桥水对冲基金深度翻译——An In-Depth Look at Deleveraging, (三)

声明:此篇文章为传奇对冲基金桥水(Bridgewater Capital) 资本创始人雷达里奥 (Ray Dalio) 的深度经济观点。本篇翻译仅作为和同好交流学习之用途,非作商业用途。

如有恶意复制并用作商业用途的,均和本公众号,本翻译作者无关。

此篇文章为世界上最大的对冲基金桥水资本用以解释其对宏观经济体必经的从加杠杆(经济债务增加)到去杠杆(经济债务减少)的周期的观点。

笔者认为,此篇文章非常具有深入学习的意义,因此特作翻译,和广大朋友同行交流,如有疏漏,错误,烦请指出,海涵!

可参考前两篇译文:

桥水对冲基金深度翻译——An In-Depth Look at Deleveraging, (一)

桥水对冲基金深度翻译——An In-Depth Look at Deleveraging, (二)

A Closer Look at Each

United States Depression and Reflation, 1930-1937

深入探讨美国自1930年到1937年的萧条以及再通胀

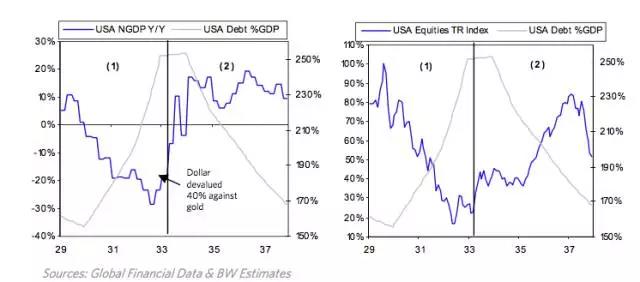

As explained, the US Great Deleveraging in the 1930s transpired in two phases – a deflationary depression from 1930 through 1932, and a reflationary deleveraging from 1933 to 1937. The charts below show debt levels against nominal GDP growth year over year (left chart) and against the total return of stocks (right chart). Debt levels as % of GDP are on the right axis of each chart. The line shows where there was a significant amount of “money printing”.

如同先前解释的,美国于1930年的大规模去杠杆活动可以被解释为两个阶段:自1930年到1932年的紧缩性萧条以及1933年至1937年的再通胀去杠杆。如下的图表展示了债务水平针对名义GDP的年增长(如左图所示)以及对股市的总回报(如右图所示)的反应。债务水平以及GDP的对应关系处于以下每张图形的右轴。而实线显示了当时大规模的“印钞”。

The first phase is labeled (1) and the second phase is labeled (2). During the first phase (the “ugly deflationary depression” phase), income and credit collapsed, with nominal growth rates falling significantly below nominal interest rates, and the economy contracted while the debt/income ratio rose. As shown, it followed the stock market bubble bursting in September 1929.

第一阶段以及第二阶段已分别被单独标记。在第一个阶段里(我们称之为糟糕的紧缩性萧条阶段),收入以及信贷开始崩塌,随着名义增长率显著地下滑,直到其处于名义利率之下,当债务对收入比值上升,经济将会随之发生紧缩。如图所示,伴随而来的将是1929年9月的股市泡沫破碎。

As a result of that private sector deleveraging, incomes collapsed, to the point that they were declining by nearly 30% per year at the end of 1932. Because of the fall in incomes, debt/GDP rose from roughly 150% to 250% of GDP (as shown on the left). Through this time stocks fell by more than 80% (as shown on the right). This first phase ended and the second phase began when the money printing started in March 1933. FDR broke the peg to gold and the dollar fell 40% from 21 dollars/ounce to 35 over the course of the year. This reflation also led to rising economic activity, and nominal growth to be above nominal interest rates. 1937 is when it ended in response to the Fed turning restrictive which caused a “re”cession (which is when the term was invented).

私有部门领域的去杠杆的结果是收入如同雪崩似地锐减,直到在1932年年底,每年甚至达到了将近30%的下滑。由于收入的锐减,债务对GDP从GDP的150% 大约增长到了GDP的250% (如左图所示)。这次股票市场表现下滑了80%(如右图所示)第一个阶段结束,当1933年3月的大量印钞开始时,第二阶段也开始了。Franklin Delano Roosevelt 富兰克林·德兰诺·罗斯福,将黄金以及美元之间的绑定关系摧毁了(亦即放弃了金本位),美元兑黄金从21美元/昂司跌到35美元/昂司。如此的再通胀同样刺激了经济行为,名义增长再次高于名义利率。直到1937年美联储再次转向严厉的市场态度并导致了一个再次的衰退(1937年这也是单词recession被创造的年份)

IIn March of '33, the Fed eased by devaluing the dollar against gold and kept interest rates low for many years. Most of the additional balance sheet expansion was to buy gold to keep the value of the dollar depressed. While the Fed made money easy through low rates and currency, it did not directly buy many risky assets (unlike today as we discuss further below).

在1933年的3月,美联储开始通过再次贬值美元,采取宽松政策,并迫使美元对黄金比值再度下降,以期多年维持低利率。绝大部分的额外资产负债表的扩张(扩表)的用意是继续大量购买黄金以压制美元的价值。当美联储开始通过维持低利率以及弱势货币让信贷更宽松(借钱更容易),美联储并未直接开始购买许多的风险资产(和我们今天即将要讨论的不同)

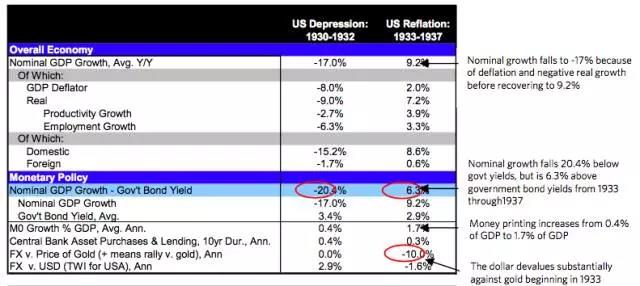

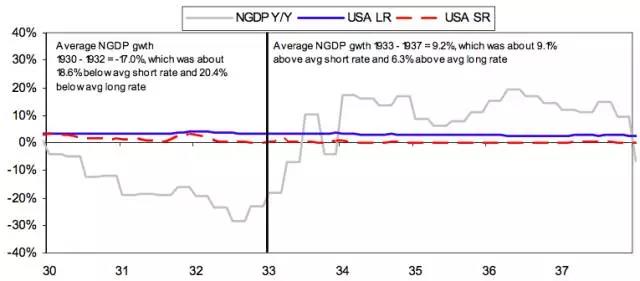

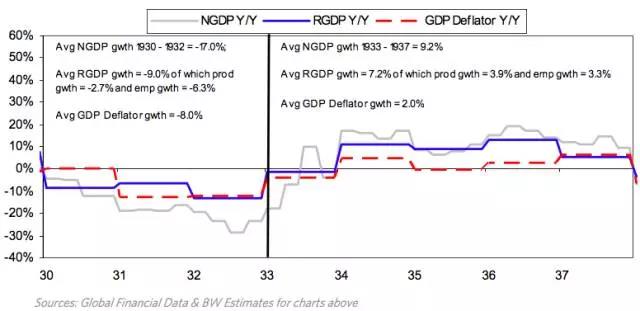

The table below tells this story more precisely. During the “ugly deflationary depression”, incomes collapsed as nominal GDP fell 17% per year, about half from deflation and half from the collapse in real demand. As a result, nominal growth was 20.4% below nominal rates, and debt to GDP rose at a rate of 32% per year. Beginning March 1933, the government devalued the dollar against gold and from ’33-‘37 it increased money supply roughly 1.7% of GDP. Nominal growth recovered at a rate of 9.2% in this period, a combination of 7.2% real growth and moderate 2% inflation. Nominal GDP rose to 6.3% above rates. The private sector reduced its debt burdens, while government borrowing grew with incomes.

以下表格可以更准确地说明这个故事的缘由。在糟糕的紧缩萧条里,收入开始雪崩似下跌,名义GDP跌了整整17%/年,大概有一半来自通货紧缩,另一半来自真实需求端的需求崩塌。结果就是,名义增长率比名义利率低了近20.4%。债务对GDP上升至32%每年。在1933年的3月初,政府开始针对黄金对美元进行贬值,而自1933年到1937年,这样的贬值使得货币供应增长了近7%,约占GDP的1.7%。这段时期里,名义增长恢复到了9.2%,7.2%的实际增长还有稳健的2%通胀。名义GDP攀升至6.3%,在名义利率之上。私人部门减少了其债务负担,同时政府的收入以及借贷都实现了增长。

Nominal growth falls to -17% because of deflation and negative real growth before recovering to 9.2%

在增长率恢复到9.2% 前,萧条以及负经济增长使得名义增长下降至-17%

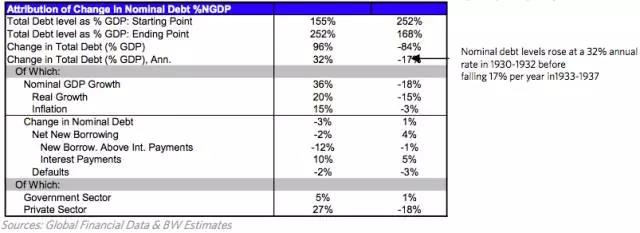

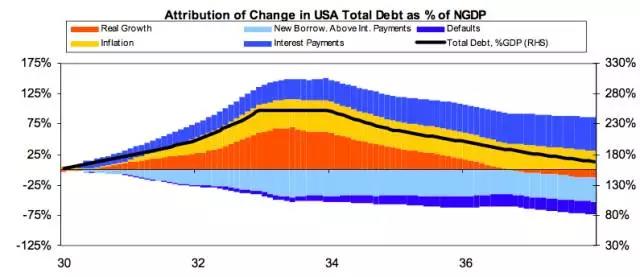

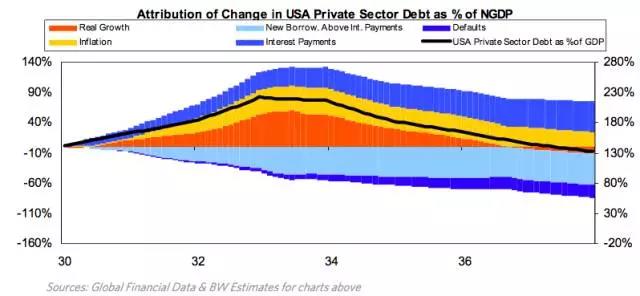

The chart below shows an over time picture of the same basic attribution shown earlier. Relative to GDP, total debt was the same in 1937 as in 1930. In between, it ballooned because of a contraction in incomes from deflation and negative real growth. The reversal of the debt burden was driven by a rise in incomes to 1930 levels in nominal terms. Borrowing for interest payments was mostly offset by paying down of debts.

如下图表展示了在相当一段时间里,和我们先前展示的同样的归因被勾勒了出来。与GDP有关,美国在1937年的总债务和1930年的债务水平相当。在1930到1937年间,萧条导致收入的收入所见以及负实际增长。名义收入的增长驱使了名义债务开始向着反方向发展。付息的借款也几近被债务的偿还给冲销。

This reversal in incomes was also the primary driver of changes in debt burdens for the private sector, along with debt pay-downs. Defaults were a small driver.

此来自收入的逆转同样的也是私人部门中债务负担变动的首要原因,同时头款也逐渐被清偿。违约倒是比较小的动因。

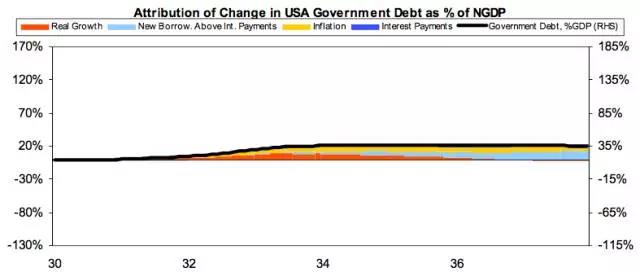

The stock of government debt was small at the onset of the depression. Initially, this debt burden rose because of the collapse in income. Nominal government debt levels increased following 1933 because of larger fiscal deficits, while the income recovery cushioned the increase in these burdens.

和来自经济萧条的冲击比较,政府积累的债务能算是相对小的负面因素。首先,由于收入的锐减,这样的债务负担开始增。1933年以来,即使有着逐渐恢复的收入作为缓冲,剧增的财政赤字使得名义政府债务水平仍然保持增长趋势。

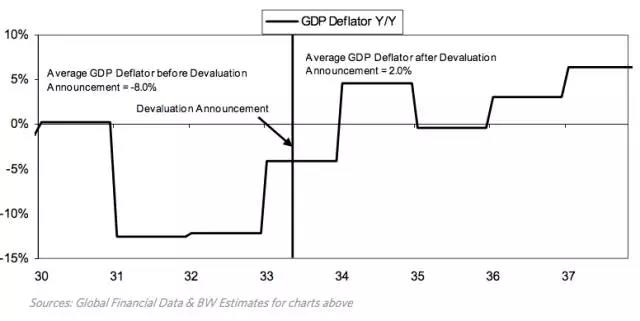

As shown below, the catalyst for the recovery was the printing and dollar devaluation against gold. Price levels turned at this point, from declining at an average rate of 8% to increasing roughly 2% per year. This is a good example of how printing negated deflation rather than triggering high inflation.

如下图所示,印钞以及美元对黄金贬值成为了经济恢复的催化剂。价格水平在这个关键点改变,从每年8%的衰减到每年2%的递增。这是说明印钞将会抵消经济紧缩而不是引发经济高通胀的一个绝好例子。

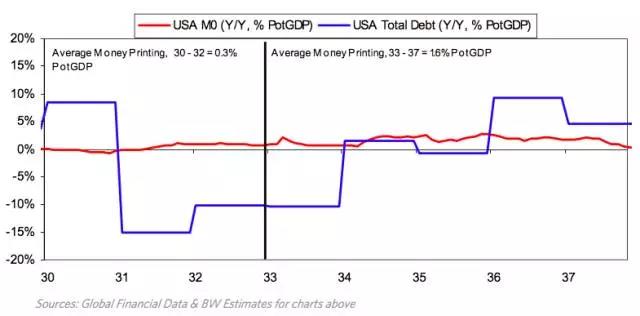

Credit stopped declining at this point and stabilized at low levels of creation, while money printing increased moderately.

当印钞保持一个稳健的增长,信贷创造在这个点位上停止下滑并且稳定在一个较低的水平

With the different policy steps taken from 1933 through 1937, nominal GDP growth moved substantially above government rates, greatly reducing debt burdens.

伴随着从1933年到1937年采取的不同政策,名义GDP实现了显著的增长 ,最终高于政府制定的利率水平,而这也极大地减少了债务压力。

This nominal GDP growth consisted of strong real growth (from a depressed level) and moderate inflation.

这个名义GDP增长包含了强健的实际增长(从一个衰退的水平)以及稳健的通胀。

$(AAPL)$$(AMZN)$$(GOOGL)$$(MSFT)$

免责声明:上述内容仅代表发帖人个人观点,不构成本平台的任何投资建议。

- 昵称是啊·2018-08-17钞将会抵消经济紧缩而不是引发经济高通胀?点赞举报

- 0billionaire·2018-08-17看来,仍有下行压力点赞举报

- 孙立冉·2018-08-17有水平有水平点赞举报