Every Minute Counts

Every Minute Counts

09.17.2018 Mon, Sunny, Air Perfect

Summary:May的脱欧协议可能遭到工党强烈阻击,导致EUR和GBP 双双回调。美国经济数据良好,部分对冲Trump贸易言论的负面影响,美国风险资产收盘基本走平。

Euro Session:

UST curve stayed almost unchanged in Tokyo session as TY held at 2.97%. Asia risks performed well led by TAIEX while A share struggled through and closed flat. The re-election as the LDP leader looks like a done deal when the latest jiji poll showed Abe's approval rate above his disapproval rate since Fed.

EU equities gapped higher and then in a firm tone while EGBs were under moderate pressure. Everything seemed good with no-one knew what was waiting ahead. Around 7:30, Labor shadow foreign secretary Thornberry told the FT that she does not think the Labor party will support Theresa May’s Brexit deal. She added that the PM would likely be defeated on the bill, which may mean a general election is needed. Both EUR and GBP suffered a heavy blow on this news. Poor EMU!

Economy data:

EMU Aug Labour costs rise 2.2% yoy.

ITA Aug HICP 1.6% yoy .

SWE Aug CPI -0.2% mom, 2.0% yoy.

US Session:

UST yield shortly fell on the miss of US Aug retail headlines. But if we take a quick look at the print , the strong upward revision to July sales that helped soothe the market reaction to the headline release. In fact, the USD rallied through the retail sales release and Treasuries continued to leak higher in yield through a much stronger-than-expected reading on US consumer confidence.

The steady drift higher in yield briefly pulled 10s above 3.0% in yield and quickly reversed the gains on Trump's report around mid-night. 0:00 reports from Bloomberg saying Trump had instructed his advisors to go ahead with up to $200bn in tariffs on Chinese goods despite Mnuchin’s outreach for new meetings, weighed modestly on risk assets, flipping a small gain in the SPX into a small loss and pulling 10s back below 3.0%. For the USD, however the trade headlines only added to the post-data gains, in most cases, as EUR/USD dipped back below 1.1650 and GBP/USD slipped below 1.31 (today’s mix of Brexit headlines reading slightly more downbeat on a deal didn’t help the GBP today either). Ultimately, US equities did recover their small losses and the S&P closed the session essentially unchanged on the day.

As to Fed, Evans said he would not be surprised if the Fed hikes four times this year and that it is time to return to “more conventional” monetary policy. He called the labor market “very strong” but added that wages ‘aren’t growing as quickly” as would be expected with a 3.9% unemployment rate. Kaplan said he thinks the Fed should be raising rates to a neutral level but warned that the Fed should raise rates gradually and patiently.

Other news, various media outlets reported that former Trump campaign manager Paul Manafort will plead guilty to the remaining charges against him and will cooperate with the Mueller investigation.

Economy data:

8:30,US Aug retail sales 0.1% m/m vs +0.4%. July sales growth was revised up from +0.5% m/m to +0.7%.

US August import prices -0.6% m/m vs. -0.2%. Export prices -0.1% m/mt vs. 0.0%.

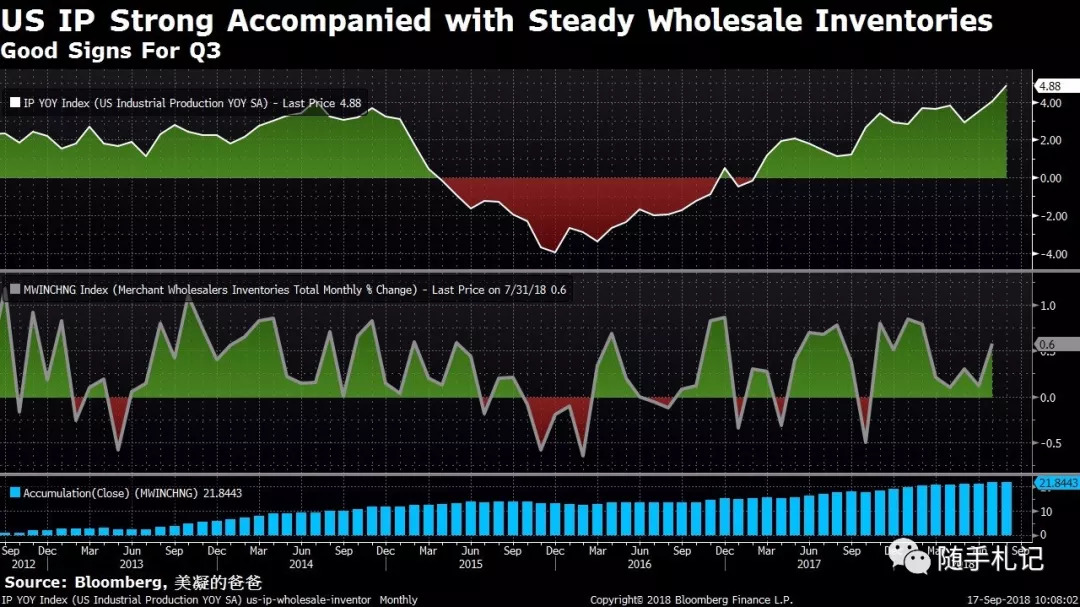

9:15, US August IP was +0.4% m/m vs. +0.3%. Manufacturing production 0.2% m/m vs. +0.3%.

10:00,US September preliminary U of Michigan confidence index 100.8 vs 96.6.Both the 1yr ahead and 5-10yr ahead inflation expectations measures dipped by 0.2% in September, to 2.8% and 2.4% respectively.

US July business inventories +0.6% m/m as expected.

Key Data And Events Ahead:

Monday: Eurozone HICP

Wednesday:Japan Trade Balance , UK CPI,Housing starts

US Current Account Balance, September Empire manufacturing survey

Thursday : UK Retail sales ex auto fuel

US Philadelphia Fed Business Outlook, Existing house

$11bn 10-year TIPS

Friday: Japan CPI

France Germany Eurozone US Manufacturing Services PMI

Manufacturing PMI (Sep, flash, index) HSBC: 55.1

Canada Retail Sales ,CPI

Comments:

I don't see too much volatility in TY in this week and look down upon the 200bn. As to the former, it's time for the market to show some respect for FOMC and from now on every minutes counts while the latter is nothing but a convenient tool to keep continuing pressure or to please his voters or to drive the supply chain out of the mainland, or both.

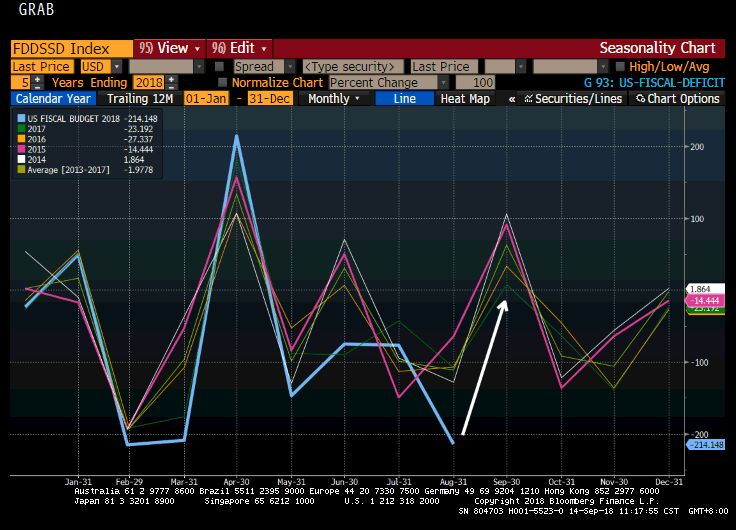

Notably, do you still remember the supply of 10yr this month was 3bn less than that in last month? It could be the budget issues on spending bill which was passed on Thursday night. But US treasury reported a budget shortfall of $214.1bn in August, sharply higher than the $107.7bn deficit recorded in August last year and slightly worse than the Bloomberg median estimate of $211bn for last month. However, the deterioration is significantly overstated due to a calendar quirk, which pushed about $70bn of outlays from September into August. Hence outlays should be reduced by the same amount in September’s data once that’s published next month. What we can get then is the decent improvement in Sep then. Watch out!

As to CFTC data, speculators remained bearish on Treasury **res over the week ending on Tuesday, September 11, extending their net short position in TY equivalents by 28K contracts. They boosted their net short position in TU, US and WN by 49K, 7K and 2K contracts, respectively, while removing 3K contracts from their net short position in FV. They also bought 13K contracts in TN, turning net long for the first time in six weeks.

个人微信zhangke8639,欢迎同业交换名片。公众号更新速度快一点儿....排版也好一点点儿....

近期重要时间点:

9月18日,EU A50会议

9月18-20日,半岛峰会

9月20日,EU非正式峰会,日本LDP选举

9月21日,美日可能举行贸易谈判

9月26日,FOMC

9月27日,意大利提交财政预算案

9月30日,美加贸易谈判截止日

10月14日,IMF峰会

10月16日,EU A50会议

10月25日,ECB议息

10月26日,s&p评判意大利评级

10月31日,BOJ议息

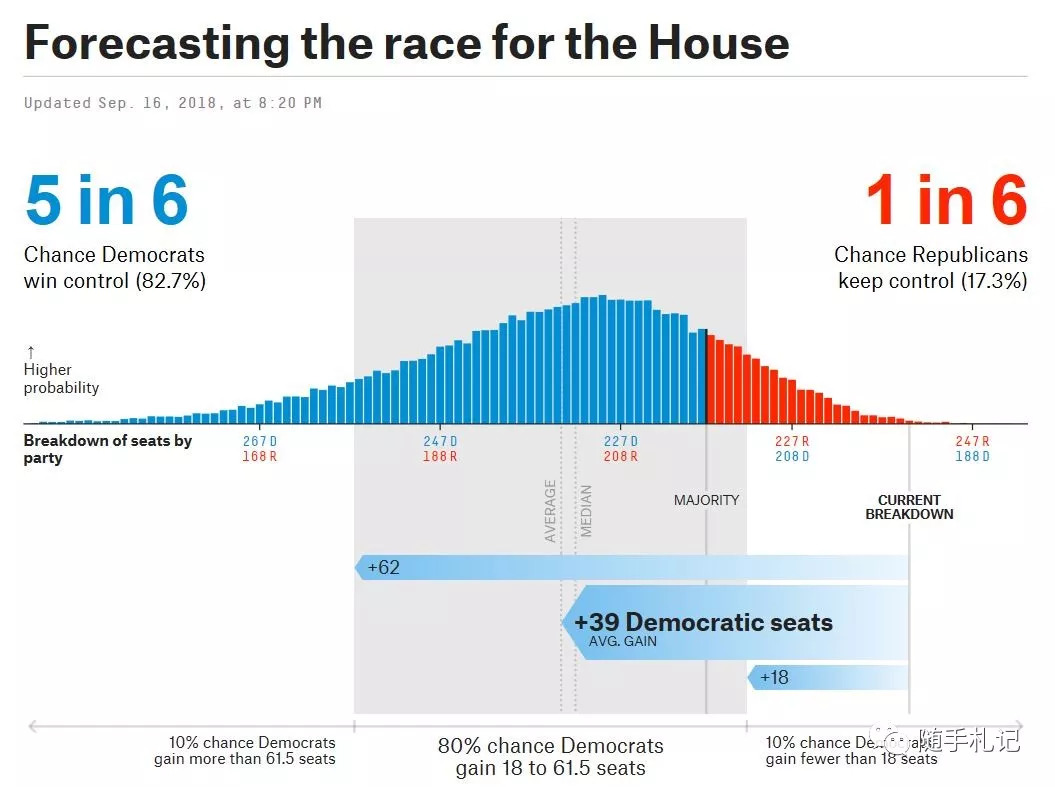

11月6日,美国中期选举开始

11月8日,FOMC

11月11日,美国阅兵 (取消了,说是因为预算问题)

11月13日,美欧特别峰会

11月15日,亚太峰会

11月30,G20峰会

12月13日,ECB议息,EU 峰会

12月20日,FOMC

12月22日,改革开放40周年

2019年3月21日,EU 峰会

2019年3月29日,脱欧谈判截止

Appendix:his t overnight

太多了,偷懒了,基本上都是flence的. 我能说不管是哪里的飓风,都是对GDP的保驾护航吗?

Disclaimer:This material was prepared in private name and out of pernaonal hobby,definitely based upon facts and robust analysis with delicate consideration of highly professionality.But with no means to conduct any trade , and before using the contents of this note in any internal or external communication, please ensure you are comfortable and fully aware this could not be sufficient enough as any action base.

Up till now, Subscribers have amounted to 4023 !

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 复兴计划·2018-09-18这么多英文啊老哥点赞举报

- lemonadey·2018-09-18我是来赚钱的点赞举报

- TengMA·2018-09-18稳点赞举报