible figurines accordingly. For example, Popmart has launched a line of toys inspired by Studio Ghibli's renowned movie, Totoro.

Furthermore, the establishment of the theme park serves the dual purpose of making Popmart's original characters more relatable and extending the lifespan of its products, allowing it to compete effectively with iconic figures like Disney characters.

ESG Considerations

1) Some of the collaborations that Popmart engages in encourages wastage indirectly. In 2022, commemorating the 35th anniversary of KFC in China, the Beijing-based toy brand introduced a limited series of blind boxes named KFC×DIMOO. This collection comprised 6 regular figurines and 1 special figurine. Despite the odds of obtaining the special figurine being 1 in 72, consumers have demonstrated their eagerness to spend RMB 10,494 to purchase 106 DIMOO, increasing their chances of completing the full set.

While the excitement surrounding this collaboration has positively influenced sales, it has also generated controversy, with certain customers opting to hire others to eat and pay inflated prices to obtain the figurines. This raised concerns from Chinese authorities, who viewed it as an extreme manifestation of hunger marketing, promoting impulsive buying behaviors and contributing to food wastage.

2) There may not be sufficient minority representation in the management level and stakeholder representation in the board level. All of the management are of Chinese descent, which means that it could be harder to scale into other markets as the difference in preferences of the consumers may not be captured. There is a potential for principal-agent problems since 44.4% of the key board members also hold roles within the management team. This overlap in roles may create conflicts of interest and hinder the board's ability to effectively oversee and hold the management accountable, which could impact the organization's decision-making processes and overall governance structure.

On a more positive note, the fact that 37.5% of the management team consists of females is a positive indicator, particularly for a company whose primary target audience is females under the age of 35. This gender diversity in leadership not only reflects a commitment to inclusivity but also positions the company to better understand and cater to the needs and preferences of its core demographic.

Conclusion

In summary, Popmart has established a distinctive position in the toy manufacturing industry through the introduction of blind boxes and strategic collaborations with global artists and brands. This innovative approach sets it apart from conventional competitors. Moreover, the company's strategic expansion into theme parks and mobile games showcases adaptability and forward-thinking, enabling it to access broader entertainment markets. With a robust brand presence and initiatives aimed at enhancing customer loyalty through diverse product offerings, Popmart is poised for sustained growth. The continued popularity of collectibles and blind box products, coupled with Popmart's ability to adapt to changing consumer preferences, positions the company favorably for a rebound in its stock price.

References 网页链接 网页链接 网页链接 网页链接 网页链接 网页链接 网页链接 网页链接 网页链接 网页链接 网页链接

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

如果你想了解有哪些前沿科技的投资机会,想学习真投资大佬们的投资秘籍,想投资自己的人生,那就快来购买《大赢家》漫画吧!漫画中采访了许多职业投资人和上市企业,通过有趣的故事传达投资理念,我们相信在阅读的过程,你一定会有所收获。https://product.dangdang.com/29564921.html#ddclick_reco_reco_relate

修改于 2024-04-02 22:13

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。