Shall We Face the Music ?

Shall We Face the Music ?

09.12.2018 Wed, Cloudy, Air Perfect

Summary:尽管欧洲次重量级经济数据超预期,但市场开始关注欧洲基本面的不确定性,欧洲资产纷纷见顶。美国股市摆脱贸易战阴影,有所走强。美欧、美加贸易谈判出现转机,导致美元轻微走弱。

Euro Session:

Asian assets mixed as investors await trade clarity. Regional bourses fluctuate except Japan equities outperform(1.3%) as JPY weakens while A share saw a choppy session after struggling to close touch lower. Trade tension between US and Japan intoxicated somewhat while one Japan official say Japan does not need FTA with US.

EU market enjoyed risk-on for another session. EU equities opened flat while the spread between core and periphery tightened. As to FX, Sterling advanced with EUR, adding to Monday’s surge, after European Union’s chief negotiator Michel Barnier said it’s “realistic” to get a Brexit deal within eight weeks. Too many whispers doubted SO-CALLED 8 weeks. Since they were close to something , why should it take so long ? I can smell a lot of long positions in EUR and GBP await taking profit.

Besides, UK was definitely in the spotlight in the day with its Jun-Jul employment statistics. At 4:30, the stronger wage growth pulsed GBP higher while EUR continued to slide moderately while Europe will also be watched for its release of Q2 employment change and DEU Sept ZEW surveys. At 5:00, all the prints beat the consensus which reversed the loss of EUR and GBP. But soon after that, EUR and GBP bleed again.

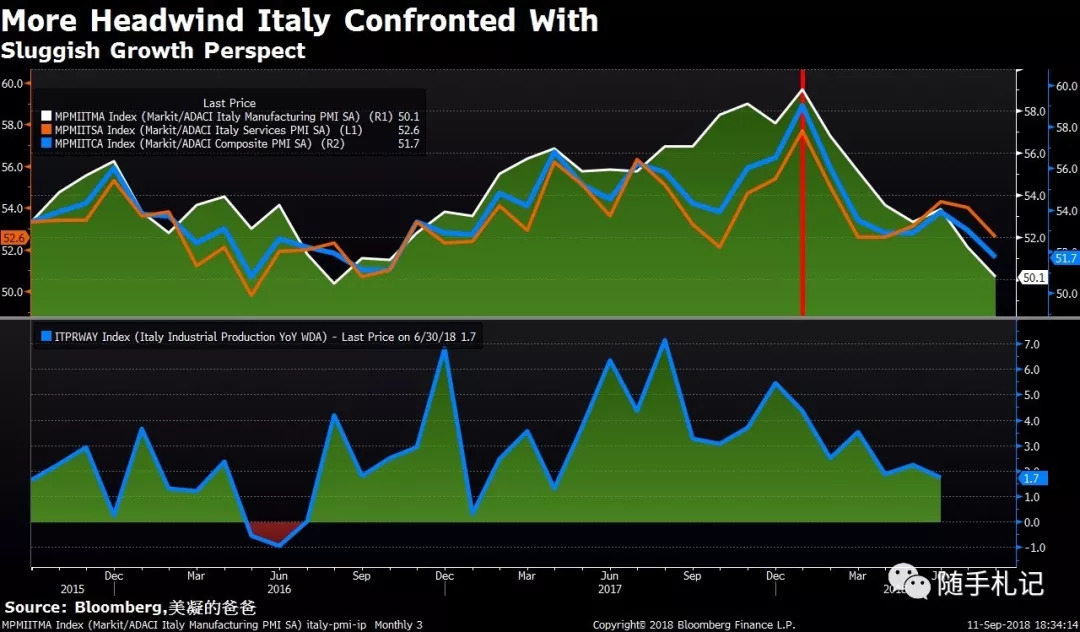

Driven by curiosity, I checked recent PMI and IP of Italy. Recent indicators do not provide a rosy picture for Italy. With some indicators even pointing to a contraction in activity at the beginning of Q3 , Italy could face a sharp deceleration in the growth momentum. This could really give a big question mark to Di mao or Salvini's words on obeying the EU rules. But later in the night, Salvini said Italy’s budget will respect the EU’s limit of 3.0% deficit to GDP.

Other news, Bloomberg reported that the UK and the EU are likely to announce a special EU Summit in November (likely the week of November 13th, per the article). The new meeting could formally be announced at an informal EU summit in Salzburg next week.

Economy data:

4:30, UK average weekly earnings 3 month avg growth while economy 2.6% yoy vs 2.4%, prior 2.4%.

UK July ILO unemployment rate 4% vs 4%, prior 4%.

5:00, EMU Q2 employment 0.4% qoq, prior 0.4%;EMU ZEW survey expectation -7.2, prior -11.1

DEU Sep ZEW survey current situation 76 vs 72, prior 72.6; expectation -10.6 vs -13, prior -13.7

US Session:

USTs sold off sharply, continuing the post-NFP weakness after Monday’s low-volume consolidation. Supply pressure both abroad (DSL 18yr, Spain 15yr, 30y Gilt) and domestically (10 IG names for ~$10bn & 3y auction) was the initial inference as core yields sold off on the EU open. The bearish move extended past the US NFIB report (new cycle highs for headline, capex and hiring)and 3yr auctions. It's notable to say something about Jul wholesale inventories, which along with retail sales and industrial production on Fri, could offer markets early insights into Q3 economic activity. Although it's revised down by 0.1%, it still strongly maintained in the positive territory for 9 months which is the longest streak since July 2015.

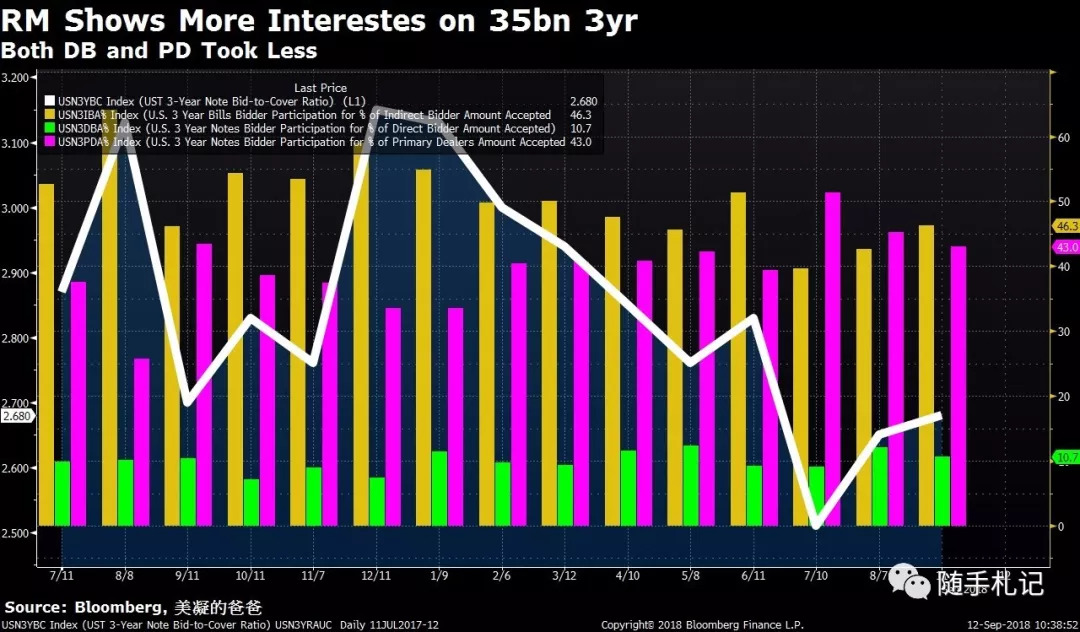

$35bn 3yr notes auction attracted more foreign real money, drew at a high yield of 2.821%, a 0.2bp tail vs. the WI 1:00PM level. Indirect bidders took 46.3% of the issues, Directs took 10.7% of the issues, primary dealers took 43%.

As to NAFTA, Reuters reported that Canada is prepared to negotiate on dairy as part of NAFTA renegotiations. The CAD jumped on the late headlines on expectations that room for negotiation on Canadian dairy could help pave the way for a deal.

Other news, Hurricane Florence could be the strongest storm for Carolina and Mid-Atlantic if it makes landslide as a Category 4 storm. The reasons stem from the hurricane's power, size, forward speed and the longstanding vulnerability of the area it is forecast to hit.

Economy data:

NFIB small business optimism up 0.9pts to 108.8 in August, above mkt.

Wholesale inventories revised down 0.1pps to 0.6% mom in July.

JOLTS job openings rise to 6.94m in July, quits rate rises to 17-yr high.

Key Data And Events Ahead:

USA: Fed's Bullard, Brainard speak, Fed Beige Book, PPI (Aug), MBA mortgage applications;

CAN: Capacity utilization (Q2), Teranet/National Bank house price index;

EMU: IP (Jul); ITA: IP (Jul), Unemployment rate (Q2);

JPN: MoF BSI Survey (Q3);

Comments:

The moment Beijing went off yesterday ,2s10s was 22.50 bps while now it is 22.61. So we can hardly tell if the curve saw bear steepen or flatten. But what we get now is 2yr yield at 10 years high and 10yr close to 3.0% again. What's the main factors behind this?

Heavy issues could be one thing , but I think it is the market finally justify the strong economy fundamental could bear higher rates now. The probability for Fed to hike for the fourth time in Dec added 7.3% from 71.1% to 78.4% based on calculation of Fed Funds. This is the principal reason, especially when VIX decrease to one week low which confirmed the equity market well prepared for the shock of rates going up. what's next?

Our motherland is often portrayed as a rising power in technology but historically, central planning doesn't correlate with innovation. At present, it seems all the trade story is all about US, maybe Japan next. AP reported that China is not accepting license applications from some American companies, citing comments from the vice president of the US-China Business Council. The article notes Chinese officials told the council that applications will not be accepted until “the trajectory of the US-China relationship improves and stabilizes.” This tension finally broke out from within the range of goods to direct investment now. When can all these end? Watch out on his approval rate. Two polls last week have reported the rate declined to below 40% since the topic of the Woodward book became popular. Politics cherish votes plus the loss of mid-term is totally unbearable given the US society is already polarized.

Last, what is today's cover about? Nothing but illusion if you choose not to stand up to the music.

个人微信zhangke8639,欢迎同业交换名片。公众号更新速度快一点儿....排版也好一点点儿....

近期重要时间点:

9月13日,ECB议息,APPLE新手机发布

9月18日,EU A50会议

9月18-20日,半岛峰会

9月20日,EU非正式峰会,日本LDP选举

9月26日,FOMC

9月27日,意大利提交财政预算案

9月30日,美加贸易谈判截止日

10月14日,IMF峰会

10月15-19日,美国财政部关于货币政策半年报告

10月16日,EU A50会议

10月25日,ECB议息

10月26日,s&p评判意大利评级

10月31日,BOJ议息

11月6日,美国中期选举开始

11月8日,FOMC

11月11日,美国阅兵 (取消了,说是因为预算问题)

11月13日,美欧特别峰会

11月15日,亚太峰会

11月30,G20峰会

12月13日,ECB议息,EU 峰会

12月20日,FOMC

12月22日,改革开放40周年

2019年3月21日,EU 峰会

2019年3月29日,脱欧谈判截止

Appendix:his t overnight

0911 1909 “We have found nothing to show collusion between President Trump & Russia, absolutely zero, but every day we get more documentation showing collusion between the FBI & DOJ, the Hillary campaign, foreign spies & Russians, incredible.” @SaraCarterDC @LouDobbs

0911 1919 #NeverForget #September11th https://t.co/ExGrrVtrEf

0911 1924 New Strzok-Page texts reveal “Media Leak Strategy.” @FoxNews So terrible, and NOTHING is being done at DOJ or FBI - but the world is watching, and they get it completely.

0911 1944 “ERIC Holder could be running the Justice Department right now and it would be behaving no differently than it is.” @LouDobbs

0911 2004 Rudy Giuliani did a GREAT job as Mayor of NYC during the period of September 11th. His leadership, bravery and skill must never be forgotten. Rudy is a TRUE WARRIOR!

0911 2029 Departing Washington, D.C. to attend a Flight 93 September 11th Memorial Service in Shanksville, Pennsylvania with Melania. #NeverForget https://t.co/O2sFUeRqeb

0911 2059 17 years since September 11th!

0911 2324 #NeverForget #September11th https://t.co/l8WZer3UOL

0912 0049 Small Business Optimism Soars to Highest Level Ever | Breitbart https://t.co/T6rFhfPz6n via @BreitbartNews

0912 0424 The safety of American people is my absolute highest priority. Heed the directions of your State and Local Officials. Please be prepared, be careful and be SAFE! https://t.co/YP7ssITwW9 https://t.co/LZIUCgdPTH

0912 0654 RT @WhiteHouse: .@realDonaldTrump and @FLOTUS visited the Flight 93 National Memorial in Pennsylvania this morning to honor the memories of nearly 3,000 precious lives lost on September 11, 2001, as well as every hero who has given their life since that day to protect our safety and freedom. https://t.co/RKwcvO7vh9

0912 0919 “You know who’s at fault for this more than anyone else, Comey, because he leaked information and laundered it through a professor at Columbia Law School. Shame on that professor, and shame on Comey. He snuck the information to a law professor who collaborated with him in........

....giving the information, and causing the appointment of a Special C without having the courage of his own convictions.....” Alan Dershowitz @TuckerCarlson In other words, the whole thing was illegally and very unfairly set up?

0912 0959 Crazy Maxine Waters: “After we impeach Trump, we’ll go after Mike Pence. We’ll get him.” @FoxNews Where are the Democrats coming from? The best Economy in the history of our country would totally collapse if they ever took control!

Disclaimer:This material was prepared in private name and out of pernaonal hobby,definitely based upon facts and robust analysis with delicate consideration of highly professionality.But with no means to conduct any trade , and before using the contents of this note in any internal or external communication, please ensure you are comfortable and fully aware this could not be sufficient enough as any action base.

Up till now, Subscribers have amounted to 4018 !

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 起风了该收衣服了·2018-09-14、、、、、、、、、、、、、、、点赞举报