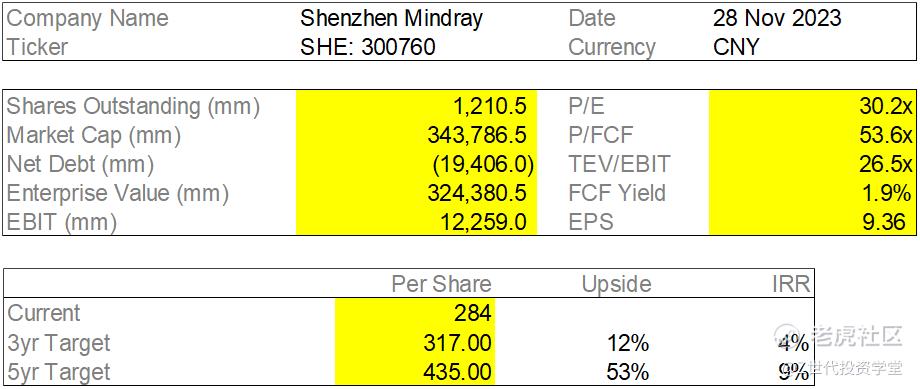

Initial Report: Shenzhen Mindray (SZSE:300760), 53% 5-yr Potential Upside (EIP, 沈佳扬)

Why did the share price fall?

The Anhui province local government used a volume-based procurement (“VBP”) to purchase chemiluminescence immunoassay (“CLLA”) in 2021. This means that the ASP would reduce, causing expected margins to decline. This triggered a selloff in share price. But the impacts were temporary or if not negligible as the factory prices were unaffected. In fact, margins and revenue size have grown since then. Thus, there may be some mispricing exist.

Business model:

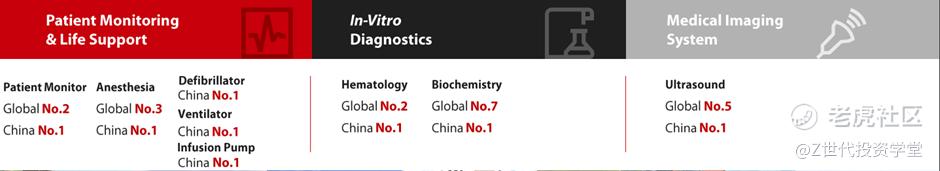

Shenzhen Mindray (“SM”) is engaged in the R&D, manufacturing, and marketing of medical devices and relevant services. It has three major business segments: (1) Patient Monitoring & Life Support (2) In-Vitro Diagnostics (3) Medical Imaging. Their key focus has established their presence among new high-end customers both domestically and internationally. The Company has a presence in ~40 countries in North America, Europe, Asia, Africa, Latin America, and other regions and more than 30 branches in China. Most of its revenue come from Emerging market, especially China. Moreover, SM has a robust global distribution network with a team of 3,540 sales personnel, 21 subsidiaries from 40 branches in China and also subsidiaries in other 40 countries.

Market share of SM

Patient Monitoring & Life Support

Their products include patient monitors, ventilators, defibrillators, anesthesia machines. As of FY22, the revenue was at CNY 13bn (44% of revenue). Below is an example of the product screening. SM has built a platform for discipline development and talent training to meet the needs of hospitals from new construction to subsequent operation in various aspects to build long-lasting partnerships.

In-vitro Diagnostics

Under this segment, their products include CLIA analyzers, hematology analyzers, biochemistry analyzers, and coagulation analyzers. Over the next few years, the Company will further enhance its competitive edge in the domestic market while strengthening business development and localized platforms in international markets. By doing so, the Company will gradually establish brand influence and achieve sustainable growth. It has a revenue of CNY 10.3bn (34% of revenue)

Medical Imaging Systems

Lastly, products including ultrasound diagnostic systems, digital radiography and PACS. It had a revenue of CNY 6.4bn (22% of revenue).

Thesis: Growing Market Share across China and other parts of the world

The company stated that they aim to have 10-15% market share in each product category globally in the long term. As of now, Mindray’s core products are ranked top 2 in China, and top 7 in the global market, and market share is continuously increasing. According to management, the TAM for China and global are CNY 120bn and CNY710bn respectively. This means that market share in China is at modest low double-digit and low single-digit globally. If we go by that logic, the share % increment based on Shenzhen Mindray’s target would be coming from more internationally. Moreover, Mindray is only present in about 17% of the sectors of the US$460bn Global medical devices market. The company has incubated new businesses such as Minimally Invasive Surgical Instruments and Accessories (MISIA), Orthopedics. I do think there’s growth in these nascent entries.

Why do I think SM is able to compete against its peers?

SM has consistently invested about 10% of its revenue in R&D since 2016, well above the peer median. Its commitment to R&D is nothing to sniff at as it has around 3,600 in-house R&D engineers and 7,955 patent applications, creating a patent and innovative DNA for the company.

Moreover, SM has relatively higher profitability, and return on capital across peers gives me comfort that the business can reap more value in the long run. The China story is still not dead as the strong tailwinds accompanied by the aging population, improving household income, and better medical insurance coverage would contribute to health demand growth.

Thus, with its innovation and patent moat, it can compete effectively with its peers.

Who is the founder?

Li Xiting, founder, and chairman of Shenzhen Mindray strikes me as someone who is ambitious and has a lot of determination. He with his other co-founders managed to integrate SM into the competitive industry in the early 90s, dominated by Philips, Siemens, and GE. In fact, they privatized SM back in 2016 and made it public again in 2018. According to SCMP, Li still spends up to 10 hours in the office every day and devotes his time to taking calls at night reflecting his drive. With the founder still very in tune with the company, I am more confident.

Risk

SM would have to look for more targets to acquire to ensure growth expectations are kept, and the possibility of finding poor targets to acquire may exist. However, the acquisition of Datascope’s PLMS in 2008 has propelled the company to become the third largest PMLS manufacturer in the world. There is some merit in their acquisition abilities.

Moreover, the risk of additional VBP for other segments may prove to hurt shareholder’s returns in the future. But as stated earlier, SM may be less impacted There are also FX risks where 40% of revenue is from ex-China. However, the export business would offset some currency risk with the cheapness of RMB as the imports are mostly sourced in RMB and overseas importers favor cheap RMB.

ESG

Shenzhen Mindray received upgrades of its ESG rating by MSCI from BB to AA. Its sustainability report follows the GRI standard which is a good global practice. I like that the firm has the intention to reduce its carbon intensity by 25% by 2030. A quick glance, the report looks comprehensive with clear materiality assessment and diversity wise, I do think it can be done better with 29% of female employees and 37.5% in senior management, albeit still in the right track. In fact, the company has also donated 1,000 AED equipment and used its equipment in public spaces of 148 times to save lives, suffering from sudden cardiac arrest. However, upon checking Glassdoor reviews, there are many bad comments on the company, and it would be good to see what is exactly wrong and if there are ways to improve the working environment. It would be good to be able to meet management if possible.

Valuation

Over the 5-year period, sales would grow driven by higher ASPs and volume growth as penetration increases into high-tier hospitals for its business segments. Albeit it looks expensive from a value perspective, I do think it deserves a premium on its business quality. It is trading at its IPO valuation at a 4-year low, and assuming revenue grows at 20% and EPS grows at 17% over 5 years, and a 25x 2027 exit, it gives me a fair value of CNY 435.

Note: Data and pictures are collected from company’s AR and broker’s note.

*Do note that all of this is for information only and should not be taken as investment advice. If you should choose to invest in any of the stocks, you do so at your own risk.

如果你想了解有哪些前沿科技的投资机会,想学习真投资大佬们的投资秘籍,想投资自己的人生,那就快来购买《大赢家》漫画吧!漫画中采访了许多职业投资人和上市企业,通过有趣的故事传达投资理念,我们相信在阅读的过程,你一定会有所收获。网页链接

修改于 2024-04-03 23:03

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。